What happens to PPF account once you become NRI?

Once you become an NRI, what happens to your PPF account? Can you continue it or do you need to close it?

The one-line answer is – NO, You do not have to close it, and you can continue it till its maturity.

But there are more details to this.

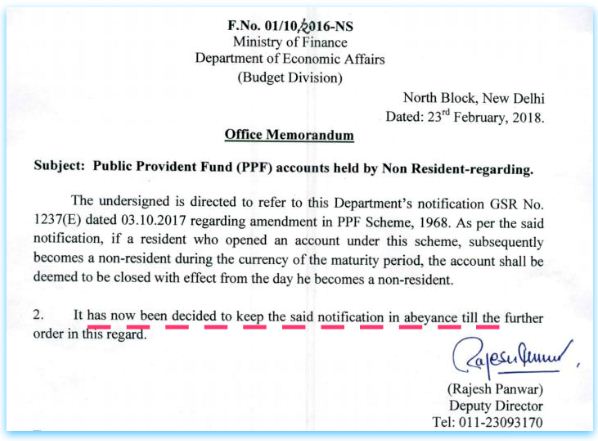

Last year on 2nd Oct 2017, govt-issued a notification that once a person becomes NRI, his PPF account will be closed on the same day he becomes the NRI and all his money will earn only 4% interest thereafter.

New PPF Notification cancels the older notification

So yes, in Oct last year the rule had changed regarding PPF for NRI. You had to close it once you become the NRI, but recently on Feb 23rd, 2018, there was another notification issued that the old notification is on hold now and canceled till further notice.

This means that the same old rule will be applicable now onwards for NRI investors. An NRI cannot open a fresh new PPF account but can hold an existing PPF account till maturity.

Let’s see a few frequently asked questions related to the PPF accounts of NRIs.

NRI PPF FAQ

Q.1 Can NRI open a fresh PPF account?

As per the change in the amendment of the public provident fund, a person cannot open a PPF account once his status changes to NRI.

Q.2 What will happen if I’m an NRI and still open a fresh PPF account?

It is possible to open a PPF account for NRI because of the inefficiencies in the system, but before doing that you must be aware that legal actions can be taken by the authority in such cases. You will not get any interest on your PPF account if they find out.

Q.3 What should I do if I have a PPF account when I was Indian residential and later become NRI?

You do not have to do anything here. You can continue your PPF account till its maturity, but you cant extend it after 15 yrs.

Q.4 Can I contribute to my existing PPF account once I become NRI?

Yes, you can invest in your existing PPF account even after becoming NRI through your NRE or NRO account. You can only contribute till your PPF account matures.

Q.5 How to close my PPF account after it matures?

The steps for this process are as given below:

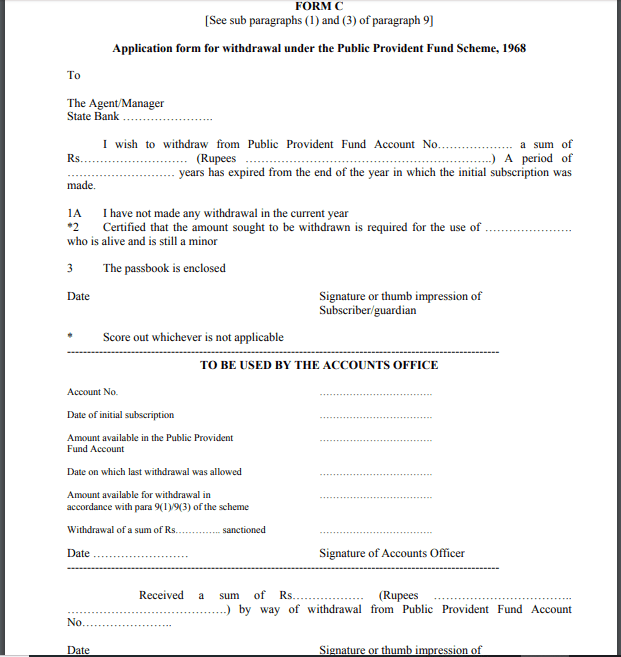

Step 1: Fill the application form for PPF withdrawal (Form C) and send it to your parents, relatives or friends in India, with an authority letter in which mention it clearly that you are giving that person the authority to withdraw your PPF.

This is how FORM C looks like:

Step 2: That person then will go to the bank where you have your NRE/NRO account and get he documents attached by the the manager and then submits the documents. Bank will accept only the attested documents.

We hope you got a fair idea on the PPF rules related to NRI. In case you have any queries, let us know in the comments section below.

March 21, 2018

March 21, 2018

With the reversal of notification, can an NRI still close the PPF account before maturity as the returns are meagre anyway?

Hi Bharani

Yes NRI can close their PPF

PPF account opened wrongly being NRI. Was not aware about the rule. PPF account is opened online.

What can be done in this case. Can PPF account be closed & obtain refund for initial deposit?

What is the solution?

I suggest just leave it as it is for now .. if enquired, then you take money back, else take it on maturity

I am a NRI and my 15 years of PPF account have completed this year. I understand that I can not extend my account now. Do I need to close the account or can I keep the money in the account and get the interest every year, I will not deposit any money.

Hi Rahul Chhabra

As per the rule for NRI’s PPF, you should withdraw the money after maturity. If you keep the money in PPF then the account is considered as “Extended without contribution” for the block of 5 years.

Hi , I didn’t understand properly , you said NRI will get a Rate of interest for 4% after october but this said notification is in abeyance , so NRI will get the normal rate of interest as residents as per my understanding , can you please clarify if my understanding is wrong ?

Hi Nitin

It was 4% earlier but now after the changed in rule NRI can continue contributing to their existing PPF and get the interest rate similar to the regular PPF (residential’s PPF). Its just that NRI’s can not open a fresh PPF account.

Can a NRI make a partial withdrawal from Ppf Account standing at post office and what is the procedure and documentation required, lf NRI is in USA

HI HH Pandey

Yes NRI’s can make a partial withdrawal from their ppf accounts. the process and documents required will be the same as for a normal ppf account.

I am a IT professional in USA on H1 visa (no green card as of now) for few years now, I believe, I am considered a NRI as per Indian Government norms (earlier I used to think, people who “settle” abroad or who have green cards etc are only NRIs). So my query is – what should I be getting as % interest on my PPF account in India now? 4% or whatever the current rate is?

Hi Somesh

The interest you will get will be similar to the interest rate applicable for Post office savings account at the the time you change your status to NRI.

I am working on ship. Opened my PPF account in 1997. In 2000 become NREI (for tax purpose) as completed 183 days outside India. After that maintained NRI status till 2010. From 2010-2011 FY – stopped working on ship and was resident till 2013-14 FY. Since 2014-15 FY again worked on ship and maintained NRE status. Iam maintaining PPF account till date. 15 years completed on 2012 and now Iam on 5 year extension. Can I continue it.

Hi Pankaj

You can not extend the maturity period now but you can continue the account till its maturity.

I am NRI in USA. I opened ppf account in 1987. I came to US in 1997 but kept the ppf account alive by depositing the money annually. I have been extending the account after initial 15 years.

My question is- how much interest rate I will get if I close the account now? I heard that NRI’s will get a low (Savings rate) interest rate “after” they become NRI, according to the ruling in October 2017. However, before the ruling in Oct 2017, they used to get the regular PPF rate. I am assuming NRI’s will get “low” interest rate after Oct 2017. Can you provide some clarification?

Hi MNDRS

Yes it is true. as per the new rule from October 2017 you will get the interest rate similar to the interest rate applicable for Post office savings account.

I opened ppf account in 1987. I came to USA in 1997 and living in USA and have kept the account alive till now by paying minimum amount. I became US citizen in 2012 and did not realize that I should have closed the ppf account. Now I hear the news about ppf account for NRI’s. I am planning to close the account when I go to India next month.

My big question is- how much interest rate I will get? I was counting on ppf account as part of my retirement income. Will I get regular ppf interest till 2012 (when I got US citizenship) or Savings interest from 1997 (when I came to US)? In the past NRI’w were allowed to invest in PPF and eligible for the regular interest rate.

Please provide comments

Hi MNDRS

You will get the interest similar to the interest rate applicable on Post office savings account from the date you become NRI.

Dear Sir,

I AM u.s citizen in 2010…before that I was resident of india.I have PAN card of india & filing tax return in India for my income earned in india & funds recd in inhartance. Now my current status is UScitizan. My ppf a/c has complited 15 years term on 31.3.2018. I have 2 options either to encash it or to continue it without contrbution….Than in 2nd option which interest will be given to me.on outstanding balance ….applicable 7.8% or saving bank interest @4% ?….please clerify till I come back to india & submit claim for withdrawal.

Hi HEMANT DESAI

You will get the interest rate similar to Savings account. and as an NRI you can not extend the maturity period of your PF account now.

Dear Sir , Thanks a lot for your kind information in this regard. I have the following queries regarding PPF

1) as a resident Indian Can I open PPF account for me , my wife and daughter separately or I can open only one account for an entire family of 3 members?

2) I opened my PPF account in 1994 , I became NRI in the year 2011 ( i.e. on 17th year of my PPF account oepned) and my PPF account completed 20 years in 2014 and I extended it for another 5 years in 2014 ( i.e. before the govt regulation came in Oct 2017) ; can I continue to invest in the same till it matures at 25th year in 2019 ?

Kindly advice me accordingly

regards

Babu

Hi Babu

You can open PPF account for your Wife and daughter separately.

As per the new rule you can not extend your PF account but you can continue it till its maturity period.

Can a person continue investing in existing PPF account even after he takes up US citizenship and becomes OCI ?

Yes

Hi,

My PPF account had completed 15 years and I had extended it 4 years ago. 2 years back I became an NRI. How long can I continue investing in the account, get interest and claim 80C benefits?

Regards

Gopal

How can I invest means ?

Oh good. Thanks for the article. I was planning to close my PPF account which I started before becoming NRI. Now I won’t 🙂

Technically, a student becomes an NRI while studying abroad. He gets a job in US. Now, he really becomes an NRI i.e. he has to stay back in US for the job. When does it become essential to change the category of bank accounts from ordinary Savings Account to NRI accounts. What happens in case of joint accounts, which were opened when the person was minor & mother operating the accounts as such.

It does not work like that. If you are not in INDIA for 182 days or more, you are an NRI in that case. You need to then convert your accounts to NRE or NRO

After maturity can NRI continue his PPF Account as PPF without contribution thus getting only interest …

Yes you can

Where can I download form c for POF closure from (link)?

Hi Rs

You can google it or simply click here https://www.indiapost.gov.in/VAS/DOP_PDFFiles/form/PPFWithdrawal.pdf

Hello ,

What about the contribution in PPF account once someone becomes NRI? Can he still contribute 1, 50, 000 annually till maturity?

Yes he can

Can he contribute to the PPF account after becoming NRI, the maximum amount which can be deposited, now the figure being Rs.150000/-.

Yes he can invest upto 1.5 lacs yearly !

Could you please clarify if NRI needs to deposit minimum amount per year in order to keep the account active ?

Yes he can invest upto 1.5 lacs yearly !

hello my husband become NRI for 2017-18, but now he dont want to continue working abroad ……..we have changed the status to NRI in demat a/c since he is working in dubai i invested rs 1.5 lac in elss from nre a/c based on his income in india and not continued with ppf, kindly advice what will be his PPF a/c status and will he get 1.5.lac deduction under 80 cc for indian income …..kindly also advice can he continue his PPF a/c for year 18-19 as he will be residence again

Now if he becomes the Resident again, then YES, he will get the benefit !