Everything in life has basic ground rules, which we should never forget. You can consider these ground rules as the pillars of your decision making activity. Even our financial lives have some ground rules to follow in order to have a great and enriching life. Over the last 5 years of writing this blog and having interacted with thousands of people, I can clearly conclude that more than making right decisions in financial life, you should focus on avoiding bad decisions. I have seen so many people who have been careful, not messed up things and their financial life quality is really awesome. They have not lost wealth due to foolish mistakes and live a clean financial life overall and while they feel lag behind others, I can say they are ahead of others in many ways. Yes – They have not taken awesome decisions, but the best part is they have not made terrible mistakes either. Lets explore more on this today

6 pillers of great financial life

Now I am going to talk about 6 areas of financial life which are like pillers. If you are clear about these ground rules and start some serious work on all of them, your overall quality of financial life should go up. But having said that, its a long term activity !

1. Rule of Earning

“Do not depend on a single income. Invest and create a second/ third source of income”

So many people just never focus on this. A person in a job has just taken it as his fate, that his only source of income will be his Salary. For him alternate source of income other than his salary is like a distant dream which he can only see, but could not achieve. The same happens with a businessman at times. He depends solely on his business income. Why? Why not also have some other passive income from other non-core business area.

Atleast start thinking in that direction ? Lets Explore some extra income source. I dont say, it need to be some grand income, but lets make some start atleast, if not in action taking, atleast in thinking about it, I personally tasted some passive income from my first book royalty, while it was not a big one (opposite to what people think) , it atleast gave me some good feeling. Other than our business income, I had some source of income from other stream. Thats important ! . It can be a small income, not a grand one . Thats okay ! . Whatever is your specialization, you must be god gifted into some or the other thing in life, start sharing about it with world by writing about it, you never know when you start making fans for yourself and it might bring some opportunity to you in life. Nandish has written a nice piece of “Giving your Gifts to the world” on our Jagoinvestor Wealth Club, check it out . If you are damn good about something , why not offer consulting or accept freelance projects in your own capacity.

Forget all that, at minimum, If you are a person who comes home early, why not take some tutions to make few extra bucks. Its not about earning a little more, its about the habit of creating an extra income. You never know when, in the future when you might have to look at it seriously! . So the point is, go ahead and put a small seed in your head about “Creating Alternate income” .

2. Rule of Spending

“If you buy things that you do not need, you may soon have to sell things you need”

People are over spending. There is no doubt about this. Just look at your own expenses & write them down. Question each of your expenses, do you really need them? Is it out of necessity or just a desire which you can avoided altogether or atleast minimized? The answer will be in front of you. If you have not yet tracked where your money is going and if you are our special member at Wealth Club, you might want to download this Budget Template.

One of our Bangalore clients told us last year that he has seen a lot of his friends, who buy a car on the first day of getting the job! and mostly they dont need it. Its either to show off, or just that short term desire of own it, without thinking about long term aspects of it. Its just unplanned!. Then there are people buying 25 shirts, when they only need only 12. There are people, who don’t have the `haisiyat` of driving an Alto Car, but they have bought a Honda City just to show off !

It just violates the rule of spending!.

Slowly but surely, this will take them towards disaster. It will come as surprise (to them) one day. Spending is a core activity of your life. You earn so that you can spend it, nothing wrong with it, but there is a difference between spending and over-spending. Understand it today to make your future more robust.

3. Rule of Savings

“Do not invest what is left after spending, instead spend after you save/invest”

This is directly related to rule 2 above. If you do not control your spending, you can never be able to save much and then you will never be able to give your best for your wealth creation. Fix this clearly & prominently in your head. For most people the formula is

Saving = Income – Expenses

If you rely on the natural flow of life, you can never save. Life will give you all the reasons why you can only save amount X . At times Nandish tells me – “Manish , you know what, if you do not define the purpose for your money, money will find its own purpose” . This is very strong point , for a moment, just slow down and think about it. you will realise what it means. You need to control the flow of money and you have to create that flow yourself.

I just ask to most of the people to do this 1 min experiment. I tell them – “Imagine your employer says that from next month, you will get a salary cut of 10% and all you will get is just 90% in your income. For most of the people, will they not be able to live the same life as they lived till now ? If the answer is YES , then why are they waiting for ? Why not give that small salary cut to yourself as your gift to your financial life. You will enjoy this salary cut in coming years. trust me.

So your next task today is tell your family, yourself and your relatives that from now on you will be living on just 90% of your salary – PERIOD! . Start doing it and slowly you will see that magically – you will be able to manage things – Try it! It works! .Your assets , your net worth , and every bit of wealth comes from those tiny savings you consistently do for years. That’s the most important ingredient part of your wealth creation. If you do not focus on optimizing it, nothing else will work out!

4. Rule of taking Risk

“Never test the depth of the river with both your feet”

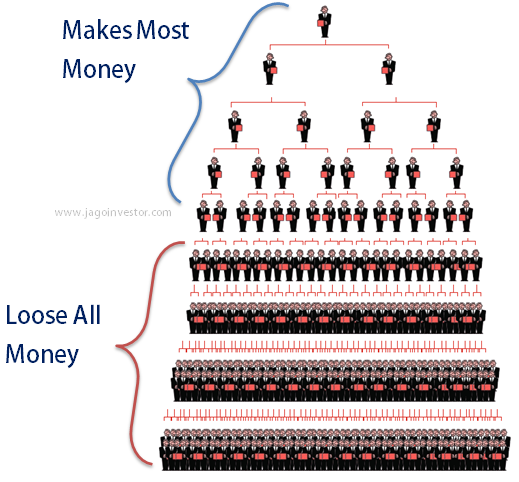

There is a very thin line between risk and calculated-risk. Calculated risk is the risk which is taken after due thought, and by accepting the future consequences and a thought full evaluation of how the odds are stacked.

If you invest a big sum of money in stocks, just because markets are going up and you do not want to miss the train, and just because that guy on CNBC said you should , then you are taking a risk. You will not be able to sleep at night for sure.

However if you look at the current market and tell yourself that – “Markets have not moved up from last 5 years, and this kind of situation in past have been proven to give great returns in next 5 years and you are economically ready to loose up to 30% of your money, and thats why you choose to invest in stocks, then its a calculated risk! . You have put some reasoning , thoughts and accepted the downside of that decision and hence you are taking that risk !

Taking risk is not a bad thing at all. It’s the only thing which can help you grow at exponential rate. Those who don’t take risks, just die a simple life most of the times. The best things in the life are on the other end of the Risk , its on the opposite side of it. So take risks, but always make sure they are calculated one ! . Over the long term, one an average, you will do great. Its proven already, I am just reminding you!.

5. Rule of Investing

“Do not put all your eggs in one basket”

Warren Buffet is not a very big fan of diversifying. All the money he has today, comes from stocks, but there is one simple rule he has followed – “Put all your eggs in one basket, if you know you are an expert of that basket and closely keep an eye on it”.

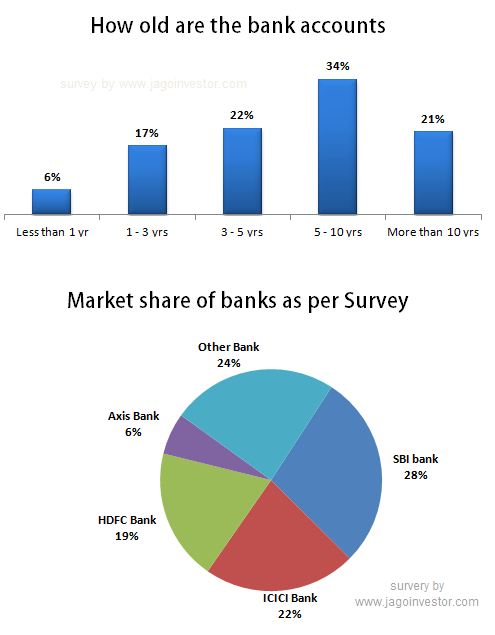

Most of us are not like Warren Buffet! . So lets not copy him. What if you have put most of your money in one single asset class or a property or a particular branch of a bank? or just a single stock. Things can go wrong, and when it goes wrong, you will cry out loud, but no will will be able to help. You will be helpless and will regret like anything.

As a best practice make sure that your wealth is not in a single place. Remember that portfolio diversification is mainly a tool of minimizing risk, not for maximizing returns, so don’t ask a stupid question like – “Will diversifying my money to different places increase my returns?” – The answer is “It might… or it might not!/. But properly done, it will surely minimize the risk of losing your wealth in future.” .

6. Rule of Expectation

“Control your expectations, and control your happiness – they are same thing”

One very dedicated reader of this blog – Pattu, who teaches at IIT Chennai, told me once that he does not expect equity to give him more than 8% of returns in long term and he always invests his money in equity, assuming that he will get 8% or better in long run. Anything more than that would be a bonus for him. I am sure that he must be happy all his life and will never be disappointed with equity returns.

In financial life, we expect agents to work in our favor, we expect financial products to give us amazing returns, we expect financial planners to charge less, but give an awesome experience (Like we give to our paid clients) , we expect life insurance companies to pay our family, even if we make some mistake while disclosing some important information, we expect our credit card to forget the penalty for in-case we

If you look, we are an “expecting” machine in our life. I can say from my tiny experience of life till date, happiness and expectations are just the two different words for the same thing. If you want to get in control of your happiness level, just control your expectations in life. Stop the expectations from others, better control yourself and your expectations, because thats all you can control. not others.

Practice these 6 rules in your financial life

If you can master these 6 rules in your financial life, your quality of life will improve. Each decision of yours should originate out of these 6 piller rules.

What do you say? Which rule did you like the most? Share it with us in comments section…