IMPS – Online Money transfer in 30 seconds from your Mobile Phone

IMPS or Interbank Mobile Payment Service is a technology which offers an instant electronic fund transfer service through mobile phones between two banks in India. There are other two money transfer systems called NEFT and RTGS already in India, but they are not a mobile payment system like IMPS and they’ll take some time to get settled. IMPS is a real time system of money payment. The service has been developed by National Payments Corporation of India (NPCI), a section 25 company formed by Reserve Bank of India (RBI) and Indian Bankers Association (IBA). Here’s a testimonial from Harsh, who transferred money using IMPS…

Recently I issued a cheque from one of my account and did a NEFT transfer to build balance but NEFT failed to do the job in 48 hours, in the middle of night i started searching for how to do a instant transfer and then I got to know of IMPS. Registration happened instantly in matter of minutes and shockingly money transfer happened in micro seconds even faster than a google search – (via)

The transfer limit through IMPS is defined by RBI in the Mobile Payment Guidelines issued to banks. The customer can transact on IMPS subject to a daily cap of Rs. 50,000/- per customer overall for transactions through mobile for the funds transfer.

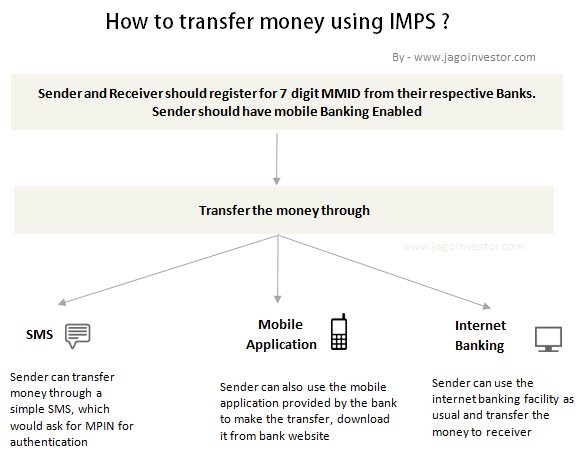

How to do Money Transfer using IMPS

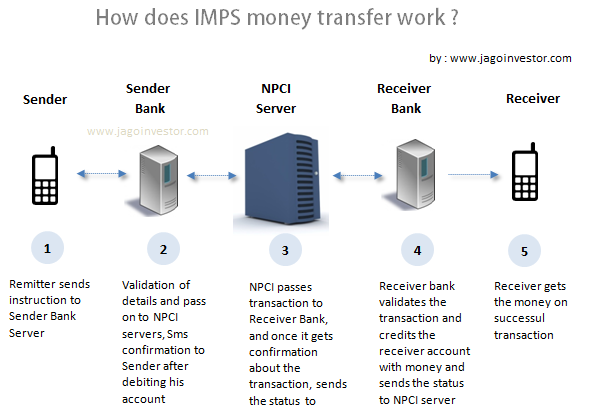

What happens with your do a IMPS Transfer through Mobile ?

When you make a IMPS transfer, your sender mobile first sends this information to the sender bank , which checks the data; whether your MMID is correct or not and if it matches with what it has in its system. If it’s all correct, it debits the money from your bank account and transfers this to the NCPI server, which then transfers it back to the receiver’s bank. The receiver bank goes about checking everything again and then sends the status of the whole transaction to NCPI, which passes it back to Sender’s bank. Both Receiver and Sender are then updated about the transaction through SMS. All this normally takes just about 15-30 seconds for everything to happen and the money gets transferred near instantaneously.

5 Advantages of IMPS over NEFT and RTGS

Let me enumerate 5 major reasons why you want to register with your bank for IMPS and generate your MMID as soon as possible. IMPS offers some major advantages over NEFT or RTGS money transfer and here they are

When you do an IMPS transfer, it happens instantly within few seconds, so it’s practically real time money transfer, unlike NEFT or RTGS which works in batches and takes time in money transfer. Which means in case of emergencies, you can use IMPS and it will act like a fast money transfer mechanism

You can transfer the money anytime, 24X 7. With NEFT or RTGS , you can’t do money transfer on holidays or even Sundays. You can’t do it outside the working hours defined by the banks. But with IMPS you can literally make transfers in early morning, midnight or whatever time you want.

All you need for making the transfer is mobile number and MMID , so you don’t need to disclose your actual account number or even the bank name.

Making a IMPS money transfer is so easy. All you need is the MMID, Phone number and the amount. The money gets transferred easily so fast. It makes easy for those who fear technology and do not want to deal with it . You can teach this to your parents or some one who is not that technologically advanced.

IMPS Charges

The charges depends from banks to banks . While exact charges details you can find from your respective bank, it seems the charges are extremely low and are on per transaction basis, not on the limit of money. It seems to be Rs 5 per transaction (not confirmed) yet. Apart from the charges from banks for using the service, if you are doing the money transfer using SMS , you will have to pay standard sms charges . However if you use internet or the mobile application, there will be no charges apart from the service charges.

Money Transfer Limit under IMPS

The limit is defined by RBI in the Mobile Payment Guidelines issued to banks. The customer can transact on IMPS subject to a daily cap of Rs. 50,000/- per customer overall for transactions through mobile for the funds transfer. Transactions up to Rs. 1000/- can be facilitated by banks without end-to-end encryption.

Which Banks are part of IMPS Facility

As of now 52 banks are the members of IMPS facility. Some of them have started the IMPS service and some will start it very soon. Those are

- ICICI Bank

- Axis Bank

- State Bank of India

- Indian Bank

- Kotak Mahindra Bank

- Oriental Bank of Commerce

- Union Bank of India

- Andhra Bank

- Canara Bank

- HDFC Bank

- Lakshmi Vilas Bank

- Bank of Baroda

- Indian Overseas Bank

- Bank of India

- Punjab National Bank

- South Indian Bank

- Vijaya Bank

- IndusInd Bank

- UCO Bank

- Federal Bank

- State Bank of Hyderabad

- Citibank

- State Bank of Bikaner and Jaipur

- Punjab and Maharashtra Co-operative Bank

- The Thane Janata Sahakari Bank

- Development Credit Bank

- Dombivli Nagari Sahakari Bank

- State Bank of Travancore

- Catholic Syrian Bank

- Syndicate Bank

- Yes Bank

- State Bank of Patiala

- Allahabad Bank

- Karur Vysya Bank

- The Greater Bombay Co-operative Bank LTD

- Corporation Bank

- IDBI Bank

- Tamilnad Mercantile Bank

- United Bank of India

- Standard Chartered Bank

- Bank of Maharashtra

- Central Bank of India

- Dena Bank

- Dhanlaxmi Bank

- ING Vysya Bank

- Janata Sahakari Bank, Pune

- Karnataka Bank

- State Bank of Mysore

- The A P Mahesh Urban Co-operative Urban Bank

- HSBC Bank

you can look at the latest list of all the banks and their details here What do you think about this technology ? Will it help in your financial life ? Are you going to use IMPS facility to money transfer through your mobile ?

October 1, 2012

October 1, 2012