Cheque Truncation System – New Benchmark for Cheques in Banks

It might happen that your cheque’s start bouncing and do not get accepted from Jan 1, 2013 . There is a new standard in banking called as Cheque Truncation System or CTS 2010 , which all the banks have to follow now. RBI has issued a circular telling all banks that they should only process and accept those cheques which follow CTS guidelines.

What is Cheque Truncation System or CTS ?

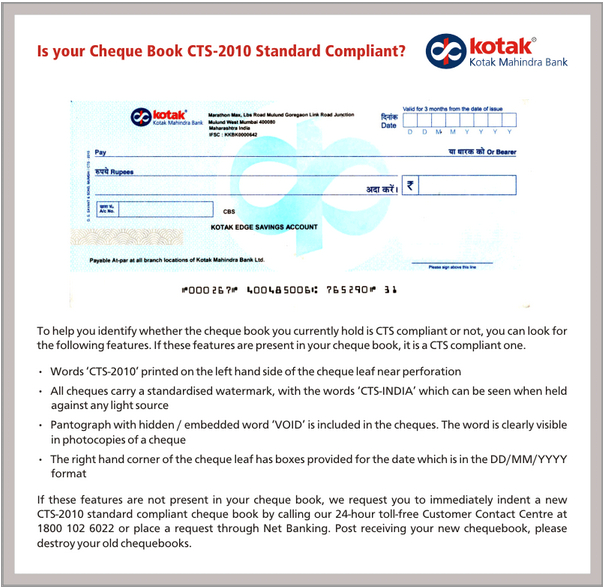

Its just a new improved structure for chqeues and a set of guidelines which will change the way cheques are being processed and cleared. Right now, all the cheques are sent directly physical to the other bank for clearance, but with this new Cheque Truncation System guidelines, the banks will send the digital version of cheques (read scanned image) to the other bank and the clearance will happen almost same day or very fast. Some of the features of CTS cheques would be

- It would have the wordings “please sign above this line” at right bottom

- All CTS-2010 cheques will have a watermark with the words “CTS INDIA”, which can be seen against a light

- A bank logo will be on cheque with a Ultra Violet Ink , which can be seen only under UV Scanners.

- The Cheque Truncation System 2010 enabled cheques will not allow any alterations. If there is any mistakes, the cheque will be invalid

- “payable at par at all branches of the bank in India” text will be at the bottom of all the cheques

- There will be IFSC and MICR code on the cheque

- You will have to sign the cheque will a darker ink, so that your signatures are valid for scanning.

If you look at these features, you can simply see that these are required for digital processing and once these Cheque Truncation System enabled cheques arrive , the whole banking system will start clearing the cheques in a must faster time. This will improve banking and save paper 🙂 . Below is a sample of cheque which fulfil CTS criteria’s.

SBI has already told all its customers to get new cheques because all the old cheques will become invalid , In the same way HDFC bank and ICICI bank have also told their customers to get new cheque books.

What you must do ?

1. Replace your Post Dated Cheques

If you have given any post dated cheques to someone like for your home loan payments or for some other kind of payment, then its the time to replace them with fresh cheques else it will just bounce and you might have to pay the bounce charges

Deposit any Old Cheque now

At times, we accumulate old cheques and deposit them for clearing only after many days or weeks. If you have any cheque which is to be cleared, better deposit it and encash !

A lot of banks have also asked its customers to give return back the old invalid cheques at their branch and collect new cheques, not sure why they need old cheques , why cant they issue the new cheques directly ? Also note that the cheques will be sent to the last updated address only. Learn more about CTS here .

You already have CTS-2010 compliant cheque books ?

Note that RBI has directed all banks to issue Cheque Truncation System 2010 enabled cheque books already from last many months. So it might happen that your cheque books are already complaint with those standards . So please check it once and dont rush to bank to issue you new cheque books . Like one of the reader found out that he already has the right cheque’s .

Banks like ICICI Bank and Axis Bank had already started issuing CTS-2010 compliant cheque books since last year. So please verify whether cheque book you have a already CTS-2010 before rushing to bank to get a new one. After I placed a request for new cheque book, I found that my existing cheque book issued to me in Mar-2012 was already a CTS-2010 one.

I hope you are clear about Cheque Truncation System (CTS) and how your cheques will become invalid from Jan 1,2013

November 29, 2012

November 29, 2012

Manish,

I’ve to come back to this article again as ICICI told me yesterday that it would take 3 days to clear my CTS cheque. It is a local cheque. I did not find anything related to RBI mandated deadlines for clearing cheques. Do you know of any?

Thanks,

Hem

I am not aware about this .. you might want to check on our forum with other readers – http://www.jagoinvestor.com/forum

Govt has been postponing the system from past 2011 onwords

And thanks for sharing the info

Welcome Vikram !

I have given some post dated cheques to people will those cheques be valid after 1st Jan 2013 or I have to give them a new cheque from CTS system ?

Thanks

If valid after 1st Apr 2013 then reissue else no need as Banks will continue to accept existing cheques till March 31, 2013.

You will have to give them new cheques , because those old cheques if does not comply with CTS standards will be bounced !

RBI has extended the deadline for implementation of the CTS 2010 system for cheques by 3 months. This means the older non-CTS 2010 cheques will continue to be valid till March 2013.

Thanks for that information Madhav !

Thanks for useful info. Inspired me to do an article on how the cheques were getting cleared before January 1 2013, new CTS 2010 clearing process, new CTC 2010 compliant cheques, old and new cheques.Cheque: Clearing Process, CTS 2010

Cheque Truncation System (CTS) or Image-based Clearing System (ICS), in India, is a project undertaken by the Reserve Bank of India – RBI, for faster clearing of cheques. CTS is basically an online image-based cheque clearing system where cheque images are captured at the collecting bank branch and transmitted electronically.

Good to hear that 🙂

CTS system is good. But wished that Issued Cheque in CTS system would be reflected as uncleared same as Deposited Cheques for specific time period so that they are not returned due to lack of funds which would increase from 01 January 2013 as many small business will find difficultly in it.

HSBC Bank has best technology in this regard wherein cheque represented anywhere in India for clearing Issued by the account holder is reflected in the account and within specific time period if money is deposited cheque is cleared and processed so that the customer has a clean record of cheque bounce. Hope all bank adopt the same technology.

Raj

Yes, lets see how fast all the banks adopt it 🙂

Check this article from TOI : where it mentions ” Since large amount of money is accepted only through cheques and third party cheques are not allowed for investments, there is very limited scope for fraud, a senior official said. However, the KYC procedure need not be done for MFs where the investor has existing investments. ”

http://timesofindia.indiatimes.com/business/india-business/Net-worth-information-must-under-Know-Your-Customer-norms/articleshow/17409788.cms

Thanks,

ritesh

Thanks for that info .. that makes life of those investors easy who had given PDC

dear manish ,

both indian bank and axis bank have started issuing from last year .

regards

dinesh saboo

Ok thanks for that info .. there are many other banks also who started issuing it from long back !

I have two accounts one in PNB and another in HDFC….When i confimed about this from them….HDFC admitted that i need a new cheque book from January But PNB people said that they dont have any such information…Even my new Cheque book from PNB that i got in Oct-2012 is Not of such type

why do you have account in lazy good for nothing psu banks? stick to pvt sector banks

Mostly the employees didnt have that info 🙂

Would you know if the new systems guarantees same day clearing of the cheques and whether they are taking the commission out of the picture?

Also, are all the banks included e.g. some of the banks in my home town are still not computerized or if they are computerized – they are not connected / online?

Not sure what is the volume of cheque transactions in India – in developed countries, they have systems like Bill Pay where you can register your biller (could be anyone) and make a payment. Cheque is really old fashion. It is rather generalized third party payment system designed to improve efficiency of the banking industry as a whole.

I m not sure of numbers, but surely this will speed up the process ,thats sure !

Nice and great information Manish

Manish,

This is really a useful information. Thanks for keeping us updated.

Welcome . Please forward this to more people

very clear n detailed info about cts..thanks..

Thanks

Manish, What happens to Manager Cheques/ DDs?

What do you mean by “Manager” here ? The rule is only for Cheque !

HDFC bank gives Manager Cheques similar to DDs; But they call them as manager Cheques.

“Manager Cheques” will be treated exactly like “Security Guard Cheque”.

I hope this helps you.

thanks fr that info !

Extremely useful info Manish!i wasn’t aware about this one…Will immediately ask my bank for issuing new cheque book! Thanksss

Thanks !

Dear All,

I have heard that people who have opened bank a/c, Insurance, MF and others before 01-Jan 2012 should have to RE-SUBMIT the KYC Form.

Kindly, can anyone confirm on this.

Thats right. See below link for more details. https://camskra.com/FAQs_KRA_v1.2.pdf

I just heard this, but I cant confirm this

Yeah Manish that is true. We have to do that.

I revised my KYC details a few weeks back. Got a notice email from almost all the AMCs for the same.

Is there any notification you got , can you forward it to me !

Sent!

What if we have done our KYC on Feb-2012, should we again do KYC, its not mentioned in the link https://camskra.com/FAQs_KRA_v1.2.pdf

Can anyone confirm pls?

No , only if you have done KYC before Jan 2012 , then you need to change it , else not

I think only if you are making new investment then only same is required. For old SIP irrespective of whether it is done before Jan 12 is not required. I read it in TOI a couple of days back.

Thanks.

Banks like ICICI Bank and Axis Bank had already started issuing CTS-2010 compliant cheque books since last year. So please verify whether cheque book you have a already CTS-2010 before rushing to bank to get a new one. After I placed a request for new cheque book, I found that my existing cheque book issued to me in Mar-2012 was already a CTS-2010 one.

Thanks for that update . I will put that on the main article 🙂

Thanks Manish!

After this new system, will the charges on outstation cheque imposed by banks not be applicable?

I guess so !

The new clearing system is welcome but there must be some transition time to be given to the customers especially from rural area who have only recently started using cheques and that too in most cases out of compulsion like requirement of PDCs etc. These people will be definite punished by financing agencies for non submission of new cheques in time. SBI has issued advertisement in newspapers that they will send the new cheque books to the customers on their registered address. In fact every bank has to do this rather than requesting the customer to surrender the old cheque book because on 1st Jan. 2013 old cheques will become waste papers. Secondly all bank should at least agree to have same format of cheques i.e. size, location of printing name of bank, branch, address, code numbers, date and place for signature of the customers. This will make using cheques more easier to more and more people. Everyone is talking about financial inclusion but when time comes to actually fulfill his or her own responsibility nothing is done seriously. Financial inclusion should not mean opening of account of the people who do not need it but servicing the people who have already joined the system so that the experience will percolate and benefits/conveniences/confidence will be shared and inclusion will automatically happen wherever necessary. Just to achieve somebody’s targets public should not be made to join any system.

Thats very good point . The insights on how it will be a menace in rural areas was something I didnt think about , thanks for adding that dimention to discussion

!

I need to hurry up to my bank to collect the new once….I came to know about this change via newspaper some 15 days back, a small notice was published by the bank however I was not having much clear idea about what it exactly is but now after I read your article I understood what needs to be done now.

Thanks Manish

Abhijit

Good to hear that Abhijit !