Lets talk about Health Insurance Inflation today ! . When you decide upon buying a health insurance policy, one of the pertinent questions that crops in your mind is the coverage amount – how much health insurance to buy? One of our readers Saket made an interesting comment on health care inflation, and how a decent cover today might look so small in distant future and raised the issue of “renewal” of policies by companies.

The Health Insuranec companies, eargerly selling policies to younger age group (mostly), are actually giving them a false sense of security about their twilight years. No doubt, the current policy will be good for next 5 years, but not later than that because of the health insurance inflation. So this sense of security has a shelf life of max 5 years. After that my fate will lie in the hands of insurer-whether it finds my policy upgrade worthy or not. Considering a most conservative healthcare inflation rate of 15% , a humble 3L coverage requirement as on date for a 38 yr old would translate into a whopping Rs 130 Lakhs ‘Final Amount’ at the age of 65 , the calculation is fairly simple – 3,00,000*(1+.15)**27 =130 lacs

Coming to the question, we can now clearly see that decision of taking health insurance in current moment depends on two points. which are

a) Health insurance is a super looooonnng term investment, which you would need most in your old age, beyond say 60 years of age.

b) It’s common knowledge that Hospital costs are increasingly rising, gradually becoming unaffordable, to the common man.

How much is enough to financially support your family’s healthcare needs, ensuring you have a peaceful retirement life. Let us take this up, step-by-step.

Costs of common surgeries & Hospital Costs In India

The cost of some major surgeries in hospitals across India has gone up in recent years. Going by these numbers, assuming only one surgery is required during a year, per member; a sum insured of Rs. 3-4 Lakhs should be good enough for the year 2012. Major supply deficit with respect to healthcare infrastructure – hospital beds, doctors and nurses, increase in cost of medical equipment’s, land has resulted in an increasing trend of health insurance inflation. Here are the 2012 costs for surgeries, compared with costs in 2007.

| Sr. No |

Treatment |

2012 Cost |

2007 Cost |

Increase |

| 1 |

Cataract |

24,000 |

16,000 |

50% |

| 2 |

Angiography |

22,000 |

14,000 |

57% |

| 3 |

Coronary Artery By pass Graft (CAGB) |

2,35,000 |

1,65,000 |

42% |

| 4 |

Appendectomy |

42,000 |

28,000 |

50% |

| 5 |

Heamorrhoidectomy (Piles) |

35,000 |

21,000 |

60% |

| 6 |

Cholecystectomy (Gall Bladder removal) |

52,000 |

32,000 |

63% |

| 7 |

TURP (Prostate Surgery) |

62,000 |

37,000 |

68% |

| 8 |

Angioplasty (PTCA) with 2 stents |

2,45,000 |

1,55,000 |

58% |

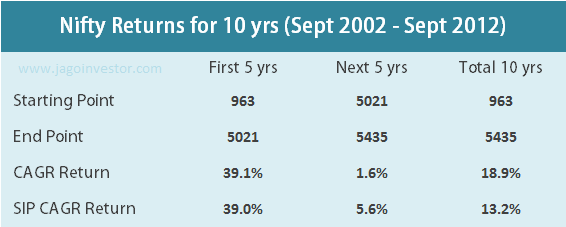

The costs of common surgeries have increased by 50-60% in 5 years! This means healthcare costs have increased by 9-10% year-on-year, since the last 5 years. We spoke to Sudhir Sarnobat, CEO at Medimanage. Here’s what he had to say

“The average annual health insurance inflation would be at 5%, if you look at 30 years duration. The hospitals do not increase their tariffs every year. Generally, they increase it by around 15-20% every 2-3 years. This would effectively come to 5% CAGR.” “India is currently having Supply Deficit when it comes to Hospital Beds. But we are seeing a good amount of capacity increase in beds in last 7-10 years which should continue to grow. On the other hand, our population is stabilizing. In 15 years, the equations should change & ease pressure on prices.

India is a developing economy and from credible reports, will continue to be on growth path for next 10 years. After that once the wealth distribution is even, we would see stabilization of inflation (world over that’s been the phenomenon, look at US Medical Inflation for last 5-7 years, it is 4%)” Sudhir added.

Some reports on Hospital infrastructure talk of a major crisis in the making in the Healthcare Industry, due to overflowing demand, coupled with very slow growth in the poor hospital bed to patient and doctor to patient ratio in India, primarily due to deprived participation from the Govt. A Tower Watson Report pegs healthcare inflation in India at 13% for the year 2012.

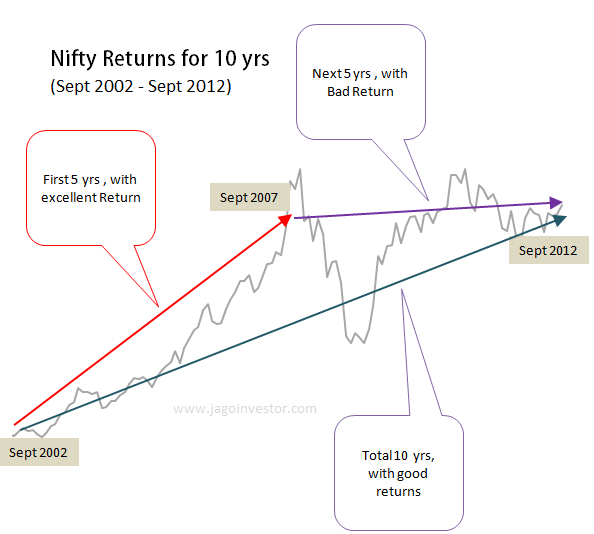

In my opinion, while costs are bound to rise due to the slow growth in the ratios, on a 30 year horizon they have to plateau somewhere. Looking at this, I suggest, let’s take the inflation year-on-year for the next 10 years at 12%, and then average 5% for the remaining 20 years.

Health Insurance Inflation and Future Costs

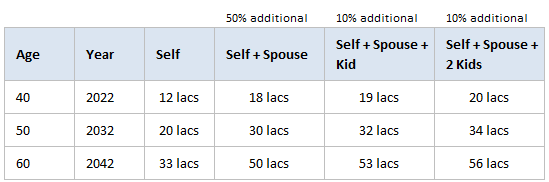

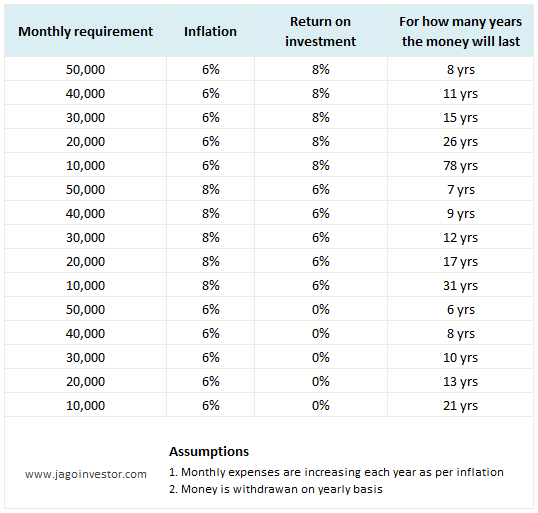

Factoring healthcare inflation on Rs. 4 Lakhs of costs expected today, in 10 years, @ 12% inflation, the sum insured requirement would increase to Rs. 12 Lakhs, per member. In 20 years @ 5% inflation, to Rs. 20 Lakhs, and in 30 years to 33 Lakhs. For calculation of floater coverage, take 50% ad hoc for every adult member and 10% for every child, and here’s the kind of cover you will need, for some of the family combinations.

So a family of 2 – Self and Spouse will need a cover of Rs. 50 Lakhs year-on-year every year, from the age of 60. This is a huge sum, and looks unaffordable to most of us. So, what does one do? A middle class guy would either have to “afford”, “plan” or “pray” be able to afford such astronomical expenses. Let’s see how we can plan to pay such healthcare expenses.

Solution to the problem

Look at the Present Value of Rs. 50 Lakhs at 10% inflation on 30 years, it calculates to just Rs. 3 Lakhs. So though the problem looks big, it definitely can be resolved by the power of financial planning. Here are the steps we recommend you to create a fool proof plan for your healthcare expenses.

a) Commit yourself to healthy living: Yes, it’s very awkward for a Health Insurance services company, asking you to commit to health, but then we believe that Healthy living is the best form of Health Insurance. Healthy living would of course mean Regular Exercise, Healthy nutrition and No ill-habits. Such lifestyle will simply help avoid huge hospitals bills. Read an excellent article on Health SIP by Nandish.

(b) Given point (a) is a way of life for you, you now need to create a Long term and Short term financial plan, for the unavoidable healthcare expenses, like hereditary ailments (Diabetes, Thyroid), age related (like knee replacement), or infectious diseases (like Malaria), or even diseases like Cancer (which still have many unknown causes. Perfectly healthy people have got cancer, in spite of no ill habits).

Note, if you cannot commit to point (a), your needs for long term and short term funds increases multi-fold, to cover healthcare expenses.

How do you create such fund?

Here’s what I recommend should be your step-by-step health insurance investment plan.

- Buy Health Insurance, preferably one which covers you for lifetime, and provides a no claim bonus, for the sum insured of Rs. 5 Lakhs individual or Rs. 7-8 Lakhs Floater. If you are buying plans, with Restore options, then the sum insured could be lower at around Rs. 5 Lakhs.

- Take a good top-up plan, which takes your cover to a floater of Rs. 10-15 Lakhs for the entire family.

- Invest in a Rs. 5-10 Lakhs critical Illness plan, which covers maximum no. of ailments, especially for the earning members of the family. This will help you get lump sum payment for critical ailments, and compensate for any loss of earnings. You can also explore the option of a more comprehensive benefit plan with your health insurance advisor, with products like Tata AIG Wellsurance, Aegon Religare iHealth, which provide lump sum benefits for large no. of surgeries, in addition to the Critical Illness benefit.

- Plan a Healthcare Contingency fund, for Rs. 15 Lakhs for individual, and Rs. 25 Lakhs for a family of 4, maturing at age 60. A contribution of Rs. 15000 per annum at 10% return will accumulate Rs. 25 Lakhs in 30 years.

So what’s the total investment for your healthcare financial plan?

Here is the approximate outgo you would incur.

| Type of Plan |

Sum Insured |

Tenure |

Costs |

| Health Insurance |

Rs 5 lacs |

30 yrs |

Premium Rs 6,000 |

| Top up Plan |

5 Deductible/15 SI |

30 yrs |

Premium Rs 5,000 |

| Critical Illness Plan |

Rs. 5 Lakhs/20 Illness |

30 yrs |

Premium Rs 3,000 |

| Healthcare Contingency |

Rs 25 lacs |

30 yrs |

Investment Rs. 15000 |

The plan above is indicative and would have to be customized depending on some of the following factors

- No. of members you want to cover

- Their age

- Their health condition

- Family history of critical ailments like

- The city where claims are expected

- The type of hospitals, rooms you prefer.

- Your lifestyle.

What do you think about health insurance inflation and your thoughts on renewal decision by the companies. Do you think creating your own health care corpus is a better idea rather than depending on health insurance policies?

You can calculate this in many ways , but one of the ways you can do is by calculating it in excel sheet. We have this calculator on our upcoming

You can calculate this in many ways , but one of the ways you can do is by calculating it in excel sheet. We have this calculator on our upcoming