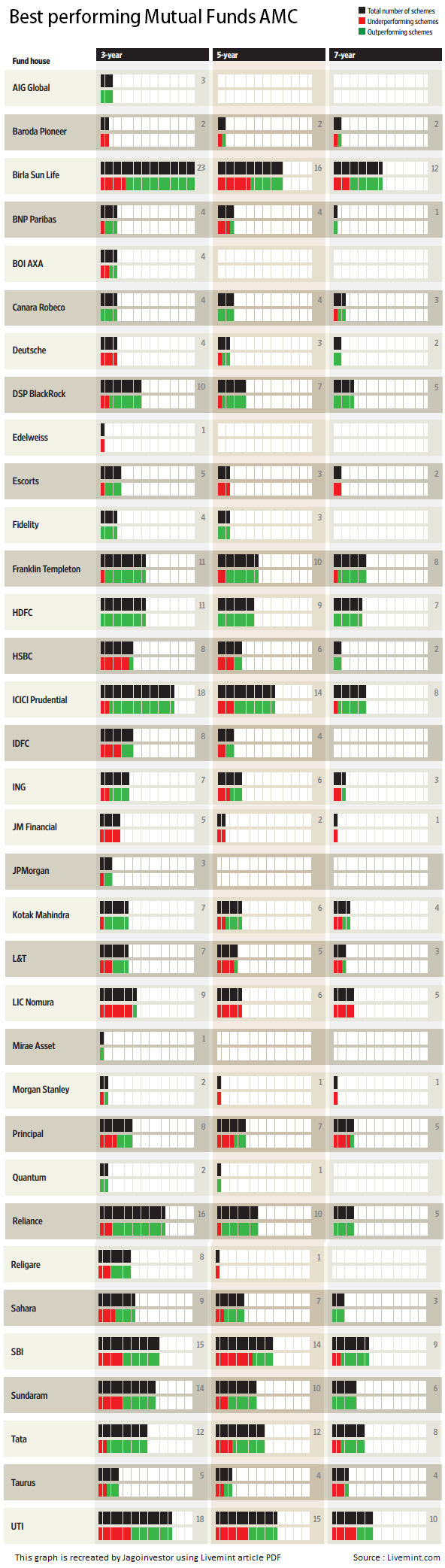

Best Mutual Funds House [Graph]

Which is the best mutual fund House ? Is HDFC better than DSP Black Rock or Reliance ? A very good way of looking at it is to see all the equity oriented mutual fund schemes of a fund house and check how many of them have outperformed its benchmarks in different time frames like 3 yr, 5 yr and 7 yrs?

For instance, Birla Sun life which has 16 equity funds with more than 5 yrs of history, but out of those 16 funds almost 8 of them have not outperformed its benchmarks, which is not very encouraging. The same kind of scenario is with SBI & UTI mutual fund houses.

On the other hand if you see HDFC , Franklin templeton, Reliance & ICICI Prudential Fund house, they have done much better, a higher percentage of their schemes has outperformed their respective benchmarks. Its a very clear indicator of a AMC overall performance . So its very important to understand which AMC’s are doing better over their whole basket of mutual funds and which are not. Below is an info graphic which I have re-aligned using a PDF document published at Livemint article here . Credit goes to Kayezad E. Adajania from Livemint who has done this research. Good show !

100% of HDFC Funds outperformed their benchmark

You can see in the above graph that only HDFC is one fund house which has all its equity schemes outperform its benchmarks in 3 yr, 5yr and 7 yr category. Which Mutual funds are you invested in? Do you feel you should move to the fund houses which have shown better performances ?

Which mutual fund AMC is your favorite and why ? What do you have to say about this study ?

July 2, 2012

July 2, 2012

DSPBR Tax saver fund is given 5 star in Value research .It appears good. i want to start SIP from next month in this ELSS

fund. Is it a good choice. Please advise.

Yes, its a good fund. You can start SIP in that.

If you need our help, let us know . Our team will help you

Hello Sir, I’m 30 yrs old earning 80k per month and investing 21k per month in MFs. i can further invest 4k more per month. please suggest me whether below portfolio is fine or need to change with any different fund in case i would have taken high risk by choosing below funds. My Goal is to build 50lakhs by next 10 yrs and 1 crore by next 15 years. Below are my portfolio diversification details ? SIP Details as below(Monthly Basis)

ELSS

1)Franklin India Tax Shield ? Growth ? 2500/-

2)Axis Long term equity fund ? Growth ? 2500/-

Large Cap

SBI Blue Chip Fund ? Growth ? 2000/-

Mid Cap

Franklin India Prima fund ? Growth ? 2000/-

Small Cap

Franklin India Smaller companies fund ? Growth ? 1000/-

Diversified

ICICI Prudential value discovery fund ? Growth ? 2000/-

Balanced funds

1) HDFC Balanced Fund ? Growth(Equity based Balanced Fund) ? 2000/-

2) HDFC MIP LTP ? Growth(Debt based Balanced fund) ? 2000

Debt Fund

Birla Sun Life Short term fund ? Growth ? 5000

LumpSum?

1. Franklin India Tax shield(ELSS invested to save tax for last FY 15-16) Rs.50000/-

2. Axis long term equity fund(ELSS invested to save tax for last FY 15-16) Rs.50000/-

Hi Rajesh

Your Funds look totally fine to us right now , just continue with these .Additional 4k can be invested into Birla Frontline Equity.

I am investing in Franklin india pension fund SIP 5000/- for last 5 years .I want to invest further 5000

I have selected following funds

a. Birla SL Frontline Equity Fund :SIP 3000/-

b.DSP blackrock micro cap :SIP 2000/-

Investment period 7-8 years

Is this portfolio good enough

Yes, both the funds looks very good ! keep investing in these

Hi…Thank u for wrote wonderful article…

I am subbiah Age 40Yrs and my SIP investments as below for my 8Yrs girl child education/marriage

1) Sundaram S.M.I.L.E Reg. Growth – Rs2500/month

2) Canara Rob Emerging equities Direct growth – Rs1000/

3)Franklin India smaller cos Direct Growth – Rs3000/-

4) Franklin India High Growth Cos Direct Growth – R2500/-

5) ICICI Pru Value Discovery Direct Growth – Rs 3000/-

6) TATA Balanced fund Direct Growth – Rs 2500/-

Lumpsum Investment

1) Sundaram select Micro cap series -9 Growth – Rs50000/-(5 Yrs)

2) Sundaram select Micro cap series -10 Growth – Rs1,00,000/-(5 Yrs)

3) Kotak Emerging equities Fund growth – Rs50000/-

I started to invest just 1year back……..Pls. suggest me can i continue with this fund?

Also i want to invest Rs1 Lakh lumpsum ….can i invest in existing funds or suggest me one new fund.

Thanks in Advance..

Your funds are already good. Dont change them

Hi Sir,

I want to invest in below portfolio as per my research . Kindly let me know in case the quality of the choice& if i need to make any changes:

SBI Magnum Multicap Fund- Rs 2000

SBI Midcap Fund-Reg-G- Rs 1000

SBI Blue Chip- Rs 2000

SBI Magnum Tax Gain- Growth- Rs 2000

HDFC Long Term- Rs 2000

HDFC Balanced- Rs 1000

HDFC Monthly Income Plan – Long Term Plan- 2000

Thanks & Regards,

Umesh

Good funds ..

Hi Manish,

My Mutual fund portfolio is as below, Should I keep it like this or need to change ?

Please advice..

ICICI PRUDENTIAL FOCUSED BLUECHIP EQUITY FUND – GROWTH: 5000

SBI BLUE CHIP FUND – REGULAR PLAN – GROWTH: 3000

Franklin India PRIMA PLUS GROWTH : 5000

HDFC TOP 200 FUND – REGULAR PLAN – GROWTH : 3000

ICICI PRUDENTIAL VALUE DISCOVERY FUND – GROWTH: 2000

Regards,

KCS

THis looks good to me . just continue

http://fundpicker.thefundoo.com/Tools/PortfolioOverlap

check overlap funds………almost more then 25% overlap is not good……

Hi, i am 35 and like to invest sip 2000 in mutual funds for 20 years. Can u plz suggest me a good one

Hi FASEAHUDDIN

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

Manish

CANARA ROBECO EMERGING EQUITIES -DIRECT 1500/- SIP PM PLS TELL GOOD OR NOT TO CONTINUE

good

I started investing last year in SIP with below funds when NAV was @ this price. Each fund SIP of 2000 is investing monthly.

My Asset Allocation with NAVs purchasing time value:

Franklin India PRIMA PLUS GROWTH 450.719800

Franklin India Smaller Companies Fund – Growth 39.881900

HDFC BALANCED FUND – GROWTH 110.447000

UTI EQUITY FUND GROWTH 104.165600

UTI – MID CAP FUND -GROWTH 82.577500

Are these good funds any thing to modify

My time horizon is minimum 8-10 years currently all my funds are giving -ve returns should i switch Or change the AssetAllocation/funds completely?

I want to reach 1 Crore how many years should wait with these funds to reach?

Your suggestion is very valuable to take my financial decision.

Best Regards

manish – Do I have any Overlapping funds so that I can change the portfolio?

manish – Do I have any Overlapping funds so that I can change the portfolio? I mean overlap atleast in Small Midcaps ?

I think you should not worry for the returns in short run .. let it be invested, I am sure you will reach 1 crore in 2 decade

Hi,

I am planning to invest 10k per month next 7 to 15 years. So, pls let me know below are the good one?

SBI BLUECHIP 1000

BSL FRONTLINE 1000

ICIC EXP 1000

MIRAE EMER 1000

SUNDARM SELEC 1000

DSP MICRO 1000

TATA BALANCE 1000

BIRLA MNC 1000

RELIANCE RET 1000

SBI PHARMA 1000

TOTAL 10000/-

YEs, these are good funds.. you can go with them

hi

I have been investing in the following mutual funds since 2010 through SIP.

Reliance Growth fund (G) – Rs. 1000 per month

Sundaram select midcap regular plan (G) – Rs.1000 per month

And i have started a SIP for 1000 per month in Reliance TaxSaver ELSS in november 2015.

Am i doing any good?

I can manage and save a 1000 more every month. So can you please suggest me a fund in which i can invest.

hi Manish,

I am invested in HDFC long term advantage fund for last 7 years on checking the performance for last 5 years it has given 9 % annualized returns. Most of the websites (moneycontrol, valueresearch etc.) advise to move out of this scheme. Is this right way to look at returns from MF ? I have a corpus now on which even If i get 9 % will be equal to FD which is more safe and risk free. My amount has almost doubled (after lock in for 3 years ) as of date. thanxx

Gaurav

I think the fund is not doing well now from last many years and its better to come out of it.

However in general mutual funds will do very well. Shift to some other fund and not a traditional option. Note that despite this fund being a bad performer has given a 9% return which is tax free (FD interest will be taxable, making its returns in range of 6-7% , considering you are in highest tax bracket)

Hi,

I am 35 and investing in MF for the past 3 years(20k per month). Now i am planning to move to US for next 3 years.

1) Do i need to redeem all the units after NRI status? If not how long i can hold the units?

2) What kind of Mutual fund i can invest after NRI(US) status?

Thanks

You need to mostly redeem them, as people in US cant invest in all kind of MF in India. Only few AMC like L&T offer mutual funds to US NRI

Manish,

Thanks for your reply.

Instead of redeem can we not hold the MF investment for next 5-10 years.

My plan is not to do MF investment after NRI status but to hold it for next 5 years. So when i return to India i can redeem the units whatever i have invested before NRI status.

Thanks

Yes, you can surely keep the units and redeem it later once you are back. Thats surely possible

Hi Guys I wasnt sure if this is the right place for this comment.

I am looking to create a portfolio which has 15% large cap , 25 % multi cap , 25% mid cap, 10 % each for balanced, secure and debt fund.

My current portfolio with Fundsindia have the following sip

Mirae Asset India Opportunities Fund-Reg(G)–(3200 rs),

Religare Invesco Mid N Small Cap Fund(G)– (1600),

Franklin Build India Fund(G)– (1600 rs),

HDFC Balanced Fund(G) –(1000rs),

ICICI Pru Focused BlueChip Eq Fund-Reg(G)–(1000),

Franklin India Smaller Cos Fund(G)–(1600rs)

all the above are monthly sip with amount in bracket suming to 10K per month which is max I can invest for the moment. I am an NRI investor, so Dont have to worry about investing in tax saving funds.

Please suggest what different funds should I have in my portfolio and what amount to be invested considering 10K as max total per month to be invested.

Hi Bharat

I think the funds you have choosen are very good . You can continue with them

Thank you Manish . I have also got a AEGON Religare imax plan taken for 15 years. It was taken in 2013. It isnt doing bad. Thus even if people say no use of having ulip plan. I think I will keep it. Do let me know what you think ? II have moved Way from FundsIndia and converted to direct plan. Only downside. I had to open investing account with all the required fund houses and they all cannot be checked in one place. But I know CAMs site will show all my holdings. But not the same as FundsIndia but I save on fees paid to distributors.

If the charges are less and its doing good, you can keep it

Hi,

Thanks for such helpful articles!

It would be great if I can have your opinion on my MF investment planning 🙂

I am not a huge risk taker so I want to balance my risk and return profile by diversifying MF portfolio into five kind of funds: 1) Large cap/bluechip fund, 2) small and mid cap/emerging cos fund, 3) balanced fund, 4) debt fund, 5) short term fund. Does this sound sensible to you? Would you like to suggest a few MFs I can look at for investing?

Previously I had invested in Franklin Blue chip fund, HDFC balanced fund and HDFC equity fund and all three gave good returns over a period of 3 years.

Thanks in advance for your help!

I think you are over thinking and over analysing . Dont do so much

2 funds are good enough !

Thanks. Would you be able to kindly suggest a good dynamic bond that is worth investing?

BIrla Dynamic Bond is a good choice

Thanks ever so much for your reply Manish. Apart from ICICI Balanced fund could you also through some insight on the following funds – if they are worth investing over a long period ( i am looking at investing for at least 15 years) in SIP

1. UTI MNC Fund

2. Axis Long Term Equity (I am looking at it only a stable return and not as a tax saving 80c tool)

3. L&T India Value Fund

Would you also suggest adding a Debt (Dynamic Bond / Gilt) fund to my portfolio?

Thanks once again in advance.

I only know that Axis long term equity is a good fund. The other two are not evaluated by me , hence I cant comment

On debt side, its purely your wish if you want to add funds for stability or not. You can put some dynamic bond fund if thats the case

Manish

You can add BIrla sunlife dynamic bond fund !

I have invested 5K (SIP) in Tata Balanced Fund and 5K(SIP) in Canara Robecco Emerging Equities Fund. Can you please suggest how these funds are? Also i am looking to invest another 10-12K per month. Can you please suggest some funds which are a good addition to my portfolio?

Hi Manish

These are good funds .. You can add an ICICI balanced fund in your portfolio

Manish

nice

I recently came to know about SIP, it looks good to invest, I haven’t did yet, Im 31yrs and government employee so I can invest for 20+ years, would you suggest which category I should opt for? Should I put all amount only with one of the fund or divide into two or more funds. Please suggest me right way to invest in Sip. Thanks.

Hi

You can choose 3-4 good funds and invest for longer term . We can help you in portfolio building . Let me know

Manish

It seems Franklin Templeton, HDFC, Quantum & DSP Blackrock are still AMCs to be associated with. Any changes in your opinion Manish?

I am planning to invest small lumpsums on Sensex drops (5K-10K). Also, any enlightenment on Index funds?

Hi Santosh

I think more than AMC Level, you need to look at fund level . Every AMC has some good and bad funds.

You can surely put some money in index funds. But if you are timing the market at this level, then why funds ? Why not direct equity itself ?