How much Health Insurance Cover is good enough?

How much health insurance a person should buy? Is 5 lakhs cover enough or it should be 10 lakhs? Should it depend on job profile, city and income level? These are the most common questions which pop up when a person starts thinking about health insurance. Anil had raised this question on comments section few days back. He says –

I am recently married and look forward to start a family. Like for life insurance where you have a referral benchmark which say’s ideal insurance should be ideally be 10 times your salary, what would be an ideal coverage for us (Floater).

Now it’s not easy to answer this question, but we can brainstorm about it and get some ideas. There can be some ways you can think about how much coverage one should take while taking Health Insurance, let’s look at them one by one:

1. Depends on Affordability

A big factor which decides how much health insurance a person requires depends on the premium amount. Not everyone can pay the premium for Rs 20 lacs cover, as it will be very huge. However, a person can pay some amount which fits within his expenses- affordability. Like lets say 2% of yearly income. If a person is earning Rs 6 lacs a year, he might be able to pay an amount that is up-to 2% of that yearly – Rs 12,000, which will give him decent cover from today’s standard. So a person with 3 lacs salary can pay for health insurance up-to Rs 6,000. A person with 20 lacs income can pay up-to Rs 40,000 per year. So you do not decide on the cover, but you decide on the premium which you can afford. Obviously, there is a limit above an income level. A person earning Rs 1 crore might not even need health insurance at all! He has so much of wealth already to take care of it!

2. As percentage of Income

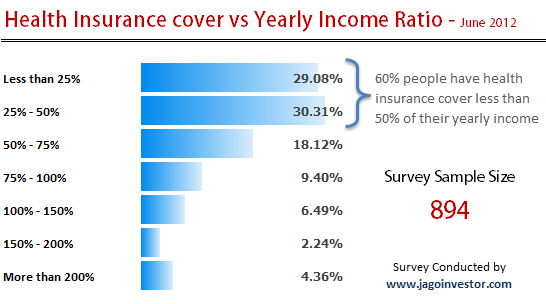

One way to look at Health Insurance cover can be percentage of your income, like let’s say 100% of your income can be the ideal figure for your health insurance cover. Like a person earning 12 lacs a year should be covered for 12 lacs cover, a person earning 4 lacs per year income should be covered for Rs 4 lacs health cover. However, there has to be upper limit to this like say 20 lacs! This is because a person earning 40 lacs don’t need health cover of Rs 40 lacs. This percentage will depend on how you think about it, I think 100% of income is good enough, you may feel 50% is fine. As per a survey done by jagoinvestor. as high as 60% of the health insurance customers have their health cover less than or equal to 50% of their yearly income, which is quite low. Here are survey results

3. Constant + Function(Past expenses)

If you have spent Rs 2 lacs in past 5 yrs on medical expenses and hospitals, one might want to consider it as the basis for calculating their health cover requirement. Like a person earning 6 lacs a year, who has spend Rs 2 lacs in past 5 yrs on health might be more inclined to take a higher cover than someone who has not spent anything in last 5 yrs. While the first person might feel a cover of Rs 5 lacs is important, the second person might feel Rs 3 lacs is good enough- because he has not experienced the pain of expenses on Health Insurance. So how about this

Health Insurance cover = 50% of Income + 100% of last 5 yrs expenses on Health (hospitals)

So in this case, the first guy will take a cover of 50% of income (6 lacs) + 100% of 2 lacs = 4 lacs in total. However the second person will take it for Rs 3 lacs only (50% of income).

4. Average bills these days

I think the most logical way of looking at health insurance cover can be, simply the expenses in the worst case for medical treatments these days for different kind of hospitalization. If you list down 10 things for which people are hospitalized and which are covered in health insurance and lets say the average bill of that comes to around 4-5 lacs, you can say that it can be the right figure for you.

5. Your Method

This method is your method. Each and every person has his/her own way of looking at a problem and I would like to hear how you think on this subject. So, I request you to please open up your thoughts and share on comments section what do you think should be the right health insurance cover and how it should be calculated ?

What are your thoughts on this? In your view how much health insurance cover is good enough ?

June 25, 2012

June 25, 2012