Which Banks have highest Fixed Deposits interest rates ?

Do you know which bank in india has the highest fixed deposits interest rates ? But before that, let me ask you – Do you know what is the interest rate of your Fixed Deposit ? If it was opened a few years back, all you would have got is around 6-8% depending on the bank and tenure. But today its a different scene! . Fixed deposits interest rates are high these days and you can observe one of the other bank announcing fixed deposits interest rates revised each month and in range of 9-10% . I will show you a snapshot of various banks Fixed deposit interest rates with varying tenures.

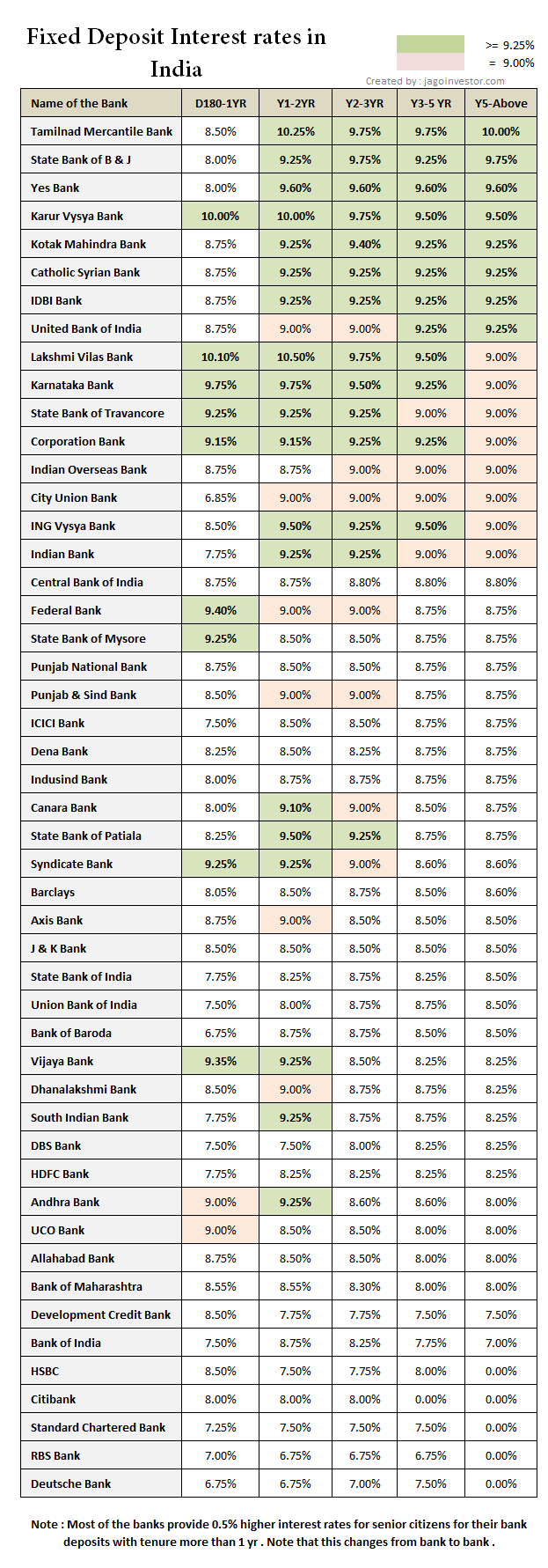

For simplicity purpose, I have not included tenures of less than 6 months . See the graph below . Green color represents interest rates higher than or equal to 9.25% . Pink represents exact 9% . The banks mentioned in the table below are Tamilnad Mercantile Bank, State Bank of Bikaner and Jaipur, Yes Bank, Karur Vysya Bank, Kotak Mahindra Bank, Catholic Syrian Bank, IDBI Bank, United Bank of India, Lakshmi Vilas Bank, Karnataka Bank, State Bank of Travancore, Corporation Bank, Indian Overseas Bank, City Union Bank, ING Vysya Bank, Indian Bank, Central Bank of India, Federal Bank, State Bank of Mysore, Punjab National Bank, Punjab & Sind Bank, ICICI Bank, Dena Bank, Indusind Bank, Canara Bank, State Bank of Patiala, Syndicate Bank, Barclays, Axis Bank, J & K Bank, State Bank of India (SBI), Union Bank of India, Bank of Baroda, Vijaya Bank, Dhanalakshmi Bank, South Indian Bank, DBS Bank, HDFC Bank, Andhra Bank, UCO Bank, Allahabad Bank, Bank of Maharashtra, Development Credit Bank, Bank of India, HSBC, Citibank , tandard Chartered Bank , RBS Bank and Deutsche Bank . Look at the table below for the indicative interest rates for different tenures.

Note that a lot of banks offer high interest rates for special tenures like 500 days, or 555 days or 1000 days, but they have some restrictions which people dont know – some of them are

- Some banks have provision, if rates increased in future, you can not apply for extention at higher rate of interest, instead you have to close that account and apply for new one.

- Automatic renew not possible.

- Upon maturity, you will not be able to get overdue interest.

- Sometimes, you cannot premature close the deposit. however, these conditions vary from bank-to-bank.

Thanks to Lokesh for this information

High level Observations

There are some patterns we can see in area of fixed deposits . here they are

- Fixed deposits with high interest rates for almost all the tenures are not the heavyweight banks, but the new generation banks, they are Tamil Nad Mercantile Bank, Karur Vyasa Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank and others

- Most of the banks provide 0.5% higher interest rates for senior citizens if the tenure is more than 1 yr . But if tenure if lower than 1 yr, the interest rates are same for senior citizens also . This is widely true , but some banks like Axis bank , SBI bank , ICICI Bank and HDFC Banks gives 1% higher interest to senior citizens.

- Most of the foreign banks like Citibank, RBS , Standard Chartered has low-interest rates in range 6-7.5% . This is unattractive during these times when other banks are giving higher rates .

Low and Medium risk appetite investors can cheer

For investors how find themselves not too comfortable with equity and for those who want to park their money for few years without taking any risk and earning some good return in range of 9-10% , Fixed deposits are very good options.

The only point is if you are in high tax bracket, most of the returns will go in tax, but for investors who are in lower tax bracket of 10% or below the permissible limits , they can look for these options without much thought . These fixed deposits were for the year 2011 , but for most part of 2012 also these bank fixed deposits interest rates will be applicable .

June 23, 2011

June 23, 2011

The bank interest shown by you seems to be very old. In my case I am receiving interest on monthly and quarterly basis. As the bank rates have gone down very low I think I will be not able to meet my requirements from Bank interest. I don`t prefer mutual funds as I have lost lot of money investing in such funds. I am interested in investments in Banks or good Companies which give better return. I would like to have your advice regarding this with latest interest I can get

Yes, it might happen thats its old interest

hi manish sir,

lic agent has suggested me to invest RS 7000 every month. my salary is 22000 is this plan of investing a lot of salary good for future or dependents.

What plan is it ?

it is jeevan anand.

Wonderful compilation Manish. Do you have a similar one for NRI’s?

No SP . No yet ..

Hi manish I want invest money in postoffice monthly sceme please tell me what to do explain it in briefly.

Inderjeet

Here is a post explaining that – http://jagoinvestor.dev.diginnovators.site/2011/01/post-office-monthly-income-schemes-pomis.html

Manish

Your name implies the investor should jago and the interest rates you provide are 3 years old!! I think you should first Jago, for rates have undergone a sea change

Yes, thats an article written long back !

Manishji,

HDFC is providing Loan of 4.9L on reducing rate of 0.99% pm | 11.88% pa for 36months. EMI coming to Rs. 16847 each month; they suggested if i can put this amount in any FD- i can earn more than interest paid of Rs. 95K after 36months. Do you suggest i should pick-up such an offer & invest in Muthoot or any other FD to earn higher interest?

Please guide

You should never take a loan just for the sake of it . The question is DO YOU BADLY NEED IT ?

Actually, i do not need it; Lure here is earning- about 40-50K extra in same time period of 36 months by investing in other avenues.. Thank you however for your guidance- i’ll follow it.

In the IDBI bank, they had last year deducted TDS for me after calculating quarterly interst calculated after every 3 months reckoned from the deposit date.Surprisingly,for my cumulative deposit dated 2nd Jan 2012, they worked out the interest due to me notionally on 2nd April 2012 as Rs 1220/-and

this entire amount was shown against the Fin.year 2012-13 ,without splitting the amount to the two fin.years involved-i.e amount calcalated up to 31 march 2012 as alloted to the Fin year 2011-12 and the rest for the two days in April 2012 as allotted to 2012-13.They argue that any amount credited to the investor on a particular date in a particular Fin year has to be paid TDS ,if the total interst for the year 2012-13 exceeds Rs 10,000/-.Please enlighten if their argument is correct or it should be split in to the two Fin years ,whenever the particular quarter crosses the 31st march limit for the Fin year .If they had split the quarterly interst amount in to two Fin yeatrs,I dont come under the ambit of TDS. Now,as a senior citizen not liable to tax ,i have to file the income tax return to claim the TDS amount wrongly done by the bank.Pl clarify if my stand that the TDS was wrongly done by the bank and they should refund it to me.Please give your view on this issue thro’ e mail to me. My mail id is”[email protected]”. thanks…p.srinivasulu

Did you give them form 15G ?

There was no need to give form 15G or 15H in my case ,as I am a senior citizen and i knew that the interst would not exceed rs 10,000/-.My contention is that there is no TDS involved in my case as the total interest amount does not at all exceed Rs 10,000/- if they had correctly calculated it by splitting the 1st quarter interest in to the two financial years involved viz from 2nd jan 2012 to 31st march 2012 (going to Fin year 2011-12)and again from 1st April 2012 to 2nd april 2012 i.e just for 2 days(going to Fin year 2012-13) .They showed the whole interest worked out for the qr from 2nd jan 2012 to 2nd april -sayRs 1020/-0r so, entirely to the Fin year 2012-13 only.This increased the total interest beyond Rs 10,000/ and as such they cut the TDS. My contention is that it is not the correct way of arriving at the actual income for the fin year 2012-13.Am i right and if so can I not demand

back the TDS amount wrongly deducted from me?..P.srinivasulu

You can always file the return and claim back the TDS

how to calculate compound int on fd

Open FD/MIS in minor childrn`s name with you as joint a/c holder. Intt. earned upto Rs.5000/- per year, per child is totally tax free.

Hello,

I have query about PPF tax saving limit. Plz confirm new limit of Rs. 1.0 Lac in PPF is appicable in current year? If I will invest 1.0 lac only in PPF for 80C deduction this year then it is OK?

Amit

Yea its applicable in this year .. it was applicable from Dec 2011 itself . You can put all 1 lac in PPF if you want

Manish

Thank you Manishbhai.

What is rate of interest for FD in all banks as of 1 dec 2011 ?

Can you please update above article ?

JRC

jrc

you will have to do this search on your own for now .. will update this later

Manish

Hi Manish

Do we have any article on how exactly the tax is calculated on FD return- for 6months or 1year period? And what is the actual rate of return/interest?

I’ve parked some of my emergency cash pool in Bank FD for 6months but just could not figure out how the tax/maturity amount was calculated?

if you could help….

Great One!

Thanks..

Also normal rates of Bank of Baroda depicted there are wrong. They give minimum 9%

Last week I purchased Bank Of Baroda 444 days FD for 9.35%

What you have depicted for Bank Of Baroda is wrong in the chart

http://www.bankofbaroda.com/pfs/barodautsav.asp

Hi Manish,

I personally feel that special schemes of diff banks shld also have been considered while compiling the list.

Eg IDBI is offering 9.50% and SBP (Patiala) 9.75%

Karun

I am a NRI customer for SBI, HDFC and Citi. I am not sure why, as you said there is huge desparity between FD rates with some banks like Citi offering lowest rates in the market. While booking FD, I consider nomination is very important. The funny part is, while we can create FDs online through net banking, we can’t give nomination through online. The nomination form as per RBI rules requires two witness signature which is very painful if we have RD kind of set-up for small FDs in a SIP manner. Filling the form manually and with two witness signs and posting it from overseas, almost each FD continues 2-4 wks without any nomination.

Another hassle that are faced by NRIs are TDS deduction. An eloborate documentation need to be submitted for lower TDS (to get some of them attested by far off embassy) and it goes back & forth. Believe me, even while we submit all documentation, the manager or concerned staff could change and max TDS is applied in the end.

One more hurdle is Form-16A. We are just a month away from tax filing due date and I am struggling to get the Form-16A from two banks.

It is a common perception that FDs are easy but latest technologies deployed by the banks only enable FD booking but all other processes (nomination, TDS & Form-16A) continue to function like age old banking with any of the bank in the market.

Krish

the issues are much more than I thought, you have explained them very nicely . Starting a FD is easy , but the processes which come after that are real thing .

i think krish should do FDs by way of Auto-sweep facility in his account, through this way information on nomination and TDS would be intact. also there will be full flexibility for withdrawl purpose, autorenew. certificate of Tax deduction is provided by bankers on demand nowadays.

Lokesh

So what you are saying is that if we do FD with auto sweep options , it compulsory to give nomination and other details which are not taken in case of online FD’s (plain) . thats a good tip !

Manish

auto sweep FDs uses same info as updated in original SB or CA a/c

NCDs to be issued by Shriram Transport looks good for 5 year duration compared to 5 year FD.

Atul

from interest point Yes , but read Abhishek comment on this , dont just judge something by interest rates : http://jagoinvestor.dev.diginnovators.site/2011/06/fixed-deposits-rates.html#comment-24262

Manish

Hi Manish,

I have heard similar complain against other companies like JP and Unitech.

Since the NCDs will be in DEMAT form and listed I am sure Shriram would be careful in addressing investor concerns (else face wrath of SEBI).

Cheers

Atul

Atul

Also read Subra’s article on this : http://www.subramoney.com/2011/06/shriram-transport-finance-debentures/

here is some more info on SRTRANSFIN:

1. Shriram Transport Finance Company Limited (SRTRANSFIN) has distributed more than Rs. 6 billion as dividend in last 5 years showing enough cash-flow while current NCD issue is fetching Rs. 5 billion.

2. 11 March 2011, News in TOI: TPG to exit Shriram Transport with 8-fold gain fetching $ 1 billion (Rs. 45 billion)

3. share prices of SRTRANSFIN has tumbled more than 25% since march 2011.

Interest rate proposed is great here and i am also tempted to buy few units, but i have gathered these news from google search only(could be incorrect). do these make sense?

In case of bank deposits, there is a column for mentioning the account no. where to deposit interest. but that account should be with the same bank.

I have done FD with cosmos bank last week for 555 days with rate as 10.25 %

Vijay

Ok , so are you saying the interest which you get each year , that can be deposited in an account of choice ., But in the same bank !

Manish

banks have a section of ‘interest payment instructions’ in deposit form, where you can check the option which you require: (Monthly/Quarterly)

1. trasnfer to Sb/ca/cc/loan a/c or

2. Pay.Order./Demand.Draft. to the mailing address

3. Others (please specify)

however, point1 is easiest for the banks, but if someone wants point 2 or 3, bank should honour the instructions.

Hi Manish,

I have a query. Will the money be credited back automatically to my savings account on maturity if I open an FD in some xyz bank?

Could you please share your inputs.

I want to share my experience on the money I have invesed in shriram transport company fixed deposit through ICICI direct.

1. Its been 3 months and I did not get any reciept until now. ICICI direct doesnt take any responsibility [when did they first of all :(] . I followed up with shriram transport guys. they say they have a problem with the courier guy.

2. After the maturity I have to send some sort of form asking to credit back the matured amount to my account to the company. Otherwise your FD will automatically be renewed.

I want to share that for an extra interest rate of 0.25%, I have to take all these risks.

Thanks,

Abhishek

Abhishek

The FD will not automatically come to your account if you have not given the directions for that . You either have to give directions for withdrawal or renew of FD , if you fail to do so , the FD matured amount will transferred to another account generally called overdue deposit and there will not further interest given in that if you dont act .

And sad to hear your case about the sriram thing . What are you doing now on that?

Manish