We will discuss few EPF rules today. A small part of your salary (12% of your basic salary) is invested in something called EPF or Employee Provident Fund and an equal amount is matched by your employer each month.

This is what 95% of people know, but there are many things which a lot of people don’t know and this article is going to open some not known secrets about EPF rules. So let’s take them one by one in point’s format.

1: You can also nominate someone for your EPF

Do you know that there is also a “nomination” facility in EPF? The nominee will be contacted at the time of death of the person and handed over the money from the provided fund. However, if the nomination is not present (which you should check), it can rise to all sorts of issues while claiming the money.

There is a form called Form 2 which has to be filled to change or update the nomination. Please contact your company finance department or directly send the form to the EPFO department.

2: One can get pension under EPF

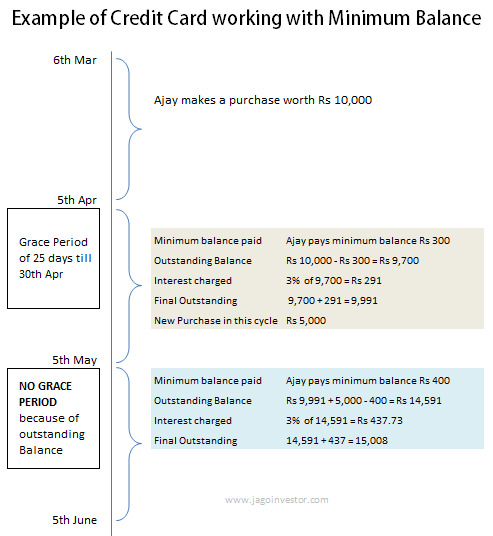

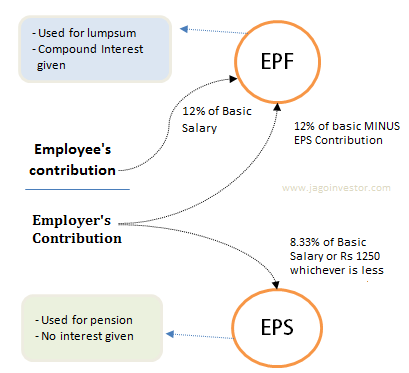

Do you know that there is something called EPS (Employee Pension Scheme) in the provident fund? The EPF part is actually for your provided fund and EPS is for your pension.

The 12% contribution made by you from your salary goes into your EPF fully, but the 12% contribution which your employer makes, out of that 8.33% actually goes in EPS (subject to a maximum of Rs 1250) and the rest goes into EPF. To understand it this way, a part of your employer contribution actually makes up your pension corpus.

But there are some caveats to this.

- One is liable for pension only if one has completed the age of 58.

- One is liable for pension only if he has completed 10 yrs of service (in case of more than one companies, the EPF should have been transferred, not withdrawn)

- The minimum Pension per month is Rs 1,000

- The maximum Pension per month is subject to a maximum of Rs 3,250 per month.

- Lifelong pension is available to the member and upon his death members of the family are entitled to the pension.

3: No interest is given on EPS (pension part)

You must be thinking that you regularly get compound interest each year on your contribution + employer contribution. But it does not work like that. The compound interest is provided only on the EPF part.

The EPS part (8.33% out of 12% contribution from your employer or Rs 1250 whatever is minimum) does not get any interest. At the time of PF withdrawal, you get both EPF and EPS.

4: You might not get 100% of your Provident Fund money

Imagine your contribution + employer contribution has been a total Rs 3,50,000 to date. Out of this 3,50,000 , suppose 2,50,000 has gone in EPF , and rest 1,00,000 has gone in EPS (for pension) . Now if you quit your job in the 6th year of employment and opt for withdrawal of your Provided Fund money (EPF + EPS actually), then do you think you will get a total of 3,50,000. NO!

That’s because you always get 100% of your EPF part, but for EPS there is a separate rule.

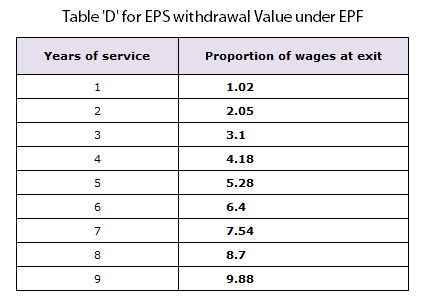

There is something called Table ‘D’, under which its mentioned how much you get at the time of exit from your job, there is a slab for each completed year and you get n times of your last drawn salary (depending on the completed year of service) subject to maximum to Rs 15,000 per month.

So if your salary, in this case, was Rs 30,000 per month, still you will be given only 15,000 * 6.40 = Rs 96,000.

Note that the table D is up to 9 yrs only, because if 10 yrs are crossed, then you are liable for a pension.

5: You can invest more in Provident Fund, its called VPF

You can always invest more than 12% of your basic salary in Employee Provident Fund which is called VPF (Voluntary Provident Fund). In this case, the excess amount will be invested in PF and you will keep on getting the interest, but the employer is not supposed to match your contribution. He will just invest up to a maximum of 12% of your basic, not more than that.

6: Withdrawing of EPF amount at job change is illegal

Almost everyone thinks that withdrawing of your Employee Provident Fund amount after a job switch is totally fine and allowed, however as per the EPF Rules, it’s illegal.

You can only withdraw your Employee provident fund money, only if you have no job at the time of withdrawing your money and if 2 months have passed. The only transfer is allowed in case you get a new job and you switch to it.

While there are no cases where EPF office tracks these things and takes up this matter, still just for your information you should know that if you got a new job and took it and then you are applying for withdrawal, it’s illegal as per law.

What in the case of EPS?

In the case of EPS, if the service period is less than 10 years, you have the option to either withdraw your corpus or get it transferred by obtaining a ‘Scheme Certificate’. Once, the service period crosses 10 years, the withdrawal option ceases.

Just for your information, you can withdraw your EPF money without the help of past employer signature by attesting your withdrawal form by a bank manager or some gazetted officer. I hope you are clear about EPF withdrawal rules.

7: One can opt-out of EPF if he wants

Yes!. I know this might be a surprising fact for many, but if one’s basic salary per month is more than Rs 15,000, he has an option to opt-out of PF and not be part of it. In which case he will get all his salary in hand (without anything deducted every month).

But the sad part is that one has to opt-out of Provident Fund at the start of his job. If a person has been part of EPF even once in his life, then he can’t opt-out of it. So if you have already had EPF in your life.

This option is not for you, but if you are new to the job and your PF account number still does not exist, you can tell your employer that you don’t want to be part of Employee provident fund. You will have to fill up form 11 for this.

8: Your EPF gives you some life insurance too

A lot of people might not know that in case a company is not providing group life insurance cover to its employees, in that case, the employee is given a small life cover through EPF. This is because there is something called Employees’ Deposit Linked Insurance (EDLI) scheme and your organization has to contribute 0.5% of your monthly basic pay, capped at Rs 15,000, as premium for your life cover.

However, companies that already have life insurance benefits to employees as part of the company, are exempted from this EDLI scheme. The bad part of this EDLI scheme is that the life cover under this option is very low and that’s the maximum amount of Rs. 60,000. While this is peanuts for most of the people in big cities.

For employees in small scale industries and small cities, this amount of Rs 60,000 will still count something.

9: You can use EPF money can be withdrawn at special occasions

So now you know that EPF withdrawal is not permitted if you are still working. But there are occasions when Employee provident fund withdrawal is allowed.

While you cannot withdraw it fully, you can withdraw a partial amount. Following is a list of events when you can withdraw the Provident Fund amount and the conditions you need to fulfill

1. Marriage or education of self, children or siblings

– You should have completed a minimum of seven years of service.

– The maximum amount you can draw is 50% of your contribution

– You can avail of it three times in your working life.

– You will have to submit the wedding invite or a certified copy of the fee payable.

2. Medical treatment for Self or family (spouse, children, dependent parents)

– For major surgical operations or for TB, leprosy, paralysis, cancer, mental or heart ailments

– The maximum amount you can draw is 6 times your salary

– You must show proof of hospitalization for one month or more with leave certificate for that period from your employer.

3. Repay a housing loan for a house in the name of self, spouse or owned jointly

– You should have completed at least 10 years of service.

– You are eligible to withdraw an amount that is up to 36 times your wages.

4. Alterations/repairs to an existing home for a house in the name of self, spouse or jointly

– You need a minimum service of five years (10 years for repairs) after the house was built/bought.

– You can draw up to 12 times the wages, only once.

5. Construction or purchase of a house or flat/site or plot for self or spouse or joint ownership

– You should have completed at least five years of service.

– The maximum amount you can avail of is 36 times your wages. To buy a site or plot, the amount is 24 times your salary.

– It can be avail of it just once during the entire service.

10: You can file an RTI application for EPF issues

Did you know that you can file an RTI applicable to get any kind of information regarding your EPF? You can file it if you are facing issues like no clarity about EPF balance, no action taken for your EPF withdrawal or transfer. To find out information about other issues on the Provident Fund. I have done a detailed post on how to file an RTI for your EPF issue.

Watch this video to know how to file RTI for EPF withdrawal or transfer issues:

UPDATES

- In the recent budget 2015, the govt has made it clear that now an employee can choose between EPF and NPS. The employer will have to give this option.

- Now the new system of UAN is in place for EPF, which has made a lot of things more simpler

Conclusion on EPF rules

The overall Employee provident fund rules are too complicated and very old. A common man does not know all these EPF rules, but knowing these minimum 10 EPF rules will help him in his financial life.