Is looking for perfection killing your financial life ?

Do you know that looking for perfection for everything in your financial life can be one big reason why your financial life is a mess! . If you dont think so, read the story below.

The Perfect Woman

Once upon a time, an intelligent, attractive, self-sufficient woman in her late twenties decided that she wanted to settle down and find a husband. So she journeyed out into the world to search for the perfect man.

She met him in New York City at a bar in fancy hotel lobby. He was handsome and well spoken. In fact, she had a hard time keeping her eyes off of him. He intrigued her. It was the curves of his cheek bones, the confidence in his voice, and the comfort of his warm, steady hands. But after only a short time, she broke things off. “We just didn’t share the same religious views,” she said. So she continued on her journey.

She met him again in Austin a few months later. This time, he was an entrepreneur who owned a small, successful record label that assisted local musicians with booking gigs and promoting their music. And she learned, during an unforgettable night, that not only did they share the same religious views, he could also make her laugh for hours on end. “But I just wasn’t emotionally attracted to him,” she said. So she continued on her journey.

She met him again in Miami at a beachside café. He was a sports medicine doctor for the Miami Dolphins, but he easily could have been an underwear model for Calvin Klein. For a little while, she was certain that he was the one. And all of her friends loved him. “He’s the perfect catch,” they told her. “But we didn’t hang in the same social circle, and his high profile job consumed too much of his time,” she said. So she cut things off and continued on her journey.

Finally, at a corporate business conference in San Diego, she met the perfect man. He possessed every quality she had been searching for. Intelligent, handsome, spiritual, similar social circles, and a strong emotional connection – perfect. She was ready to spend the rest of her life with him. “But unfortunately, he was looking for the perfect woman,” she said.

Just like the story above, we all are looking for the “best” and the “perfect” financial products, services and financial life, which does not exist in reality. As we don’t get perfection in most of the things we are looking for till the extent we want, we don’t take any action. We keep on searching that perfect financial product which has no defect and which is better than it’s competitors and gives us the maximum benefit.

Let me share with you couple of instances which happen in real life

Imagine a guy who wants to buy a term plan. He wants a term plan which is cheapest in the premium, he wants a term plan with best customer support, he finds few options. He was going to buy it but then suddenly he read that there is something called “claim settlement ratio” and the best of premium and customer support is of no use if this “claim settlement ratio” is not high. 3 months are gone.

He again gets on net and then concludes that the company with best settlement ratio’s have high premiums and only 2 companies are with good settlement ratio and low premiums, but he has seen 2 people complaining on jagoinvestor.com about the bad customer service. He decides to wait for some other company which fits in his criteria. 2 yrs passed by .. he never took any term plan.

Now imagine a guy who wants to go for a fixed deposit for 3 yrs. He is so excited with high interest rates that he decided to put some extra money then he planned for. But then came the issue, there are smaller banks which are offering 0.25% higher interest rate than his bank and he does not want to “loose” the free interest money. After all, all the banks are same. Then some one advises him that never go for pvt banks because they are all “chor”, but PSU banks especially the big one’s which his father approves are not giving that high interest rates. While all this as going on suddenly banks have now dropped the rates back and all his plans are dropped. His money kept lying in saving banks only.

Now again imagine this guy wanting to hire a financial planner, The planner he wants to hire comes on TV , writes few articles on few websites and also educates everyone. The financial planner charges Rs 20,000, but this guy “feels” that the fees is too high for him and that planner is not giving him sample plan also and the planner is not ready to give a free consultation too! . So there are few things which didnt match his expectation and he decided to give himself some more time. And this guy had 20 lacs in saving bank account which remained there for next 3 yrs because he didnt know where to invest it for best returns.

Is looking for perfection stopping your financial life to grow?

Now coming to the real point, what I want to say is that we all are looking for perfection in our financial lives, mutual funds, term plans, financial planners, bank deposits, relationships, education, marriage etc etc. This looking for perfection is somewhere not helping us grow. Its stopping us from taking decisions which can be much much better than not taking any decision because we didnt find that perfect thing.

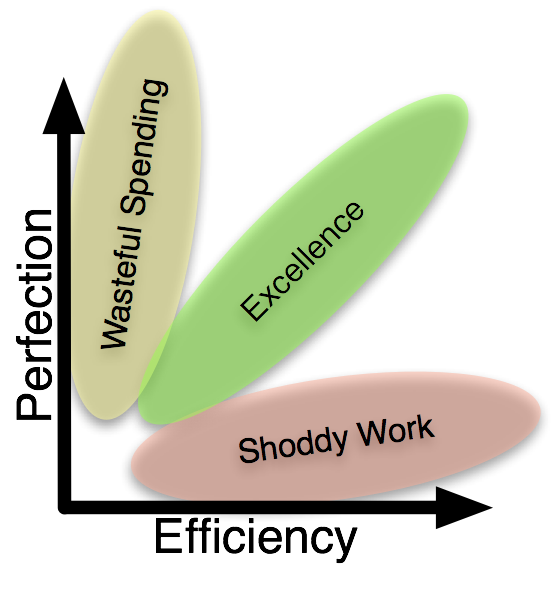

90% Perfection Rule

I will say that the only solution to this problem is to look for only 90% perfection in whatever you do and let 10% go. Focus on the next step, that’s taking action because 10% of it will be things you will neither be able to find out, nor it will be totally constant. So as soon as you start getting a feel that you have understood 90% of something and 10% of things are remaining, focus your mindset on taking action, choose things based on that 90% knowledge itself. While this 90% is subjective, you can choose 95% of 85% , but make sure its not 100%, because then it does not serve you.

What do you think about this?

May 10, 2012

May 10, 2012

HI Nobuddy,

Can you give the company names you were referring to?

Thank You Very Very Much Manish for giving a platform to share the comments from different peoples.

Very nice information.

Best of Luck for the future threads and your efforts to make aware of financial planing and decision making.

Thanks

Hi Manish

I have a different view. It runs like this:

• A person does not know the effects of under insurance, or ill effects of not saving

• He reads something here and there, and comes to know these things

• He talks to a few people, 10 people suggest him 10 things

• He thinks – “oh God, this is too complicated, wish there was somebody to advise me in an unbiased manner and make things simple for me”

• He doesn’t find such a person. Life moves on. Tax season comes.

• One fine day, he gets to see a very good ad that emotionally tells him how important is to keep the head held high….he is moved!

• He calls the agent. Agent is fantastic in his job. He tells the agent – “tell me where I have to sign”

• Some months later, he meets another of his friends, who says – what a useless choice you made!

• He goes home…now it’s the product vs his ego….he realizes that his friend was right!….his ego is shattered. He blames the system, the agent, the company….

• Life moves on – new responsibilities, family, work….

• And then somebody tells him…hey you haven’t got home insurance…go get one! Now, he thinks, what to do….and the circle repeats itself again

And this circle happens till he messes up beyond control and comes to realization – hey, I need help! And approaches a financial planner! I think there will be a very less percentage of population that will keep their decisions pending because of looking for perfection, most of them suffer like this…some lucky ones though get saved as they get to your blog in time:)

Abhinav

Yes wht you mentioned is the story of most of the people, but how is it related to this article ?

nice article which gives importance to taking action

Thanks for appreciation

Excellent Article… I have faced the same issues which are described in this article and This experienced teched me that Action is more important than 100% perfection.

Thanks for confirming this concept !

A man was sure he will never find the PERFECT woman, so he acted and married a not so perfect woman, now a few years later, he meets a friend who introduces him to a PERFECT woman, what should he do? Leave his first choice from whom he has 2 children Divorce her and leave the children and go and re marry the new person he has met?

Lets relate this with Financial Planning a man has been “Investing” in Insurance policies(Not so perfect Woman but marries anyhow) FD’s and Post office schemes and some random MF schemes, now comes along a FINACIAL PLANNER and tells him to SURRENDER all his “Investments ” lock stock and barrel and plan according to what he says.

Would love to get comments from Manish and other readers on this almost real life situation!

Its very simple .. see the life ahead , if its worthwhile , you can move ahead. Also in your example it involves two people , who both have emotion, giving divorce to wife means it will hurt lady and you might feel bad and she too. In which case you might not want to .

In case of financial life, you are the person , the real person , you wont care for a policy to feel bad 🙂

Excellent article… I was in fact facing the same problem in many things for long time, but not able to find the solution. Really your article has given me a solution that actually lies within me not outside. Now on wards I will satisfy with what I am having. Thanks a lot.

Good to hear that 🙂 .. concentrate on action !

Manish – Good treatment of Behavioural finance. Hope we have many people read this and take steps towards financial independence though not necessarily thru the ‘perfect’ way.

There was some article in ET few weeks ago which said the worst performing Equity scheme itself had returned more than 10% CAGR in a decade – good enough to beat the 100% FD dependent investor.

Leaving aside the perfect financial product behind (if not visible/available when we try) is the best way forward! Excellent article again.

Yea .. thanks for acknowledgement on this !

Hi Manish,

As usual this article also gives us insights on how we ignore important things in life such as Financial Planning. I have also experienced the same at some part of life. It happened with me that I was postponing to take a term plan, but finally I did it last year…

Thanks for all your thought provoking articles…

Good to hear that Deepa

Hi Manish, very nice article. I have been following your blog for 2-3 weeks now and your latest series on term insurance is very insightful as I am planning to buy one.

Hopefully I won’t fall into perfection trap and get one soon!

Sure ! .. Just do some study and choose a good one , the rest is ACTION

nice article. i too have been postponing the term plan. But not any more.

Good to hear that

Which one are you getting ?

Aegon religare. Claim settlement ration has been discussed threadbare in this forum. AR has a poor CSR. But ultimately as i understand what matters is how truthful one is at the time of filling the form and also getting the medical done as a baseline to clear any doubts which may arise in future regarding nondisclosure of illnesses. Manish please correct me if i am wrong. lot of negative comments have been posted for AR online term plan, but i find it good. any comments manish?

typo at ratio

There are tons of positive comments also , as you said all what matters is giving correct info while filling up the form .

nice article..its really worth reading and taking financial decision

Thanks Sahil

Good One.

Hi Manish,

Very true!!! Infact I have been wanting to encash the ELSS for the last 1yr+ hoping the market to catchup so that i can encash all my losses and convert them into FDs. However that perfect moment has still not arrived 🙁

Although I took a similar step with my ULIP 1 yr back I’m glad that I did. 🙂

We really are those typical optimistic Indians wishing for a little better day…

– nice article…

Thanks for your comment Varun

I am sure you are very clear now that you need to take actions on that ELSS !

Still hoping for the market to improve :p in order to cash out.

I can recollect being faced with multiple choices during work also, when people ask

“Which is the best way to load large file to database”. Possible answers are

1. use SQL Loader

2.write a Java program

3.use an external table

4.use Informatica to load or some new technology.

The best answer given was by my mentor who said if there was a single best way then there would be only “one” way to do so.

Thats great a great answer ! 🙂

I can recollect being faced with multiple choices during work also, when people ask

“Which is the best way to write an sql query”. Possible answers are

1. use SQL Loader

2.write a Java program

3.use an external table

4.use Informatica to load or some new technology.

The best answer given was by my mentor who said if there was a single best way then there would be only “one” way to do so.

Its perfectly true. In terms of finanaial planning/investment it really happened with me. who so ever the writer of the article may be, its amazingly relevant to many of the reader.Thanks for such articles

Thanks Suresh !

Tough but true.

Thanks Rajiv

Very true. My personal experience: Only when I overcomed this “Perfect Products” illusion, Only then I brought a mediclaim and opened a PPF Account. (Manish Had earlier written an article on the same concept where a guy wanted to find a perfect woman)

Good to hear that you cracked it !

Your article is True and hope let it open eyes of many 100% perfection seekers!?

Thanks Damodaran !