Balanced Funds Performance – HDFC Prudence vs HDFC Top 200

Have there been times when you thought of investing in Balanced funds like HDFC Prudence, but did not invest because you wanted to invest in pure equity funds with maximum exposure to equity? If yes, than you need to rethink this thought because balanced funds have performed superior than equity funds in some cases and given their diluted exposure to equity as compared to that of a pure equity fund, the returns are really worth considering. So here you go-

What are Balanced Funds ?

Balanced funds are Equity Mutual funds, which are not as aggressive and as pure equity diversified mutual funds and keep equity component in the range of 60%-75% and rest in Debt products or Cash. By definition you can see that Balanced funds are not exposed to equity in the same way as regular equity diversified funds whose equity exposure is generally 95% or more in an average scenario. Balanced funds keep a balance between equity and debt, with equity still being the higher component.

For example, HDFC Prudence keeps its equity allocation around 75% in most of the cases and rest 25% in debt or cash. However, Reliance Regular Savings Balanced is generally low on equity and keeps it around 60-65%, but from last some months, it has raised its equity exposure to 70%, but hasn’t touched its limit of 75% ever! . From tax point of view, any mutual fund which has equity component more than 65% is considered as “Equity Fund” and long term capital gains are exempted from tax after one year just like an pure equity equity fund .

Balanced funds Returns less risky than Pure equity mutual funds

As balanced funds are lower on equity exposure, the fall in case of market crash is lower than pure diversified funds. For example, during the financial crisis of 2008, balanced funds lost only 42% as compared with 53% drop in returns by diversified equity funds.

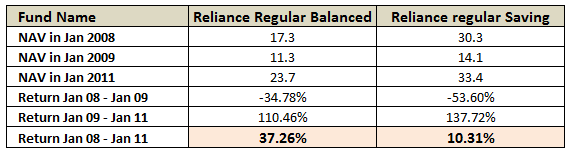

Lets also see another example of Reliance Regular Saving Balanced fund, its NAV was around 17.27 on 1st Jan 2008, exactly after 1 yr on 1st Jan 2009, its NAV fell to 11.26 which is 34.78% drop, where one of the best diversified equity fund from Reliance AMC called Reliance Regular Saving NAV was 30.28 on 1st Jan 2008 and it dropped to 14.05, which is 53.6% drop. After that in next 2 yrs, Reliance Regular Balanced fund has given a return of 110% , where as Reliance Regular Saving Equity gave a 137% return, which shows that Pure equity fund gave much better return than balanced funds in 2 yrs time frame (Jan 2009- Jan 2011). But the most interesting thing is to look at the 3 yrs return starting from Jan 2008 to Jan 2011, which shows that the return of Reliance Regular Balanced fund was 137% where as the return of Reliance Regular Saving Equity was 110%, which shows that if you also consider the crash of 2008 into the overall scenario, Balanced fund out performed Pure equity fund by a considerable margin.

Comparision of Returns from Reliance Regular Saving Balanced and Reliance regular Saving Equity Funds

Main Advantage of Balanced Funds

Balanced funds have to maintain their ratios of splitting between equity and debt by fixed percentage. In order to do so, the fund has to keep on buying and selling from time to time which leads to the concept of Asset Allocation. So, if a balanced fund has a ratio of 70:30 (Equity: Debt) and suppose it reached to 77:23, the fund manage will make sure that he sells the excess part of equity to rebalance the fund back to 70:30. However in equity funds, if the ratio itself was 98:2 earlier, despite the big run in markets, the equity part will still remain around the same ratio and there is no question of asset allocation.

So the conclusion is that the asset allocation is the internal advantage available to Balanced funds which leads to superior returns over longer term, but in short term, balanced funds will not out perform pure equity based funds incase there was a bull run. You always have to give balanced funds a long time to see the performance.

Performance of Balanced Funds vs Equity Funds

Can you imagine HDFC Prudence out-performing HDFC Top 200 despite having a low equity exposure compared to HDFC Top 200? Yes, it has happened! Now let me show you some statistics which I found out.

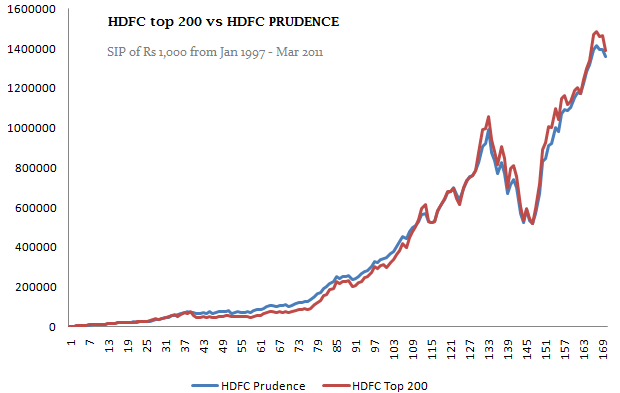

SIP investment in HDFC Top 200 vs HDFC Prudence

Over the last 14 yrs from Jan 1997 to Mar 2011, if you had done a SIP investment of Rs. 1,000 per month in HDFC Prudence, it would have become Rs 13.6 lacs and return turns out to be 25.93% CAGR. However if you had invested the same 1,000 per month in HDFC top 200, it would have become 13.9 lacs and return turns out to be 26.20% CAGR, marginally more … Which shows that despite having much lower equity exposure, HDFC Prudence has given almost equal returns like HDFC Top 200, which in my opinion can be called out-performance. Here is the chart of how the corpus was moving in both HDFC Prudence and HDFC top 200 for 14 yrs (SIP of Rs 1,000/month).

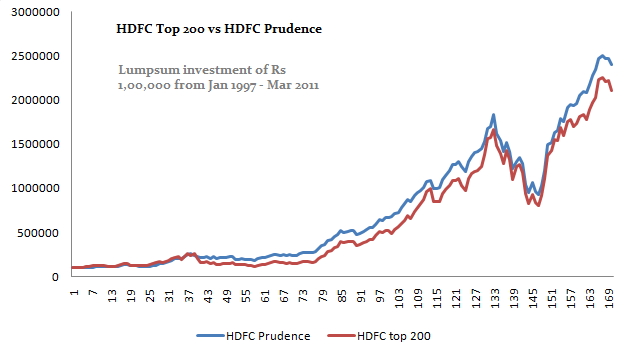

Lumpsum Investments in HDFC Top 200 vs HDFC Prudence

Now let’s come to lumpsum investment. Imagine you invested Rs 1 lac in HDFC Prudence on 1st Jan 1997 and I invest the same money in HDFC Top 200 on same date. We both redeem our investments on 11th Mar 2011. Who will have more money? Answer is it would be You, You will have around Rs 24 lacs (CAGR return = 24.94%), whereas I will have approx 21 lacs (CAGR return = 23.78%). See the chart below to look at how the corpus moved per month in case of one time lumpsum investment.

Some more statistics on Balanced Funds

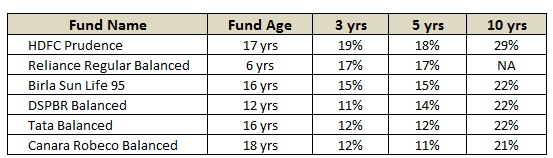

- In the last 10 yrs , the return from HDFC Prudence is 29.38% . Only 2 Equity Diversified funds has outperformed HDFC Prudance in true sense, which are Reliance vision and HDFC Top 200

- HDFC Prudence 5 yrs returns is 17.93% cagr and its more than pure equity funds (The best return is from HDFC top 200 at 17.90%)

- HDFC Prudence returns have outperformed all the equity diversified equity funds in 3 yrs time frame, HDFC Prudence returns for 3 years is 18.65% and the best equity diversified funds in 3 yrs time frame was Mirae Asset India Opportunities Regular with returns of 17.88%

- The average of top 5 balanced funds return in last 5 yrs was 15.88% (17.93 , 16.97 , 15.54 , 14.55 , 14.40) and average of top 5 equity diversified funds was 16.63% (17.9 , 17.63 , 16.88 , 15.72 , 15)

- The average of top 10 equity diversified funds in last 10 yrs was 27.67% , balanced funds was 22.57%

List of good Balanced Mutual Funds

Source of Data : All the data is taken from Valueresearch , and for growth category of mutual funds , not dividend , All data as on 19/04/2011 .

Do you invest in balanced funds ? What you think it would be wise to invest in balanced funds compared to pure equity funds ? Share your thoughts on this HDFC Prudence vs HDFC Top 200 comparision which must have shown you difference between equity funds and balanced funds

April 24, 2011

April 24, 2011

Hi Manish,

I am a regular follower of your blog. After reading few of your articles i have invested 30K in HDFC top 200 Growth plan and have a SIP of Rs 1000 per month in the same going Forward for one year.

As shared by you that debt content is equally important in a portfolio, but HDFC top 200 Growth has 0% debt content.

Please suggest me regarding the same. I have a Moderate Risk apetite with a time horizon of 25 years and a sum of 35k in hand to invest further.

Thanks,

Utsav Jain

For now you can add that only ..

Thanks for your reply Manish! 🙂

Can you please suggest me atleast one more Mutual fund apart from HDFC Top 200.

I expect a 13-15% p.a. return with a time horizon of 25 years and a sum of 35k in hand to invest.

Thanks,

Utsav Jain

Quantum Equity is good one

Hi manish,

Last year I have started investing around 8K P.M thru SIP in equity funds.. Here are the funds..

HDFC Top 200 (3000)

Birla Sunlife Frontline Equity (3000)

DSP Black Rock Equity Fund(2000). -> This is not doing great..

This year I have enhanced by another 10K p.m. I have chosen these funds. I am looking for a long term investment in these (10 to 15 yrs).. Please advice if my porfolio is okay and suggest me if I need to make any corrections.. I am living in an own house and I have taken necessary steps to cover for life insurance and medical insurance for my dependants.

HDFC Prudence Fund (2000)

ICICI Prudential Focussed Blue Chip Fund (2000)

Franklin India Blue chip (2000)

SBI emerging business(2000)

HDFC Gold Fund Growth(2000)

Rgds

Hi Ramesh

Please take some views on our forum regarding your portfolio – http://www.jagoinvestor.com/forum

Now a days ICICI prudentila Balanced fund also in limelight. It is top rated fund for outlookmoney and valueresearchonline.

Yea even that one is good now a days !

Gr8 Article. As usual, i am starting bit early for tax planning for next year.

Its been around 8-9 months, i am doing below investment

1. HDFC Prudence: Rs. 7000

2. Reliance Gold ETF: Rs. 3000

3. HDFC Cash Management for left over amount.

Do you suggest doubling the amount, as my income has increased now?

Yes .. increase it !

Hi Manish,

Thanks for your website and inspiring articles because of which, I have started investing 5000 Rs. each in HDFC Prudence and HDFC Equity Direct Growth plan through SIP from this month.

I was looking at the performance of these above (non direct) Funds for last five years on moneycontrol.com. I think, after 2007, Mutual Funds have not produced much exciting results. Is it unless there is not consistent growth in the market or there is a bull run Mutual Funds will not perform very well? The graph goes up and down, but does not go increasing upwards much, instead it stays almost same. The downturns in the market are coming very often now and market often looks bad. Looking at the world economy and Indian markets do you think that investing in Mutual funds or stocks is not advisable? Instead, if one takes advantage of ups and downs in the market and does trading instead of investing, will that make more financial sense? what do you say about this? Thanks in advance.

I would still say that look at the long term like 10-15 yrs . Short term movements like these should not affect your original plan

Hi Manish,

I have strated my SIP of 5000/- p.m. in HDFC Equity Direct Growth and 5000/- p.m. in HDFC Prudence Direct Growth from last month. Finally I took an action on my plan and started to invest in Mutual Funds. Thanks to your blog and awesome articles.

I was just checking the performance of the above two funds (without direct option) on moneycontrol.com for last 5 years. And I feel that, unless there is no bull run in the market or a continuous growth which continues for a while Mutual Funds fail to perform well. Then we just have to hope that, the kind of market condition will come and then you will get that capital appreciation. Now, looking at global financial situation, it looks like down turn and bad market conditions will occur frequently and all economies will struggle to show a consistent stable growth. I could not see the graph is going up and up in that time frame. It is going up and down but overall it’s not leading always upwards unlike market before 2008. Is it advisable to do trading by taking advantages of ups and downs and not doing long term investment? What do you say about this? Thanks in advance.

Yes you can do that, but the question is Are you ready to take the risk of not able to time the market and loose the money ?

Hi Manish,

1. I am investing for the first time in mutual funds and after doing some research I have zeroed upon the following options :-

(a) Franklin India Blue Chip fund ( Rs 2000 pm) for 10 years

(b) ICICI Prudential Discovery Fund (Rs 2000 pm) for 6 years

(c) HDFC Balanced/Prudence Fund (Rs 2000 pm) for 8 years.

(d) Reliance equity Oppurtunity RP (Rs 1000) for 6 years.

2. Pl forward your thoughts on my choices.

Regards

Shrikanth

Better start with 2 funds as of now .. a and c looks good to start with

CAN YOU SUGGEST SOME STOCK IN THE RANGE OF BELOW RS 10 FOR BULK BUYING FOR VERY LONG TERM THAT MEANS NEED TO INVEST BULK IN EVERY 6 MONTHS AND LOOK FOR BUILDING CORPUS

Ask on http://www.jagoinvestor.com/forum/

Hi Manish,

I am new to MF. I have planned to invest in these 3 funds. Can you please tell me whether the plans are rightly choosen?

1. Franklin India Bluechip (For retirement)

2. HDFC Prudence (For Kid’s Education)

3. IDFC Premier Equity (For Kid’s Marriage)

Thanks

Udayakumar

Amount distribution is as follows:

1. Franklin India Bluechip (5000 / month)

2. HDFC Prudence (3000 / month)

3. IDFC Premier Equity (2000 / month)

Yes. .these are all great funds. JUst make sure you understand their nature and the risks involved !

Hi Manish,

What is the difference between direct plan and Existing plan ?

In direct plan, you will buy it directly from AMC, and there will be no AGENT, so the charges will be low and good for customer

Hi Manish,

I’m planning to start a SIP in HDFC Prudence fund and HDFC Balanced fund 1k each. ? Does it become duplicate instead should i start in one ?

I have a demat account in Sharekhan can i charge from it or Open new one in Fundsofindia ? Does sharekhan charge extra amt or brokaregae ?

You can start it from Sharekhan, regarding charges, you will have to confirm it from them only

sharekhan will not charge extra for mutual fund investments … it is one time charge for DMAT account around 500/- per year

Hi Manish,

Some balanced mutual funds specifying asset allocation ration in equity and debt as ” between 25:70 and 40:60 “. In these type of cases, from tax perspective, these funds needs to be treated as equity fund or not?

Thanks,

Raja Sekhar

ONly if the equtiy part is above 60%, its treated as equity fund !

Manish

I am of 25 years of age and I want to start investing Rs 2000 per month in mutual funds through SIP. I am thinking about investing through fundsindia.com. I want to invest Rs 1000 per month in HDFC Prudence. I am not so sure about the other MF to invest in. Could you suggest a good MF for this with high allocation to equity?

Anand Sarin

IDFC Premier equity is a nice aggressive fund

Hi Manish,

I am thankful to you for spreading financial awareness among investors. I am regular reader of your articles and blogs. I started investing in mutual fund through SIP since last one year. Following is the list of my funds:-

1. Reliance Gold Saving fund- Rs. 1000 pm

2. Reliance Banking Fund – Rs. 1000 pm

3. Reliance Pharma Fund – Rs. 2000 pm

4. HDFC Prudence Fund – Rs. 2000 pm

5. HDFC Balanced Fund – Rs.1000 pm

6. SBI Magnum FMCG Fund – Rs. 2000 pm

7. HDFC Tax saver – Rs. 100o pm( to save tax)

Apart from funds listed above, I did lumpsum investment of 10k in Reliance Growth fund. Please review my investment and suggest me improvements.

Thanks & Regards

Amit

Amit

I think you are investing in too many funds. Just concentrate on 2-3 funds, thats all

I would say HDFC Prudence Fund is appropriate one , and also start in DSPBR top 100

Manish

I am of 25 years and want to invest 2000 per month in mutual funds through SIP from fundsindia.com. I am thinking of investing in two MFs , one in balanced fund (thinking about HDFC Prudence) and another in a fund with more exposure to equity (can you suggest one good MF for this?). I wanted to ask what should be my allocation to each of these funds per month, should it be 50:50? I also wanted to know what should be my time horizon for these two funds?? should it be short, medium or long term? I am asking about in which case the profits i can earn would be more?

Anand Sarin

I have already answered that some timeback on some other article

Manish

I am of 25 years and want to invest 2000 per month in mutual funds through SIP from fundsindia.com. I am thinking of investing in two MFs , one in balanced fund (thinking about HDFC Prudence) and another in a fund with more exposure to equity (can you suggest one good MF for this?). I wanted to ask what should be my allocation to each of these funds per month, should it be 50:50? I also wanted to know what should be my time horizon for these two funds?? should it be short, medium or long term? I am asking about in which case the profits i can earn would be more?

Anand Sarin

Manish,

I am of 25 years age and thinking of investing of mutual funds through fundsindia.com (after reading your articles on mutual funds.). I want to invest Rs. 2000/- monthly in Mutual funds. I am thinking of investing in two mutual funds, one of balanced nature (thinking about HDFC Prudence) and another of a bit higher in risk (could you suggest one good mutual fund to me for this?). And how should i distribute the 2000 rupees in these two funds? Looking forward to hearing from you.

Anand Sarin

You can invest 1,000 in HDFC prudence and 1,000 in DSPBR Top 100

Hi Manish

I am investing both in HDFC Prudence and HDFC Top 200. Would that mean I am overlapping and not enough diversified or you think I should continue please. Thanks

Can you check their top companies and how much they both are investing in them , then you can see how much are they overlapping

I also wanted to know what should be my time horizon for these two funds?? should it be short, medium or long term?

Can any one advise the name of best MF?

I would like to start SIP in MF but having no much idea.

Thanks in Advance

Vivasvan

You can start with HDFC Prudence

Hello Mahish Ji

I read your post regularly. It is very informative to me as i have no idea about MF, Share, SIP etc. Now I am planning for a SIP with a low amount as 1000rs per month for a period of 5 to 10 year.

There are 2 question now

1- Is SIP period can be increased beyond its last date

2- Which one is good to buy as I am new & have zero knowledge .

1. You can start a new SIP again

2. Go for Balanced Funds like HDFC Prudence !

Thanking very much Manish Ji to help me step in for a another way of investment. Now I am also considering a term insurance. Please suggest me a good term insurance around 50 lacks. also give also an idea about Bharti AXA. I am a non tobacco user non alcoholic. I also like your article on term insurance with return premium. it is very analytic & true

Thanks & Regards

You can go with any company, does not matter much ! .. Bharti Axa is also a good option !

which one is better sbi emerging bussiness fund or icici prudential discover fund or icici prudential discover-ip fund in growth option. please replay ur answer to my mail

icici prudential discover fund would be a good fund

sir,thanks for ur replay .sbi emerging bussiness fund. from last 3 years sbi performing well rather than icici fund.hence why u preffered icici prudential discover rather than sbi emerging bussiness fund. is there any specific reason could you explain?

SBI emerging is a sectoral fund mostly, but ICICI one is more of a diversified one , and for a common investor, we generally suggest to be in diversified one , do you understand what SBI emerging fund is all about and how it works ? Where does it invest , what is their phylosophy ! ?

mf through sip of Rs1000/ month.