This article is an experience sharing from a blog reader Anup Ramachandran. He wants to share how he learned from this blog and took some actions in his financial life and made a lot of changes. I hope many people must be taking actions and completing many things in their financial lives.

Anup Sharing On his Actions

I am writing this, to give out my own experiences on financial matters and express my personal views on it. I have been a regular reader of this blog for the past one month now. I got hooked on to the website a few months back when I stumbled upon it while doing a regular Google search on some financial matter. The simplicity of matters explained on the website intrigued me. The lucidity of the language used on the website amazed me as did the content. There’s an old saying, “Give a man a fish, he’ll eat for a day. Teach a man how to fish, he’ll never go hungry”. This is exactly what the website is achieving by spreading the knowledge on financial matters.

To begin with, my introduction. I am Anup Ramachandran, 31 years old & married (no kids as of now). I am a Govt Servant for the past 6 years now and presently based in Pune. I get around 50,000 in hand and save about 40,000 every month because the expenses are very little as a result of the good amount of perks I am getting by virtue of being in Govt service. I feel fortunate to say that my wife is also a Govt servant getting the same amount of salary. All in all, I can say that I am saving much more than what my friends in the same age group are saving.

The pen picture drawn here would give the impression of a person who is financially secure and who would be able to achieve all of his financial goals by the end of his working tenure. How wrong could anyone be? The details being illustrated below will throw more light on the mistakes that I made.

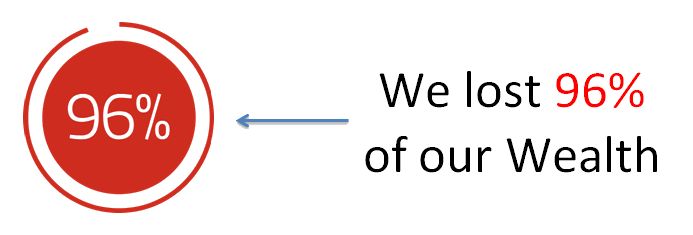

I am not an expert on financial matters. I would consider myself somewhere above a novice, but with keen eyes & ears for personal finance matters. I have made financial mistakes (read blunders) over the years which I realised after having been through this website. I decided to do a self-audit of my financial situation. The results were astounding. Leave aside savings and financial security. I found that my hard-earned money was depleting. I would list out a few “savings” that I had.

1. LIC Policies

I had a few LIC policies, the combined premium of which was around Rs 15,500 and with the assurance that I shall be getting close to 15-20 lakhs over a period of 30 years from now. The risk coverage was Rs 3,50,000 (I do not remember correctly, which is actually a tragedy). I got into this when I was working in Corporate about 8 years back, obviously before I joined the Govt Service. One fine day, I received a mail from the Company Fin Dept saying that we need to submit the tax-saving certificates. During a casual chit-chat with a colleague, got a reference of an insurance agent & within a week I had these policies with me. (I didn’t submit the receipts to the finance dept eventually, which I feel was pathetic on my part)

2. ULIPs.

2 x ULIPs the combined annual premium of which was around Rs 32,000 (22000+10000). The risk coverage was somewhere around 1 lakh (I may be wrong again, as I do not remember. The reason we do not remember these things is because of our skewed sense of fin security & savings. We get into these sorts of things without any planning, with the soul view on the money-back and with very little interest in the coverage being provided)

3. Postal Life Insurance

Took a Postal Life Insurance Policy in my first year in the Army. Monthly premium was Rs 2,075 (Annual: 24,000, let’s assume for simplicity’s sake). The coverage provided was 4 lakhs or so. I had taken this because it covered war risk, which means that even if anything happened to me during any operations, the policy would be honoured. This was more of an emotional decision than a financial decision.

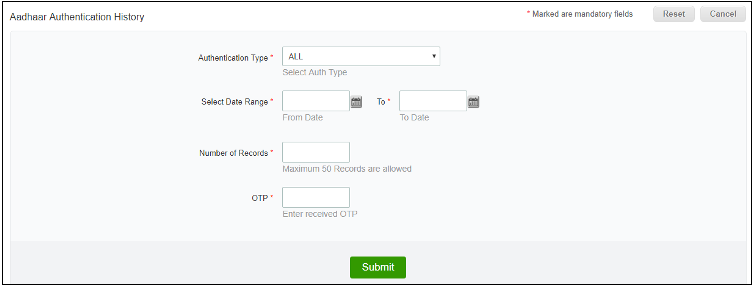

So, my annual cash outflow towards my “savings” could be tabulated as below:

|

LIC |

15,500 |

|

ULIPs |

32,000 |

|

PLI |

24,000 |

|

Total |

71,500 |

Here I was, with 71,500 being paid towards savings, with the view of securing my future (or so I thought). Combined Insurance cover of below 10 lakhs sounds pathetic, to say the least. And mind you, the amount being paid was quite a hefty one considering that I was paying a little more than 10% of my annual earnings towards these “saving schemes”. There is more money than I contribute towards a Group Insurance policy and other such schemes of the Army, but I am not counting that as they are mandatory and I do not have any control over it. Only policies/schemes figuring in my calculations are the ones that I have gone forward and taken separately.

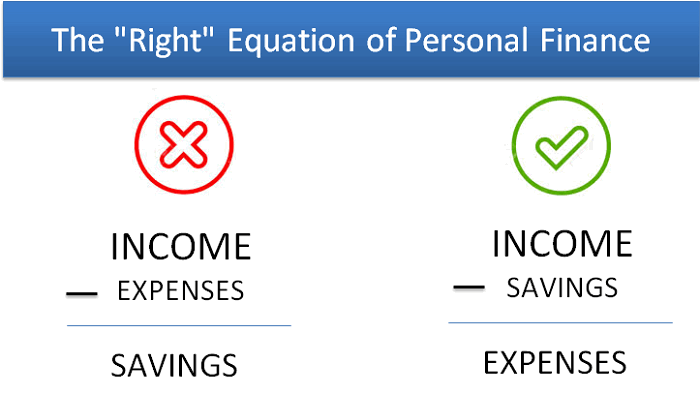

So after seeing the table above, I questioned myself, was there any other way I could put this money to better use? Armed with a little awareness gained from this website & with the help of a fantastic tool called MS-Excel, I did a few calculations.

Let’s assume that I take term insurance (term of 25 years) of Rs 1 Crore, the premium for which comes to 10,000 annually. I am now left with 61,500 for investing. Let’s assume that I am being ultra-conservative by putting the money year on year into an FD with a minimal return of 7% (for assumption sake. In reality the annual rates are higher for FD). I entered the details in MS-Excel and waited for it to churn out its figures. I figured out that if I parked 61,500 years on year into an FD, at the end of 25th year I would get about Rs 41,00,000, which was a good 10 odd lakhs more than what all my other policies were promising me with their combined effort and that too a good 5 years before them.

Surprising, is all I can say! Mind you a few assumptions made were as follows:

1. Compounded annual interest rate of 7%, which is way below the present market rates. This was done to check the lowest possible assured returns. What I mean is that I found that without putting any additional effort within 25 years I could get 41 lakh rupees, assured. What this essentially means is that with proper planning and careful monitoring I can get returns far beyond that.

2. I have put all my eggs in the same basket (in FD). Diversification will surely provide better results.

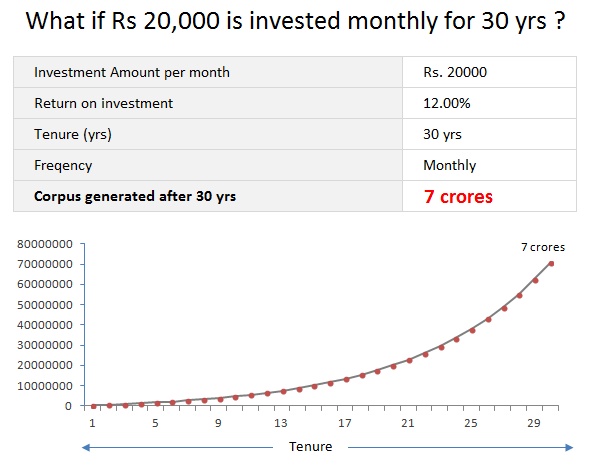

3. For simplicity sake I assumed that the annual cash outflow into my savings kitty is constant throughout. In reality with increase in salary I can afford to put more money into this kitty. Let’s say I add 1,000 every year into the contribution. Just a little tweaking and tuning into MS-Excel provides me with the astounding figure of 47,00,000. Six lakhs more than what I would have got with constant contribution every year. Not surprising actually! (Power of compounding, eighth wonder of the world, ring any bells?)

So, the picture was crystal clear. I was wasting my hard-earned money into junk policies and stupid saving schemes. I had just been diagnosed with ‘LIC Syndrome’, just like millions of my Indian brethren. But the good news was, the diagnosis was timely. Cure was available before this financial cancer ruined my life (and my families’ life too).

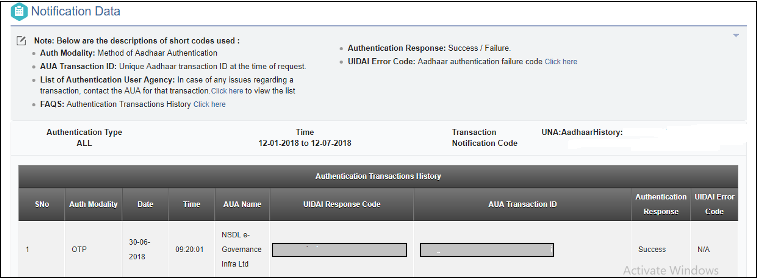

I set out to right the wrongs done in my financial past. Here is what I am doing:

- Getting term insurance of 1 Crore.

- Cancellation of all LIC policies, ULIPs & PLI policies.

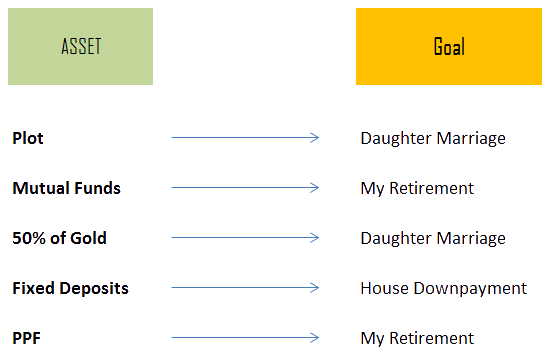

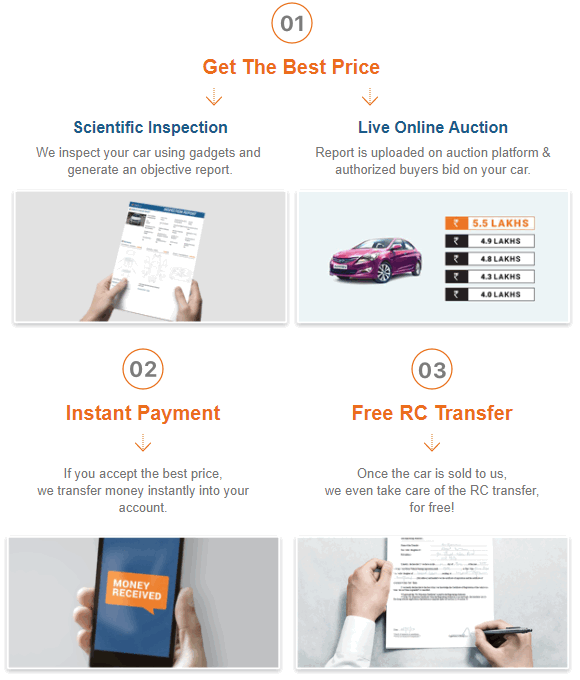

- I started investing in stock market. I have been lucky that many stocks are available in the market at great valuations at this time. Planning to take the SIP route for investment in MFs too.

- Placing a part of my wife’s salary into DSOP (Defence Service Officers Provident Fund), this is something like a PPF and follows the same interest rate as well. This should take care of the debt portion of my savings.

- We own a flat in Pune on loan (luckily all the decisions made by me were not bad). We plan to clear off the loan in the next 5-10 years’ time, which we feel with our combined effort should not be a problem.

This is just the beginning, I am sure there’s a lot more to be done. But that was just my experience.

I would like to offer a few comments (my own personal view) with regards to personal finance.

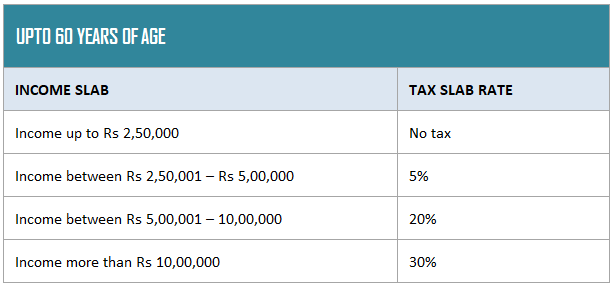

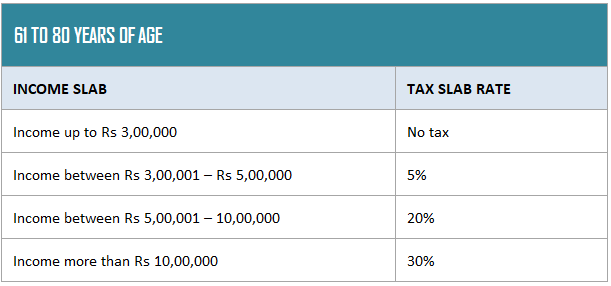

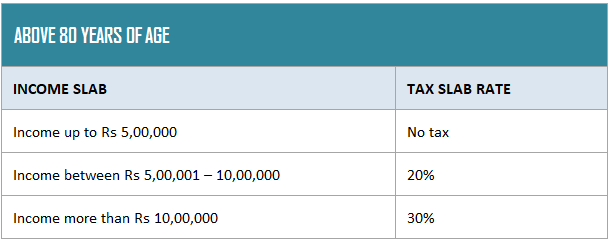

1. Income Tax – The moment we hear this, we run helter-skelter to get some policy/scheme to reduce it. It needs to be understood that even with these “schemes”, the tax burden is only reduced, it is not totally removed. So, effectively we block 1,00,000 every year for saving a few thousand rupees. There’s only a limit of 1,00,000 provided under section 80 (c), thereafter it is completely taxable. Most of us, if we do a self-audit, go for an overkill resulting in more than 1,00,000 being blocked in the name of section 80 (c).

My personal view is, we should NOT shy away from paying taxes. The mentality of many people is to avoid taxes, even if they say they are looking to save taxes. Look at it as your contribution towards nation-building. The roads, bridges, schools, educational subsidies, the subsidies that we enjoy on diesel & LPG is all because of the taxes that we pay. There’s a very old saying, “The Army marches on its belly”. I would add to it by saying, “And that belly is filled with the taxes that we pay”.

Let’s look at it another way. For saving a few thousand rupees, we blocked 1,00,000 rupees. What we have done is we have paid the LIC 1,00,000 rupees so that we can save a few thousand rupees from going to the IT Dept. In effect, we have paid 1 Lakh + taxes (after savings) to the govt (LIC & IT Dept are Govt’s own babies, remember?). What could have been done was, pay those extra taxes (and feel happy for your contribution towards your nation), keep the rest of the money in some diversified avenues (as explained very well on this website many times) and feel happy to see the money grow right in front of you?

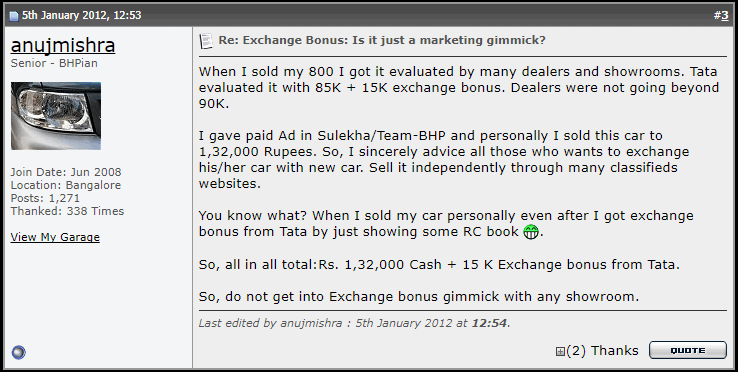

If that is not convincing enough, here’s another view. How do you think LIC makes money? It collects money from all of us and puts the money in various avenues, a major chunk of it in the stock market. There was a piece of news a few days back that 5% of stocks of Infosys is owned by LIC. There was also an interview of LIC Head on a TV News Channel the other day, in which he said that LIC is planning to put 5,000 crores in equities over some time. These are just a few inputs, if you search for them on the Internet, you can find may more. What this means is that they are making a hefty profit with the money given by us and paying us back pittance (often lesser than the inflation rate, leading to erosion of our hard-earned money). If LIC, our “trusted brand” feels that the money is safe in stocks, then why can’t we ourselves put this money in the equities directly and earn the handsome returns without having to share the profit with LIC and its agents?

2. I am not against LIC – LIC, like any other company, is trying to conduct its business. Unfortunately, we as a nation demand for these kinds of policies/saving schemes. The greatest dichotomy is that we take this under the name of Insurance Policy, but what we end up with is very little Insurance. Just look at term insurance. Despite being the purest form of Insurance available in the market, there are very few takers for it. Amazing is all I can say!

3. Goal-oriented savings – Many of us are not clear why & what we are saving. We are trying to draw a picture without exactly knowing what it should eventually look like. At the risk of sounding repetitive, as this fact has been explained again and again in this site, I would urge everyone to set financial goals for themselves. That will keep each one of us focussed and usher in some financial discipline.

4. Financial Advisor – I am not canvassing for anyone, but if a person doesn’t feel good with his finances and is not sure what needs to be done, it is would be better to seek some help from a Fin advisor. Think of this way, many of us smoke cigarettes in a year which will eventually cost more than what your Fin advisor will actually charge you. It will be better to be safe than to feel sorry later. Remember, that you are ready to pay the likes of LIC for their shady schemes with the hope that they will provide you financial security? I think that will make the strongest case for employing a fin advisor.

5. My personal view – is that the rampant corruption in the country can be partly (not fully, there are many other factors too!) attributed to these kinds of policies. Let me explain how. I am sure all of us are in agreement when I say that we, as a race, look forward to having more money. I mean, today I want more money than what I had yesterday. With this in mind, we look for avenues where we can multiply our money and find some financial security too. These “saving schemes” are the most prevalent avenues that we find. Not that there aren’t any other avenues, it’s just that they are omnipresent. By parking our money into these schemes, we are living like paupers (with the hope of getting rich someday) and hence feel the pinch for money all the time. On the other side the returns that we get are negative. So over a period, a person realizes that he has got very little money. Imagine a working person burdened with family expenses and with dreams of providing quality education to his children & yearning for a comfortable retired life. How would he feel at this juncture? He feels that his income is not sufficient for his requirements and feels the urge for more money (read greed). Again, that’s just my point of view, you are free to differ.

6. Keep Reading and Educating – Last, but not the least keep reading & educating yourself. What anyone says (even I or a fin advisor, for that matter) may not be taken as Gospel truth. The biggest reason for all of us falling for these shady schemes is because they work with huge numbers. For example, when someone says he will give you fifty lakh rupees after 25 years, we immediately come to attention. What they would not tell you is that after 25 years, what we see as 50 lakhs today will be equal to just 8 lakhs in value terms after 25 years (assuming 7% of inflation every year). One needs to do simple analysis and use tools like NPV & IRR to determine the viability of fin products being sold to him. Emotions need to be avoided while making financial decisions. A little use of that very uncommon thing, popularly called common sense, is all that is required to sail us through.

Thanks to Manish and other bloggers on this website I feel more comfortable with financial matters & in control of my personal finances than ever before in my life. Imagine it took a few centuries for Renaissance in Europe (and the world over eventually) and it just took a fortnight of reading this blog for realizing my personal “financial renaissance”.