1 small trick which can drastically increase your saving rate each month

Do you want to save more money each month?

Today, I am going to reveal a secret trick that will help you to increase your monthly investments by some margin. This trick is more of a psychological shift in the way you think about money, emergencies and how much should you invest.

However, this is applicable to only those who are already investing some money on a regular basis each month.

Let’s start …

You might be thinking that my secret is nothing but making your savings “automatic”. But no, it’s not the case. Making your investments “automatic” is just the first step, but there is something else that will take your savings to the next level.

Let’s get into it!

Here is how most people invest their money

- They earn a salary

- They spend money on their regular expenses (Rent, Grocery, Movies, travel)

- Some money is left at the end of the month

- and finally, a partial amount out of that is invested

Did you see that last line?

Only a “partial” amount is invested in the leftover savings at the end of the month is invested, not FULL.

Let’s dig deeper into this …

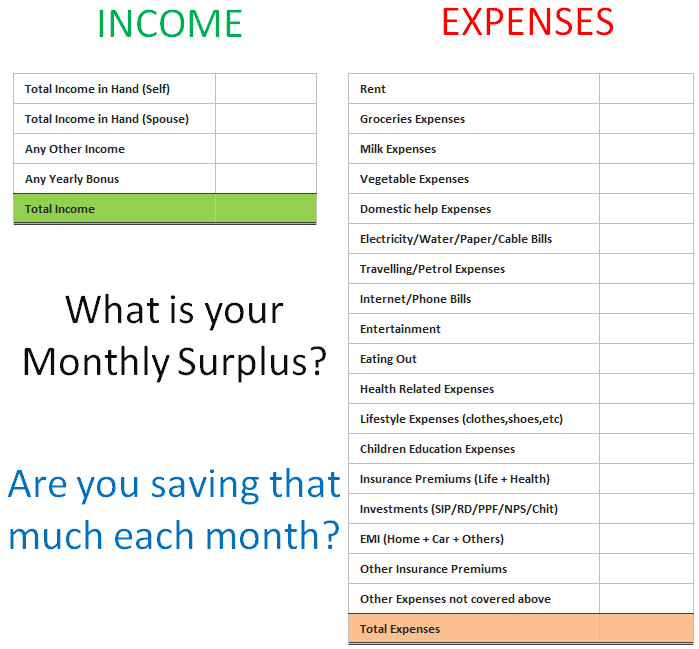

Take a sheet of paper (or open an excel sheet). Write down the total income you get in a month on the left-hand side, and on the right side, mention all kinds of expenses you have. Put Rent, Groceries, Maid expenses, Travelling, Eating out, movies and whatnot.

Now add up all the expenses and find the total expenses and deduct it from the total income you get each month. You will get your Monthly Surplus!. This is the amount you are left over each month and you should ideally invest this whole amount.

Below is a template which you can use for the calculation

What is your monthly surplus?

Will you start a Recurring deposit for that amount or start an SIP?

I guess the answer is NO.

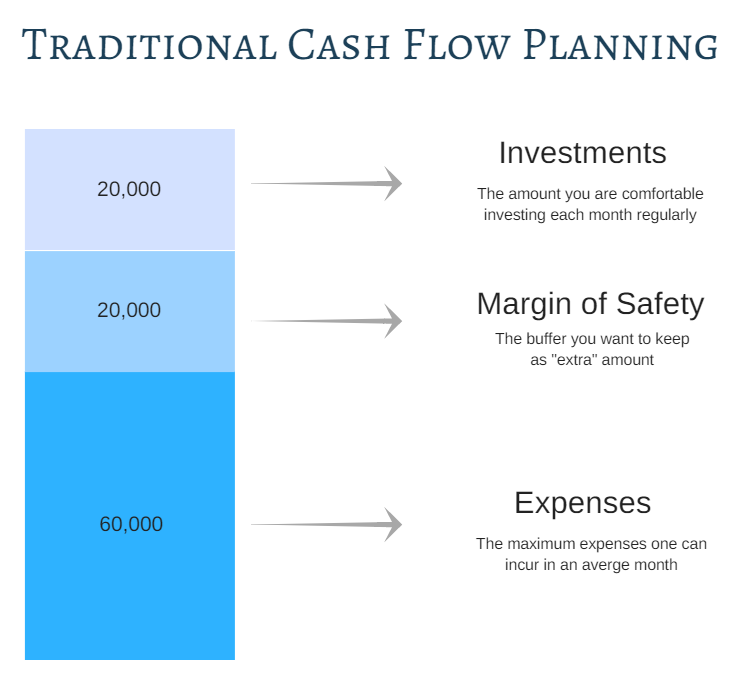

As an example, if a person is earning Rs 1 lacs per month and their expenses are around Rs 60,000, their monthly surplus is Rs 40,000 per month.

But this person will probably invest only Rs 15,000-20,000 per month on a regular basis. They will keep the rest as “Margin of Safety” amount which they might need, because what if they suddenly need it?

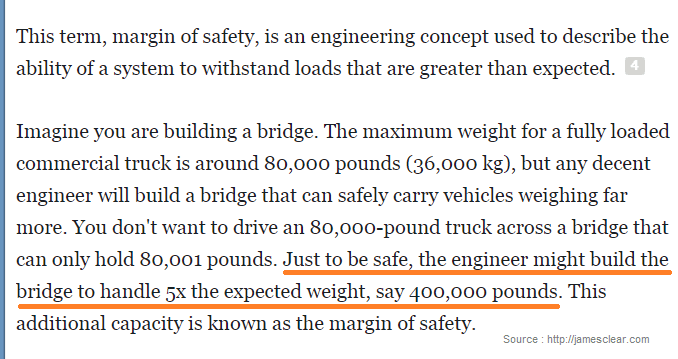

The margin of safety is a simple concept, it’s just an “extra buffer” for “what if things go wrong” kind of situations.

This is called a traditional style of cash flow handling which is a very intuitive and natural way of thinking. We all do it and it feels right!

But there are some problems with this approach

But there is one big problem

While this traditional method looks very natural, there is one big issue with it. Here it is!

Once your investments are set, you feel a sudden excitement that now your investments are in shape, but because you have left a big margin of safety (the extra buffer), your expenses will automatically expand and eat away your margin of safety.

The mere availability of the buffer money will create various short term demands in your financial life and you will use that buffer each month.

Suddenly you will start ordering various things online (most of the time things which are not required), your eating outs will increase, upgrading your phone will appear within your budget, etc.

Supply creates its own Demand – Economics 101

The availability of money will create the demands in your expenses and almost all the time you will justify them. So from Rs 60,000 expenses, you will see that automatically it’s reaching Rs 80,000.

And after some time you will be used to Rs 80,000 per month expenses.

Just imagine, if the person had started a Rs 30,000 SIP and left just Rs 10,000 as a margin of safety? Can you see that here the person still has a margin of safety and invests 50% more amount each month?

What about Rs 35,000 SIP and just Rs 5,000 as a margin of safety?

Welcome to 10% margin Cash flow Management System

This is the crux of the system.

We all feel that we need to keep a big margin of safety because in our mind things will go wrong. And they will!

There is no doubt that things can go wrong in some months and some unexpected expenses can come up which can really disturb your regular investments and that’s why most of the people leave a big buffer between expenses and investments.

However, let’s deal with reality.

Most of the times these emergencies are not real emergencies and if we didn’t have enough margin of safety, we would have justified them as “not important” expenses!

Also, you should not depend on your monthly cash flows for emergencies and have a separate fund that can be touched in case a real surprise expense comes up. I call this new system as “10% margin Cash flow System”

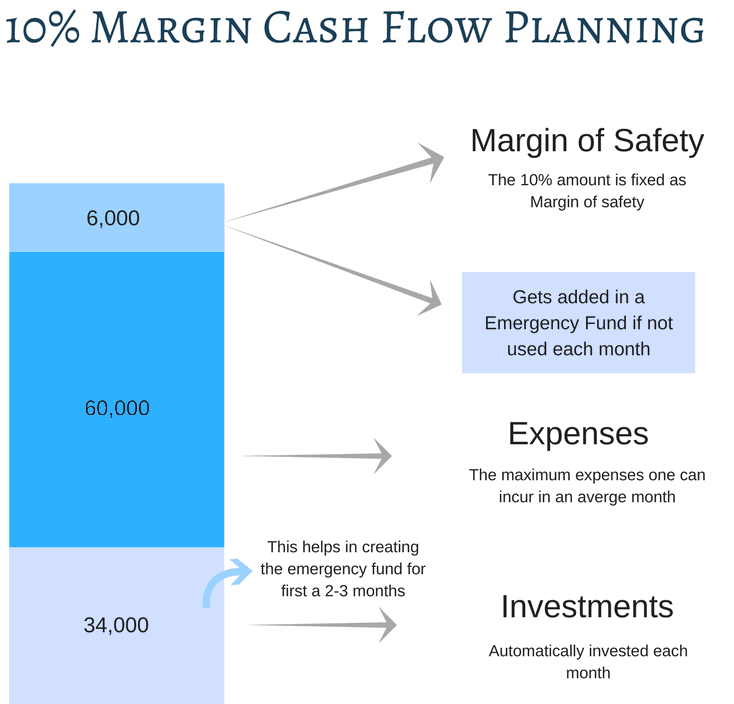

10% margin Cash flow system

Here is how you design this cash flow system

Step 1: Write down all your expenses and make sure you put realistic numbers, neither less nor very big.

Step 2: Calculate 10% of your expenses and that’s your margin of safety. If your expenses are Rs 40,000 per month, then your margin of safety is Rs 4,000

Step 3: This margin of safety amount is the only extra money you will keep with you each month apart from your expenses, and even this money should be auto invested in a liquid fund, which can be redeemed on a short term notice of 24 hours.

Step 4: Make sure that before you start your actual investments on a monthly basis, you create enough emergency funds which can be 3X of the size of your monthly expense. Any sudden surprise expenses which are outside of your regular expenses list will be taken care of from this emergency fund and not your monthly surplus.

Step 5: Set up your investments in an automatic mode (like SIP in a mutual fund, or a recurring deposit or a combination of both) for all the money left other than regular expenses and 10% MOS (margin of safety)

Here is how it looks like

Taking the same example of Rs 1 lac income, the guy has Rs 60,000 expenses in total. His margin of safety is Rs 6,000. Rest amount left is Rs 34,000

For the first month, he puts this full 34,000 in a liquid fund. If any additional money is left from the 6,000 MOS then he puts that in an emergency fund, else he can spend it. For next 2 months, he puts 68,000 more in a liquid fund and his total liquid fund amount is around Rs 1 lacs +

Now, this guy will set up his SIP of Rs 34,000 per month.

Now imagine what happens in 4th month

In 4th month, here is how it looks like

- Rs 34,000 SIP is executed and the money gets invested (make sure the SIP date is in the start of the month)

- Rs 60,000 is the regular expenses

- If there is any need of extra spending, then Rs 6,000 extra is already there (most of the months should be like this)

- If for some reason, some surprise expenses come up, you redeem that much money from liquid fund and use it.

- Repeat!

Can you see how the whole game changes here?

I hope you got the whole idea of this new model now.

You can always withdraw the money if a real emergency arises

I tried this concept on one of my friends last year. I asked my friend if he will be able to do any SIP?

He said “NO”.

His expenses were almost equal to his income. However, I said that he should start a small Rs 5,000 SIP. He said that he will not be able to because he is not left with any money at the end of the month.

My simple solution was – “Withdraw the money in a month if you really need it”

His SIP ran for the next 12 months

He finally started his SIP with a lot of reluctance and the SIP ran for 12 months straight ! with 1-2 withdrawals in between. However, my friend was proved wrong.

The mere unavailability of money made sure that he had to fit his expenses into this “visible income”.

So don’t worry and dare to start a bigger SIP then you can handle, in the worst case, you can always STOP it, you can always redeem some money back if you need it. But in my experience in most cases, people are able to handle bigger investments each month compared to what they imagine.

Let us know if you liked this article and if you are going to implement this new model of investing?

Do you really think this unconventional way of cash flow management can bring different in your financial life?

May 29, 2017

May 29, 2017

[…] are actually developing the HABIT of saving on a regular basis, which is not an easy thing to […]

Hello. Though I usually like your articles better much and like coming back to your blog. But sometimes I feel that the articles like other blogs are incomplete and do not provide practical advise. It’s more like just promoting SIP that I agree is a good investment while leaving the topic incomplete. As simple as that in this article you say monthly income minus monthly expenses is the surplus and ideally while should be invested. What about the expenses that are not monthly but are certain like insurance premiums, school fees of kids, maintenance chargers of house and car etc and other expenses that are totally uncertain like doctor fees and medicines. Please suggest a comprehensive and robust plan to decide the right regular investment amount and strategy while considering more of these practical stuff.

You need to plan for those irregular expenses and one time expenses and do a separate investments for handling those expenses using the liquid funds .. Only the regular monthly expenses should be counted into monthly expenses.

fe MF houses are giving instant redemption liquid funds. With in a hour redepmption will be credited the bank account.

With that safety margin in Bank accounts can further be reduced

Nice article I am also started implementing.

One more thing that I will do is I will pay the credit card bill as and when I spend.

I will only use the credit card to by all the online shopping and paying the bills. Before the billing cycle every week end I pay the credit card from my saving account. In that way its like actually spending from saving account and will control the instance spending habit.

I think thats a very good idea. In my case, I have setup an auto debit from my saving bank account to pay credit card bill

how to invest in liquid funds.can you spread some light on it?

All you need to do is complete your mutual funds KYC and then start investing online.

Our team can help you on this if you require assistance – http://jagoinvestor.dev.diginnovators.site/mutual-funds#sign-up

Hi Manish,

Thank you for this article. Putting away balance money in a liquid fund is a simple way, yet effective.

Thanks for your comment Mumtaz

I have one more idea… Had experienced it during my singlehood…

Once you get a salary, withdraw the money for your monthly expenses – whatever the amount you feel right on Day 1 of the month. It may be even higher than the expenses. Then start spending it in cash (of course the monthly domestic expense). Try to use the amount withdrawn till the 10th Day of the next month…. Repeat this and withdraw same amount of money on the 20th Day of subsequent (third month).. With this habit, you keep withdrawing the same amount but you try to limit your expenses in such a way that you extend your withdrawal every time by 10-15 days…. Eventually, there you save a lot…

This is a very good idea !

Basically you stretch yourself and try to use the money for 40 days instead of 30 days and in that bargain , use the 2 months worth of money for 3 months !

is still mutual funds a worth investment idea. pl let me now I am interested if there is any good return mf.

Yes it is

Please fill up this form , so that we can talk to you

http://jagoinvestor.dev.diginnovators.site/mutual-funds#account

Should we include the premium payment towards health, life etc. insurance in monthly or yearly expenses?

Yes you can do that.

I calculate all my yearly expense, divide them by 12 and start an RD for that amount. I have planned all my Insurance renewals in the month of May of every year, so i was able to do it with single RD.

Thanks for the article. This one compelled me to make an (informed) investment right away using the buffered margin of safety money in my savings account

Glad to know that Kapil ..

Nice article Manish!!!

After choosing a liquid MF plan for emergency fund. We can start a STP from that liquid MF

instead of a SIP directly. Like this one can save on service charges usually charged for the SIP.

STP carries no service charges/commission.

Yes, this is a good option for those who want to mainly invest in EQUITY fund for a big amount !

I started doing SIP back on 2010 when i learnt about mutual funds from my friends and your website.

I did start with 7000 pm . i could have put my entire salary back then but somehow was reluctant as i was new

to mutual fund world of investing.I came up goals and how much i required, somehow what i was investing didnt match.

I dared to invest around 50000pm last year 2015, i thought if i could not meet it, i will reduce or default SIP.

Till now i havent defaulted or thought of reducing the SIP. With this current SIP set up, i can see myself acheiving my target amount.

PS: i am married, my spouse income is used for household bills and EMI.

Glad to hear that.

With your story, seems like you are confirming the thought process discussed in the article

Manish

Yes Manish.

I appreciate your effort on improving knowledge of personal finance to public. I have been regular reader of your website. Through this site ,i have started to look investing beyond traditional saving scheme.

I had the opportunity to correct my wrong investments.

Looking forward for many more articles from you.

Glad to know that ALSESA ..

I have adopted a famous technique used in manufacturing , it is JIT [ Just in time ] methodology. By this method i have a very little by of savings in my saving bank account . Thus keeping the amount of money held under the guise of ‘ Margin of safety’ is very low. Overall my point is that this article achieves to do the same.

Thanks for confirming that 🙂

Hi, I am doing SIP. But this concept has showed the bigger prospective. Now I will plan accordingly and will recommend as well.

Thank you.

Glad to hear that !

Hi Manish, it is very good article and I will surely share this with my friends to follow and I will also plan accordingly. Regarding, putting the initial money in a liquid fund… What funds you suggest as I think all fund will have exit load if we take out money in before 1 or 2yrs. Please advise some good funds.

Liquid funds dont have exit load 🙂

You can take out money in 1-2 days also if you want without incurring any loads.

I cant recommend any fund as such, because in liquid funds its hardly different from each other.

Manish

Hi Mani,

Thanks for the eye opening article about savings ..

I have question that … The investment in liquid funds or SIP in any MF … Would take 2 to 3 days for redeeming the invested money .. as what I experienced …

You said in short notice … just 24 hours to redeem from liquid fund… I have just this concern .. pls through some light on it….

Have you liquidated from liquid funds ever ?

Incase of liquid funds, if you redeem before 2 pm, you will get the money mostly by next day ! .

Manish, I understand different people may tend to consider different MoS levels, but this concept is really nice and highly useful. One of your best articles. Thank you!

Glad to know that Tapas Ghosh ..

Thanks for the article, very insightful.

Thanks for your comment DEEPAK

It is a brilliant article. In India, no one teaches like that. No one encourages you to save or save more, for their future. While India is bent upon encouraging spending, by way of loans, credit cards and so many schemes which are contrary to our Social and economical requirements. We have dire need to encourage savings. We just copy West.

This type of articles should be floated frequently and regularly, till India realise that what is the importance of SAVINGS. Salute to you. After years, I came across such good article.

Glad to hear your appreciation !

Thanks

Hi Manish , Awesome Post.

I maintain 0% Margin of safety. For emergencies am maintain online small small 5k, 10k FD’s .

Great !