10 uncomfortable truths about your job no one wants to admit

Today you are going to read 10 truths about your job and why you should accept them and act upon them as soon as possible. We all start our jobs with big dreams and future, but somewhere we are so lost in our daily routine that we do not observe some important things.

This is a guest article by Mr. Hory Sankar Mukerjee, who has been working in the industry for the last 15 years. He has worked with banks, FMCG, media and Information Technology companies. He currently trains people. He is an author for Oxford University Press. He blogs, trains and loves to travel.

So let’s see some lessons which you should keep in mind. Detailed description of these 10 points is done later.

[su_table responsive=”yes” alternate=”no”]

| Lesson #1

Jobs are a transactional relationship between you & employer |

Lesson #2

Hiring and firing are two sides of the same coin |

| Lesson #3

You may need to a plan B anytime, be ready with it |

Lesson #4

Promotions stagnate at one point, hence invest in yourself |

| Lesson #5

Start investing your money – Don’t depend on your active income forever |

Lesson #6

Don’t get ‘caged’, ‘institutionalized or ‘comfortable at your workplace |

| Lesson #7

Work on a second income, while working in your current job |

Lesson #8

There is a life beyond the job |

| Lesson #9

Live within your salary |

Lesson #10

The biggest lesson – Understand how companies work! |

[/su_table]

Lesson #1 – Jobs are a transactional relationship between you & employer

If you ask, ‘why did your organization hire you?’ The answer is obvious. You were probably the best choice, the right fit and there was work for you in the organization. It also implied that the organization where you are currently working has hired your ‘skills’ and have agreed to remunerate you for your ‘time’ and ‘skills’ in exchange for money.

Another hypothetical but obvious logical question, therefore, is: What happens if the organization, ‘does not need your skill set, or you, or your time’? You simply get ‘FIRED’.

[clickToTweet tweet=”Love your job but don’t love your company, because you may not know when your company stops loving you” quote=” Love your job but don’t love your company, because you may not know when your company stops loving you” theme=”style2″]

Relationships in and with organizations are transactional. You can be fired for anything. (E.g.: Global unrest because of North Korea firing a nuclear missile on USJ). Jobs are about: ‘give and take’. You give your time and skills and they give you money in exchange. The day they do not need you, they will not keep you.

Implication #1: Never ever get emotionally attached to your organization.

Lesson #2 – Hiring and firing are two sides of the same coin

You have been hired and you can also be fired. While this was not so common, while my/your parents were working in the government sector, this is true today, especially for private-sector employees.

If your arguments are otherwise and you feel, my sector or my company is the safest, you need to re-think.

Take this example – Teaching is considered to be one of the safest professions. Unfortunately in my career, I have come across many educational institutes, which have fired people on a days’ notice. Across my experience in multiple industries, hiring and firing is just another process for the organization.

The trauma is for the person and his family who have been fired. Firing can cut across industries, roles, skills, technology, and jobs. Firing does not need a reason. Therefore there is no need to ‘feel secure’.

Implication #2: Just as you have been hired, you can be fired. Be ready.

Lesson #3: You may need to a plan B anytime, be ready with it

Jobs, like life, is very capable of throwing ‘surprises’. We may like some of them but would love to dislike most of them. In ‘jobs’ that we are in, we also need to mitigate the ‘uncertainty/unpleasant surprises’. We, therefore, need a Plan B.

Plan B is a plan that you keep close to your chest, (a ‘good’ hidden agenda) while playing a game of cards or a plan which helps the hero of a movie escape in case the rogues have understood your earlier plan. That is your ‘escape route’.

While in a job be ready with your Plan B. It could be teaching, opening a road side restaurant, wedding photography or a rental income. It could also being an entrepreneur, life coach, and writer, encouraging your spouse to work or selling homemade pickles online.

Your Plan B essentially has the power to bring ‘food back to the table’ in case you face the risk of losing your job. It is also capable of taking care of your ‘needs’ during an emergency.

Implication # 3: Ask yourself ‘what is your plan B’? Have you started working on it? Do you have something to fall back upon if you lose your job today?

Lesson #4: Promotions stagnate at one point, hence invest in yourself

Wouldn’t it be great if our employers had granted us lifelong employment, secured jobs, yearly growths, and lifelong benefits? We all love ‘risk-free’ and ‘guaranteed returns’ like our love for FDs, KVPs, PPFs, LICs, and NSCs. However, returns from these like any other investments are either not guaranteed nor risk-free.

[clickToTweet tweet=”There is only 1 investment that gives ‘guaranteed and risk-free’ returns: ‘INVESTING IN YOURSELF'” quote=” There is only 1 investment that gives ‘guaranteed and risk-free’ returns: ‘INVESTING IN YOURSELF'” theme=”style6″]

Any investments that you do on yourself, like walking, hitting the gym, learning new technologies, not eating junk, staying healthy, getting up early, quit smoking, getting certified, learning to cook, getting back to the college to earn a higher degree, learning about stocks and mutual funds, pay you in the long run. Some other day this skill comes very handily.

Let me give you an example

The global head of an organization met me for a coffee and told me about his interest to do a doctorate. I asked him, ‘what motivated him to do that?’ He said, ‘I do not see a future for myself anymore here. Our organization is getting top-heavy.

Promotions are stagnating.

However since I am extremely interested in teaching, (Plan B) I want to quickly pursue it and move into teaching.’ After a year or two, I saw him getting registered into a doctoral program and working seriously on it.’

Implication #4: While you are in the job, do not stop investing in yourself. What is that you wanted to learn and you could not do it? Get back and re-start investing in yourself. This could be your Plan B.

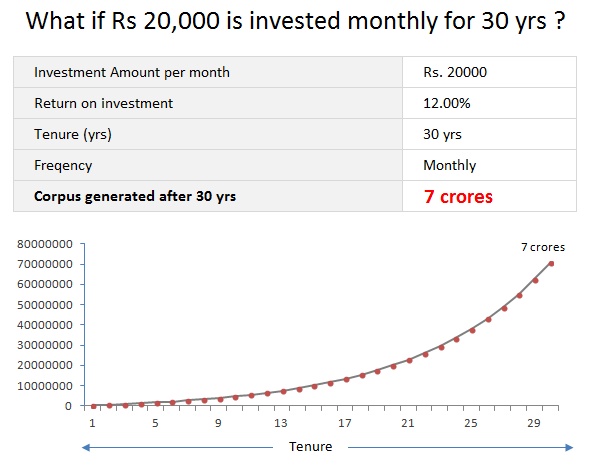

Lesson #5: Start investing your money – Don’t depend on your active income forever

Would you not love it, if your employer kept paying you even after you left the company? Wow…I would love to die to join such a company.

But it never happens.

The money that you earn not only takes care of your today but also takes care of your tomorrow when you stop earning. (Retirement)

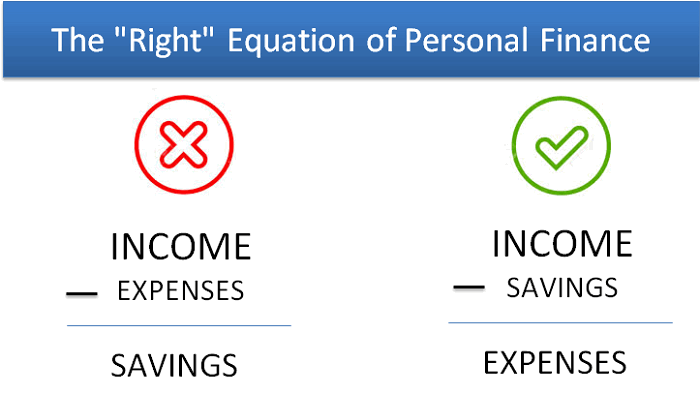

Earning is essential but not sufficient. It loses value. Start investing. Investing helps to save you from the rainy days of your future. Saving and investing, therefore, are not one and the same.

When I started working in 2003, had I invested Rs 1000 a month, in Franklin India Bluechip Fund, the fund value today, would have been Rs 5.4 lakhs. Unfortunately I did not.

I did invest. But the investments were in ‘stupid financial products’. Choose the right products. When you need term insurance, do not buy a traditional life insurance policy. When you do not have the expertise to invest in stocks, invest in mutual funds.

When you do not need a house, do not take a loan to buy it, especially when you are young. There is no dearth of financial products. But choose the right ones, which you understand.

Lead a frugal life.

Frugality is not depriving yourself.

Frugality is living simple and with a minimal. Many rich people are known for their frugal lifestyle. Frugality has its own advantages. The best of course is to ‘achieve financial freedom’.

Showing off could be deadly. Make a list of things ‘you have bought’, which you never made use of. It will throw a lot of surprises. Remember that an elephant has two sets of teeth. One is for eating and the other for a ‘show-off’. It gets ‘killed’ for the one it shows off.

On a thumb rule, invest (not save) what you spend.

Implication #5: Saving money is useless unless you invest it. Even more useless, is to save in the wrong set of products. The most ‘useless’ thing, is planning to invest after you have spent. Trust me you will never be able to.

Lesson #6: Don’t get ‘caged’, ‘institutionalized or ‘comfortable at your workplace

Three things that kill employee’s morale, growth and prospects of doing great. First is getting caged, second is getting institutionalized and third the idea of being comfortable at work. Let us understand them.

Caged: ‘Who will hire me after 10 years in the banking industry? I am lost and I cannot get out of this mess. Even if I want to, my family problems are not allowing me to.’

Institutionalized: ‘I am so comfortable with this place that I do not feel like changing. This company gives me respect and I am happy. Everyone knows me in this company. Let it go on. I am planning to retire from this place.’

Comfortable: ‘This place gives me peace. I am happy doing whatever I am doing. I do not want to change. It is the same soup everywhere. Why do you want to change, when things are so good here?’

Getting caged, institutionalized and being comfortable is when we set boundaries to ourselves. We are unwilling to try new things, find new solutions or unwilling to look beyond the ordinary.

Remember that the relationship with the organization is transactional. The day they do not need us, we are all gone.

Physical boundaries, mental and emotional boundaries tie us up.

A couple of my colleague’s hometown is in Kolkata. They intend to settle in Kolkata, post-retirement, however, they have bought homes in Gurgaon, where they currently work. Some of them are getting better opportunities in other cities of India, are unable to move, because of their emotional attachment to their newly-bought houses. (And the banks’ love for their home loan interests.)

Implication #6: Set yourself free. Do not get attached to your organization and look beyond the boundaries. Any change will initially bring discomfort and then things will settle down. You will then start enjoying it.

Lesson #7: Work on a second income, while working in your current job

My father retired from the Indian Army without a job in hand. In those days, getting a job was difficult. One day while he was worried, my mom said, ‘Why are you worried? You should not be. I have mine and that will be good enough till the time you do not find another one.’ This comforted my father. However, within 3-4 months, he got a new one.

The lesson to be learned is that, a second income is not bad. It gives you a cushion. This is very true especially for people with non-working spouses. Second income, gives you some extra luxury, some extra investments, and faster financial freedom.

Remember not to splurge the extra income that you generate, but invest a significant part of it. Also, ensure not to overburden yourself with that ‘extra work’. It should be something that you would enjoy doing.

Manish has already written on some nice ideas to create a second income, go read it and get some fresh ideas to work on

Implication #7: A second income is great. It gives you comfort, extra savings and after all a place to fall back upon in cases of emergency. In a world of uncertainty, this is surely a cushion.

Lesson #8: There is a life beyond the job

The work that you do was there before you joined the organisation. The work will be there after you leave. Work will never get over. Therefore there is no reason to panic. It is not a sprint, but a marathon. Have a life beyond the office. Spend some time with your GF, spouse, family or children.

They are the ones who will support and cushion you in your bad times. Spend some time in a week doing charitable work, teaching the poor, helping your wife cook or taking your old parents for a walk.

It will help you learn ‘life skills ’and make you more ‘humane’. Someone had asked Dalai Lama, what surprises him the most. He said, ‘Man…Because he sacrifices his health in order to make money. Then he sacrifices money to recuperate his health.

And then he is so anxious about the future that he does not enjoy the present; the result being that he does not live in the present or the future; he lives as if he is never going to die, and then dies having never really lived.”

Implication #8: Family is equally and more important than your job. Your work can wait. The time that you did not see your child grow up, will never come back.

Lesson #9: Live within your salary

Jobs and salaries do not imply living beyond your means. It gives you a right to spend, but not the authority to splurge. It is not only about you, but the ecosystem supported by your salary- Spouse, child, parents, grandparents, maid, milkman and the driver.

It also does not authorize taking more loans because the banks are willing. It also does not authorize purchasing five shirts or trousers, when you already have ten. Living a life, ‘paycheck to paycheck’ is risky and unworthy. It disturbs the ecosystem surviving on you.

Keep it simple – One house, one car, one bank account, a few shirts and trousers, one credit card, one debit card, one health, and one term insurance. Spend all the remaining time that you are left with into something more meaningful.

Every Diwali, when the newspapers are filled with offers and bargains, ensure that you are not the ones jumping in to buy. When you buy at a discount, you save, 50 percent, but when you choose not to respond or buy, you save, 100%. Ask, ‘Is it really needed?’

Implication #9: Debts are needed but not at the cost of destroying our mental peace.

Lesson #10: The biggest lesson – Understand how companies work!

The day Cyrus Mistry was fired, I learned the biggest lesson of my life. If a person of his stature can be fired, we are no one at our jobs? For the organization, we are dispensable.

If we feel that we are ‘assets’ for the organization we work with, the organization may think of us as an ‘ass’ (minus the ‘et’). After all, organizations are run by people. People change and so does their culture, values, and priorities.

Implication #10: Stop treating yourself or pretend to treat yourself as an asset and make sure you understand the realities of working with an organization.

Can you add another point?

I would like to know if you have any more point from your side? Can you add the 11th point in the comments section?

Also share with us, if you liked this article?

February 9, 2018

February 9, 2018

thanks for sharing info i really like it.

Thanks for your comment

thanks for sharing such amazing information i really appreciate .

Thanks for your comment farhan .. Please keep sharing your views like this..

Manish

thanks for sharing such great information.

Thanks for your comment farhan .. Please keep sharing your views like this..

Manish

Great article, Brother!!

I literally am agreed with everything that was mentioned here. Very intriguing content. I myself write about humour, life and Cricket and you can read it on my Blog. Overall, very informative and i will be looking forward to read more from you.

Thanks for your comment Amit Sharma .. Please keep sharing your views like this..

Manish

Thank you sir 🙂

Wonderful post.

Thanks for sharing such a insightful article.

Thanks for your comment Dkm Online .. Please keep sharing your views like this..

Manish

Thats a great article.

I would like to add – “Jump the ship before it sinks”. You need to identify when is the right time to move on before your manager does.

Thanks for your comment Mahesh .. Please keep sharing your views like this..

Manish

Nice post i like this post

That’s really an amazing topic and the reality. I really like the statement, the less you own, the more you have. 100% true. Many thanks for this article.

Thanks for your comment Santanu .. Please keep sharing your views like this..

Manish

Wonderful.. Eye opening article.

Thanks

Very well captured all the points and explained well. Another point is … many companies pay more than enough money to take care of your day to day needs and even to some extent takes care of next few years. In such cases these salary starts acting Golden Hand-Cuffs. Which starts making people blind and they start thinking (24×7) about job/work/company. And that starts further limiting/killing your true potential as well as going away from families/friends/society etc. It’s very tricky to know this and then a courage to break these golden handcuff.

Very good point !

Hi Manish,

Enlightening Article and the point you mentioned are most important Life lessions one should learn, hope i follow all to the best of my abilities.

Thanks,

Shravan

Hey Shravan

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Exactly. Agree with you.

Thanks for your comment Kabir .. Please keep sharing your views like this..

Manish

On the point article! Kudos. Especially liked the optimistic tone!

For all the IT people out there .. a straightforward way to generate second income is to freelance online or for budding startups. Sometimes IT people complain about not getting opportunity to work on the latest technology inside their company and feeling stuck with maintenance work.

Freelancing is a great way to hone your skills, earn second income & build a backup when things don’t work out at your primary job. Check out freelance websites like upwork. With sites like fiverr & 99designs you can even indulge your creative side like graphic design or writing content and make a second career out of it.

Be ethical and ensure you are not violating your employer’s policy on moonlighting outside of office hours. And definitely don’t do freelance work during office hours or use intellectual property like code from your employer. Doing so might get you fired from your primary job and/or land you in legal trouble.

Very good suggestion Naren

Very much doable !

Excellent points to remember in our entire life span. So many points you mentioned in this article have been faced already. Seriously thinking of making second income since last couple of years nothing has been materialized apart from my regular IT job. Life looks very uncertain. Thank you for sharing these wonderful article.

~Srinivas P.

Thanks for your comment Srinivas P .. Please keep sharing your views like this..

Manish

HI Manish,

I come to JAGO from time to time and always find that 4 out of 5 articles preaching about the monthly investments or small payments for a period of 25~30yrs like that…but i get lost in that idea when i couldn’t find any instruments/tools which provide the 12% return[Except for Equity and life hangs in balance there]. Even the PF which is like holy grail, also seems to be changing these days.

Can you direct me at any such “PRESENT” which gives 12% return from your experience or gatherings.

By the way the article is very good and keeps one updated about the perspective that can happen anytime.

Regards,

Loki

12% return over long term can come from EQUITY asset class, that can be direct stocks or equity mutual funds . But its easier for a common man to manage a mutual fund investments.

Wonderful message…..I loved it…

Thanks for your comment R Saravana Rajesh .. Please keep sharing your views like this..

Manish

A wonderful insight opened truthfully. Bravo !

Thanks for your comment Prem Aggarwal .. Please keep sharing your views like this..

Manish

Great Article Manish. Thanks for sharing it. There are various forums (websites, TV channels, books, articles) that advises us to save & invest for future. That’s the first part of the equation and most of the readers of this site would be doing it pretty well. However nowhere do we get the advises on what to do after we reach retirement age and these investments have reached a sizable kitty. what next. How can one build a portfolio that will generate regular income for the retires. Can you pls. focus on this topic in your next articles. I see a need of a very detailed article on this aspect with respect to the lump sum amount spouses will get after a sad demise of a loved one (sole earner in the family).

Thanks, Sunil

Yes Sunil

Will try to focus on that and will do an article .

Sounds an great idea Manish…All the best & I am looking forward to it.

Thanks a lot for drafting these practical thoughs at one place. It will be very useful for many youth. Thanks again. Great worange. I like.

Thanks for your comment Madan Lal .. Please keep sharing your views like this..

Manish