99% mutual fund investors do not understand these 3 critical points for long term success

Are you investing in equity mutual funds or planning to invest?

GREAT!

While you might have done your research and reading about investing in a mutual fund, but I am sure you still do not have 100% clear idea about what does it mean to invest in a mutual fund. In this article, my attempt is to make you understand what exactly you should be expecting out of your investments in equity mutual funds.

A lot of investors are approached by advisors and agents who sell equity mutual funds to them in the name of “high returns”. But investors are not informed about the risks associated with it. Because of this most of the investors redeem their investments if markets fall or if the returns are not that great after a year or so and hence lose out on getting the benefits of mutual funds over the long term.

This happens because in investors’ mind a mutual fund is all about “getting high returns”.

So it’s very important to clear all the wrong notions about equity mutual funds and set a clear understanding of them in your mind so that you get the best out of your mutual fund’s investments.

What are Equity Mutual Funds?

This article is all about “Equity Mutual Funds” and not any kind of mutual fund. One of the biggest myths is that

Mutual Funds = Stock Market

NO!

There is various kind of mutual funds, ranging from super safe mutual funds (like liquid mutual funds or debt mutual funds) to high risky funds (like mid-cap funds and equity mutual funds). Below is a

3 important points to know before you invest in equity mutual funds

So in this article, I am listing various important points you should know if you are investing in equity mutual funds or planning to do the same.

#1 – You are investing in diversified businesses

Investing in an equity mutual fund is not like putting money in a fixed deposit or real estate. When you invest in an equity mutual fund, it invests your money in a portfolio of companies.

Equity Mutual funds are a way to invest in a number of stocks using one single investment and get it managed by an experienced and well-qualified fund manager.

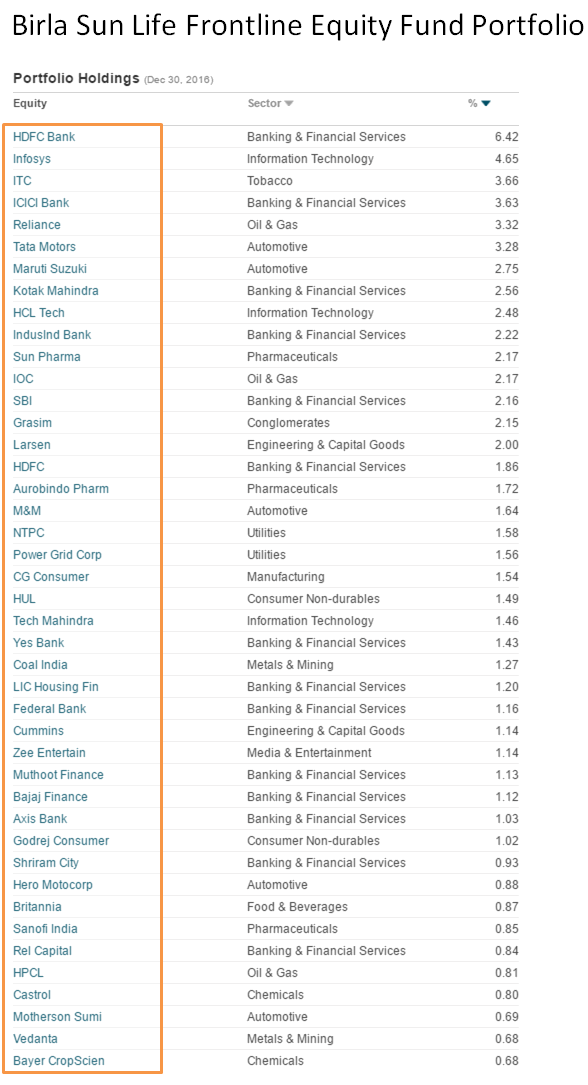

For example, Birla Sun Life Frontline Equity had 80 stocks in its portfolio as on 30th Dec 2016, as per the money control website. This means that if you are investing in these mutual funds, you are actually investing in 80 companies.

You own 80 businesses

Your returns or loss depends on 80 different company’s performance over time. Think about it.

Below is a partial list of companies in the fund.

Now when you know that you are actually invested in 80 different companies, it’s important to know that returns from your mutual funds actually come from the returns from these companies stocks performance over time, it’s the average of these companies.

Below is a very good video, where it’s explained how business create wealth over the long term in Indian context

#2 – You are investing for long term

No business earns exceptional returns over the short term. Now as you know that you are actually investing in a business when you are investing in equity mutual funds, that too in multiple companies, the great returns will come over the long term.

Some companies will not do great, some of them will do average and some of them will grow exceptionally. And when you do the average, you will get very good returns.

The best part is that the chances of great returns are much higher because you are diversified across various sectors, companies, management, and size.

76 times return in 20 yrs period

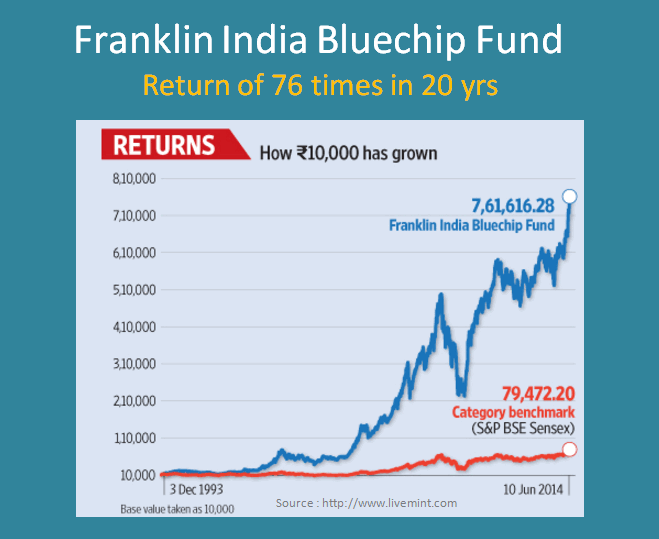

Let’s talk about a Franklin India Bluechip Fund which started in 1993. It’s been 23 yrs now since inception.

Over the first 20 yrs (from 1993 to 2014) the fund has given 76 times return. It turns out to be 24% CAGR return and by any standard its mind-boggling returns, especially because it’s for 20 yrs compounded.

10 lacs invested became 7.6 crores.

If this same 10 lacs was invested in Fixed Deposits, then in 20 yrs it would have grown to 67 lacs.

So its 67 lacs vs 760 lacs.

Sadly, investors don’t wait in mutual funds

Sadly, this 76 times returns do not reflect in most of the investor’s portfolios because investors don’t think long term and think short term. If for some years, the fund does not perform well, they want to move to something else which gives them awesome returns.

Businesses go through various cycles (success and failure, good and bad). So you need to wait for a very long term to see some amazing returns.

If you are right now invested in equity mutual funds, it’s very important to understand that you will not get great returns over the short term (2-5 yrs). Trust your mutual funds and keep investing and over time you will reap the benefits.

There are various mutual funds that are 10+ yrs old and most of them have created big wealth for their dedicated and committed investors.

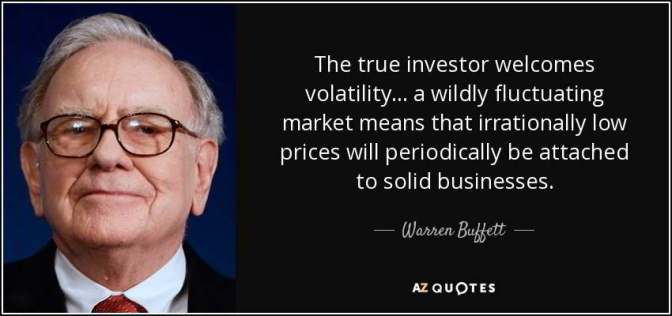

#3 – You are going to face volatility

“Mutual Funds investments are subject to market risk, please read the offer document carefully before investing”

You will hear this line often in the mutual fund’s advertisements on TV. A lot of first-time investors who do not understand equity investments think that “Market Risk” here means that their money is at risk and they can lose all their money by investing in the stock market or mutual funds.

Mutual Funds are Volatile

That might be true with one particular low-quality stock. But with mutual funds, it’s far from truth. Dozens of quality stocks portfolio which is monitored regularly can bring in some ups and downs in the short term, but your money will not be lost at all.

All you can expect is VOLATILITY with your mutual fund’s investments. Your investment value can go up one day and then down one day, and then again down another day and again down 2nd day and then boom… UP on the third day and then again down and again up and up and up …

I hope you got the point.

But you need to understand a very important thing. Volatility is an inherent part of mutual funds investments as it’s investing in stocks, but it’s more of short term phenomena. You need to sit tight and look at the long term trend and how it moves.

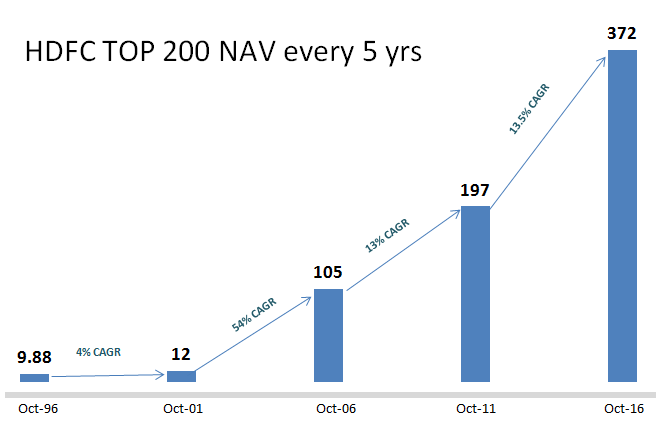

Example of HDFC Top 200 fund

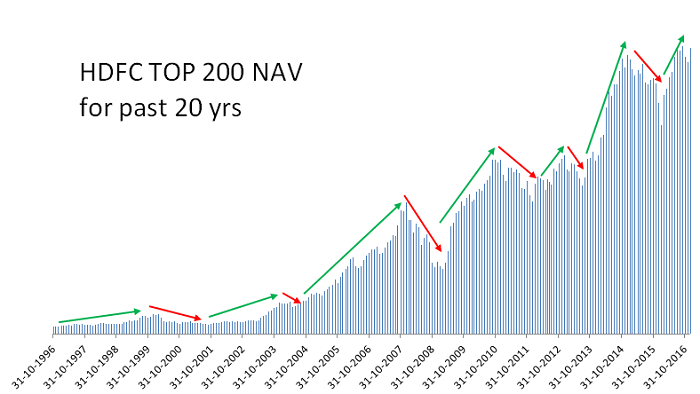

HDFC top 200 is one of the most well-known equity mutual funds which has created great wealth for its investors. Its NAV rose from Rs 10 to Rs 372 in 20 yrs.

It’s a great return over the long term, but the journey was not simple. Its NAV went up first, then came down and then again up and down. See the ups and downs in the below chart for 20 yrs

Did you notice how tough it would be for someone to not exit and stay invested?

If deep down the fund value is growing. This can be measured by check how the moving average is trending. If you do the average of 2 months NAV and then 3 months and 5 months and keep increasing it, you will see the trend is up and that’s what is the most important take for an investor.

Let’s see how the moving average trend looks like for this same fund over 20 yrs period

Don’t look at the fund performance and NAV movement every day or month

The volatility in the stock market will keep hitting your emotions and tell you – “Hey, it’s better to sell your funds and be safe”. The biggest problem with mutual funds is that its NAV is available on the daily basis.

What would happen if you were allowed to see your mutual funds NAV and its performance only after a period of 5 yrs? What if an investor who had invested in HDFC top 200 long back in 1996 was able to find out how its fund had performed every 5 yrs?

Below I have plotted the NAV data for the month of Oct for 1996, 2001,2006,2011 and 2016. See how it looks like

This tells us that if we stay with our funds (provided they are chosen properly and reviewed from time to time) can help us grow a massive amount of wealth.

So stop looking at your mutual fund’s performance in short terms like 3 months or even a year.

3 more critical information you should know

Mutual Funds investments are highly liquid – If you redeem your mutual funds, you can get back your money in 3-4 business days in case of equity mutual funds. In case of liquid funds its just 1 day, so for short term requirements you can keep some money in liquid funds, but most of your long term goals related investments should be in equity mutual funds

Post-tax returns on mutual funds are better – As of now, the long term capital gains in equity are tax-free, which means that after 1 yr of investments, any profits are not taxable. So this is another advantage of investing in equity funds

You can change your investments any time – Other than tax saving mutual funds, almost all the mutual funds can be switched to other mutual funds if you want. So if your fund does not perform well, you can switch it anytime to another fund

I hope you got some great insights into your equity mutual funds investments and how you should behave as a mutual fund’s investors. It’s very different from investing in Fixed Deposits or PPF or any other kind of investors and your expectations should be very different.

Let me know if you have any more points to discuss or ask in the comments section.

January 27, 2017

January 27, 2017

Interesting N educating article. I am a retired man N can you suggest some funds to invest Rs 20 lacs. where I can get some monthly income for my expenses as well as there is an appreciation in value to beat inflation.Thanks

Sir , suggesting a mutual fund name without understanding your risk appetite and your requirement in detail is not a right thing. If you can leave your details here on our website, my team will give you a call and talk to you and guide you

http://jagoinvestor.dev.diginnovators.site/mutual-funds

Very well expland about mutual funds and its type, Good information.

Thanks for sharing

Glad to know that Amol ..

Hi Manish,

Thank you.

Are you talking about the below fund which holds good in current scenario ?

ICICI Prudential Value Discovery Fund (G)

Regards,

Praba

You mean in the article ?

Can you give links to site where we can plot this 200 NAV average for MF. Or may be how to DIY.

There is very less technical material available for MF as compared to Stocks

I am not sure were can you do that analysis !

One common investing strategy used by many mutual fund investors is to look through the fund rankings at the end of each year and pick the top four or five best-performing funds to invest in for the next year. On the surface, this sounds like a reasonably logical investment strategy. There is just one problem; it does not usually work very well. The strategy overlooks the fact that investments tend to be cyclical.

Thanks for sharing that Rishika

Hi,

Is investment in blue chip company risky or safe investment option?????

Investments in any stock is always RISKY !

Can you suggest me some good mutual funds dat invest in blue chip

Take any diversified fund like ICICI pru Discovery !

Hi Manish – Awesome article. I wanted to start investing in a SIP for long term period atleast 10-15 years is the time line.

I am well aware of SIPs and made some investments long back. Do you recommend any particular fund. Would like to go some what aggressive this time. I had invested in HDFC top 200 and IDFC premier …

You might want to look at ICICI Pru Discovery this time .. a good fund ! . Also let us know if you want to invest through Jagoinvestor ? We have many benefits for our clients ! .. Just fill http://www.jagoinvestor.com/mutual-funds#sign-up

hi Manish,

Need your valuable suggestion on this Mutual fund scheme : IDFC Premier Equity -Direct Plan – Growth.

I am investing in this fund 5 years through SIP’s. Manager Kenneth Andrade has left and Anoop Bhaskar has joined IDFC and managing this fund since April 2016. This fund was a 5 star fund a few years back and now is a 1 star or 2 star fund.

Financial experts are suggesting to exit this fund and invest in other midcap funds which are doing well.

But my gut feeling says that since Anoop has good track record, he will get the IDFC Premier Equity fund back on track in a few years time. Also, if we continue with our SIP’s thru the lean period of the fund and the fund manager can make the fund perform well, then we can reap profits.

Big dilemma is Should we stick with this fund or exit this fund. Please provide your valuable opinion and suggestions on this fund. Thanks.

Regards,

Balaji

I think you should still stick to the fund . Most of the times there is a big team which manages the whole fund, instead of just a single person. See how it goes for next few months before you decide to exit !

Thanks Manish for ur suggestion !

Thanks for your comment Balaji

I have my pension a/c in SBI chandrayangutta Branch now. Here service is bad and I have to keep contacting them without any response often. I want to transfer this pension a/c to near by Ramakrishnapuram Branch of SBI. Will theer be any problem with Pension credit? I have auto debit to MF thro NACH autodebit. Will it get affected? Earlier EC debit to LIC will continue?

Please advise.

Sorry we are not aware of that.

perfect knowledge

Thanks for your comment rajeev

Nice article, Manish. Very well written and makes me believe more on MF.

I have a question though, how does compounding works in MF growth. Isnt it directly propotional to NAV of the fund. Today nav is 100 rs and for 1000 rs I bought 10 units. I hold the units for some years, and then decided to sell it. On the selling day, the nav can be more than or less than 100 and hence i get NAV*10=xx rs. where is compounding playing a role here?

Hi Prem

There is no fixed interest you get in mutual funds, the compounding is back calculated in MF. so if you buy at NAV of 10 and your NAV becomes 100 in 10 yrs, you back calculate and say that you got 25.89% Compounded return . Its not known in the start ..

Basically compounding means that the growth happens on not the investment amount, but the grown amount every time .. thats what is called compounding ..

If you need help in mutual funds, our team can help you in everything .

Just fill up http://jagoinvestor.dev.diginnovators.site/mutual-funds#sign-up

-Nice article but have a Question?

In all your examples you mentioned a Lumpsome amount invested in a certain fund and its returns after a span on 23 years ( 10 Lac in 1993 is now 7.6core now). But as an average investor, we can only reach to that amount only after few years of regular SIPs. So you suggest to STOP investing in that Fund when we reach a good amount and then leave it for 20 plus years for good returns? If that’s the case, we never be alive to see such returns. 10 Lacs amount in 1993 is now equal to 50lacs in 2016 after inflation adjustment.

Sir, this is mainly for those who still have 1-2-3 decades left for investing in equity. If someone is already near his retirement, then this is not applicable for them as the time is already gone.

Really appreciated. Simply understandable to everyone. Thanks.

Thanks for your comment Dominic

Manish, I have a query regarding Franklin India Bluechip Fund. As per the image for Rs. 10 Lakh invested in this fund from 1993 to 2014 the returns are 76 times i.e., 760 lakhs. I tried to verify it on valueresearchonline.com with Rs. 5,000/- Monthly SIP for 20 years so, my investment is Rs. 12,05,000/- and the returns are Rs. 2,52,91,300/- which is around 20.9 times. So, how you got 76 times?

Because the data I showed is for Lumpsum investment and not SIP , with SIP you might get different numbers and thats what you got !

Thanks for giving wonderful insights on MF which is a very gray topic. What fascinated me is the list of 40 odd out of 80 companies you have provided in one example. Is there any way we can see which all companies an MF invests into? When they say Midcap, Smallcap or Bluechip I assume they invest in a handful of companies. How can we figure out which all?

Appreciate your continuous attempt at making India financially literate.

Glad to know that Akshay ..

Nice Article Manish!

I liked the point ‘if you were allowed to see your mutual funds NAV and its performance only after a period of 5 yrs’.

Good graphic!

Yea.. if that happens, I think most of the people will benefit !

Hi i am new to this SIP way of investement. Can you plzz suggest me , which fund i should buy. I want to invest 5k in a month that too in two ways. One with low risk and one with average to high risk. Plzz suggest. Thanks

Good article. But what is the impact of the various charges levied by the fund on the mgmt,

Your point on staying long is well taken. Appreciate it. thanks

When you say Impact, you mean negative here I guess.

Charges are deducted from the fund value and the NAV is then published. Its a active managed fund and hence the fees. But if there is no fees, then who will manage it ?

Very informative article. Thanks for this.

Thanks for your comment Mumtaz

Hi Manish

Nice Blog. I have one question Am Investing via SIP in Franklin India Blue Chip for one of my financial goal which is about 10 to 15 years from now. Recently I have switched to Franklin India Prima Plus gradually. How about this fund’ s track record. Is this a good fund for long term.

Thanks

I think prima plus is a wonderful fund to invest in 🙂 ..