How to unlink Aadhaar from Bank, Digital Wallet & Other Service Providers?

Good News!!

The Supreme Court has ruled that citizens of India do not have to link their aadhar number to a range of services such as bank account, mobile sim, digital wallet (paytm), passport, etc. However, the Supreme Court has said that biometric ID is mandatory for accessing social welfare schemes and subsidies such as, LPG subsidy, Jan Dhan Yojana, etc.

Last year a lot of stress was there for having an Aadhar card and urgently linking the aadhar to avail public and private sector services. That panic state in the country made us link our aadhar with a bank account, sim card, investments (KYC updation) and whatnot.

After all, there so many questions were raised on the basis of the Right to Privacy and Right to avail the basic services which should not be stopped on the question of not having aadhar card number.

There were so many news such as,

After all these, the verdict of Aadhar not mandatory has been passed.

So, now it is a good news for those you never had an aadhar and never got it linked with anything. However, for those who have linked the aadhar with their private accounts and are concern about their private information getting hacked, may delink the aadhar.

Process of Un-linking

Now, the question arises is it so easy to delink? Do I again need to stand in the queues at post office and banks for hours for delinking my aadhar? The answer is NO. Because, Aadhar delinking is optional and not mandatory. If you feel insure that your private information may get leaked than you should delink your aadhar number.

Below given are the processes of delinking aadhar from Post Offices, Bank, Digital Wallet, and Mobile operator.

1. How to unlink aadhar from Bank Account

Before proceeding to unlink Aadhaar from Bank, first, make sure that your Bank Account is not linked for any DBT (Direct Benefit Transfer). If you unlink the Aadhaar with the bank which is linked for DBT (like Gas subsidy), then you may not receive the DBT money in your account. Hence, try to unlink Aadhaar from bank cautiously. Following are the steps for delinking aadhar from bank.

- Visit your branch

- Ask customer service to give you Aadhaar De-Link Form.

- Submit the de-link form

- Within 48 hours your Aadhaar details will be de-linked from your bank account.

- Cross-check after 48 hours whether it has been de-linked or not.

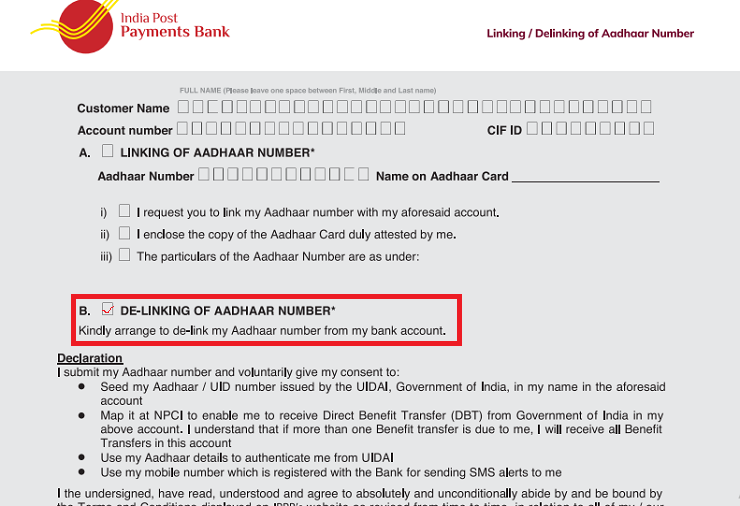

2. How to unlink aadhar from Post Office Account

For delinking aadhar card number from post office accounts, you just need to submit a form of delinking of Aadhar Number. This is how Indian post office payment bank de-link form looks like.

3. How to unlink aadhar from digital wallets such as Paytm, Mobikwik, Freecharge

- Call the customer care and ask for the procedure to de-link.

- You will receive an e-mail to attach a soft copy of your Aadhaar.

- After sending the e-mail, you will receive a reply stating that within 72 hours (depends from company to company) your Aadhaar will be de-linked.

- Cross check again after 72 hours with the customer care.

4.How to unlink aadhar from sim card companies such as jio, Vodafone, idea, etc.

- Call the customer care and request for unlinking aadhar.

- You may be asked to send an e-mail with a request to de-link your Aadhaar details.

- Once you send it, then they will send you the confirmed message of unlinking Aadhaar.

There might be some difference in the process of delinking for every service provider. Because as of now there are no standard rules set up for delinking. So, you may directly contact the customer care of the service provider and they will guide you on the exact process.

Please feel free to comment on how fruitful this article was.

January 3, 2019

January 3, 2019

I have been continuously asked by my employer to link my Aadhar with UAN number (Provident Fund account). Is it mandatory? I am asking since the SC order only talks about non mandatory linking to private services like telephone, service providers etc. Thanks in advance.

Hi Aditya Ambekar

Thanks for your comment.

As far as I know, Now its not mandatory to link aadhar to UAN.

Vandana

Is there a point to delinking AADHAAR as they have it saved on thier database? Or does delinking come with an agreement that our information will be wiped from their data base@?

Hi Arjun

Thanks for your comment.

Delinking assures that your bio metric is not registered with them. So that any future fraud of leak of crucial information can be avoided. The data like address, aadhar number and date of birth will still be with them.

Vandana

your article are always so so useful and fully informative

Hey Advocate B.Santosh Kumar

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Thanks for the information. It is very useful to safeguard our personal information from misuse.

Is it also applicable to insurance policies? Can we ask for delinking Aadhar number from the insurance policy? Please clarify.

Hi Mr. Ajitshah

Thanks for commenting, Yes you can ask insurance company to unlink aadhar from your policy.

Vandana

So I expect the bank should not insist on Aadhar for new account opening. But I am quite sure the bank staff will not be aware of this so they will refuse to do so.

Do you have a link to any document which would clearly show this ruling?

Thanks for commenting Mr. Yogin

As far as I know, for opening an account we need to attach an address proof, few years back we use to attach aadhar to the KYC form just for the same purpose. So now also aadhar will work as address proof and you will not be asked for the bio-metric.

You may visit to UIDAI webpage for reference.

Vandana

It was informative I wasn’t aware of it.

Thanks for your comment Murali Krishna .. Please keep sharing your views like this..

Manish

Banks de-link account from Aadhaar but didn’t de-link your customer ID.

Thanks for your comment ABBASALI MAVA .. Please keep sharing your views like this..

Manish

Thank you very much the information provided was very much useful, my one more concern is while applying for job they ask for Aadhar details right before joining in these case do we have the right to refuse ?

Hi Arun,

Thanks for commenting,

Aadhar works for providing basic details of yours like – name, address, DOB, Photo ID. So, unless and until you are asked for bio-metric it is not risky to provide aadhar. Just by giving bio-metric impression to private dealers, or other places we may invite risk over our privacy.

Vandana