Wow .. Today I am going to talk about your SPENDING habits and what governs it. Spending money is a critical part of anyone’s financial life and pretty much define’s how our financial life looks like.

Spending more is pretty much a reason why we go to our work, because at the end of the day, money has to change hands, be it now or later. In a way its a beautiful creation of this world. We have some great things in life today because we have spent money on it and bought it.

While I can keep talking about the best parts of spending , today I want to cover why we spend “more” and why we sometimes go beyond out set limits.

Most of the investors financial life today is highly screwed mostly because of their spending habits and the way they deal with their expenses, and many fall into the trap of “living on paycheck month after month” . So Today I want to pick few reasons which force us or makes us spend more money than we should . Lets look at each point in detail and yes – grab some coffee 🙂

Reason #1 – Because you don’t use CASH

Yes – This one simple thing can urge you to spend more.

The whole payment system has transformed totally in last 10-15 yrs in our country. There was a time when you carried cash every time you went to market to buy something. You knew how much you will be spending before hand, carried exactly that much money with some small buffer amount and bought the stuff you wanted.

Be it Milk , Vegetables, Grocery, Petrol or anything else. It was simple transaction. Exchange money and get what you want.

Then credit cards and debit cards happened. They arrived as “convenient” ways to make payment and this convenience came at a big cost.

Paying by Cash is emotionally painful

While cards gives you convenience, it also takes away that emotional feeling which you get when you pay by CASH. When you pay cash, you take out the money, count it, can think about it and it leaves your wallet and you “feel” that something parted away with you. This is not the case with credit or debit card.

This can be clearly seen in online shopping. A lot of people buy things on impulse using their cards online, the bought items arrive and you take it because you mostly have no choice. Compare this with paying cash, you think you want something, order it with cash on delivery and then let some time pass.

In this option, you have enough time to think back on your decision simply because the money has not yet left your wallet (with cards, it’s already gone) .

This is exactly what happens in real life too, people who buy things on cash on delivery often change their mind and reject to buy things because now they think they no longer need it. Read the report below

Cash on delivery is the most inconvenient payment option. It allows customers too much time to change their mind,” said K Vaitheeswaran, the founder of Indiaplaza.com.

Indiaplaza.com, which sells books and electronic goods, was the first to introduce the payment method more than a decade ago. It realised in about a year that cash on delivery was “painful”. Rejection rates are at about 45%, partly because there is no upfront cash commitment, according to Vaitheeswaran.

Source – Economic Times

Cash discourages spending

While this might not be consciously visible to you and many will deny this, but as per various studies, its shown that cash payment discourages spending, while using credit cards or gift payment encourage spending. Below you can read one of the studies on this topic.

Priya Raghubir, PhD, of the Stern School of Business at New York University, and Joydeep Srivastava, PhD, of the Robert H. Smith School of Business at the University of Maryland, College Park, asked participants to read various buying scenarios and answer questions about how much would they spend using cash versus various cash equivalents.

In the first study, 114 participants estimated how much they would pay using various payment forms for a vividly described restaurant meal. The results showed that “People are willing to spend (or pay) more when they use a credit card than when using cash,” the authors wrote. They attributed the difference in spending behavior to the way cash can reinforce the pain of paying.

Have you ever realised that when you use cards for payments, you are too casual about the actual bill amount, because you can pay any amount at that moment without worrying about it.

Also you generally don’t see the money leaving your wallet at all, the bill comes after a month and by that time, it’s too late to think about it in detail and your only job it to pay that bill. It’s just another bill and nothing else.

You can read this awesome report on cash vs cards payment and do listen to this short audio on this matter.

I am not saying that stop using cards. Do it wherever you feel its applicable and you can’t control things, but “cash payment is a pain” is highly overrated thing. You can very much use cash for various payments in today’s time exactly like you did it few years ago.

In fact you can take out cash from your account in start of the month for all the pre-planned expenses and then use cash for it.

Note that there can be some reasons like cash back and reward points offered on cards because of which you can use the cards, nothing in that. The point I just want to make sure is that using cards can change the spending behaviour in people and you should control that.

Reason #2 – Because you don’t make a list of items you need

Me and my wife shop all our grocery from DMART, a retail chain mostly in all the big cities in India. We once went there to buy “few grocery items” which were roughly 6-8 in quantity, and when I came out of the store after 45 min, I had a bill of Rs 2,800 in my hand with two big bags in my hand which had tons of things we shopped inside.

I didn’t feel much about it at that time, only to realise next morning that once again we bought many things we either don’t need or we bought it in high quantities than required. So what happened when we went to the store without a predefined list of items?

There was a chain reaction of “We need that also” and “Lets keep this too, as its going to finish soon” and then one items led to another and then we went to clothing section and then utensils sections and we could see so many things which we need WANT.

We went there without a purpose and the whole world was open for us to shop, mix this with the convenient method of payment (card) and you don’t have to feel the pinch at the same moment. It’s a deadly combination !

The other problem is that you buy things on the name of “lets try this once” and also buy things in quantities larger than you need. I once bought peanut butter, just to check why people in US love it so much, but I didn’t love it and only consumed it once, thank god my wife finished it by mixing it in curries instead of raw peanuts !

Did you use the lists many years back while shopping ?

Go back 15 yrs in life and think about those times when you mother handed over the small piece of paper which had those 10 things written down along with quantity. It was easy then, you went with the list to shop, handed over the slip to the shopkeeper and waited there for 10-15 min and that was it.

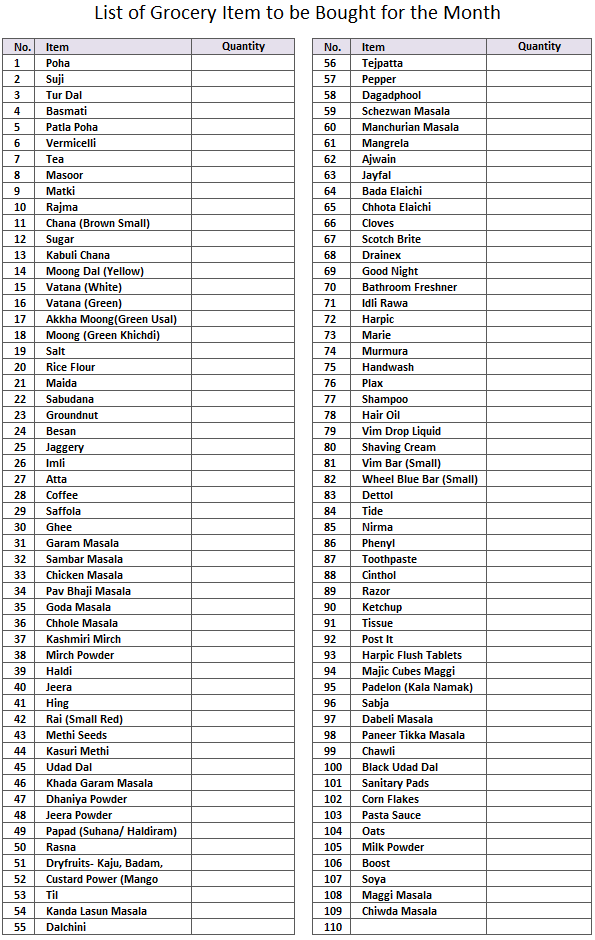

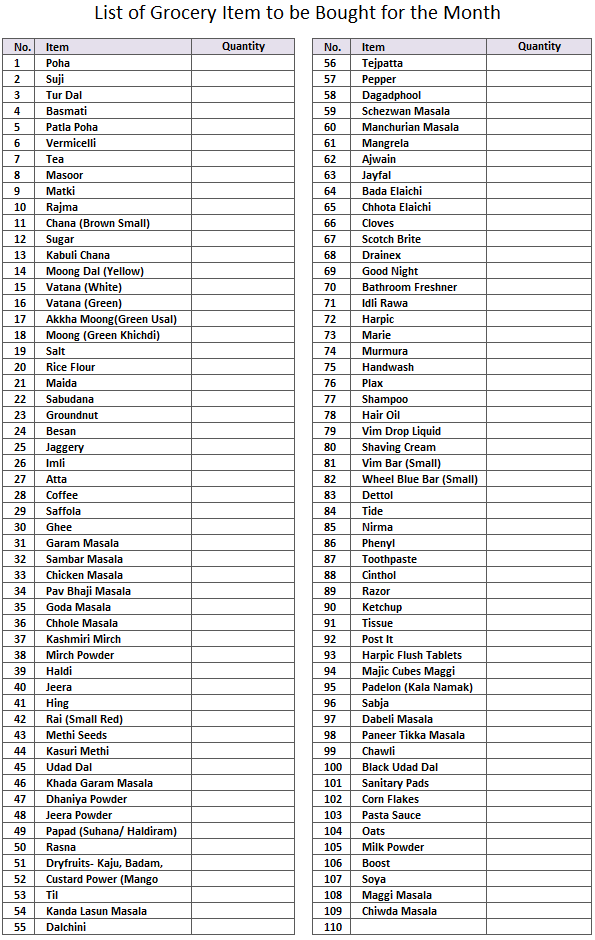

Good that my wife still does that most of times when we do the monthly grocery shopping. My wife has actually take written down all the kitchen ingredients (109 items) in excel sheet, taken many print outs and every month she checks what is needed and what is in stock. While we still buy few things which are not in the list, but it’s very small percentage.

You can see the same list of 109 items below

When you go shopping without a pre planned item list, it’s almost sure that you will buy things you really done need. If Rs 3,000 is enough to cover your actual requirement, you will spend Rs 6,000 just because you don’t go with the list. While I am not saying that you should totally shift to this kind of shopping, at least try it 2-3 times and see if you can stand it or not.

Reason #3 – Because you buy things on on short term excitement

This is mostly for the big purchases (anything above Rs 1,000) . It can be that juicer, the bigger TV, clothes, weighting scale, or even bigger car and house. Most of the people don’t spend enough time to understand if they really need something or not. This is how it typically works

- You come across something

- You are delighted by looking at it (and there is also a sale going on)

- You come across a reason which justifies you wanting it.

- Buying stuff is easy anyways (net banking debit card or credit card)

And after a week, that same thing is lying at your home unused or used once or twice. Most of the wardrobes are over stuffed by things which was bought on an impulse, because it was on Sale or because they thought they needed it (but in reality they don’t need it)

It’s extremely critical to understand today that the whole world is trying to make the buying process extremely easy for buyers today and tries to lure them with EMI’s (which makes things look affordable)

Let the excitement settle down

The solution for this is to make sure you WAIT for some time, before you buy the stuff. Let some time pass by and let that instant emotion die down.

You came across that great shoe online, where you get 40% OFF, that too with FREE home delivery and anyways your credit card is pre stored on the website – All you need to do is login and punch the CVV number and thats all – You just bought the stuff which you 100% want, but mostly don’t NEED !

I will share my own 2 dumb mistakes I did recently. First I bought a costly bicycle last year, because I so wanted to get into cycling. I joined 2 online clubs, researched a lot on cycles and within 24 hours bought one which I have to admit I hardly used. It still needs my attention.

Next I bought a little bigger size TV recently, which I wanted and needed (I watch lots of TV), but later realised that I should have bought a much bigger one, because now I can’t find much difference in the size I earlier had and the new one which I have now.

I feel I could have avoided both the mistakes, if I waited for 2-3 days and let that impulse die down. If only I had written down 3 reasons why I badly need it, I could have saved myself from the blunder I did, because I know I would not be answer myself on why I need those things strongly.

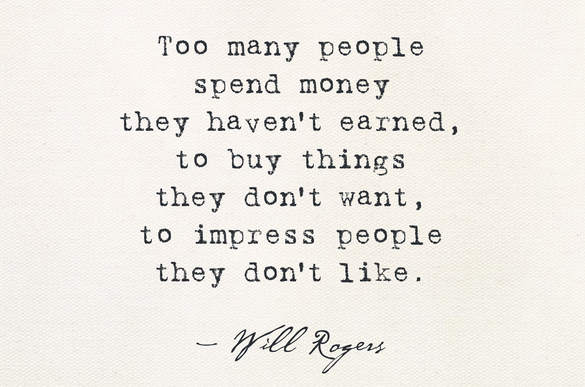

Reason #4 – Because somebody in your family/friends also have it

I seriously cant speak a lot on this, because it looks so stupid to even think how people buy things just because others have it and not because they need or want it. There are two things here ..

First is Peer Pressure , Just because friends in your group have something, you feel the pressure on you to have the same thing in your life so that you can be equal to them. If their kids go to school A , you also want your kid of go to school A , not school B . If they drive a 10 lacs car, you feel a bit uncomfortable having a Rs 4 lacs car.

The One sided Pressure most of the people feel

Most of the times, this pressure is just one-sided . It’s in your mind and not in your friends mind or even your relatives mind. True friends and people who care will never judge you with what you own and compare it with themselves. If they do, it’s better to let them go out of your life.

This peer pressure is clearly visible when it comes to giving gifts to friends/relative and spending on others when they visit you. Just because “they” put Rs 501 in the envelope, next time you can’t put less that, and god forbid if you put Rs 1,001 , now its their turn to “gift” you next time when its their turn.

If you read a book called “Linchpin” by Seth Godin, you will love the way he talks about how the world has become a place of transaction , where no real “gift” or “favor” exists in this world. Even if you truly gift something to someone without expecting anything , still the other party know it does not work that way.

Some day they will have to return the favor !

Apart from the peer pressure, at times there is purely the act of “looking good” and wanting to show off ..

People spend purely because they want to stand apart, because they want to attract some eyeballs and their ego’s are pampered just because others are talking about how great your “stuff” is , not YOU 🙂

Reason #5 – Because money is “available”

I know this would sound strange to many , but a lot of spending happens because there is money available in the pocket. However stupid that sounds, there is huge element of truth in this. Just because you have a lot of money lying with you, all the reasons to spend money seem justified to you.

Many expenses will suddenly appear “unavoidable” . Have you ever been into a situation when the supply of money was restricted for months and months? Did your life move on peacefully or not ? Did you find reasons to postpone or avoid expenses or not?

Always remember a very important point about money ..

“Money is like flowing water, if you don’t give it direction, it will find its own”

Always make sure you define a purpose for your money and allocate it for some goal in life, so that you know what is it going to be used, this is important because next time when you have some low priority expenses coming up, you know you can’t touch the money allocated for some higher priority expenses in future.

I have beautifully explained this in one of my books written by CNBC

Not just label the money, but let it leave your bank account and get invested in some financial product. By default make it tough for yourself to use it (not so tough that you cant use it at all) .

Example

To give you an example, imagine you earn Rs 80,000 per month , after your EMI and other commitments, you are left with Rs 20,000 saving per month. One thing you can do is let it be there in saving bank account and let it grow over time . After 3-4 months, you will have 60-80k in your account and more coming up in future.

At this moment, you are not that happy with your 4 yr old car and your friends are upgrading to a better car and now a small “wish” is seeding in your mind that even you deserve it (I am assuming your old car is still good enough) . In few months, you will surely make your mind to upgrade your car because you have the down-payment ready in your bank account and you also have capacity to pay the EMI for the car !

Compare this with the situation when you have already defined that the extra 20,000 will go into a recurring deposit for next 3 yrs , so that you can accumulate around 7-8 lacs in 3 yrs which will be used for your house renovation, or kids school expenses or some vacation you are looking forward from last many years.

Once you define that and let your money leave your account each month, you virtually don’t see anything lying in your bank account and your tempt to use it for your car up-gradation will die down.

This point is so powerful, that I even decided to answer one of the questions on quora.com

What is some money advice I can learn in less than 10 minutes, which will help me become rich?

Understand that I am not against upgrading your lifestyle, you have to upgrade some times when life demands it and when you really deserve it, but most of the people upgrade things not for themselves or for some strong reason, but just like that because they want to show it off or just feel a temptation.

Upgrade your life responsibly if you have to, its tough to downgrade it later 🙂

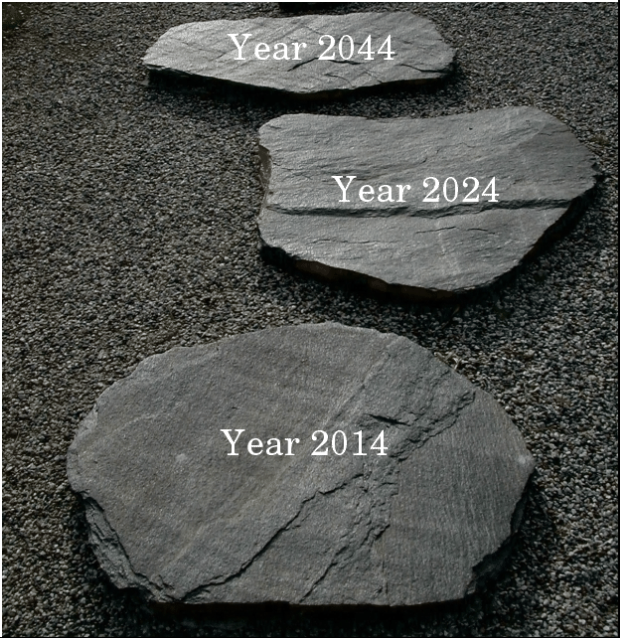

More Availability of Money and What you can Buy

You can notice that India has changed a lot in last 10-15 years in terms of availability of things we can spend on and even in disposable income lying around. There is a lot of money which can now chase a big amount of things, so naturally the temptation of buying things has gone very high.

I can say with confidence, that your most important expenses today form a very small part of your overall expenses and the big part is on things you don’t need for survival.

So whats the solution ? If you are someone who is left with money each month after your expenses, make sure you list down your goals in life, list out how much money you need to invest to achieve those goals and start your SIP’s in mutual funds or recurring deposits and let your money chase those financial goals .

Reasons #6 – Because small expenses turn out to be BIG by the month end

I love this point and this is something you can relate to easily. A lot of expenses look small in nature or a very small ticket size, but when you look at them on a monthly or yearly basis, they turn out to be a big one.

Something which costs Rs 200 might look a non trivial thing at that moment when you are spending on it, its effect on your monthly budget will not look big, but this is not how it happens in real life, you do the same thing 7-8 times and that means few thousand rupees which does not even register in your mind.

Take an example of online shopping of clothes or gadgets, while doing on transaction, it would be few hundreds or thousands, which does look big, but if you add up all the expenses by the month end or in a quarter, you will realise it was a major one which you didnt even considered while you were trying to recall where exactly your money went.

Watching Movies and Eating Out – The silent expenses

Now – I am a real movie buff (I have even started watching Marathi movies and they are so awesome) and we also eat out quote often. These two expenses are might not look quote big if you focus on it just one time. You feel you so much deserve it and that’s why you are earning so much money, But these can go over board and turn out to be a big number (at times 10-15% of your take home).

You need to keep an eye on it and I am not talking about a mental calculation, but actually writing them down for a month and seeing the real numbers. It might turn out to be a big surprise .

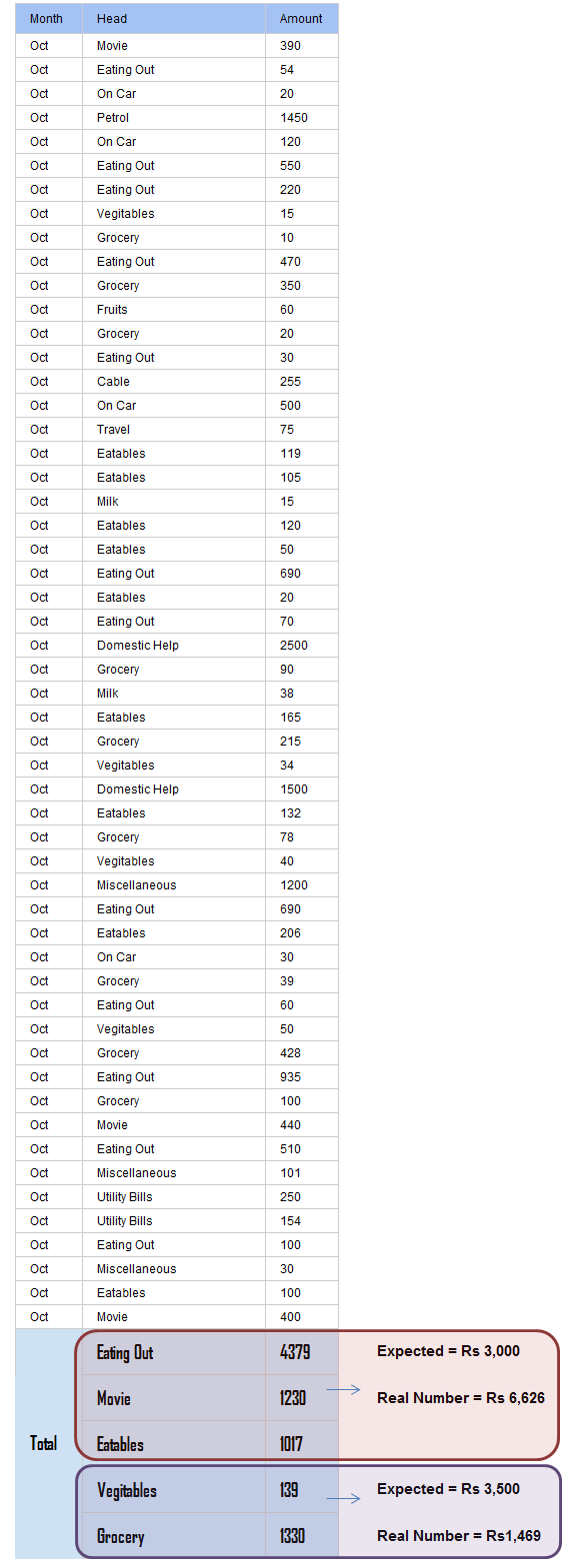

I did exactly that for the month of October 2014. I originally thought that my movies + eating out + snacking expenses should be somewhere around 3,000 and my grocery + veggies expenses should not be crossing 3,500.

But when I actually wrote it down for each day for the month of Oct and saw the real numbers, I was shocked to see that my movies + eating out expenses turned out to be more than double of what I originally thought, on the other hand, my grocery expenses was so less (seems like that month the grocery expenses actually were very less for some reason, as we just 2 of us).

Below you can see the exact numbers

So what you should do ? Truly speaking – I don’t think one should restrict themselves on spending on things which add up to their quality of life and if you truly enjoy it. You can surely spend money on things you truly wish and cut down on things which are waste or does not add much to your life. Ramit Sethi calls it as ‘Conscious spending’ and you should read his article on this point.

So just be a bit alert on things you are spending on and when it starts going over the roof – take charge of it and control it. Dont be over fanatic over controlling each bit of it, it does work in real life.

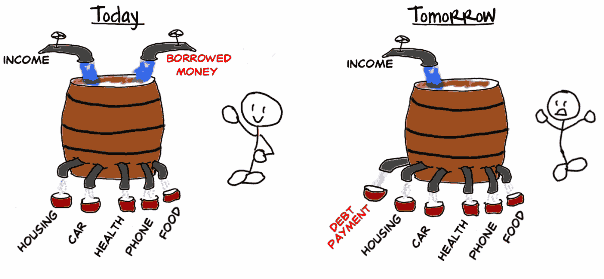

Reason #7 – Because of ‘Enjoy today, Pay Later’ trick

The last point I want to cover is EMI option of payments. The option of payment in installment is a powerful tool to make people believe that they can afford a stuff and because the EMI amount fits their monthly income, most of the people buy things much more than they need or can afford.

EMI option in payments is nothing less than a revolution which has driven the consumption levels to insane levels. Everything you can imagine today, especially in online shopping, where you can buy literally anything on EMI and bring it inside to your “affordability zone” by just choosing “Buy on EMI”.

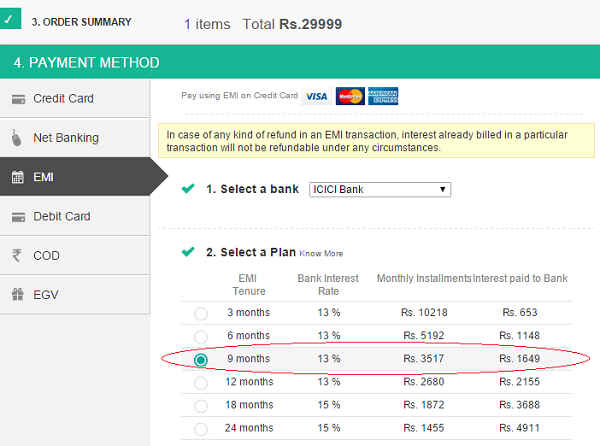

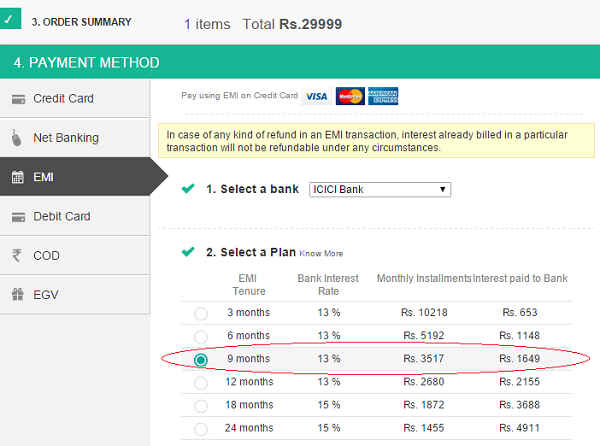

If you look at an example of flipkart , I add Moto X smartphone which costs Rs 29,999 in the cart for buying. Now for someone who has a salary of Rs 30,000 per month (A lot of youth lies in this category) can’t afford this phone because its equal to one month salary.

How EMI option changes the whole equation of affordability

They can purchase it without any issue just because they can buy it on EMI option and suddenly they will just have to cough up Rs 3,500 per month. While this looks really amazing to some people, this is how the debt cycle start for most of the youngsters new into job and then they get trapped into it for many years.

Here is a report from Livemint which talks about the way companies use EMI options

EMIs (equated monthly instalments) aren’t new to Indians, but it’s a strategy that companies such as Apple Inc., Gold’s Gym and others are increasingly adopting in a bid to beat the sluggish economy, convincing customers to overcome their reluctance to spend too much money and to go ahead and splurge on an iPhone or a fitness club membership.

Clearly, India is turning into an EMI nation.

A range of items are available—cellphones, sunglasses, jeans, vacations, hair transplants, gym memberships—as companies seek to drive consumption in a weak economy. And it seems to be working, most evidently in the case of the iPhone, once a rarity, but suddenly more commonplace in urban India.

IndiGo and Jet Airways (India) Ltd, two of India’s largest airlines, are the latest to announce the availability of air tickets on three- or six-month instalments. Although the schemes have been on for a year, the firms’ recent promotion through newspaper advertisements helped persuade dithering customers, especially since fares have surged 25% in the holiday season

Hence, its important to make sure you don’t fall into the trap of EMI’s for those things which you absolutely don’t require and cant afford.

So how to spend optimal money ?

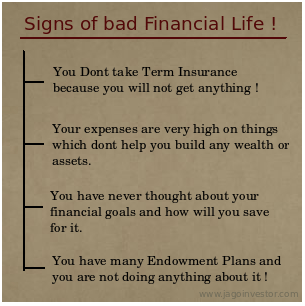

Expenses are important element of your financial, if you earn a lot , its of less use if you also spend a lot , because what ever is left at the end of the month goes into creating your financial wealth in long run. Its important review your spending pattern, various categories you spend money on and talk with your spouse, parents about it and try to optimize it.

Review each thing and see which of those expenses can be reduced or eliminated or shifted to some other category.

At the end of day we all earn money primarily to spend it on things, but at times things get out of control and does not fit into what we had originally planned.

What are your thoughts about this article ? Please write down your comments by clicking here