NRI investment in mutual funds – A complete and detailed guide

Most of the NRI’s who are new to mutual funds have this confusion if they can invest in mutual funds in India or not?

In this article, I will share with you all the rules, restrictions and some of the important points that NRI investors should know before investing in Mutual funds.

Can NRI invest in mutual funds in India?

The simple answer is YES. NRI’s can invest in mutual funds in India.

In the case of NRIs, no special approvals are to be taken from SEBI or RBI, however the documentation can be little more and in case of US and Canadian NRI’s, there are some limitations in terms of which AMC’s they can invest in.

So let’s look at the basics first.

NRE or NRO accounts should be used

An NRI can invest in mutual funds only from an NRE or NRO bank account. The Non-Resident External Rupee (NRE) account is a rupee account from which money can be sent back to the country of your residence and the Non-Resident Ordinary Rupee (NRO) account is a non-repatriable rupee account.

Here is a detailed 30 min video explaining NRE/NRO accounts along with various other basics for NRI’s

Which means that if you are living in particular country and you want to invest in Indian mutual funds, but later in future, you want to redeem back the money and use it back in your country, then its better to invest by NRE account as its repatriable, otherwise NRO account can be used.

Procedure for Investing

For an NRI the procedure of applying in a mutual fund is similar to the one followed by residents.

Step #1 – KYC (Know your client)

This is one-time documentation required to invest in mutual funds and its a requirement set by SEBI. For doing your KYC, the following documents are required.

- Copy of Passport is compulsory

- Copy of Overseas Address Proof (in English)

- Copy of Indian PAN card

- Two passport size photos

- The fully Filled KYC form

You can complete your KYC either by taking support from a mutual fund distributor or directly submitting the filled KYC form at CAMS or KARVY Offices in your city by personally visiting them.

Important Points:

- Incase of POI, the POI card is also required in documentation

- In case your overseas address is not in English, you need to get it translated by a translator in your city and get their stamp

- In case you do not want to travel to India just for making investments, you can always give POA (Power of attorney) to someone trusted who can do the process for you. In our case, a lot of NRI readers of jagoinvestor, courier us their documents and we help them in doing their KYC and starting their investments.

Once your KYC form along with required documents is submitted to the registrars(CAMS, Karvy, Sundaram, etc.) It will take 4 to 5 days in registration. Once it is registered you can start investing into mutual funds. You will get the alert about the registration via mail or SMS. However, if you want you can check the status of your KYC by entering your PAN in either of the links below:

https://kra.ndml.in/

https://camskra.com/

https://www.karvykra.com

https://www.cvlkra.com/

https://www.nsekra.com/

You can also refer to these links for downloading the KYC application form.

FATCA

There is something called FATCA, which is also added in KYC documentation these days and it’s done for all investors. However, its mainly required for US and Canada investors. One has to provide information like country of tax residence, tax identification number from that country, country of birth, country of citizenship, etc.

Once the FATCA is submitted, NRI can start investing in mutual funds.

NRI’s from the US and Canada

Now, since the last few years – most fund houses in India don’t allow NRIs from the US and Canada to invest with them due to cumbersome compliance requirements under FATCA or Foreign Account Tax Compliance Act. When FATCA came into place, fund houses stopped taking investments from the USA and Canada because of the complexity associated with the compliance. However now, following fund houses accept NRI investments from US and Canada

- Birla Sun Life Mutual Fund

- SBI Mutual Fund

- UTI Mutual Fund

- ICICI Prudential Mutual Fund

- DHFL Pramerica Mutual Fund

- L&T Mutual Fund

- PPFAS Mutual Fund

- Sundaram Mutual Fund

Some of these fund houses have certain conditions on which they allow investors based in the USA and Canada to put money in their schemes. For example, ICICI Prudential AMC, Birla Sun Life Mutual Fund and SBI Mutual Fund allow investments only through the offline transaction with an additional declaration signed by the client. Similarly, L&T Mutual Fund doesn’t allow US and Canada based clients to invest in close-ended funds.

So, if you are the US or Canada NRI then look after the procedure and norms of Mutual funds in regards to NRIs of US/Canada before investing. We help a lot of our US and Canada clients to invest in mutual funds by making sure that their portfolio is designed well out of these limited sets of AMC which allows investments.

What if I was investing in mutual funds and moved to the USA, now I am an US NRI??

In this case, if the AMC you were investing with, continues to accept US NRIs then you just need to update the documents and have your FATCA verified, else you can just keep your investments as it is.

How do redemptions work for NRI?

When an NRI investor redeems the money from the mutual funds, the amount is credited back to your bank account after deduction of the applicable taxes in the form of TDS. Below are the taxation rules

NRI Taxation rules

NRI investors often fear that they will have to pay double tax when they invest in India. Well, this will not be the case, if India has signed the Double Taxation Avoidance Treaty (DTAA) with the respective country. For instance, India has signed this treaty with the US. Hence, you can claim tax relief in the US, if you have already paid taxes in India.

So if you have already paid X amount in India as tax, and If your taxation in the current country is Y, then you just need to pay Y-X tax in your country, provided the double taxation avoidance treaty is signed (in most cases its there for sure). Some documentation will be required for this benefit.

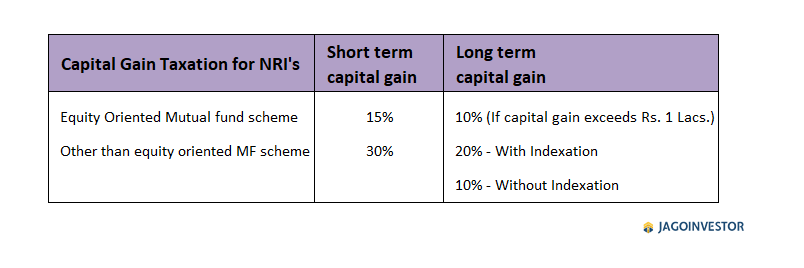

Equity and Debt taxation

The gains from equity mutual funds (funds where the composition of equity and equity-related instruments in the portfolio is 65% and above) are taxable based on the holding period. Short term capital gains (holding period 12 months or less than 12 months) attract tax at the rate of 15%. However, Long Term Capital Gains (holding period more than 12 months), in excess of Rs 1 Lakh, are taxable at the rate of 10%.

In case of debt funds (Hybrid funds with less than 65% equity exposure, Gold funds etc all are Non-Equity funds) Short Term Capital Gains (holding period less than 3 years) are taxable at the rate of 30%. Holding the fund for more than three years will result in a 20% tax on the gains with indexation benefit. LTCG on non-listed funds will be taxed at 10% without indexation.

Below given table shows the rate of TDS for NRI redemption on the basis of different holding periods and the type of funds.

If you are an NRI and you wish to start investing in Mutual funds, you can contact our team here.

If you are looking for Financial Planning, then visit our NRI Financial Planning page here

We have more than 100+ NRI clients across the globe who are doing their wealth creation using our help. We will help you in all the process and investing process.

We hope this article cleared the confusion about rules, regulations and taxation part of NRI investing.

May 21, 2019

May 21, 2019

Nice article, keep up the good work.

2 questions:

1. The list of MF gets narrow for people from Australia or is it the same?

2. Also, the tax rules remains the same or is it different – in DTAA context?

Thanks!

Hi AB

1. For Australia, there are no restrictions like US/Canada NRI . ONe can invest in all MF’s just like a RESIDENT

2. Australia has DTAA treaty with India, so one will be able to offset the taxes paid in India. Tax rules for MF is same for NRI across the world

Manish

Thanks Manish, that was some useful information.

welcome

Thank you sir i learn about NRI concept in mutual funds it really helpful for me in further life

Glad to know that !

Being an NRI myself, this was something that I was considering. Glad to came across this article.

Glad to know that Sandeep.. Do let me know if you have any further queries, we help NRI’s in their investments and financial planning in case you are looking for it ?

Manish

Dear Manish,

Before becoming NRI some MF SIP are with Saving account. How to change the Bank to NRE?

Also some MF SIP are linked to NRO account can we change bank account to NRE?

what is the procedure ? Whether we need to stop all MF and can switch without stopping SIP?

You can just contact your bank and ask them to convert the normal saving bank account to NRE or NRO. You can do it from NRE , there is no issues as such .. Why do you want to do it to NRO?

Stopping all SIP and then restarting them from other NRE/NRO will also work

Manish

Hi Manish,

Thanks for the detailed explanation. According to my knowledge, the bigger hurdle for NRIs (especially US and Canada) for MF investing is that : In USA, a person needs to declare all MF investments and he also needs to pay tax on Mark-to-market basis. So, even if a person do not sell MF, he needs to pay the tax on Global income ( which is on-paper profit here).

Hi Ripul

Yes, that’s the issue with NRI from US … But we have some solutions for this like using your parents to invest in their name and using income tax clubbing provisions to save that tax!

Manish

Ok. That is good option. But does it mean NRIs in USA themselves cannot have simple MF investment on their own? That’s the current issue for active participation in MF from NRI

Yes, NRI from US can have their own MF investments without going through an intermediary.. The only issue may be the KYC part. How will they do it themselves?

Hi Manish,

Could you please confirm about this? (So, even if a person do not sell MF, he needs to pay the tax on Global income ( which is on-paper profit here)? As long as if we dont sell MF, no need to pay Tax in USA. Please correct me if i am wrong here

Yes, in US you need to pay tax on the ON PAPER profit also ! … Unlike India, when the tax is to be paid when you sell it . In US, it does not work like that. So if you invest 10 lacs in India and it grows to 12 lacs next year, then you need to pay the tax on 2 lacs !

Manish

good

keep it up

Hi Manish,

Nice Article.

As I understand for long term investments in equity MF 10 % of the Tax need to pay if the Capital gain exeeds 1 Lacs. I have a portfolio of 1.14CR in MF (Jago investor), In that 87% is on equity.

1) Does the capital gain means Principal and profits or only profits?

2) If I loose NRI status, how much tax I need to pay during Redemption and which account it will be credited?

3) During Redemtion if capital gain is below 2.5 Lacs (with out any income in India and below tax range), can I claim the tax which I paid during Redemption?

4) What is the meaning of Indexation?

Please guide me how to check that my Hybrid MF equity percentage?

Regards,

Ranjith

Answers below

1. ONly profits

2. You dont need to redeem once you loose NRI status. When that happens, all you need to do is change your KYC status to resident.. Everything continues after that in the same manner.

3. Yes

4. To understand Indexation , read more here – http://jagoinvestor.dev.diginnovators.site/2009/05/how-to-calculate-capital-gains-and-what_7801.html

Indexation mainly means taking into consideration INFLATION in the cost price and giving its benefit to the investor.

Manish

Can NRI from germany invest in Shares through a a dealer like Jago?

Yes, they can invest in SHARES, but we are not any dealers 🙂

However, if you want to invest in mutual funds, you can do that through us, we are AMFI distributors !

Thanks for sharing such nice post.

However I have a query around OCI but as I found that OCI holders are also having same rights in India as NRI’s.

So the question is — Is there any specific rules for OCI holder living in India only. Can we OCI holder living in India can invest in Mutual funds alike NRI only or is there any specific rules ?

No separate treatment for OCI ! … you can invest in the same way like NRI’s

Manish

In addition, one should look at tax implications in country of residence.

As far as I know, in US, MF gains are considered income (i.e. it comes under regular income tax, and not capital gains tax; regardless of period of holding).

However, stock gains are considered capital gains.

Please correct me if that’s not the case.

You are correct !

Two questions.

1. If a person in USA does MF investment, does he have to mention this in tax filing in USA?

2. Can an NRI do KYC through Power of Attorney?

Thanks.

Hi Kishore

1. I am not sure on this, but I think the answer is YES, because you need to pay tax on your global income, so you need to share with them where you have invested

2. Yes

Manish

I think only when investor withdraw invested money, then they need to pay tax. As long as you are investing and not redeemed any funds, no need to pay IMO.

Please confirm.

Yes. That’s correct ..

So tax is to be paid only on the profit part on “Realization” , means when you actually sell (or switch)

Not really. Any dividends will also have to be disclosed for the tax year that you received them.

Srihari

In my comment we are not talking of dividends.. its a general discussion on when a person pays tax on capital gains ..

If short term capital gain in debt fund is less than the income tax limit, say just fifty thousand and there isn’t any other income, then how will be the tax liability calculated.

In that case no tax is to be paid ~

Can NRI combine STCG or LTCG of Debt fund with Income? or is this provision only allowed for Resident Indian?

For ex, if i have STCG of 1 Lakh from debt fund and Other Income of 1 Lakh. Since combined income is less than the IT Threshold, i can claim exemption?

Remember two rules

1. Long term capital losses can be set off only against long term capital gains

2. Short term capital losses, can be set off only against short term or long term capital gains

These rules are only for those things, where long term capital gains are not tax exempted !

Hi Manish,

Nice article. I believe that you were meant to say – repatriable instead of repairable against NRO accounts.

Yup . I made the corrections .. thanks for pointing it out

Seafarers do not have overseas address.

Csn you please advise documentation for people from merchant navy.

Hi Sammeer

It needs to be evaluated for how many days you have lived in India and abroad.. Every merchant navy person is not treated as NRI always ..

We handle lots of merchant navy investors, please leave your details at help@jagoinvestor.com and we will guide you

Manish

Thank you for your reply.

Please elaborate procedures for both Resident status and Non resident status

The process is all same ! … only documents wise, NRI’s give extra documents ..

Nice article

Thanks