15 Best Tax Saving Options under Section 80C

What so ever we earn, even then if our income is taxable we don’t want to pay tax on that income. We have a soft corner for our income. In this way, we tend to avoid paying taxes. We must remember that paying taxes on time signifies that you are a good citizen of your country.

As we all know the Government of India knows that we work so hard to earn this income. So in order to save more money from being taxed, the Income-tax Act 1961 section 80C allows a certain deduction to lower tax liability against taxable income.

Who all can claim deductions under section 80C?

An individual and HUF (Hindu undivided family) can claim all deductions under section 80C.

Most of the people are concerned about taxes, especially newly joined employees. Everyone wants to know about the deductions under various sections so that they can invest their hard earned money and save tax. To help you understand more, I have listed down what all tax savings investments come under section 80C of Income Tax Act 1961.

Tax saving investments U/S 80C

[su_table responsive=”yes” alternate=”no”]

| Options #1 – Equity Linked Savings Scheme (ELSS) | Options #2 – 5 yr Tax Saving Fixed Deposits |

| Options #3 – Public Provident Fund(PPF) | Options #4 – Sukanya Samriddhi Yojana |

| Options #5 – Life Insurance Premium | Options #6 – National Savings Certificate(NSC) |

| Options #7 – Infrastructure Bonds | Options #8 – Tuition Fees |

| Options #9 – Senior Citizen Saving Schemes(SCSS) | Options #10 – Home Loan Payment |

| Options #11 – Registration expenses of House and Stamp duty | Options #12 – Post Office Time Deposits |

| Options #13 – Unit Linked Insurance Plan(ULIPs) | Options #14 – National Pension System(NPS) |

| Options #15 – Employees Provident Fund(EPF) |

[/su_table]

If you are in a rush and you want to cover all the points. So, we have attached a crisp video for you below.

ELSSs are equity mutual fund schemes that invest in stocks. They have a mandatory lock-in period of three years. They are riskier than other options like Public Provident Fund, National Saving Certificate, etc. However, they also have the potential to offer superior returns. ELSS category has offered an average return of 18.45 percent in the last five years. Investments in ELSSs qualify for tax deduction under Section 80C of the Income Tax Act. The maximum tax deduction allowed under Section 80C is Rs 1.5 lakh.

Options #2 – 5 yr Tax Saving Fixed Deposits

Tax saving fixed deposit (FD) is a type of fixed deposit, which comes under section 80C of the Indian Income Tax Act, 1961. This kind of deposit is offered for a lock-in period of 5 years. The maximum deduction an investor can claim through it is Rs 1.5 lakh. FD gives us 100% security of capital + guaranteed return on invested amount.

The rate of interest offered by banks ranges from 7 to 9% (may vary from banks to banks). The deduction is available to individuals, members of the Hindu undivided family (HUF), senior citizens and NRIs. As it is a lock-in fund, premature withdrawal is not allowed. This deposit account can be opened as single or joint holding mode. However, in case of a joint account, the tax benefit will be availed by the first holder of the deposit.

Options #3 – Public Provident Fund(PPF)

PPF is a long-term investment option of 15 years by the Government of India with an attractive interest rate of 8%(with returns fully exempted from Tax). One can invest minimum Rs. 500 to a maximum of Rs. 1,50,000 in one financial year. Deposits can be done in a maximum of 12 transactions only. One can also enjoy loans, withdrawals, and extension of the account. Loans can be taken against the Public Provident Fund between 3rd to the 6th financial year. A partial withdrawal facility can be taken from the 7th financial year onwards. The account can be extended for a period of 5 years after maturity but in a block-in mode.

Options #4 – Sukanya Samriddhi Yojana

This scheme is one of the most popular schemes by the Government of India. The aim of this scheme is to give a better future to the girl child in terms of education and marriage expenses. This scheme was launched in 2015 as a part of the Beti Bachao and Beti Padhao campaign. Parents or guardians can open the account anytime in the name of a girl child between the birth of a girl child till she attains the age of 10 years.

Up to 50% of the deposit amount can be prematurely withdrawn once the girl reaches the age of 18 years. The interest rate on Sukanya Samriddhi Yojana is 8.1%. The investment amount is limited to a maximum of Rs.1,50,000 in a financial year. Investment, withdrawals & maturity amount are tax-free. The maturity of this account is after 21 years.

Options #5 – Life Insurance Premium

The life insurance premium is a payment made to secure our life. It is paid in the name of the taxpayer or the taxpayer’s wife and children. It is an eligible tax-saving payment under Section 80C. The deduction is valid only if the premium is less than 10% of the sum assured. One can get deductions up to 1.5lakhs a year.

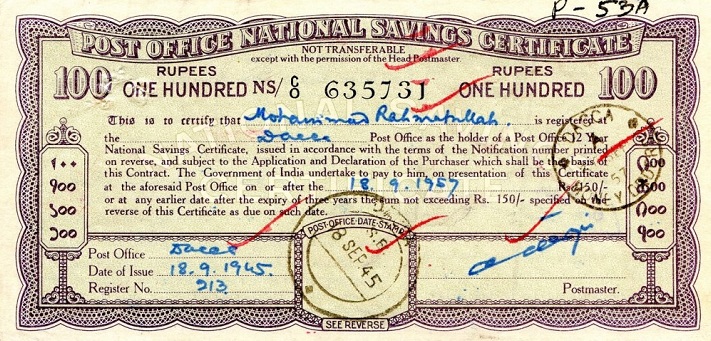

Options #6 – National Savings Certificate(NSC)

NSC is a savings bond that encourages subscribers (mainly small to mid-income investors) to invest while saving on income tax. This investment is mainly a savings scheme for resident individuals only. Hence, Hindu Undivided Family (HUF), Trusts and NRIs cannot invest in this scheme. Indian individuals can buy it from the nearest post office in an individuals name (for a minor) or with another adult( as a joint account). This investment comes with 2 fixed maturity periods – 5 years and 10 years.

The minimum investment amount is Rs 100 with no maximum limit. Investments of up to Rs 1.5 lakhs in this scheme are allowed as a deduction under Section 80C of the Income Tax Act. The interest rate is fixed which 7.6% to 8.5% annually is currently. Many investors take loans on this certificate from the banks. The NSC can be transferred from one individual to another if the certificate holder intends to transfer.

Options #7 – Infrastructure Bonds

A bond is an instrument to borrow money. Basically, they are borrowings that are to be invested in government-funded infrastructure projects within a country. They are issued by governments or government authorized Infrastructure companies or Non- Banking Financial Companies. Infrastructure bonds are not available all the time.

Whenever the government needs some money then they issue these bonds to raise money from the common people. An Indian resident(not minor) and HUF can invest in this bond with a maturity period of 10-15 years with an option of buy-back after a lock-in of 5 years.

These bonds are listed on Bombay Stock Exchange(BSE) and National Stock Exchange(NSE).Investments up to Rs. 20000 are eligible for income tax deduction under Section 80CCF of the Income Tax Act(this is over 1.5 lakhs of deduction available under section 80C).

Options #8 – Tuition Fees

Under section 80C, the government of India allows tax exemption on the tuition fees paid by the individual for their children. To be more precise the deduction is available only on the tuition fees part of the total fees paid. Other components of fees such as development fees, transport fees are not eligible for deduction u/s 80C. The deduction can be claimed for only 2 children.

For e.g, If a person has 4 children and father is the only earning member in the family whose income is taxable then he can claim an exemption for only 2 children and not 4 children. But if both the parents are working and both of there income is taxable then they both can claim and get an exemption for all the 4 children. Adopted Children’s school fees are also eligible for deduction.

Options #9 – Senior Citizen Saving Schemes(SCSS)

SCSS is a savings scheme for a senior citizen who falls under the age group of 60 years and above. Those senior citizens who are at the age of 55 years or more but less than 60 years (who have retired on superannuation or under VRS) can also avail of this scheme, within one month of receipt of retirement benefits and the amount should not exceed the number of retirement benefits.

The senior citizen can visit the nearest post office to avail of this scheme. A joint account can be opened with a spouse or husband only( with the first depositor as the investor). The account can be transferred from one post office to another.

There can be only one deposit in the account in multiple of INR.1000/- maximum not exceeding Rs 15 lakh. The current interest rate is 8.7% per annum. Maturity period is for 5 years. After maturity, the account can be extended for three years more (by giving an application in the prescribed format).

In such cases, the account can be closed at any time after the expiry of one year of extension without any deduction. TDS is deducted at source on interest if the interest amount is more than INR 10,000/- p.a. Nomination facility is available at the time of opening the account and also after opening the account.

Options #10 – Home Loan Payment

One can claim deductions on principal repayment for the home loan. The exemption is available up to Rs. 1,50,000 within the overall limit of section 80C.

Conditions for claiming the deduction are as follows-

- The home loan must be for the purchase or construction of a new house property.

- The property must not be sold in five years from the time one takes possession

Options #11 – Registration expenses of House and Stamp duty

Registration expenses of house and Stamp Duty charges and other expenses related directly to the transfer of house are also allowed as a deduction under Section 80C, subject to a maximum deduction amount of Rs. 1.5 lakhs. One should claim these expenses in the same year one makes the payment on them.

Options #12 – Post Office Time Deposits

The post office time deposit is a post office scheme. An individual and minor(for 10 years and above) can open an account here. Minor after attaining majority has to apply for conversion of the account in his/her name. A joint account can be opened by two adults. A single account can be transferred into joint and vice-versa. Nomination facility is available at the time of opening and also after the opening of an account.

The account can be transferred from one post office to another. The Interest is payable annually but calculated quarterly. One can make a minimum investment of Rs 200 with no maximum limit. The investment under 5 Years Time Deposit qualifies for the benefit of Section 80C of the Income Tax Act, 1961.

The interest rates increase year after year –

- 1 year A/c is 6.9%

- 2 year A/c is 7%

- 3 year A/c is 7.2%

- 4 year A/c is 7.8% (interest rates as on 01.10.2018)

Options #13 – Unit Linked Insurance Plan(ULIPs)

ULIPs stands for Unit-Linked Insurance Plans. It is a combination of insurance and investment. Here policyholder pays a premium monthly or annually. In this plan, a small amount of the premium goes to secure life insurance and rest of the money is invested just like a mutual fund does. ULIP offers investors to invest in equity and debt. Life insurance ULIP must be kept in force for 2 years to claim deduction u/s 80C.

Options #14 – National Pension System(NPS)

The NPS is a pension scheme by the Indian Government which allows the unorganized sector and working professionals to have a pension after retirement. This can be opened by any Indian citizen aged between 18 and 60. No limit on maximum contribution.

The interest rate varies between 12% – 14%. Partly withdrawals are allowed only after 15 years but under special conditions. Investments of up to Rs. 50,000 can be used to avail tax deductions under Section 80CCD. This limit of 80CCD is deductible over and above the maximum limit of section 80C (Rs.1.5lacs).

Options #15 – Employees Provident Fund(EPF)

EPF is a retirement scheme which is available to all salaried employees. 12% of basic salary + DA, is deducted by an employer and deposited in the EPF or other recognized provident funds. Any employee with a basic salary of 15000 per month can open the EPF account.

The interest rate payable is 8.55%. The basic requirement of this scheme is that both the employer and employee will have to contribute a minimum of 12% basic pay+D.A. The entire PF balance with interest is tax-free if it is withdrawn after 5 years of continuous service.

Case Study – Radha recently started working in an organization. She wanted to have a better life after retirement. So she decided to save more for her future and requested her employer to deduct more 8% from her basic pay in terms of EPF. So all together Radha invested 20 % of her basic pay every month for her better and secure future in EPF. This phenomena of voluntarily investing more in EPF is called VPF (Voluntary Provident Fund).

CONCLUSION :

So, by now you all have come to know the various options to save your hard-earned money from getting taxed. Rather than just sticking to one option, don’t you think you should invest a little-little in few options so that you can get good interest rates and lump sum amount after maturity.

Please let us know your views about this article. If you have any doubts or query, leave in the comment section.

December 29, 2018

December 29, 2018

yes, very good list as most have said before. My 2 suggestions are: (1)- to add a table at the end showing whom each type of investment is most suited, expected gain, and tax-liability/exemption on interest gain, etc., and (2) suggest how to reduce paper work and monitoring (e.g., with direct ELSS and net banking, all investment work can be handled from home, and monitored easily.

Thanks for the suggestions, we will work on it.

Vandana

Good info

Hey Angshuman Chakraborty

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

clean and simple explanation.

Thanks for your comment mahesh thadani .. Please keep sharing your views like this..

Manish

Excellent write up .

Thanks for your comment Vinay Kumar Singh .. Please keep sharing your views like this..

Manish

Mutual fund or investment in direct share market through Karvi etc , which one be better when time horizon is about 7-8 years.

Thanks for commenting Mr. Vijay,

I would say Mutual Fund, due to it’s features such as expert fund managing, well diversified portfolio etc. However one can invest in stocks provided they know the stocks fundamentals.

Vandana

Thanks for this post! Shared it with everyone in our company so it helps then execute their 80C investments for this FY. Are there a particular ones from this list that you like or recommend? Will help narrow things down.

Thanks Mr. Demitrias Pais.

We suggest you to go for ELSS because it has the potential to beat inflation and gives you very good returns.

Second good thing about it is that they have a lock in period of 3 years so, as you can not withdraw it anytime it will force you to control your sentiments that comes due to market changes and helps your investments to grow for longer period.

Vandana

Good to read. However, I am already aware about Tax especially u/S 80C. but not aware about the stamp duty payment for the registration of house.

Thank you very much.

Thank you so much Prof. Dr. D. P. Singh for your valuable comment.

There might be many people in your circle not aware of the same thing so, Please do share the article in your family and circle.

Vandana

now infrastructure bonds not come under80c

Thanks for commenting Mr. Ananthula Narender.

You are right infrastructure bonds are not covered in 80C for now i mean this year. However, it may be there in future because whenever the funds from public are in need to the Indian govt, these bonds are issued and so, for that financial year only investments to infrastructure bond will be deductible u/s. 80C.

Vandana

very good information for for those who are looking for tax saving instrumen,t of all these ELSS is the best option, which also acts as retirement planning for long term wealth creation

Thanks Mr. N Chandrashekar,

You are right that ELSS can be the best avenue for saving your tax as well as creating a good corpus to meet your retirement planning.

Vandana