NPS (National Pension Scheme) – A beginners Guide for Rules & Benefits

NPS is one of the most famous and talked about financial products today in our country and it’s quite a detailed and complex product. Today we are doing to talk about NPS in detail and I will try to teach you various aspects related to it.

National Pension Scheme is initiated by the government of India to make sure that in the coming future, more and more people have pensions to support their old age. The core focus of this scheme is to help investors save money for their retirement and also provide a regular income once they retire.

Since NPS was launched a few years back, there have been a number of changes and revisions to this scheme. So, this article will be the guide to NPS and answer to all your queries and confusions.

What is NPS?

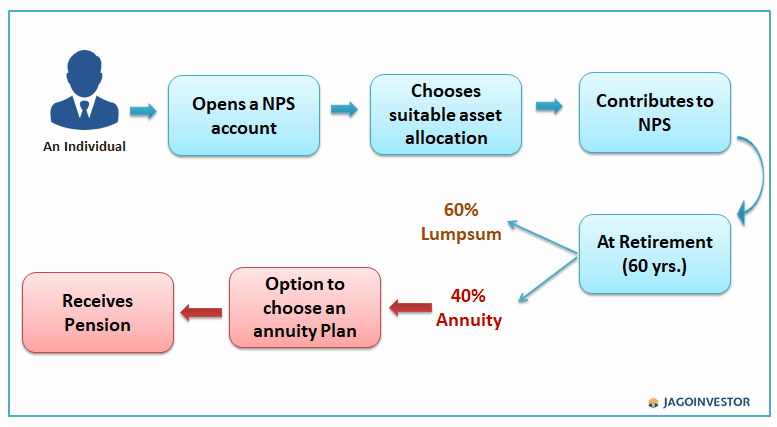

NPS is referred to as National Pension Scheme or New Pension Scheme. In this scheme, a subscriber can contribute to a pension fund that will be a mix of equity and debt investment. You have to invest in NPS till your retirement and the final corpus will depend on how the pension fund has performed over the years.

At retirement, you can withdraw part of the corpus as a lump sum and the balance will be used to provide you a regular pension till your death (and many other options are there).

Who can invest in NPS?

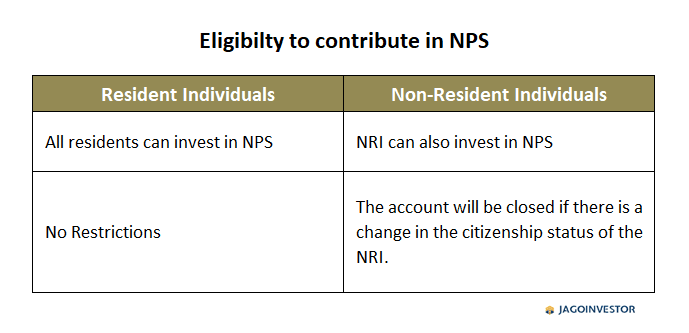

Earlier only government employees were allowed to invest in NPS, but now anyone (including NRIs) can open the NPS account. The below chart will simplify it.

Important Point: Entry age for NPS is above 18 years and below 65 years.

Who regulates NPS and manages money invested?

NPS is regulated by PFRDA – Pension Fund Regulatory & Development Authority. The money invested in NPS is managed by Pension Fund Managers (PFM). These are companies that are authorized and appointment by PFRDA to manage the wealth of investors. There are eight PFM right now.

- ICICI Prudential Pension Fund

- LIC Pension Fund

- Kotak Mahindra Pension Fund

- Reliance Capital Pension Fund

- SBI Pension Fund

- UTI Retirement Solutions Pension Fund

- HDFC Pension Management Company

- Birla Pension Fund

How can you invest in NPS?

The first step is to open an NPS account which can either be Physical or Online. First, let’s see the physical mode of the opening NPS account.

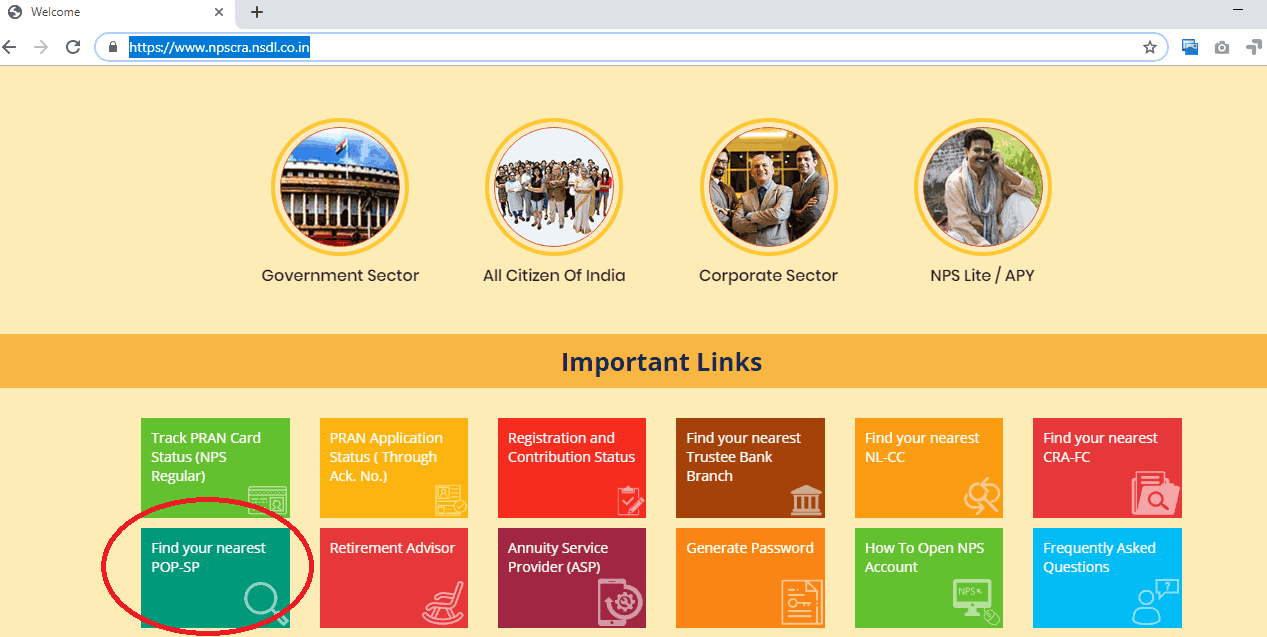

1. Physical Mode – For this, you have to open an NPS account with POP – Point of Presence service providers. POPs are the banks or post office or other non-financial institutions. You can find your POP through this link https://www.npscra.nsdl.co.in

There you need to enter your country and location and you will get the list of POP-SPs near you. Select the Point of Presence (POP) where you have an existing relationship – either a savings / current account (in case of Bank) or any other account such as Demat/Mutual Fund/Insurance etc. (in case of non-Bank POPs).

Once you have searched your POP, you need to submit KYC forms along with the NPS registration form to POP and after registration, you with getting a PRAN i.e. Permanent Retirement Account Number. This is a 12 digit unique and portable number issued to all the subscribers.

Important Point: For Government employees, there are NODAL offices where they can get PRAN for the NPS account. Mostly they get it at the time of joining.

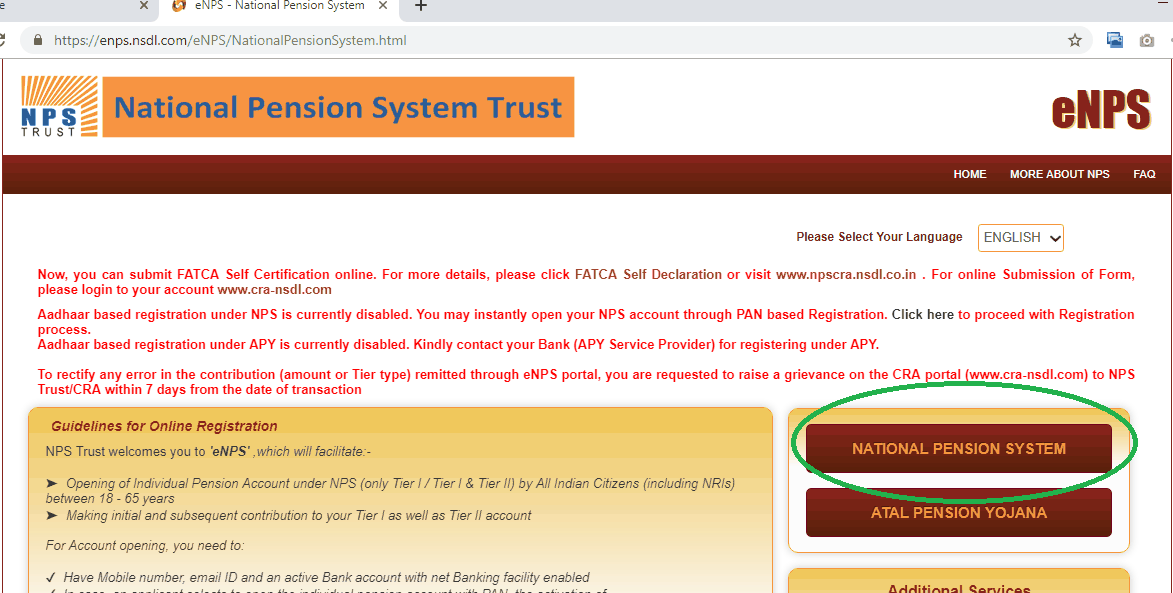

2. Online Mode – This mode is simpler than physical. You need to visit the e-NPS website and click on the National Pension Scheme. After clicking you will get 3 options i.e. registration, contribution, and tier-II activation. You need to select Registration.

There you need to select appropriate options, enter your PAN and select your bank/POP. After clicking, continue you will get a registration form, fill the form online, attach the required scanned documents like PAN, address proof and scanned signature. Once it is done your PRAN will be generated and you can start investing in NPS.

Important Point: For online registration, it is mandatory to have a net banking account

What are the investment options in NPS?

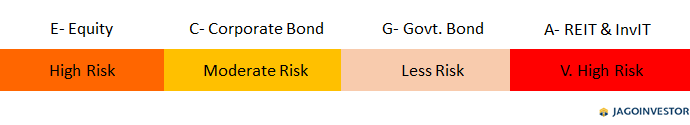

Your money in NPS will be invested in 4 asset classes. Which are referred to as ECGA?

- E – Equity (High Risk – High Returns)

- C – Corporate Bonds (Moderate Risk – Moderate Returns)

- G – Government Bonds (Low Risk – Low Returns)

- A – Alternative assets like real estate investment trust (REITs) & infrastructural investment trusts (InvIT) (Very High Risk – Moderate Returns)

The choice of asset allocation among these options above will be defined by the subscriber himself (Active mode) or it will be auto defined depending on the age of the subscriber (the older you get, more stable will be your investments). In both options, 75% is the maximum limit for investing in equities and for alternative assets class maximum contribution can be 5%.

What is Tier I and Tier II in NPS?

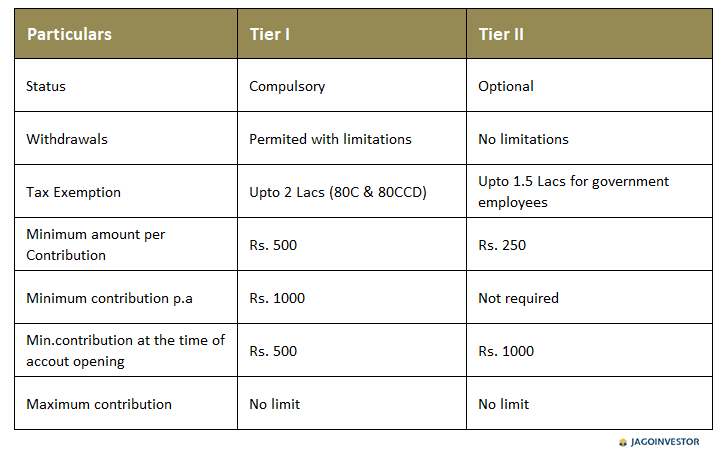

These are two account types of NPS accounts. Tier I is primary compulsory account for NPS also referred to as “Pension account” whereas Tier II is an optional account commonly referred to as “Investment account”.

Following chart will elaborate the difference between Tier 1 and Tier 2 NPS accounts-

What are the tax benefits of NPS?

- An employee’s own contribution in NPS will allow tax deduction under section 80CCD(1), up to 10% of salary plus dearness allowance and for self-employed individuals it is 20% of total income in a financial year, but this has to be within the overall ceiling of Rs. 1,50,000 of Section 80C to Section 80CCE of Income Tax Act.

- An employer’s contribution up to 10% of salary plus dearness allowance is allowed as an exemption from tax under Sec. 80CCD(2)

- Moreover, individuals can claim an additional deduction of up to Rs 50,000 under Section 80CCD (1B), which is in addition to Rs 1.5 lakh permitted under Section 80C.

The below-given table will simplify this to you –

What are NPS withdrawal rules (Tier I)?

Once an investor retires at 60 yrs., they will get 3 options

Option #1 – Exit from NPS at 60: If you want to exit from NPS at 60 years of age, you will get lump-sum 60% of your corpus and for remaining 40% an annuity will be generated with a PFRDA-registered insurance company(called as Annuity Service Providers) to provide monthly pension after your retirement. There are different annuity plans provided by a few insurance companies, you can choose any of them. And you also have the choice of increasing your annuity contribution (40% is mandatory). However, if the total corpus is 2 lakhs or less than it then the whole amount is given a lump sum.

Option #2 – Continue NPS with contribution till 70 yrs. : You can choose to continue contributing to NPS for more 10 years i.e. up till 70 years. This option is mostly chosen if you are earning after the age of 60. At the age of 70 withdrawal rules will be the same as the exit from NPS at 60.

Option #3 – Continue NPS with till 70 yrs., but without any further contribution: You can choose to not contribute to NPS and wait for your corpus to grow more by 10 years. This option is chosen mostly when you have monthly income flow from somewhere. Thereafter at the age of 70 withdrawal rules will be the same as an exit from NPS at 60. This option has to be exercised 15 days before the default date of withdrawal.

Important Point: Subscriber has to exercise continuation or deferment options 15 days before the date of retirement. Lump-sum withdrawal from NPS is tax-free. Whereas monthly pension will be taxable as per the tax slab of the subscriber.

Withdrawals in Tier II?

There is no limit on tier II withdrawals and all the withdrawals are taxable as per the slab rate of subscriber. It means Tier II works in the same way as Mutual Funds – Investing into Equity/Debt funds and has high Liquidity.

What is the NPS withdrawal procedure?

The withdrawal process starts 6 months before retirement so that pension will be started immediately after retirement. A subscriber can withdraw online or offline.

1. Online Process of pension withdrawal –

A claim ID is generated by a central record-keeping agency, six months before retirement, for which you will be notified via mail or letter. With the help of this ID, the subscriber can check and change his account details like address proof or bank account. Once the withdrawal claim is initiated, no details can be changed. Following is the process of initiating withdrawal –

Step#1 – Login to NPS using PRAN and Password

Step#2 – Go to Exit Withdrawal request and select initiate withdrawal

Step#3 – Select withdrawal type i.e. Exit at 60

Step#4 – Select ratio of Lump sum & Pension

Step#5 – Select One Annuity Service Provider

Step#6 – Verify all details and submit request form

Step#7 – Download request form

Step#8 – Sign and submit the request form to POP or Nodal Office

After 4 working days, lump sum amount will be credited to registered account. For pension all the details will be sent to ASP, once ASP processes all the details, you will start getting pension as per your selected annuity plan.

2. Offline Process of pension withdrawal –

In offline process withdrawal application is to be submitted at POP or NODAL office along with required documents. They will forward them to Central Record Keeping Agency (CRA) and NSDL. CRA will then register your request and issue an application form for withdrawal. Fill in all the details and describe the percentage of lump sum & annuity and select an annuity plan as per your needs. Once your request is processed you will receive the lump sum and pension as per plan selected.

What if I want to early withdraw i.e. before 60 years of age?

As NPS is a purely retirement solution product you should not exit before your age of 60. However, in some special circumstances, you can withdraw 25% in total of your own contribution in NPS. This you can do only after 3 years of investment and just 3 times in the entire tenure of NPS. The special circumstances are –

- Children’s wedding or higher studies

- Building/buying a house

- Critical illness of self/family

Important Point: Partial withdrawal from NPS is tax-free.

What if I want to exit from NPS before 60 years of age?

After 3 years of NPS investment, you can opt for a premature exit from NPS and don’t want to contribute anymore, then you will receive 20% of your corpus as a lump sum and balance 80% will be mandatorily used for annuity fund. You can choose pension payment mode like monthly, half-yearly or yearly.

Important Point: In this case, the lump sum and pension you receive both will be taxable as per income tax slap.

What amount of Pension or annuity I will get?

An annuity is a fixed payment like pension that we get every month, half-yearly or yearly depending upon the chosen model. In NPS 40% of the corpus is invested as an annuity with annuity service providers i.e. PFRDA registered insurance companies.

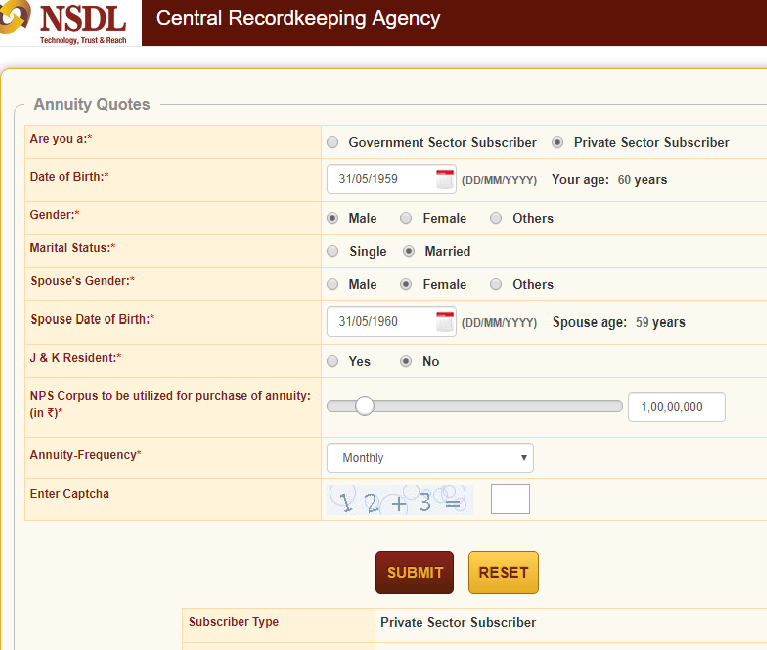

While creating an annuity plan, the following details are required like,

- The sector of employment (Government or Private)

- Date of Birth

- Gender

- Marital status

- Spouse’s Gender

- Spouse’s Date of Birth

- NPS corpus amount that you utilize for buying an annuity plan

- Annuity Frequency

So, on filling all the details as mentioned above you will get the list of annuity plans along with the amount of pension that you will receive.

Other than this, the amount of pension also depends upon followings –

- A prevailing interest rate of the annuity: The Interest rate on annuity will be the same as government securities, ranging from 6% to 8%.

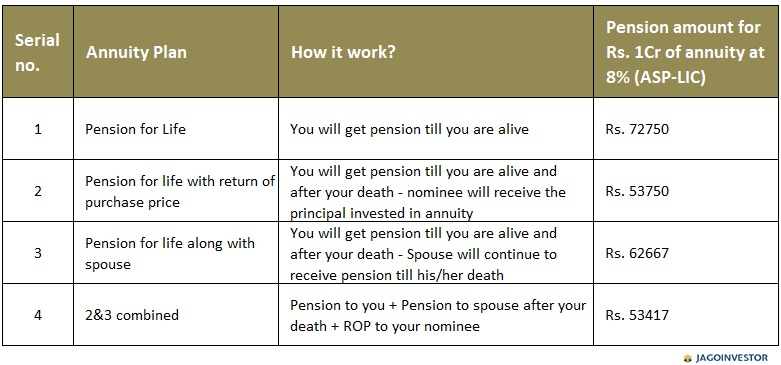

- Annuity Plan that you choose: There are different annuity plans provided by ASP. Here are some generic annuity options offered by ASPs. Remember, some ASPs may offer a slightly different or combination of these options:

You can go to the NPS trust website to get the calculations on how much pension you will get.

Who is the Annuity Service Providers?

Following are the PFRDA – registered ASPs –

- Life Insurance Corporation of India (LIC)

- SBI Life Insurance

- ICICI Prudential Life Insurance

- Bajaj Allianz Life Insurance

- Star Union Dai-ichi Life Insurance

- Reliance Life Insurance

- HDFC Standard Life Insurance

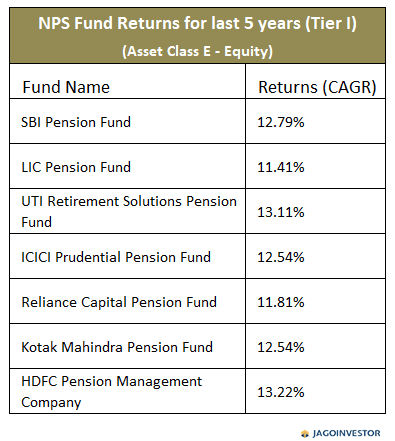

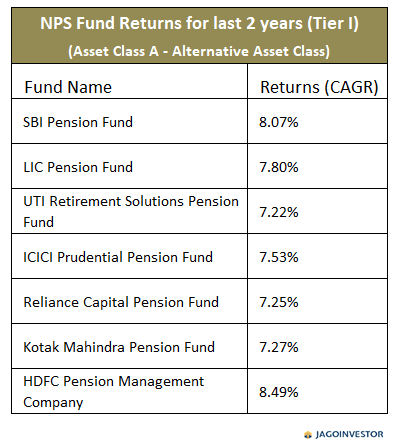

What is the result of NPS fund performance till now?

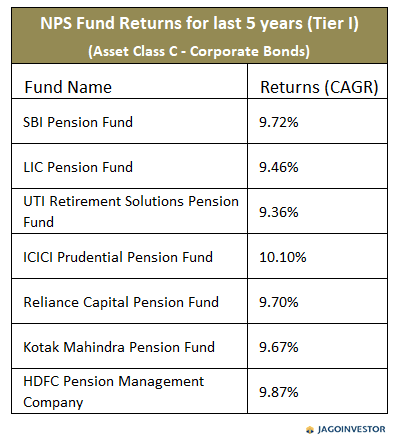

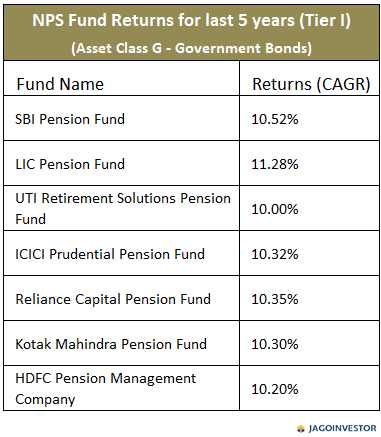

Following tables will show a return of pension funds in the last 5 years –

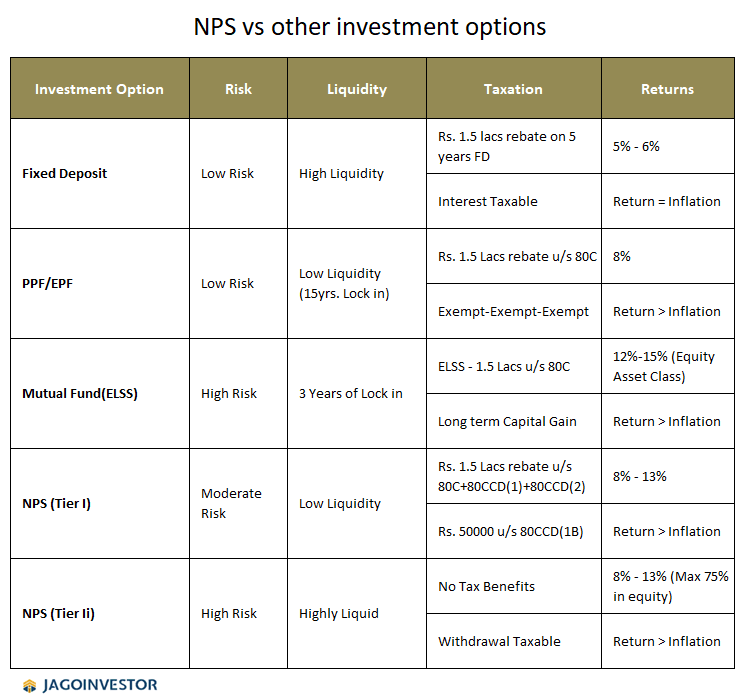

NPS vs Mutual Funds (ELSS) and Fixed Deposits / PPF/ EPF

Here is a small comparison between NPS with other investment options like ELSS mutual funds, FD, EPF, and PPF. The below-given table will show the difference between NPS and other Tax Saving investment options –

There is also an app for NPS to provide more convenience to its subscribers. Do let us know if you have any queries regarding NPS. It was quite an exhaustive article, hence there might be something we might have missed.

June 18, 2019

June 18, 2019

I am 43. Due to various personal and financial and health issues, I could not save money for future. I am a private employee. I only have PPF which I have been utilizing fully 1.5 lakhs since a few years. I opened a NPS T1 account few weeks ago. I understand that tax saving is only 50,000. But as I don’t have any retirement amount, I am planning to invest 1.5 lakhs in NPS by equal monthly contribution every month apart from the 1.5 lakhs in PPF. I understand that I wo’t get tax benefit for the extra 1 lakh in NPS but I would like to save for retirement, Please advise

Yes you can do that if you wish to.. Remember that NPS will be locked for long term and only 60% of it will be givn to you at the end, rest will have to be used for annuity.

Also why you are not investing in mutual funds ?

Agree with your points sir it was really helpful. I was planning to open an account for myself. NPS is a good investmentz plan for those who can afford to take the low or minimal risk. Since the minimum amount for investment is 1000/- Rs NPS can be the best option for people with low income group and they can financially independent after retirement.

How much interest rate will be for the 40% annuity amount at 60 yrs?

pls ignore.. I see it is mentioned in the article. I missed it earlier.

Thanks for the detailed write-up, how different is this from the Super Annuation scheme & which is more beneficial?

Hi Raja Mohamed

Thanks for your comment.

NPS is more beneficial from the tax saving point of view. Otherwise, superannuation is also a good way to do retirement planning if your employer is contributing. The important thing in both cases is the selection of funds.

Vandana

Hi Manish, I am not very clear on the 80CCD tax benefit. Say, a person has used up his 80C limit for PPF/EPF/LIC contributions. Now can he invest 50K in NPS and use 80CCD to claim tax exemption?

Yes, that 50k limit is over and above the 1.5 lacs!

Hi,

First of all thank you for this article. It helped me understand this product better. I have a query as below –

Can you please help me understand how does the additional 50000 tax benefit in section 80CCD(1B) work? I mean do I need to invest more or additional amount to claim this benefit and how much additional amount? I am a personal professional and do not withdraw salary from any company.

Thanking you in advance for your response!

Hi Amey

Under section 80CCD(1B) you can claim up to Rs. 50,000 of investment in NPS only if your 80C limit of 1.5 lac deduction is exhausted. Suppose you have life insurance premium, ELSS and other tax saving investments of Rs. 1.20 lac which are deductible u/s 80C, and you also have 50,000 of NPS investment so Rs. 30,000 out of this will get deducted in 80C (assuming it to be 20% of your annual income) and remaining Rs. 20,000 will be deducted u/s 80CCD(1B)

Thank you,

Vandana

Thank you Vandana for your response and clarifying my query!!

Welcome !

Hi,

Any idea on the taxability of tier 2 withdrawals?

I understand it will be taxed like capital gains on mutual funds, but equity and debt mutual funds are taxed differently. So how will Tier 2 withdrawals be taxed, considering there are 4 potential components – equity, g debt, c debt and alternative scheme.

Thanks

Hi Rahul

It will depend upon the composition of the selected fund. If equity portion in fund is up to or more than 65% then it will be taxed as equity capital gain. Otherwise it will be taxed as debt.

Thank you

Vandana

Hi,

Wonderful article again from jago!

If i decided to invest, is my amount need to be consistent for every month or i can invest varying amount. Can it be once in a year or lumpsum? Which one is more profitable? monthly or lumpsum per year?

Thanks,

Siva

Hi, Shiva

It is totally up to you, how you want to invest in NPS (Lumpsum or monthly or yearly), the only thing is there is a minimum limit of Rs. 1000 in it.

And I can’t tell which method would be more profitable because it depends on the stock market performance.

As the market is uncertain we can not say anything about it. However as NPS is a long term investible product, it is suggested to invest lumpsum.

Thanks

Vandana

Who will get Rs. 50,000 benefit for tax deduction?

Hi Kiran

Any Individual investing in NPS can get this benefit when he has exhausted the limit of deduction of Rs. 1.5 lac under section 80D.

Vandana

What are the withdrawal rule if I continue beyond 60 years of age till 70 in both cases – with and without contribution? What is the maximum permissible amount in each case ? Is it 60% only?

Hi Samir Purohit

Thanks for your comment.

Withdrawal rules are the same even if you have increased the tenure of NPS.

Maximum amount for lump sum is 60% however, for annuity plan you can deposit for than 40% (40% is the minimum required for annuity plan)

Vandana

Hi,

My Mother’s DOB is 16/04/1961, should I invest in NPS in the name of my mother ?

Hi Deepak

NPS investment can not be done at someone else’s name.

Thanks

Vandana

How I can change my portfolio manager mean presently Kotak Pension Fund is handling my NPS. I want to change it from Kotak to HDFC or SBI

Hi Mahesh Chandra

Thanks for your comment.

For this, you need to visit the NPS website and you will get to know there. You can also contact the NPS support team.

Vandana

If I start now and after few years if I turn foreign citizen will they close my account surely? Since I heard about PPF, NRI’s who are potential citizens who already have started can continue but not for new applicants. Can you please clarify..,

Hi Mahee

Yes, This account is for Resident individuals or NRI. If you are failed to fulfill requirements of being NRI then your NPS account will be closed.

Vandana

Is pension depicted under Annuity plan per month?

Hi Raj Indupuri

Thanks for your comment. YEs pension will be received every month from NPS annuity.

Vandana

Manish, the article is nicely written. thanks. however, i would be interested to see what is your recommendation for investors. should we go for it? i had been thinking quite a while to invest only from tax instrument & retirement perspective as i had exhausted my other tax exemption sources. one thing which i am skeptical in NPS is – govt had been making this product to undergo lot of changes since beginning – for e.g., initially it was EET category, now it is EEE category which is good. but what worries me is – the frequent changes. like how govt has now indicated that partial withdrawl is allowed only 3 times – tomorrow there is a possibility seen that the withdrawl of 60% on maturiy could also be reduced to keep the surplus in PFRDA hands for liquidity 🙂 .. what is your view overall for those?

Hi Srinivasan

Yes, frequent changes in NPS is a problem for investors. Thanks a lot for bringing this point.

Vandana

I am contributing from my Salary 5000 towards NPS and it is segregation of my CTC. Till Apr 2019 I was getting deduction in 80ccd but in May my company has put this contribution as taxable perquisite in my Tax computation. Please advice is this correct.

Hi Saiprasad

Thanks for your comment.

If the contribution by your company is more than 10% of your basic plus DA, it will be taxed as perquisites.

Up to 10% of basic plus DA is exempt under section 80CCD(2).

Thanks

Vandana

Hi Manish,

I am regularly following your articles and very much informative. I read your books on financial planning and made me to think wisely invest. Coming to my doubt, I am a central government employee and last financial year only i started investing Rs. 50000/- in NPS tier 1 account bcz as already in GPF scheme and 1.5 lakhs is already saved through GPF. I am 45 years now and suppose if i want to get VRS around 53 years, NPS can be closed and 60% of accumulated money can be withrdrawn and 40% can be used for annuity. Kindly confirm. (I registered your Chennai event on 30th June. I eager to meet you on that event and hope you will be coming).

Hi Satheesh

You are right. Thanks for commenting.

Vandana

Nice article. Very informative.

One query: Any reason NPS tier 2 should be used instead of regular mutual funds from returns and tax perspective. I see that you have mentioned that returns are almost similar and withdrawals from Tier 2 are taxable, where as Mutual funds are considered in long term capital gains tax.

Hi Ashutosh

Thanks for your comment.

As I have mentioned in the article, Tier-2 is equivalent to mutual fund investing. The only benefit of investing in tier-2 is for government employees from a tax perspective.

Vandana

Hi Manish,

When I Exit from NPS at 60, I will get lumpsum 60% of the corpus. Is it taxable?

Hi Krishna

Lumpsum withdrawal in tier-1 of 60% is tax exempt.

Vandana

Why does it say National Penstion Scheme

Hi Sudheer,

It is called the National Pension Scheme because it is approved by GOI for retirement planning which provides annuity to resident as well as non-resident individuals.

Thanks,

Vandana