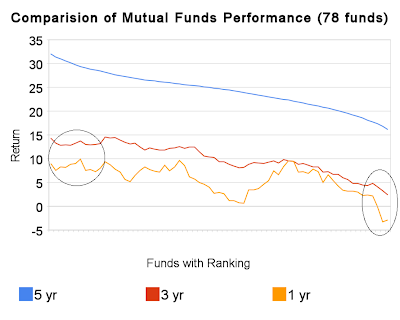

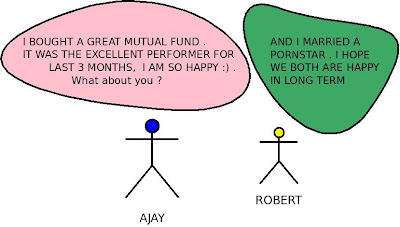

“Invest in Equity for Long term” You might have heard this sentence from me and others numerous number of times, but have you ever thought, why I say so? Or what is the logic behind that? What is the authenticity of what I say? Why should you believe me?

Hence, I came up with the most time consuming article of this blog till date. Lets explore the world of Equity today and I will show you some amazing numbers and graphs which will change your perception about Equity.

To make this article Crisp and short, I will show you 4 charts and explain each of them that will show you Power of Equity. Mainly the idea of this post is to show you the return potential of Equity in Different time frames and to find out what is the kind of return we should expect from equity in Long run like 15-20-25 yrs.

For the sake of calculations and source of reference, for almost all of the article I have used value of Sensex Index, but it should be almost similar for any Index Fund, ETF, or a Equity Diversified Mutual fund.

All the below study is based on historical 30 yrs of Sensex data from the year 1979.

1#Sensex Return Chart

Sensex has returns close to 18% CAGR in the long term till date for One time investment and SIP investment.

This chart shows you the CAGR (Compounded Annual Growth Rate) return of Equity after each passing Month. I have manually noted down the Index value for each month starting from Mar 1979 – Sept 2009 (total 350 months approx) and then did some number crunching (actually a lot) and came up with the CAGR returns the index has given for that time frame.

For example: for the month 36, the Index value was 218.82 and my starting Index value was 122.23 (Sensex actually started from 100, but I had a little late data). So the actual return was 23.16% for SIP investment and 20.78% return for one time investment.

So this chart shows that if you had Invested your money in the start and then hold it for a particular time frame then what will be your CAGR return till that point.

The chart shows the return for two kinds of Investment modes: SIP and One time investment. So Blue line shows the CAGR return if you did SIP investment and the RED one shows the CAGR return if you had invested in Start and sold after ‘n’ number of months.

View Data

Points to Note

- In the Short term, returns have Wild Swings which is the basic nature of Equity

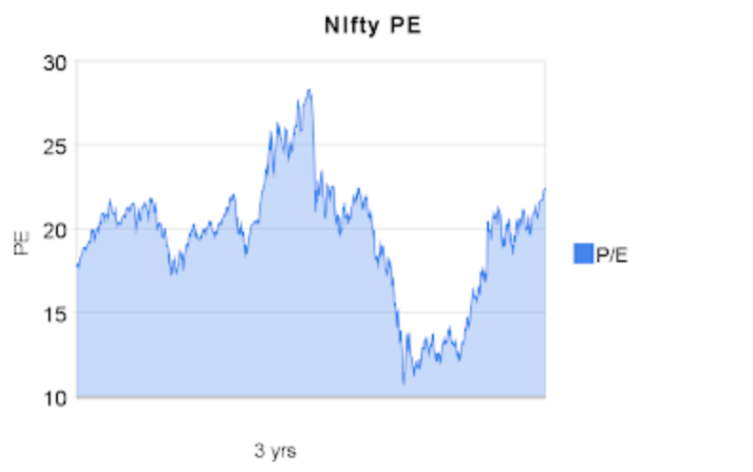

- In the long run, returns were in the range to 18-23%, where it goes up and down because of Bull and Bear markets. See Nifty PE Analysis

- SIP performed better than One time for starting 4-5 yrs and then SIP and One time investment were close enough.

2# Nifty Return Chart

Nifty has given returns close to 18% for SIP investment and close to 12% in 12 yrs from 1997-2009 .

This one is similar to the above chart just that it is for Nifty 12 yrs data. This chart shows you the CAGR return of Nifty after each passing Month. I noted down the Index value for each month starting from 1979 – 2009 (total 146 months approx) and came up with the CAGR return the index has returned up to that point.

For example: for month 120, the actual return was 23.33% for SIP investment and 13.17% return for One Time investment. So this chart shows that if you invested your money in the start and then hold it for that particular time frame then what will be your CAGR return till that point?

View Data

Points to Note

- You can clearly see that the returns kept increasing with Tenure and there were less wild swings up and down with Returns.

- SIP performed better than One time Investment in all the time frames. See that blue line was always higher than Red one for any given month.

Do you like the articles on this blog, Fill Fan book

3# Absolute Average Return for Each month (Sensex Data)

This shows you how much of absolute average return in percentage terms would you get if you hold your investment for X months.

This is an interesting Chart. It shows how much of absolute return can you expect when you hold your Equity investments for 1 month, 5 months, 50 months or 200 months. I will tell you how each duration is calculated.

This is an interesting Chart. It shows how much of absolute return can you expect when you hold your Equity investments for 1 month, 5 months, 50 months or 200 months. I will tell you how each duration is calculated.

Let’s say duration is 12 months, so what I did was that I took all the 12 months time periods like Apr 1979-Apr-1980, Mar 1979-Mar-1980, June-1979-June-1980 and like this the last 12 months time duration Sept-2008-Sept-2009, total of 113 different values, then calculated the Returns for each time frame and calculated the average of those 113 time frames.

I finally got average returns of 12 months Investment horizon (total 113 values for 1-13, 2-14, 3-15 month Index value). So I got a single value of 25.60% for 12 month time frame. This is absolute Return and not CAGR return.

So, if I invest 100, I get 125.60 as return.

Please make sure that you understand that this 25.60% is the simple average of 113 values, there might be many values which may be negative, 0, or may be 100%. But we are more interested in what is the average of all such values.

In the same way the Absolute Average return for 120 months was 672.60%, which means that 100 invested would have become 772.60 in 5 yrs. Please understand that we are just trying to show this as the time frame increase the return potential of equity goes up and up.

Don’t interpret it as the return guarantee for any time frame. It’s Equity, Respect it else it will punish you badly for your Ignorance.

View Data

Points to Note

- In the long run, the average return has increased

- For close to 15 yrs, the returns on Equity kept increasing but at a lower speed.

- from 15 yrs to 29 yrs, the Absolute return increased very fast

- So the real power of equity comes with long term.

4# Number of Times the return from investment was Positive for some time Frame (Sensex Data)

This graph shows that how many times an investment has returned positive for some particular time frame, for example for 4 yrs time frame (48 months). There would be many 48 months time frame like Mar-1979-Mar-1983 OR Jan-1994-Jan-1998 or any other date, out of all those 48 month time period, the investment gave positive returns for 87.36% times.

So this graph shows how the number of times went up and up as the time duration was more and more.

For a particular time frame like 50 months, I calculated returns for all possible 50 month window and then saw how many number to times it gave positive return and then divided it with total number of times to get the percentage of times, the return was positive.

For a particular time frame like 50 months, I calculated returns for all possible 50 month window and then saw how many number to times it gave positive return and then divided it with total number of times to get the percentage of times, the return was positive.

So if there were total of 200, “50-month” period and 180 times the return was positive. The result would be 90%. I did this same thing for every time duration from 1-300 months and plotted the graph.

View Data

Points to Note

- One an average the chart was rising, which kind of proves that Risk of losing in Equity decreases as time duration increases.

- After 11 yrs, there was no instance when equity return was negative, which means that you invest any time in Sensex index and take your money out after 11 yrs, you will not lose. The return would be positive always.

- For smallest time frame of 1 month, the percentage was around 55%, which shows that for smaller time frame the equity returns are random like coin toss which is 50%-50% possibility. But as time horizon increases its more of power of Equity, rather than randomness.

Get Free updates on your Mobile

Conclusion

Many people are afraid of Equity because it can give negative returns, which is 100% true and possible, but people do not understand that its not a short term wealth building asset class. Its some thing for long term.

When you invest in Equity for Long term, you are bound to get excellent returns given that you have faith on Statistics, Historical performance and the concept of Equity in general. You can also maximize your investment performance by active participation in your investment and honoring Asset-allocation and portfolio re balancing from time to time.

Time spend and tools used to this article

You might have spent 20-30 min to read this article, but I spend close to 25-30 hours on

- Finding data

- Doing calculations

- Making Computer program in Python: See the Python Code written by me for this article

- Making Charts in Excel, See Chandoo.org for excellent Tips

- Actually Writing this article

Comments Please, I would like to hear your views on this article and your views on Power of Equity. Is there something to be added? And Did this article succeed in changing your views about Equity or not?

Note : I will be on vacation now and will keep posting some articles whenever I get time .=”