Do you know how to write your financial goals? How many lines or words does it take? Think about your retirement goal for a moment. Now if you thought, “I have to generate a corpus of 5 crores in next 30 yrs” is a goal, you are mistaken… to a really large extent! While this way of defining goals is better than not defining a goal at all, this is not how you’d do it if you want to be inspired each moment as you work towards that goal. After a point, you’d just be lost again in your daily life. There is another way of writing financial goals and today, I show you how to do just that.

Let me ask you a simple question. When are you excited about watching a new upcoming movie? What if I tell you that there is a new movie out soon, called “Kuch Log”? Will this tiny bit of information do anything in your mind? Does it excite you any? Does it inspire you to go to theatre and watch the movie? No! .

But what if I show you a trailer? Some exciting snapshots of the actual movie that give you a feel of how it will look like? The best tantalising glimpses? Won’t it then, create a shift in your mind and motivate you to actually consider watching the whole movie? I’d say Yes! . In the same way your financial goals defined in just one dry, boring line, with a target amount & date can not motivate you enough. It can motivate only those people who really are disciplined and committed in life .

In this article, I’ll share something very personal about us at Jagoinvestor. This process, is what we do with our clients. The way we work with them, goes way beyond traditional financial planning. Instead of just goal setting in the traditional way, we do something additional called Goal Visualization! . Goal Visualization is converting your target amount and target date into a more descriptive paragraph and see how your life will be in future . It gives you more clarity and what you actually want your goal to look like .

Here’s an example…

Year : 2040

I am retired now, and living in my native town of Bangalore. My house is a little far away from the city because I like to spend most of time in nature related activities like hobby farming and some social causes like consulting with poor farmers on how can they use today’s technology in their work.

I am trying to get back to my routine work, these days, as I’ve just returned from Australia , where I spent a month-long holiday. Next year’s destination is South Africa which recently got added to my list as the next world cup is there! I have all the time now, to go watch my country win there. It will also give my wife a chance to explore various historical sites of that country, which she loves a lot. Its part of my “30 countries I visit before I die” target that I had set for myself.

It gives me immense pleasure and satisfaction, when I teach mathematics to a group of 30 poor students who can’t afford a fee! That’s exactly I am doing these days. As I am retired now and really love the subject, I want to help in sharing my knowledge any way I can.

Me and my wife go for a daily walk in the morning; we have been doing it for years now, the last 20-25 years in fact. We have made sure that we won’t be victim of deteriorating health which will make all the money we have saved, all our lives fruitless! We have always done our best to keep ourselves on the move and now we have joined one the biggest health clubs in the city. It’s cost us more than 70 lacs for a lifetime membership, but it’s been worth the cost and it gives us all the time and resources we need from it, whenever we visit it.

I have generated enough wealth in my life which takes care of my basic needs and luxuries in life. I never have to think twice, before buying something important. Money does not come in the way of my leading the kind life which I always dreamt of! I have achieved this! While I like to live simply, I have created a situation where money is the last thing which I have to worry about, as far as my life is concerned.

I have spent most of the time working for software giants across India and US, and I never felt as if “This is exactly what I want to do!” Now I am free of those worries, which came in the way of my desired life. I feel I am really spending each day of my life the way I always wanted to, not the way I am forced to because of various reasons in life. I am happy!”

Goal Visualization is not Dreaming

Goal visualization is not dreaming ! . You need to have a visions in life and this goal visualization is looking at how your vision will look like in future . Remember that Dhirubhai Ambani never had a goal of have 5 crore in retirement , He had a vision and that vision inspired him each moment in his life to move forward. To do anything which makes his vision true .

Goal Visualization gives you the power, it inspires you ! . It makes you crave for your financial goal which you create for yourself. You will not believe but most of our clients discover themselves and are amazed to find out how they themselves wanted their future life to be , and it happens only after they approach us to work on their financial life. There is less of number crunching here and more of human activities which connect to a person , motivates them and fills them with energy.

Your Action today after doing Goal visualisation

When you do goal visualization, go into the future and see yourself – Are you are happy? Excited to see yourself getting what you really want? Then, come back to reality (come back to NOW). The next step is to answer a bigger and important question. You now, have to write what commitments are you willing to make, what efforts are ready to do today which can lead you to the goals you want for yourself.

It goes a little like this…

Year : 2011 ( Today)

I was actually thinking of upgrading my car from Santro to Honda as my salary has gone up by 100% in last 3 yrs, but If I look closely now, I feel that it was a “wish” created out of nothing. It’s not actually a “need” !. If I ask myself whether it’s really required, I see myself answering “Not Really”. I can actually continue with same Santro for next 3-4 years. Better that I, use my increased income to reach my retirement goal at the earliest.

My wife has subscribed to a gym membership but her trips to the gym are very limited. On second thoughts, we will stop paying 3,000 per month fees and better use Rs 150 per day pass every time she goes. Anyway she goes about twice a week, so it would save 1,800 bucks without compromising what we are doing right now. It’s just that we have to relook things and restructure them.

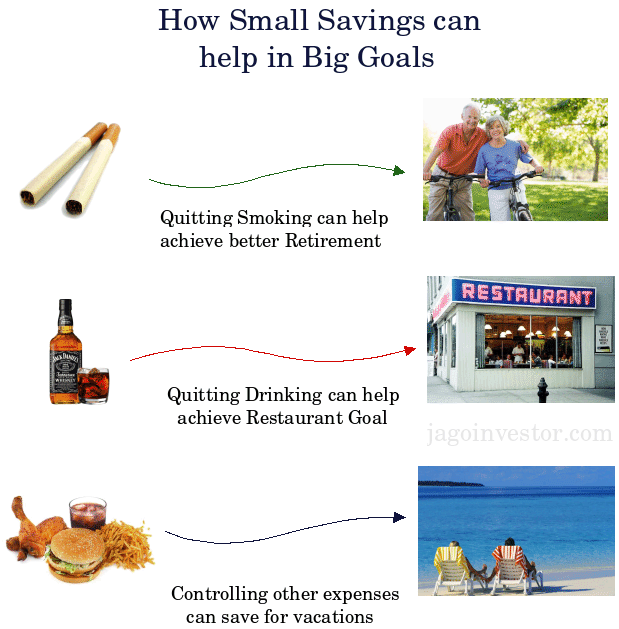

I save around Rs 5,000 a month, but after doing the goal visualization exercise, now I am committed to achieve it at any cost. I am not just committed, reaching my financial goals is my sole focus now. I will car-pool, I will cut on my smoking, I will limit my outings (at least the ones that do not matter), & I will cut down wherever I really can. I will not compromise on things which I love or add to my family lifestyle and happiness, but I will be really merciless when it will come to things which I truly don’t want in my life. I will be now committed, on finding a better opportunity to work, I will get out of my comfort zone and take some hard decisions in life to make things happen now. I am going to start my SIP next week, Wait… why next week? What’s stopping me from doing it today? What’s keeping me from doing right now? I will call someone right now and find out how its done! I will not let “I don’t know” kind of excuses come on my way! I’ll use “I just want it at any cost, no matter what” kind of energy to reach it.

This is the new mantra of goal setting which we are trying to incorporate in each person we meet or each person we encounter at Jagoinvestor. We give them food for thought, we make them connect to their own financial life and show them the power of doing Goal Visualization and not just scribble some numbers. If we were just computers, it would have worked! .

We make them write these things down. We do more of listening and less of instructing, because we make people instruct themselves!

Goal Visualization is not a replacement of Goal Setting

Note that goal visualization is not an alternate of traditional goal setting , rather its a supplement and additional exercise to make your vision stronger , make your commitment more strong and a reason for you to look at your goal with high priority and seriousness.

I hope you appreciate the fact that this way of goal visualization is better than fooling yourself with something like “I want to create 5 crores in 30 yrs for my retirement?” . It only gives you a short-term orgasmic happiness and then you start you day next week in the same manner as if nothing happened ! , unless you are high on discipline to save for that goal . Only then it can work ! . If you mix goal visualization with traditional way of goal setting , it can be much better than just goal setting and finding a number which you need to save monthly .

If you don’t take action after reading this post, it would be waste of your time truly speaking. So now, is the time you start writing down your goals in detail and visualize it. Do it right now! Not later, not after dinner today, not on the weekend and definitely not when you are free!

It has to be today, right now at this moment.

Send your goals visualization to me (A strong exercise)

What about this ? Download this Goal visualization sheet, Take two prints, You fill one of them and let your wife fill another (incase you have). Goal visualization is a joint family exercise, not just yours. It has to be taken by your spouse separately. You will be amazed to see how much it differs for you and your partner even if the target amount and date was same. You two, might visualize it very differently.

Once you are done with the goal visualization, send the filled sheets to me at manish [at] jagoinvestor [dot] com. I’ll do my level best to look at them and give my comments if they are of any help to you. I don’t guarantee that I will get back the next hour, but I will try to get back as soon as possible . This exercise alone however, will give you some power to take action which you are missing till now in your life!

Comments ? You can also pick up a goal and do goal visualisation on the comments section too. See if you feel it is strong enough! , Do you feel it helps you to generate some commitment and leads you one step closer to taking action ?

Disclaimer : The examples given in this article for goal visualization are created just for article and it’s not a real example of some person.

Cribbing Investor : This investor always find problems with the system, he keep on blaming Regulators, agents, companies and everyone else but not himself! He cribs at every one and about every thing around, from how he was

Cribbing Investor : This investor always find problems with the system, he keep on blaming Regulators, agents, companies and everyone else but not himself! He cribs at every one and about every thing around, from how he was  I-want-everything-Free Investor : This one needs everything for free or at throwaway price. He’ll say “It’s very expensive, Will get back to you later” to a

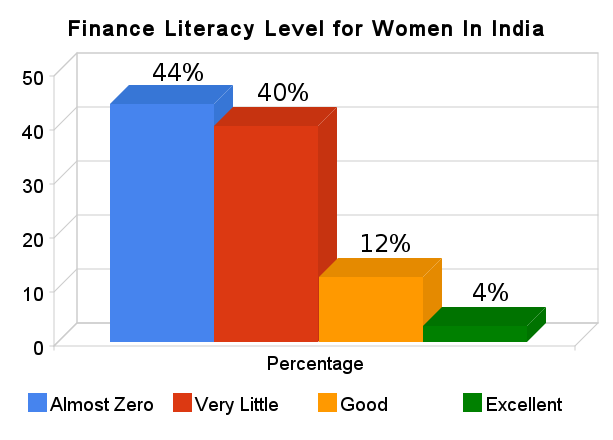

I-want-everything-Free Investor : This one needs everything for free or at throwaway price. He’ll say “It’s very expensive, Will get back to you later” to a  Lost Investor : These are the investors who have literally no idea about anything! He gets confused between Filing Tax returns vs Paying Tax. They get confused between IRDA, SEBI and RBI! If an agent comes to them and shit jargons on their face, they will most probably buy it as they feel bad to admit that they are dumb in the area of personal finance. This guy also thinks that 80C is compulsory and keeps buying unsuitable products every year with personal loan.

Lost Investor : These are the investors who have literally no idea about anything! He gets confused between Filing Tax returns vs Paying Tax. They get confused between IRDA, SEBI and RBI! If an agent comes to them and shit jargons on their face, they will most probably buy it as they feel bad to admit that they are dumb in the area of personal finance. This guy also thinks that 80C is compulsory and keeps buying unsuitable products every year with personal loan. Fun-Making Investor : These investors are very naughty. They are experts and make fun out of situations. If they get a sales call, they ask tough questions like “Can you tell me

Fun-Making Investor : These investors are very naughty. They are experts and make fun out of situations. If they get a sales call, they ask tough questions like “Can you tell me  Virgin Investor : These are fresh entrant in the area of money, who don’t even know what’s

Virgin Investor : These are fresh entrant in the area of money, who don’t even know what’s  Not Interested Investor : They are just not interested in Investments. Only at the gun-point you can force them invest and even then, they will start an SIP of Rs 1000/per-month and start skipping their breakfast ! . They dont claim their LTA, medical bills & even HRA, it’s too much of documentation and you have to physically move from one place to other, not worth the effort! And why take

Not Interested Investor : They are just not interested in Investments. Only at the gun-point you can force them invest and even then, they will start an SIP of Rs 1000/per-month and start skipping their breakfast ! . They dont claim their LTA, medical bills & even HRA, it’s too much of documentation and you have to physically move from one place to other, not worth the effort! And why take  Fantasy Investor : These investors live in fantasy world when it comes to money. Even in today’s world their aim is to become a “crorepati” (

Fantasy Investor : These investors live in fantasy world when it comes to money. Even in today’s world their aim is to become a “crorepati” ( Pissed-Off Investor : These investors get pissed off with everything. If Insurance company increases the premium because they are smoker, they get irritated . If their demat account charges him a yearly fee, he is irritated. He is also irritated because his mutual fund now ranks 3rd, which was a top performer when he bought it. They get pissed off at ICICIDirect site for not opening at right time and they are forced to sell their stock at Rs 156 instead of Rs 157 sometime back ! .

Pissed-Off Investor : These investors get pissed off with everything. If Insurance company increases the premium because they are smoker, they get irritated . If their demat account charges him a yearly fee, he is irritated. He is also irritated because his mutual fund now ranks 3rd, which was a top performer when he bought it. They get pissed off at ICICIDirect site for not opening at right time and they are forced to sell their stock at Rs 156 instead of Rs 157 sometime back ! . Informed Investor : Tele-marketers really cut their name from their lists, as they get embarrassed each time in front of these investors by talking something non-sense. These investors happily let their

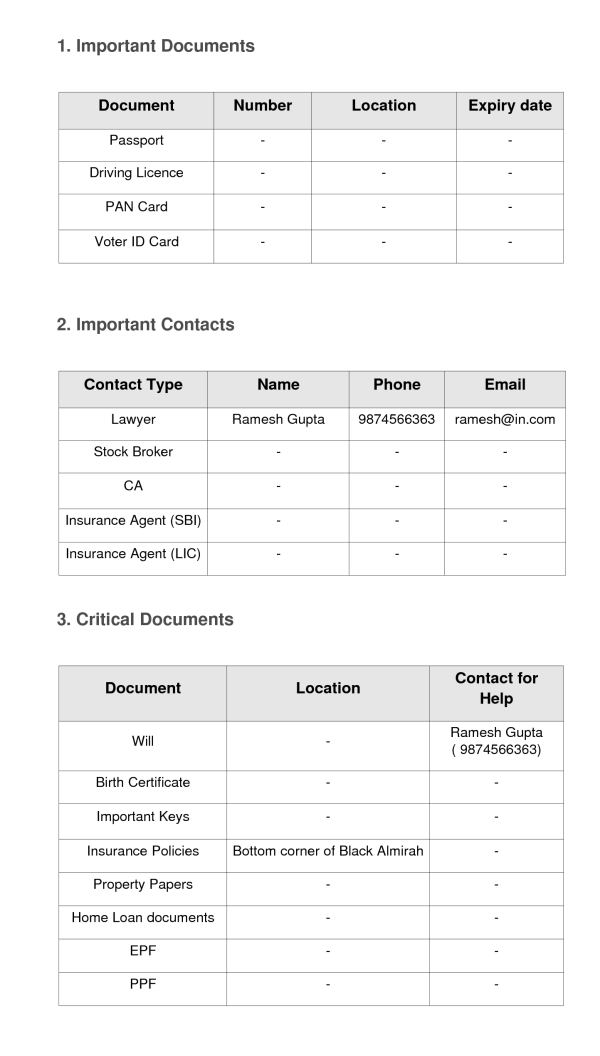

Informed Investor : Tele-marketers really cut their name from their lists, as they get embarrassed each time in front of these investors by talking something non-sense. These investors happily let their  No-Idea Investor : These are investors who have no-idea about things in their financial life. they often find their insurance policies and other important papers here and there. They struggle to mention the funds name in their portfolio . Their Policies get lapsed often,They have no idea why they are saving, Their demat accounts are active from years and they have no idea that they are paying yearly charges . They never match the actual spending and their credit card bills, ever!

No-Idea Investor : These are investors who have no-idea about things in their financial life. they often find their insurance policies and other important papers here and there. They struggle to mention the funds name in their portfolio . Their Policies get lapsed often,They have no idea why they are saving, Their demat accounts are active from years and they have no idea that they are paying yearly charges . They never match the actual spending and their credit card bills, ever! Tax-Saver Investor : These investors are really mad about tax-savings!. Their financial life is at mercy of tax-saving products. You can suddenly see a new energy in them after Jan 1st each year. If you need blood, you can get it from these investors provided you convince them that they can get a tax exemption on that. Mention a section like 80K or 80Z for faster response. His last wish in life is to find out everyone involved in designing Direct tax code and then kill them to death one by one, slowly!

Tax-Saver Investor : These investors are really mad about tax-savings!. Their financial life is at mercy of tax-saving products. You can suddenly see a new energy in them after Jan 1st each year. If you need blood, you can get it from these investors provided you convince them that they can get a tax exemption on that. Mention a section like 80K or 80Z for faster response. His last wish in life is to find out everyone involved in designing Direct tax code and then kill them to death one by one, slowly!

You have to understand the real goal of financial planning first and then identify the areas you really need to concentrate on .

You have to understand the real goal of financial planning first and then identify the areas you really need to concentrate on .