How much Time should you spend for managing your Personal Finance

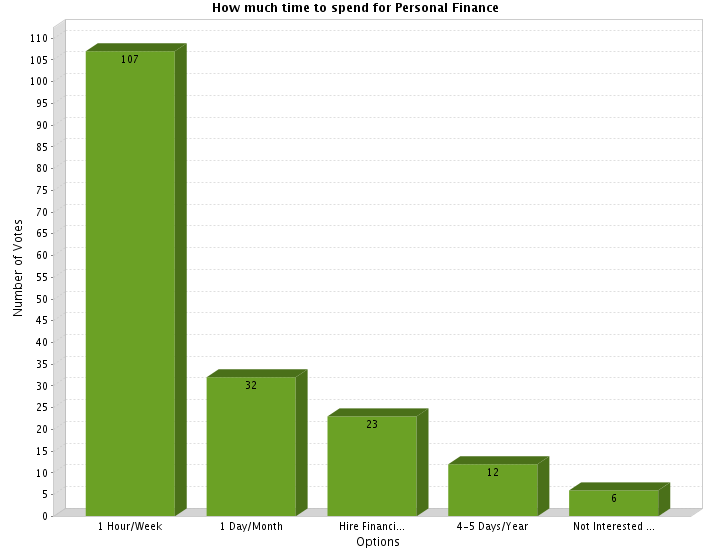

Some months back I wanted to find out how much time a person would spend on his Personal Finance? So I did a poll which asked them this question and gave them some answer options to choose from. Around 180 people participated in the poll. Let us find out what most of the people think about spending time on their Financials.

[ad#big-banner]

Results of the Survey

So the survey asked them a simple question “How much time you would like to spend managing your Personal Finance” and gave them following 5 options

- 1 Hour/Week

- 1 Day/Month

- I would rather like to hire a trusted Financial Planner

- 4-5 Days/Year

- I have other important things in life

Any Debt funds and Stock Market experts here? Please step in our Forums and help in answering questions like “Best Investment theme for future in Indian Stock Market” and “Debt funds?”

Here is the pie chart which shows all the results

Important Learning’s and Insights

- Around 60% people say that they would like to spend around 1 hr/Week. Another 18% said 1 day/month, which is again some how same as 1hr/week in some sense. So I can say that people are interested in spending around 4-5 hrs per month. Personally I feel that 3-4 hrs a month is more than enough. Choose last weekend of month and sit one Sunday or Saturday evening for 3-4 hrs after lunch and look at overall your portfolio. Find out how everything in portfolio is performing, how your mutual funds are performing, track if your investments are growing as per your expectations and plan.

- Very small percentage of people said that they have other important things in life than managing their personal finances. This shows that everyone somewhere in their heart recognizes that Personal Finance is an important part of their life. But may be because of ignorance or because its too boring. We don’t get into managing or understanding it and try to ignore it to a level when its too late 🙂

- Only a small percentage of people think that they should hire a Financial planner. There are two reasons for this: First, that they don’t feel a need to hire a financial planner and they think that its an easy task which they can do themselves, they think like “why to pay Financial planner?”. Second, that people don’t yet understand what is the goal of Financial planning and don’t appreciate it’s importance in life.

Please put your comments and involve in discussion, What do you think is the best way and time to manage your money?

Note: I feel that I will not be interested in writing a review for any product now onwards. One of the reader feels that I have received Money from Aegon Religare and reviewed iTerm Insurance, see the comment . I don’t say that it looks very unbiased and yes my word seems to be very promotional may be because of my trust in the company and their philosophy.

I am not an emotional person at all but it has hurt me as a writer. I would love to hear your comments on that. If most of you feel the same way feel free to put your comments there without hesitation. If most of the people feel the same way. In that case I will have to refrain from writing such articles, so that it does not put wrong impression. Miss-trust is the last thing I want from readers. If people are not happy, I should also think about removing the ads I put on this blog if it makes people uncomfortable and feel like I am biased. Please accept my public Apology if I have hurt your Trust 🙁

[ad#small-banner]

December 18, 2009

December 18, 2009

@ Manish:Keep up the good work.Jago Investor is doing a gr8 job in parting financial literacy.

Thanks Rajiv

Are you on Forum , please help answering others … contribute your knowledge 🙂

I have to learn a lot.There are more well versed people on this forum whose knowledge on financial literacy I respect, starting with you.

Thanks for your kind words !

Hi Manish,

I hope you don’t stop reviewing the new products.Wish you to continue that,it helps investor to analyse product either negative or positive.I am your new follower,started learning from your website.

Keep posting and reviewing.

Regards,

Raju

Raju

Yep , I will keep doing that 🙂

Manish

hey manish

if you stop writing useful reviews because one pupil feels that way than you are stopping something good from reaching people.

if bad things come we cant block them but if good things block it hurts more and do more bad .

keep the good work going.

i personally analysed all available insurance options and found you are really good and no objection is there.

Saurabh

Thanks 🙂

Dear manish,

paucity of time is not allowing me to read the interesting comments above.. which i would have ideally liked to do …

Let me tell you one thing i was really surprised by your thoughts on not putting your point

across with regards to a product anymore !!

Do you know :

As some gentleman has pointed out that you cud have edited the comment

You could have no comments enabled at all !! there by trying to sound prophetic !!

And many more points i can add 🙂

By not doing any of these things clearly shows your intent …

Who does not have critics !! Big B , Sachin almost everyone … thats how the

world is balanced there is a neutron for every proton !! mere existance of a neutron

should not warrant the demise of the proton !! both have equal importance …

Take the comments positively and march ahead …

You have a far more mature head resting on your shoulders than your age warrants !!

You are the best judge .. but don be judgemental !!

To sum up i quote roosevelt :

It is not the critic who counts;

not the man who points out how the strong man stumbled

or where the doer of deeps could have done them better.

The credit belongs to the man who is actually in the arena;

whose face is marred by dust and sweat and blood;

who errs and comes short again and again…

who knows the great enthusiasms,

the great devotions,

and spends himself in a worthy cause;

who at the least knows in the end

the triumph of high achievement;

and who, at the worst,

if he fails, at least fails while daring gently,

so that his place shall never be

with those cold and timid souls

who know neither victory nor defeat.

~ Theodore Roosevelt ~

regards,

som

Som

thanks for your comment , really appreciate it 🙂

Manish

Nice to see hindi comment, how you people type hindi ? would you like to share please.

Khalid

Go here : http://www.google.com/transliterate/ and type in hindi (type english word , it will convert to hindi , like “AAP” will convert to Hindi word )

then copy paste 🙂

Manish

हिन्दी में टाइपिंग के लिये मैं “बराहा” सोफ़्टवेयर का प्रयोग करता हूँ जोकि http://www.baraha.com/ पर निशुल्क उपलब्ध है. किसी प्रकार की सहायता के लिये आप मुझसे संपर्क कर सकते हैं.

एगोन रेलीगेर के iTerm प्लान के बारे में आपका विचार व साथ ही यह बिन्दु कि इस कम्पनी का क्लेम रिकार्ड उपलब्ध नहीं है, आपकी ईमानदारी का प्रमाण है. अत: आप अपने विचार हमारे जैसे पाठकों के लिये अपने ब्लोग के जरिये जारी रखे.

आपके लिये मेरे मन में कुछ पंक्तिया आ रही है जो (आशा है) आपको प्रेरणा देगी :-

जगत भर की रोशनी के लिये, करोड़ो की जिन्दगी के लिये, सूरज रे जलते रहना !!

जो दूसरों का हित सोचते हैं उन्हे ऎसे ही अनुभवों से गुजरना होता है. अत: अपना प्रयास जारी रखे. आपका प्रयास हमारे लिये तो अमूल्य है.

मुकेश पंड्या, मुम्बई

मुकेश

आप की टिप्पड़ियों के लिए बहुत धन्यवाद ! , आशा है आप को ये ब्लॉग बहुत पसंद आ रहा है , ये जान कर अपार ख़ुशी हुई की इस ब्लॉग के हिंदी पाठक हैं , मैंने कई बार सोचा भी की किस तरह से हिंदी पाठको तक ये ब्लॉग पहुँचाया जाये पर समझ नहीं आया ! आशा है आप इस ज्ञान को दूसरो तक पहुचने में सहायक होंगे 🙂

आप के क्या विचार हैं इस विषय पर ?

मनीष

आप अपने कुछ लेख हिन्दी में भी लिखकर अपने ब्लोग पर डाल सकते हैं. इससे भी अच्छा होगा अगर एक हिन्दी ब्लोग इस विषय पर शुरू किया जाय. दुर्भाग्यवश हिन्दी का पाठक-वर्ग इस विषय से कुछ अनभिज्ञ सा है. फ़िर भी कुछ प्रयास तो किया ही जा सकता है. आपके प्रत्युत्तर हेतु धन्यवाद.

पर हिंदी पाठकों की संख्या कितनी है ? क्या हिंदी में पढने वाले काफी लोग है ? इन्टरनेट पर तो सिर्फ अंग्रेजी में पढने वाले ही ज्यादा हैं , अगर मुझे इस बात की तसल्ली हो जाये की हज़ारो लोग हिंदी लेख पढने में रूचि रखते हैं तो इस पर कुछ विचार किया जा सकता हैं ! हिंदी.जगोइन्वेस्तोर.कॉम (hindi.jagoinvestor.com) के बारे में आपके क्या विचार हैं ? क्या आप इस कार्य में किसी तरह से सहायक होंगे ?

मनीष

आपका यह कहना सही है कि नेट पर हिन्दी के पाठक कम है. लेकिन संख्या बढ रही है. इसका अनुमान आप विभिन्न हिन्दी की साइटों से लगा सकते है. हिन्दी में सामग्री तैयार करना (खासकर टाइपिंग) बहुत समय लेने वाला काम है, फ़िर भी आप लीड लेंगे तो मेरी तरह कई हिन्दी के जानकार जुडते जा सकते हैं. मैं अपनी तरह से पूरा सहयोग दूंगा.

I am looking for an online portfolio tracker (preferably free) to track my personal investment (equity, MF, ppf, FD etc.) portfolio. Some of the options that I looked into are the ones provided by moneycontrol, valueresearchonline.

Let me know what tools you folks are using and your feedback.

I am from a poor family background… unfortunately i did not know anything about money products like FDs, insurance, MFs, etc nor my father did because we were just living based on income. Now i am working at good software company. I feel like i have already lost so much time as i am now 33yrs old. I read quite a bit and i have read many of your posts and i found that interesting. I have never had a habit of investing.. but i feel now i am left behind. i started on with MFs but since i have started late i am spending too much time on it almost 30 to 40mins reading about investment everyday. Is this good thing for a late starter?

Madhu

I must appreciate at your interest and confidence .. every start is small , and with time things grow , same applies to knowledge too . Read everyday and dont hurry ,, concentrate on making your understanding very robust about personal finance and one day you will be able to take all the decisions well 🙂

Manish

dear manish

i think for many of us YOU are the CFP of our financial investments guiding us thru your blog. i dont think that the trust factor people have gained in u over the months would be there with any body else. keep up the job buddy!! and dont be bogged by some loose comments by some body.

kishan

Dr Kishan

thanks for your trust 🙂 . Keep commenting

Manish

Manish,

First, a big thanks for writing such an informative blog which is easy to understand and based on some logical analysis.

I see a post where reader has asked for a wish list. Is it in place now ? I would like to have more information on PPF, Pension plans and retirement schemes i.e. what to look for, why they are good and bad …

One another question is how do we get Financial Planners ? All I have seen in the name of Financial Advisors and Planners are Agents. I have not encountered any one who gives unbiased and trustworthy information. To me, every one seems to be selling products of one or the other companies and once you make the investment they will disappear some where and will reappear once some new products are launched … Real motive always seem to be selling products which gives them max commission.

Thanks,

-Deepak

Deepak

Wish List is still not in place 🙂 . Will do it soon .

Regarding Financial planners , I am coming up with the post on this . Keep watching . For now just understand that you need to Hire CFP’s who are independent Financial planners and do not have compulsion of executing the plan through them . Do you know what is CFP and where to look ?

Manish

I know CFP is Certified Financial Planner. Even the agent that I work with is, I think, a CFP but the question is that of trust. My problem is that if some one tells me to invest in for e.g., a certain NFO ( I know they are usually bad and should be avoided but I came to know after I had invested in NFOs on the advise of some advisors from ICICI and Kotak) or some other product such as Gold Harvest scheme by Birla, then I am not able to decide that it indeed is a good product and there are no hidden benefit of the ‘advisor’. I agree and fine with the fact that they are there to make a living out of that but then how do we ensure that it will not be a parasitic relationship ?

If you can provide a resource to find out the list of independent CFPs then that may help.

Thanks,

Deepak

Deepak

Trust is really the one thing one needs while hiring the FP . But that will come only after your interact with FP , spent time with him/her . Choose one on the level of comfort you feel and not just qualification . What kind of trust level or comfort level you feel with Jagoinvestor or me in particular ?

You can get the list of CFP here : http://www.fpsb.co.in/scripts/CFPCertificantProfiles.aspx

Manish

I agree with you on the ‘trust’ factor. However, if you are new in a city, you hardly know any one, now how do you find a person you can trust with your money ? That is the challenge. And that is when I guess one objective selection criteria can be CFP.

And then developing trust is also a long term process i.e. if he makes some recommendations, whether they were good or bad you will only come to know after 2-3 yrs. By that time you may have lost 2-3 valuable years.

You have sent a link on finding CFPs but then a reference/recommendation is always better. I feel that trusting some one with your money is one of the most (probably the most) difficult things in this world 🙂

Regarding trusting this blog, I do trust and one of the reasons is because the articles, suggestions and advises are generic basis and I do not feel that there is a hidden agenda. It would have been better if some one like you can help some one like me with his financial planning :).

Deepak

Yeah .. if there is no time for trust , then definately one has to go with the certificates and qualification part .

I mailed you personally regarding my services .

manish

Thanks, you have a great mind……….

.-= pankaj Singla´s last blog ..Tax Implications on Second House Property =-.

Hi Pankaj

You have a great blog on tax . I would be reffering to it for my doubts 🙂 .. Great work

Manish

Dear Manish,

You, as JAGOINVESTOR, are very instrumental in imparting financial education to lot of novice people like me. Keep-up the spirit and continue your march to spread awareness amongst general public. Each and every article posted by you is thought-provoking and easy to understand/follow.

Your taking that particular comment positively shows your maturity at this young age and your dedication to “Learn from Others” and “Let others Learn”.

Keep writing and wishing you all the best.

Regards,

N K Rana

Thanks N K Rana .

What are your views on Taking sessions live , How will that help ? Do you support it .

Manish

During the day, being occupied in Official Affairs, I may not be able to Take Sessions Live. But for the benefit of general investing public, I would support it and welcome it whole heartedly.

Keep up the continuation of your good work.

Regards,

N K Rana

I was talking about Weekend like some Sat or Sun .

Manish,

Keep up ur good work! Pls don’t let some negative comments ever effect you. You are doing a wonderful job in enlightening people on personal finance.

Also I guess AR example is there because it is a standout product, new product and ppl are not very aware of such a wonderful product so pls keep post such wonderful examples.

Thanks

Naveen

Thanks Naveen .. keep commenting 🙂

Manish

No Manish, you cannot stop writing, Not only me, many of friends whom I suggested your site became fans to your blog. One person criticizing the blog is not at all countable. There are unlimited people supporting you. Keep blogging.

–Rajendra

Hehe .. I am flattered 😉

Thanks for the support

Manish

To be honest, it was a bit confusing why you were so vocal in the company’s favor, even though you hadn’t used its product. Having been a follower of your blog, I didn’t question your integrity, and attributed it to reciprocity. They treated you well, and you were returning a favor. Personally, I feel that individual reviews are fine but at the same time, we should take into account the views of people who have opposing views.

Keep up the good work, negative comments are part of the game, and shouldn’t let you down. You are doing a good job and please continue with it.

.-= Manshu´s last blog ..Interesting Reads 19th December 2009 =-.

Thanks for comment ..

Opposite views are totally fine .. I like them and there is nothing wrong with it .. actually its better that 100% people dont feel the same way otherwise the purpose of blog commenting would be defeated .

But I take your point .. I should sound more un-biased 🙂

Manish

Hi manish,

felt very bad while reading NOTE. Not sure how can someone say that way. I know you personally as well. you are not of that kind.

BTW: I appreciate and thank you for post on iterm. If u wouldnt have written I would have never know about that. Also I took a 25L poicy as extra cover for 2k comapred to 5.5k while 50k was sufficient for me.

your post as well as AR strategy were very impressive. Please continue to spread word about such good financial products.

Ravi

thanks for comment .. i will take care 🙂

Manish

I agree than 4-5 hours/month is more than enough for a review of our portfolio..

It was an excellent idea to conduct such a poll and results show that “readers/fans of your blog” are competent investors (Thanks to Manish for making us competent) who know what exactly is required and don’t spend too much time like “day traders”.

As regards to some negative comment on your iterm blog, DON’T WORRY on that.

I don’t feel there was anything wrong in the blog (logo is also OK) since you have also summarized by giving +ve/-ve points and it is OK for a financial consultant to write a review of a product / company.

Readers should take relevant points and they should also do some work / research before buying a product (There is nothing like a FREE LUNCH……)

Keep up the good work !!

keep blogging….

JP

Thanks JP , i will keep it in mind

Hi Manish

i am a regular visitor to your blog and learned so much about personal finance. Thanks for your suggestions. I would like your suggestions on following topics.

> NPS

> Monthly income funds (MIP) and how to differ with Debt funds which one is good depending upon risk takers

> what kind of help you get from financial planner and what you look for, how to reach them

> different saving schemes depending upon risk like FD is safest with no risk and equity is high risk and high returns

NPS : Hold on on this . you can do better

MIP : MIP are different kinds , risky and safe , govt and pvt , etc .. so you should look at valueresearchonline.com for more .

Financial Planner will act like a Doctor to your Financial life and tell you what to do , what not to do .. and he will plan for each part . You can find them in FPSB directory , you can also contact me 🙂

These are the product with increasing risk and return

FD -> NSC -> PPF -> FMP -> Debt funds -> Balanced Funds -> Equity Funds -> direct shares -> options

Manish,

You are doing a wonderful job by educating and advising each one of us. Don’t pay too much heed to such comments and concentrate on the work in hand. There is not a single day that i don’t visit your blog.

Keep up the good work.

Rakesh

Really !! .. Not a single day 😉

I am glad 🙂

Manish

Thanks for the support ravi

I will remember your words 🙂

Manish