What does it takes to be successful in Trading ?

We are going to see 2 articles on this subject, this is Part 1. In this part I will give introduction to Trading and tell you what exactly is it and how should you approach it (if you want to do it).

Dr. Alexander Elder, explains in his legendary book “Come in to My Trading Room”, the 3 M’s of Successful trading, which I will touch upon today and will explain it in my own way to you. In the second part we will see the 3 M’s in my way of explanation.

Let us first see what exactly is the difference between Trading and Investing and then we will go over the explanation.

Difference between Investing and Trading

Investing means buying a stock of financial instrument for a long period of time, typically over several years. Assessing good investment opportunities often makes use of fundamental information, such as earnings, but can also use technical analysis to detect long-term trends.

Trading means buying and selling stocks or other financial instruments for shorter periods of time, typically less than a few months. Assessing good trading opportunities typically makes use of trading systems or chart-based techniques to detect short-term patterns.

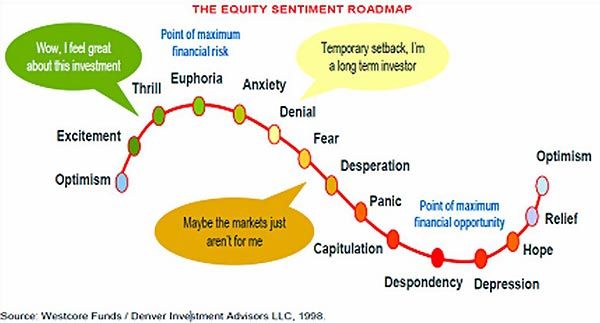

The main advantage of trading over investing is that it provides the ability to make money regardless of the overall direction of the market or the price of an individual stock. The general consensus is that You can make more money in bear markets with Trading than Bull markets. Because bear markets provide steep movements compared to bull markets .

How Risky and Rewarding is Trading ?

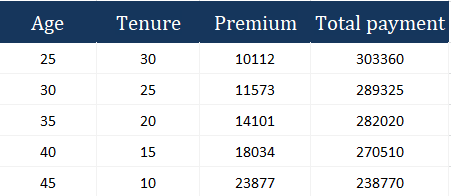

Risk : Trading is considered as one of the most risky business you can ever do. Trading can wipe out your entire money so fast that you cant even imagine. As per the data, every 19 person out of 20 who does trading eventually looses. So the success ratio is not more than 5%, even out of this 5%, 3-4% just make small money, actually big money is made by 1% of people.

Reward : If done correctly and successfully trading can make you enough money you cant imagine. Most of the successful traders make more money in a month than people who are considered as “making good money” make in a year. but this numbers is for highly successful traders.

The other reward for successful trader is Independence. Once successful, you are your own boss, can work whenever you want, trade from all corner of the world while travelling.

For people who want to try there skills in trading can try mock trading on moneyvidya.com, Just buy and sell stocks and see how much money are you able to make in 2-3 months, It will give you some feel of trading. You can also read past my article on MoneyVidya.

Should you try Trading ?

Well, Just anyone who thinks that trading is a “get rich quick” thing, is doomed to failure, this is the biggest reason why people fail, they start or see trading with wrong attitude, they want to make millions (if not billions) in just a month or a year from Trading, They underestimate the Risk part and over estimate Reward part of Trading and eventually fall pray to Market’s anger.

Just because its “BUY” or “SELL”, they think its easy. and they need to read a little bit and because they are so successful and smart in whatever they are doing currently, they will succeed in Trading too. The approach Trading in a wrong way with totally unrealistic expectations.

So the main question still is “Is it for you ?”

you have to ask your self some of the questions which are as:

- Are you ready to take Great risk of losing money ?

- Do you have time and energy to learn the stuff required to Trading ?

- Do you like Markets, numbers and what ever required for Trading ?

Some of the thing which “does not matter much” in Trading are :

- Are you highly intelligent person ?

- How successful you have always been in whatever you have done earlier in your life ?

Conclusion :

Understand very well that Trading is a very very risky business and not an easy thing , you have to learn it just like any other profession like Medicine or Software and it takes time . But , now a days I would say Trading is much easier compared to earlier days , Now with the online trading and lots of data available on Internet , there is lot of scope in Trading now .

In the next post we will quickly see 3 M’s for successful Trading . here is Part 2

Disclaimer : I am myself a student of Trading and still in my learning Phase , I have lost good money in Trading and still struggling to break even . But Eventually its going to happen, because I have not lost the confidence and still on fighting in the battlefield (Markets) .