The traditional, age old ways of buying gold have been ways like gold ornaments from jewellers or coins, bars, biscuits from banks or jewellers. However, since the last few years, new ways of buying gold have emerged. These include buying gold in demat form (electronic), through gold futures, gold ETFs and the latest one is E-Gold. So what is this E-Gold? This article makes an attempt to throw some light on this new product.

What is E-Gold?

The National Spot Exchange Limited (NSEL) has introduced E-series products in commodities. To start with, they have launched E-Gold and E-Silver. Later on, they also plan to cover few other metals and also some agricultural commodities in the same series. Trading in E-Gold has been on since 17th March 2010. E-Gold units can be bought and sold through the exchange (NSEL) just like shares. Here one unit of e-gold is equal to 1 gram of gold. For long term goals like accumulating gold for children’s marriage, retail investors can buy e-gold in small quantities in their demat account over a period of time. Once their target is achieved, the individual can take physical delivery of gold through the exchange. By buying gold in electronic form (demat), the individual need not worry about the purity of gold, storage costs and the insurance of gold. If the individual has bought e-gold only for investment purpose and does not need to take delivery of physical gold, then he can always sell the e-gold units and encash them. How to invest for Child related Goals

Requirements for E-Gold

To buy E-Gold units, the individual needs to open a demat account (beneficiary account) with one of the impaneled Depository Participants (DP). The list of the impaneled DP’s is given on the NSEL website (or see the list below.) Retail individual can place buy and sell orders for e-gold units with their broker through phone or through the internet (broker’s website). Investing in E-Gold or other metals opens up one more asset class for retail individuals to diversify their investment portfolio. It provides a means to buy, accumulate and sell E-Gold as well as to convert the same into physical gold. To invest in E-Gold you need to have your Demat account at any of these places… India Infoline Ltd, Karvy Stock Broking Limited, Geojit BNP Paribas Financial Services ltd , Anand Rathi shares & stock brokers ltd and many more.

[DDET Click Here to see the Full list of DP’s]

Globe Capital Market Limited

Religare Securities Limited

Goldmine Stocks Pvt. Ltd

M/s. IL & FS Securities Services Limited

Karvy Stock Broking Limited

Monarch Project & Finmarkets Ltd

SMC Global Securities Ltd

SSD Securities Limited

Alankit Assignments Ltd.

Zuari Investments Ltd.

Stock Holding Corporation of India Ltd.

Aditya Birla Money limited / Apollo Sindhoori

India Infoline Ltd.

Master Capital Services Ltd.

LSE Securities Ltd.

Geojit BNP Paribas Financial Services ltd

Farsight Securities ltd

Eureka Stocks & Share Broking Services limited

Microsec Capital ltd

Ashika Stock Broking limited

Anand Rathi shares & stock brokers ltd

IFCI Financial Services limited

These are also known as empanelled DPs

[/DDET]

Delivery Centres

If an individual wants to take physical delivery of his e-gold units then he / she can take it in multiples of 8 grams, 10 grams, 100 grams and 1 kg. To start with the exchange has delivery centres at Ahmedabad, Delhi and Mumbai. In due course of time the exchange plans to open more delivery centres in other cities. India for long has been the largest consumer of gold in the world as Indians love to buy gold. But since last few years because of the steep increase in the price of the yellow metal, it is getting further out of reach of the common man. By introducing the E-Series range of products, NSEL is focusing on the affordability factor by keeping one unit equivalent to 1 gram of gold which makes gold affordable once more, for the masses.

Charges

The Exchange shall levy the turnover charges of Rs. 20 per lakh of turnover to both buyer and seller member on monthly basis. This shall be applicable on all executed transactions. Storage charges shall be levied by the Exchange on monthly basis. Such charges will be computed based on the holding in the respective accounts on the last Saturday of every month. The charges per month per unit of E-GOLD will be 60 paise only. For conversion of e-gold into physical gold as per the current rates, VAT will be 1 % of the value of goods. In case physical delivery takes place in Mumbai, octroi @ 0.1 % of the value of delivery will also be applicable. Interested readers can read in detail in this circular

Conclusion

Though the product serves the purpose of common man of accumulating gold in small-small quantities over a period of time, not many people are aware of this product. To make it a success NSEL will have to create awareness about this product through various investor education channels, so that people realise the benefits of this product. How they go about doing this, remains to be seen.

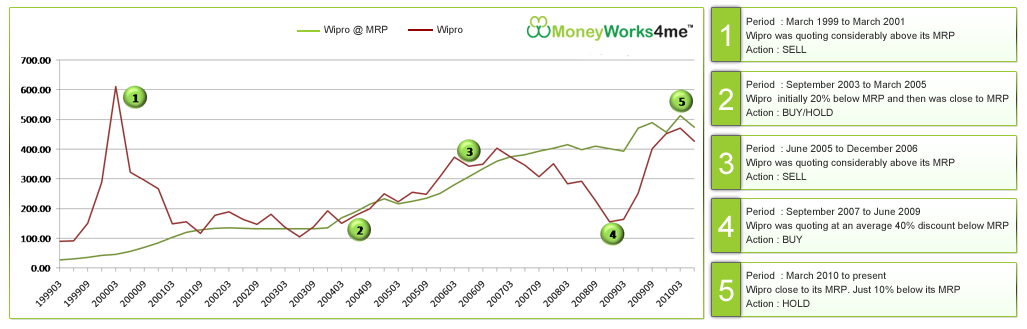

This is Guest post by Gopal Gidwani , who writes on his blog BachatKhata.com . I have edited it with more information and added the chart .