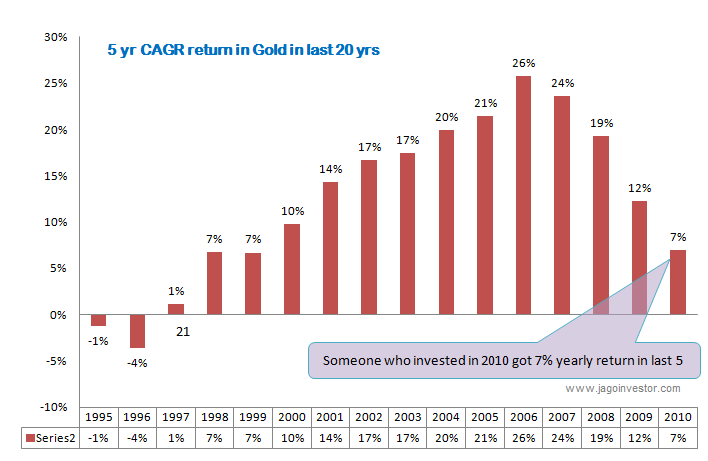

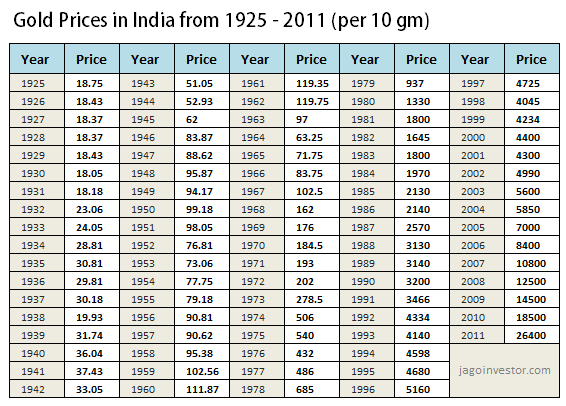

Most of the investors feel that gold is a good option to invest. One, because it gives quite reasonable returns and second but most important, we have an attachment with gold as per our traditions.

However, if you want to buy gold physically, you need to bear storage cost i.e. locker rents and along with this, it is not easy to buy and sell physical gold. And hence, Gold ETFs came into existence, which enables investors to trade gold on stock exchange and earn returns like they would be doing in case of physical gold.

But, now there is another option which is just like you are investing in physical gold available in Demat form, which can be traded on stock exchange, and also get a small amount of interest on the investment.

We are talking about Sovereign Gold Bonds. These bonds are issued by RBI in consultation with Govt. of India.

What is Sovereign Gold Bond?

Sovereign gold bonds were introduced by the Government of India in 2015 under the Gold Monetization Scheme, to enable investors to invest in an asset class which is a substitute for physical gold.

RBI announces public issues under these schemes in tranches i.e. specifying series along with dates of subscription of series of bonds and date of allocation.

You can refer below table for the SGB scheme 2019-2020 issue –

[su_table responsive=”yes” alternate=”no”]

| S. no. | Tranches | Date of subscription | Date of Issuance |

| 1 | 2019-20 Series V | October 07-11, 2019 | October 15, 2019 |

| 2 | 2019-20 Series VI | October 21-25, 2019 | October 30, 2019 |

| 3 | 2019-20 Series VII | December 02-06, 2019 | December 10, 2019 |

| 4 | 2019-20 Series VIII | January 13-17, 2020 | January 21, 2020 |

| 5 | 2019-20 Series IX | February 03-07, 2020 | February 11, 2020 |

| 6 | 2019-20 Series X | March 02-06, 2020 | March 11, 2020 |

[/su_table]

As these bonds are issued by the Reserve Bank of India on behalf of the Government of India, they carry sovereign guarantee. These bonds are issued at the discretion of government from time to time with a specified close date, and they are open for the public to subscribe.

The bonds are denominated in units of one gram of gold or multiples thereof. Minimum investment in these bonds is one gram.

9 features of Sovereign Gold Bond?

Let us understand the Sovereign gold bond in detail by referring to all its features.

1. Who are eligible to buy sovereign gold bonds?

Any resident individual including HUFs, trusts, universities and charitable trusts can buy sovereign gold bonds. This bond can also be purchased by a guardian or parent on behalf of a minor. But, a non-resident or ordinarily non-resident of India cannot buy a sovereign gold bond.

However, if a resident individual who bought SGBs, who has now become NRI can hold them till the maturity of the bond but cannot repatriate the maturity amount. He/she cannot even trade SGB’s on stock exchange.

2. Denomination of gold bond

Each investment will be denominated in multiples of gram or grams with a basic unit of 1 gram at least to be purchased in a single purchase i.e. minimum investment. It means if you want to invest Rs. 10,000 and the rate of gold on purchase date is Rs. 4000 per gram. So your investment will be denominated in 2.5 grams.

3. Maximum Amount

There is a limitation on the amount of gold that you can be held in sovereign bond. How much gold one can have in a financial year i.e. April to March (whatever can be the price of gold) is given for each category of eligible investors –

[su_table responsive=”yes” alternate=”no”]

| Category | Maximum Subscription |

| Individuals | 4 kg |

| HUFs | 4 kg |

| Trusts and similar entities | 20 kg |

[/su_table]

This ceiling will include bonds purchased under different tranches during initial issuance by government i.e. subscribed in the primary market as well as via the secondary market.

4.Issue Price

The price of the bond will be fixed in Indian rupees on the basis of the average closing rate of the last 3 working days of the week preceding the subscription period of gold having 999 purity (24 caret) published by India Bullion and Jewelers Association.

The issue price of the gold bonds will be less by Rs. 50 per gram for those who subscribe for it online and pay through digital mode.

5. Interest rate

The investors will be paid Interest on the amount of initial investment at the rate notified by RBI for a particular tranche at the time of its launch and is payable semi-annually. Till date interest is near to 2.5% p.a.

6. Redemption

Redemption price shall be fixed in Indian Rupees and the redemption price shall be based on a simple average of the closing price of gold of 999 purity of the previous 3 business days from the date of repayment, published by the India Bullion and Jewelers Association Limited.

7. Listed on the stock exchange

These bonds can be held in Demat form and the government has enabled trading of gold bonds on the stock exchanges i.e. NSE and BSE. This feature is given to enable easy trading of bonds and one can buy bonds even after the subscription period is closed.

8. Maturity

The tenure of the bond will be for a period of 8 years with exit option in 5th, 6th and 7th year, to be exercised on interest payment dates. It means one cannot redeem bonds before the end of 5th year. However, if one wants, he can transfer bonds via the stock exchange platform. So, we can say that there is no lock-in for SGBs.

9. SGBs can be used as collateral

Bonds can be used as collateral for loans. The loan-to-value ratio (LTV) is to be set equal to ordinary gold loan mandated by RBI. Therefore, it is a very good option that you can use gold bonds as security against loans like stocks.

9. Payment Options

The payment of SGBs can be made in cash (up to Rs. 20,000) or Demand Draft or Cheque or electronic mode. It’s good that you have an option to use cash for it. However, on redemption or transfer, the amount will be credited to your bank account.

How to buy Sovereign Gold Bonds?

Whenever the government of India announces a series of bonds, they specify the dates of subscription, date of issuance of bonds and the amount of purchase per gram. A subscriber can go via physical mode or online mode for subscription of SGBs.

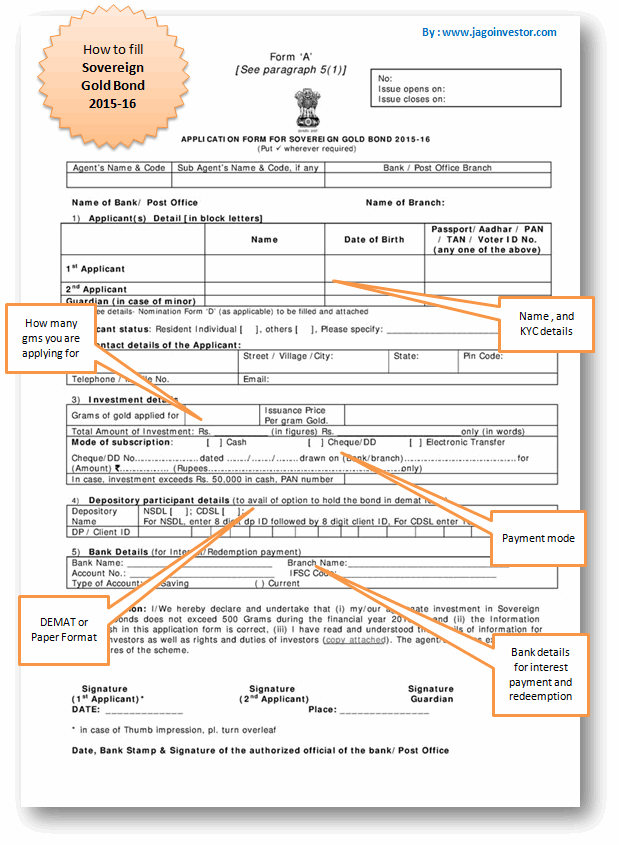

1. Physical Mode – To invest in gold bonds, you can fill in the application form which is provided by issuing banks or from designated post offices. You can also download the application form from the website of the Reserve Bank of India.

Scheduled Commercial Banks (excluding RRBs, Small Finance Banks and Payment Banks), designated Post Offices (as may be notified), Stock Holding Corporation of India Ltd (SHCIL) and recognized stock exchanges viz., National Stock Exchange of India Limited and Bombay Stock Exchange Ltd. are authorized to receive applications for the Bonds either directly or through agents.

2. Online Mode – To invest in bonds using online mode, one can use their intermediaries/broker’s platform or bank platform. There will be a discount of Rs. 50 per gram if you purchase via online mode and paying through digital mode.

Every applicant must provide their PAN number issued by the Income Tax Department. Without a PAN, one cannot apply for investing in gold bonds.

Tax treatment of Sovereign gold bonds

The capital gains tax arising on redemption of SGB to an individual has been exempted. This is an exclusive income tax benefit offered on gold bonds to encourage investors to shift to non-physical gold.

However, the transfer of gold bonds before maturity will attract Capital gain tax. The indexation benefits will be provided to long term capital gains arising to any person on transfer of bond using secondary market after 3 years from the date of purchase.

The interest received on SGB per financial year is taxable as per the slab rate of subscriber.

Comparison of Physical gold, Gold ETF and Sovereign Gold Bond

[su_table responsive=”yes” alternate=”no”]

| Points | Physical Gold | Gold ETF | Sovereign Gold Bond |

| Returns | Lower than actual return on gold (due to making charges) | Lower than actual return on gold (due to brokerage) | Higher than actual return on gold (due to interest payments) |

| Safety | Risk of handling physical gold | High | High |

| Purity of Gold | Purity of gold always remains a question | High as it is in electronic form | High as it is in electronic form |

| Capital Gain | LTCG applicable after 3 years | LTCG applicable after 3 years | LTCG applicable after 3 years (No capital gain tax if held till maturity) |

| Loan collateral | Yes | No | Yes |

| Tradability | Conditional – depending upon availability of buyer | Tradable on exchange | Tradable on exchange and redeemable 5th year onwards |

| Storage cost | High | No | No |

[/su_table]

Are sovereign gold bonds safe?

As we already mentioned, these bonds are issued by RBI in consultation with GOI, it ensures that there will not be any question about default risk i.e. no risk of repayment. However, the price or the redemption value of the bond will depend upon actual market price, so a drop in the market price of gold can put the capital at risk, which is a fact in case of holding physical gold or gold ETFs as well.

Why should you invest in Sovereign gold bonds?

See, buying SGB’s are suggested just as a substitute for buying physical gold. The flaws of buying physical gold are many like, they are not easily tradable and involve heavy storage cost, you don’t earn any interest on holding physical gold, you bear making charges and if you earn any gain on sale of gold you have to pay capital gain tax.

In SGBs you need not to face all these flaws instead they are very safe in terms of default risk, We cannot say that there is no risk, considering capital loss risk that may happen due to market price change.

Conclusion

If you are looking for long term investment in gold then instead of physical gold, SGBs are suggested. You don’t need to pay any tax i.e. capital gain tax on redemption of SGB on maturity or after 5th year. But, keep it in mind that there is STCG tax or LTCG tax on the transfer of SGBs on stock exchange before maturity and there is a limit on the quantity of gold that one can hold per financial year in the form of bond.

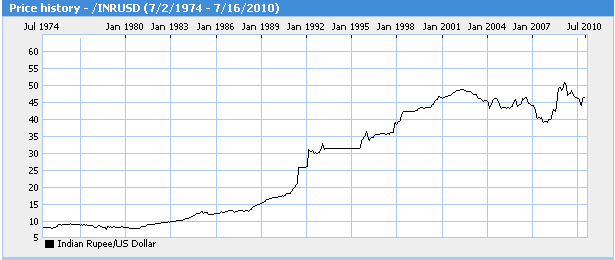

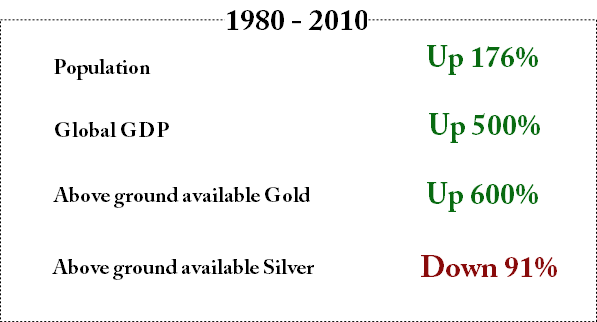

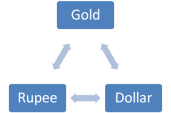

Today also, each emperor (so called Government) produces and controls their own currency as DOLLOR, Rupee, Dinar etc. But internationally, gold still remains the purest form of currency as it cannot be manipulated. Now in paper currency world over, Dollar became the most acceptable currency as US economy is still the biggest and almost all countries trade with US. After US dollar, the most acceptable form of currency is GOLD. If you have gold and you are not carrying dollar, you can still buy items in any country of the world but you cannot do so with Indian Rupee. Hence, in economic terms, gold is a currency.

Today also, each emperor (so called Government) produces and controls their own currency as DOLLOR, Rupee, Dinar etc. But internationally, gold still remains the purest form of currency as it cannot be manipulated. Now in paper currency world over, Dollar became the most acceptable currency as US economy is still the biggest and almost all countries trade with US. After US dollar, the most acceptable form of currency is GOLD. If you have gold and you are not carrying dollar, you can still buy items in any country of the world but you cannot do so with Indian Rupee. Hence, in economic terms, gold is a currency.