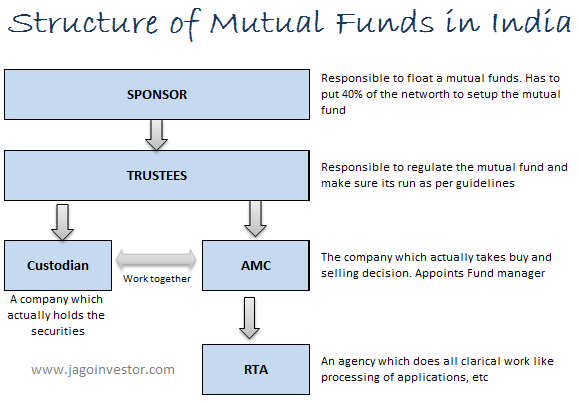

How mutual funds operate internally and have strong structure ?

Today, I want to help you understand how a mutual fund operates in layman language and how its structure looks like. How various entities come together to create a mutual fund.

There are a lot of investors who are new to mutual funds concept and they have just heard about the mutual funds. All they know about it is that some investors pool in their money in mutual funds, which invests in markets by a fund manager and they get very good returns. While that’s a simple explanation, I today want to inform you about the details and how things actually are structured, which makes mutual funds one of the safest instruments and highly professional, and leaves almost no chance of fraud in mutual funds

So let’s get into the entities which comprise of a mutual fund.

1. Sponsor

The first entity is the “sponsor” of a mutual fund. It’s a person or the corporate body which initiates the launch of a mutual fund. You can see this person as the promotor of the company, who is the first one to think about the company. As per SEBI, the sponsor should have a good reputation, great professional competence and they should be financially sound to become a sponsor.

They also need to have at least 5 yrs of experience in the financial services industry and should contribute 40% of the AMC net worth (we will soon see what is AMC). The sponsor is not responsible or liable for any loss or shortfall resulting from the operation of the schemes beyond the initial contribution made by it towards setting up of the mutual fund

2. Trustees

The next thing you should know is that a mutual fund is created as a public trust and registered with SEBI. The sponsor appoints the trustees which look after the trust and they are the owners of the mutual fund property and assets.

However, the role of the trustees is not to manage the day to day affairs of the mutual fund, but only to regulate the mutual fund. They make sure that everything is happening as per regulations and the money invested is managed as per the objectives set by the mutual fund. The trustees act as a protector of unitholders’ interests.

As per the SEBI rules, At least 2/3rd of the directors of the trustees have to be independent directors who are not associated with the sponsor in any manner.

3. AMC (Asset Management Company)

Now comes the main thing.

AMC means the Asset Management company which actually manages the investor’s money and takes the decision of investing the money. The AMC is appointed by Trustees. AMC does the fund management and charges a fee for their services which is borne out of the investor’s money (that’s why expense ratio is there)

The AMC has to be approved by the SEBI and the Board of Directors in AMC must have at least 50% of Directors who are independent directors. So an AMC functions under the supervision of SEBI, Trustees and the board of directors.

Some rules set by SEBI

As per rules set by SEBI, An AMC (also referred to as fund house) can’t use the same broker to buy more than 5% of the securities. Just like we use a trading account to buy and sell securities, in the same way, an AMC uses a broker to buy and sell securities in large quantities, but they can’t buy a bulk quantity with the same broker, which makes sure they can’t have any “arrangements” with one of them.

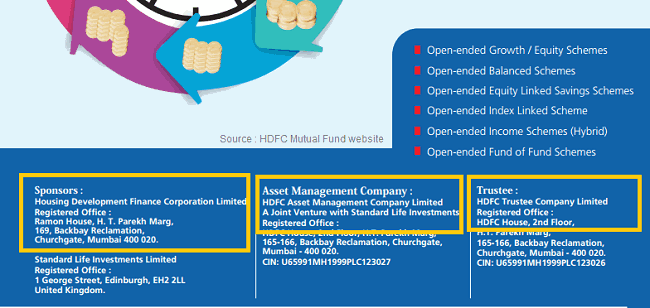

So when you say HDFC Mutual Fund, you are referring to the Trust. The AMC for HDFC Mutual Fund is “HDFC Asset Management Company Limited”. So all the investment decisions of buying and selling the securities are taken by the AMC and not HDFC Mutual Fund (the trust)

Below you can see the details of trustees, sponsor, and AMC which I took from the HDFC Mutual Fund website

AMC is responsible for floating a new mutual fund scheme, and inorder to do that, they have to follow rules prescribed by SEBI and require the signature of the trustee.

So the HDFC Top 200 fund was floated by HDFC Asset Management Company Limited (AMC), but owned by HDFC mutual fund (the trust). It is the AMC that hires all the fund managers, IFA (agents) who helps in sales, and all the employees who work at the AMC offices.

4. Custodian and Depository

Here comes the interesting part.

The securities which are bought and sold by the fund manager, it’s actually not in the custody of AMC, but another entity called custodian or the depository participant. It is registered with SEBI and has the access to the securities.

A custodian keeps the physical securities (like GOLD and any physical certificates) and any Demat stocks/units are stored at Depository level.

A custodian is also responsible for keeping an eye on all the corporate actions like when is a stock declaring dividend, bonus issue etc in the stocks where fund has invested. So an AMC just focuses on the decisions like buying and selling and all the task of managing, storing of actual securities happens at the custodian level

Note that an AMC can have more than one custodian for various kinds of securities, like in case of HDFC AMC, the securities are with HDFC Bank LTD (one of the custodians), but for their HDFC Gold ETF, the custodian is Deutsche Bank A.G which stores physical gold.

As per regulations, Sponsor and the Custodian must be separate entities which make the mutual funds a very safe instrument and fraud is almost impossible.

5. Registrar and transfer agents (RTA)

Finally, comes to a very important entity called as Registrar and Transfer agents(RTA), which are appointed by AMC

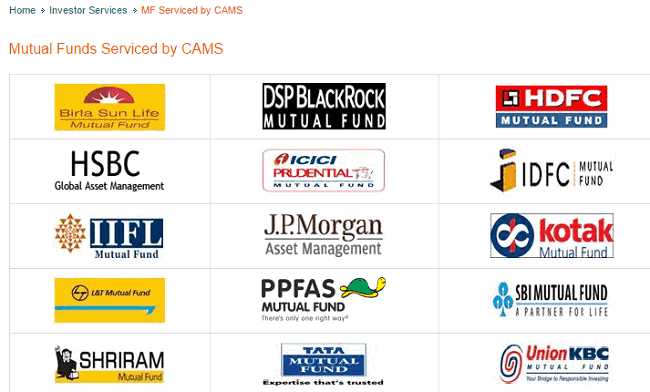

These RTA are the entities that carry out all the clerical work like processing of applications, processing KYC of investors, issuing unit certificates, sending refunds, processing redemption orders etc. So you must have heard about CAMS and Karvy, which are the RTA agencies for mutual funds. So some AMC’s give contract to CAMS and other AMC’s have given it to Karvy. The RTA charges a service fee for the work they do.

So for example, HDFC, Birla, ICICI, SBI are serviced by CAMS, whereas Reliance, UTI, Axis mutual funds have chosen Karvy as their RTA. Note that all the AMC offices also carry out the clerical tasks like if you want to change the address in your mutual funds or add a nominee, you can go to AMC office directly or their RTA

Below is a snapshot of what all mutual fund companies servicing is done at CAMS at the time of writing this article

This completes the high-level structure of mutual funds. There are various other small entities that are sub-parts of these bigger entities but let’s not get into that as of now.

By looking at the above structure you can understand that a lot of care has been taken to design the mutual funds and at various points, the conflict of interest does not arise.

Are you investing in mutual funds?

Mutual Funds are wonderful products and especially for long term goals. You can now start your mutual fund’s journey with Jagoinvestor if are planning to invest in mutual funds.

February 15, 2016

February 15, 2016

CPSE exchange traded fund is in the top of Large cap fund list. Is it good fund? How to invest in this? Is there a special procedure to invest in ETF funds. Can i start SIP in this fund. Please advise.

I have not heard about it

Hello sir,

Gud eve. I am 23 yr old and has just started investing i. Mutual Funds. My current SIP are as follows :

1. Birla Sun Life Frontline Equity Fund

2. DSP Black Rock Balanced Fund

3. Franklin India Prima Fund

What are your views on these funds? Also, I plan to invest for a long term Should I change my portfolio or these is fine?

These are good funds you can keep them and carry on happy imvesting

Hi Sir, Am a regular visitor of your blog and learnt a lot from your articles. I just got a doubt that say the market got crashed today(09-Sep-2016) but my SIP date falls on 25-sep-2016. is it possible to invest during market crash by advancing my next sip which is today(09-sep-2016). Is there any provision like this?

there is nothing like that. If you want to invest after CRASH, you will have to do it manually !

Sir,

Am planning to do SIP in the following funds,

1. Kotak Select Focus Fund(G) – 2000

2. Franklin india smaller companies fund (G) – 2000.

3. DSP BlackRock Micro Cap Fund (G) – 2000

4. ICICI Prudential Value Discovery Fund (G) – 2000

5. Principal Emerging Bluechip Fund -(G) 2000

Please let me know whether i can start with this?.

Thanks!!

Suresh

I think you can choose all except the Principal one .. If you want to invest using our platform (NSE) then you can leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/invest-in-mutual-funds

Hi, very informative article.

I am 28 years old and I am searching for good investment options. I just came to know about peer to peer lending as an emerging platform in India and wanted your views on that.

Hi Asha

You might want to look at Mutual funds as the option to invest. Do let us know if you are interested to invest in mutual funds. Just fill up this and our team will help you http://jagoinvestor.dev.diginnovators.site/solutions/invest-in-mutual-funds

Hello Manish,

I have bought two SIPs as belowback in Jan 2015 for a period of one year only.

1) ICICI Pru Dynamic-G

2) ICICI Pru Value Discovery-G

After completing a year I haven’t extended it but kept amount.

Now after 19 months I have gain of 6% and 7% resp. for both funds.

Please suggest shall I keep the amount or invest it somewhere else( Suggest long term fund for lump sum amount)

Thanks

Keep investing in the same funds !

Hi,

I am 28 year working man, wants to invest on SIP.

Is Reliance Classic Plan II is good plan to invest?

Thanks,

I am not sure if thats the mutual fund at all.

In case you are new to this, my team can help you with setting up everything from start to end. Just fill up http://jagoinvestor.dev.diginnovators.site/start-sip

Hi Manish

I was invest Rs1000/month HDFC Top 200 Fund – Direct Plan – Growth Option fund for three years. Last installment will july, 2016. How can i continue this fund.

YOu just have to extend your SIP , go to the HDFC branch for this

Hi sir I already invested 3 funds.

SBI Blue Chip Fund (G)

SBI Magnum Global Fund (G)

DSP BlackRock Micro Cap Fund – Regular Plan (G)

all in growth option at 2k sip planning to keep for next 10 years …

Is my options are good …please help???

Yea these are good funds ..

Hi Manish.

I am 24 yrs old girl..just started to earning after completion of MBA. but my family is financially dependent on me by holding them i want to invest money…where should i invest as i don’t know much about finance. which best options would u suggest me?

You can take mutual fund route by doing small SIP’s and then gradually increase your contribution. You can have a look at moneycontrol mutual fund page to get an idea about the same. To start with you can get in touch with your bank say SBI and ask them that you want to start SIP.

Since you havent shared your financial planning and because family is dependent on you its bit difficult to suggest you mutual fund product. But you can have a look at following funds that are giving good returns:

1) SBI Blue Chip Fund

2) Mirae Emerging Bluechip Fund

3) Reliance Small Cap Fund

4) SBI Magnum Midcap Fund

You can also choose ELSS (Equity Linked Savings Scheme) to avail tax rebates. And one of the best performing ELSS fund is:

1) Axis Long Term Equity Fund

For more details you can visit Moneycontrol mutual fund page.

http://www.moneycontrol.com/mutual-funds/best-funds/index.html

Hope that helps.

Hi Pooja

I suggest you read following article to get starting knowledge

http://jagoinvestor.dev.diginnovators.site/2012/11/investing-for-newcomer.html

http://jagoinvestor.dev.diginnovators.site/2014/09/the-shortest-guide-for-a-22-yr-old-to-start-investing-his-money.html

Also we can help you to get started with mutual funds if you want. Our team can guide you for everything. If interested, just fill this form

http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

Manish

Hi sir…planning to invest in ELSS

4 funds selected

Axis long term equity

BIRLA TR 96

RELIANCE TAX SAVER

FRANKLIN TAX SHIELD

all in growth option at 3k sip planning to keep for next 10 years …

Is my options are good …please help???

Yea these are all good options !

I want to gift a equity mutual fund to my brother on the occasion of his wedding. What is the minimum amount, which mutual fund to buy. Also suggest if demat account of my brother is required or not.

No , demat is not required.

You can always buy the units on his name and make payment from your accounts (its called 3rd party payment) , but you will have to get your brothers KYC done 🙂 , which means that the gift cant be a surprise one 🙂

Thanks for your response.

Hi Manish,

I am a 26 year old working woman.

Firstly, a big salute for the commendable work you’re doing by educating amateurs like me on the basics of personal finance.

Inspired by you, I now have active RDs and PPF. I have planned to start investing in Mutual funds through SIP. I have shortlisted Axis Long Term Equity for ELSS and ICICI Pru Balanced Adv. Are these good for my first MFs?

Yes Mumtaj, they are good funds ..

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

Manish

Hi Manish,

There is a news published in ‘economic times’ with headlines “Sebi warns mutual funds against bailout of companies ” about mutual funds.What is your opinion on this? Can we expect a fraud in Mutual fund industry in future?Please respond on this.

Below is part from economic times:

“Banks are increasingly refraining from giving fresh loans to companies and promoters who have defaulted on their loan repayment. Many lenders are asking company promoters to sell their assets and repay loans especially after Vijay Mallya’s loan fiasco. With various sourcing of finances drying up, companies are approaching mutual funds for temporary lifelines “

I am not sure how this can lead to fraud ?

Sir I want to invest 10000 taxsaving fund.suggest me 4 or 5 good tax saving fund.similarly suggest me 3 or 4 non tax saving funds. Ihv already invested 10 lakh in MF but I am not satisfied with fund performance

ICICI Tax saver is good option

Hi Manish,

Presently I am investing 20 K in 6 MF. I want to take Jagoinvestor paid service to review the performance of these MF time to time & suggest to switch if required.

Is it possible if yes, how…?

Regards,

Amol

Yes, you can contact us at http://jagoinvestor.dev.diginnovators.site/services/

Sir I want to invest 15000pm out of which 10000 tax saving .please guide me about good funds

ICICI Pru Balanced Advantage Fund is one good option !

Nice blog Manish.

If I wish to start SIP in now what is your views on these MF’s – equity oriented schemes?

1. Large cap – Franklin India Bluechip Fund

2. Large and mid cap – Birla Sun Life Frontline Equity Fund

3. Hybrid equity – HDFC Balanced Fund

4. Mid and small cap – HDFC mid cap

5. Mid and small cap – Franklin India smaller companies fund

6. Mid and small cap – Motilal Oswal MOSt Focused Midcap 30 Fund – Regular Plan

7. Mid and small cap – Mirae Asset Emerging Bluechip Fund – Regular Plan

8. Mid and small cap – ICICI Prudential Value Discovery Fund

All these funds are very good, but then just choose any 2-3 out of these. Not 8 of them

Thanks- so from my list if i have to optimise the list – what would be your pick (any 2) in mid-small cap?

Cant pick any 2 .. all of them are very good funds. Take the first 2

Hi Manish,

I am planning to start sip (1000 rupess monthly) in ICICI Prudential value discovery fund for 8 to 10 years. Is this a good one to invest? Should i choose growth or dividend option?

Its a good one. Choose growth option

Sir i want to sell my house and govenment land value is 1000000

And i will invest money in mutual funds my question is how much tax will i pay for house selling property ?

That will depend on the capital gains which you get