New Fraud by Agents – Changing Policy tenures from “Single Premium” to “Yearly”

Today, I wish to highlight a fraud, which has been going on for many years, but one that has not received enough attention. While the fraud itself is small and easy to conduct, its impact on investor wealth is significant.

What is exactly is the Fraud ?

Many investors, who wish to deposit money in some financial product as a ONE-TIME payment, opt for a ‘Single Premium’ policy. Here they are required to just pay the premium fee once, and the policy carries on for many years after that.

The mistake some investors make, is that they convey these instructions verbally to their agent and do not fill up the form themselves. Neither they do verify the tenure filled by the agent. Now what many unscrupulous agents do, is that instead of ‘Single Premium’, they specify ‘Regular Premium (or yearly) as the payment scheme – leading to a situation where the investor has to pay the same premium amount every year for many years thereafter.

What are the possible problems which happens ?

- The premium amount is quite substantial at times. People can’t afford that sum each year and subsequently have to discontinue the policy

- Investors remain unaware about the tenure of the policy and stay under the assumption that they do not have to pay any more money. However, the policy lapses after a year due to non-payment (If the investor does not have an email id, they do not even get premium reminder emails)

- Even if investors come to know about the changed tenure, they need to run around from pillar to post just to cancel the policy – suffering the consequences of a problem which should never have been theirs to begin with

- This whole experience shatters their faith in agents/ companies and leads them to avoid other agents in the future, even good ones.

- There is a massive emotional impact as investors see this as a breach of trust and at times they lose their hard earned money – funds which thy might have set aside for some dream project!

3 real life examples of how investors were cheated by agents by changing the Tenure

There are several readers on this blog, who shared their real life experience in the comments section on how they were cheated and lost their money and peace of mind. I just want to make you aware of these experiences. Read on below.

Example #1 – How Mr. Syed Jibran cheated by people at HDFC Bank

Through the HDFC bank, I told the concern person to deduct the amount of Rs 200000/= from my saving account and consider as the single premum only, as i cant pay the amount of rs 200000/= every year. But later I come to know that they have consider my premium as the regular premium. Next day I sent the mail to head office, not to process my application and refund the same amount in my saving account.

I got the call from head office, that they cannot process to cancel my application, as they required in written cancellation letter . I agreed with team, but this is not at all my fault. Yesterday, I got a mail mentioning that there are free-look charges. This mail shocked me – even your agent cheats me, but you charges me. I send you many mails not to proceed my case and refund the same amount in my account. you can check that????????????????

Example #2 – How Naresh policies were Lapsed because he was cheated

One of my relative taken policy from Religare insurance broking ltd before 5-6 years ago with kotak-3 lacks, birla-8 & 5 Lacks as one time premium, now they are saying that the policy was regular premium plans and that is lapsed. sir now my relative want his money back.what should he do now.pls help.

Example #3 – How Reliance Life Insurance agents cheated Mr Ashok

We discussed with Reliance Life Insurance , Senior Sales Manager Mr Amit Khandelwal that we need single premium policy , he has taken our signature on application form and advised us not to fill the forms saying that “ form is complicated and likely to be filled wrongly by you consequently form will be rejected , better I will fill up the forms , as discussed , we are doing day in out this. “

Later on , he filled up the forms in his own handwriting, he has given his own home address and the worst thing he did he has filled up regular premium payment of 5,00,00/- for 5 years despite that we decided for single premium.

Return of policies was not possible for us as we have received policies very late , much beyond 15 days free look period , as policies were dispatched to Sr Sales Mgr address.

Even after this Reliance letter , I was keep on getting phones from local Indore office that we are discussing your case with our HO Mumbai , but off-late nothing has happened as yet. It is a clear case of mis-selling , breach of trust, fraud and forgery by Reliance Life Insurance. Reliance Life has terminated policies and Fund value is 50%.

Why is this fraud done by Agents ?

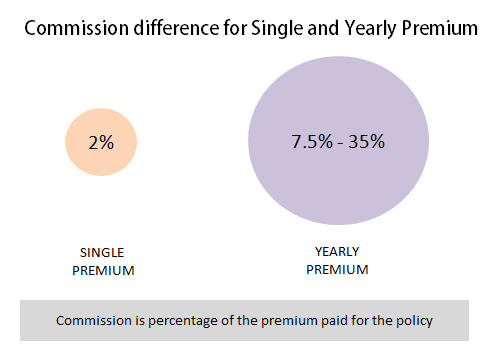

Frankly, it’s just because they earn higher commissions through this ploy. Agents earn meager commissions on “single premium” policies, but on yearly premiums they stand to reap much higher rewards.

For example – For pension plans, the single premium commission is capped at 2% (that too one time only), however if it is a regular premium, the commission would be 7.5% for first year premium and 2% in subsequent years. Which means that if a person buys a pension plan with Rs 1 lac premium, for a Single premium policy, the agent will get 2,000 rupees, whereas if he cheats the customer and puts “regular” as the premium tenure, then he will get 7,500 rupees in first year and 2,000 in next year premium (provided it is paid by the investor).

Also on various other life insurance policies like endowment and moneyback plans, the first year premium is as high as 35-40%. So why would an agent settle for just 2% premium as commission, when he can take 20-40% of the premium (which is 10-20 times original commission)

How to save yourself from this fraud?

Here are some simple common sense tips which will work

- Never ever let the agent fill up the form; you should always fill up the form yourself.

- If you can’t fill the form for some reason, let the agent fill it in front of you, and once he is done, review each point filled by him. Take photocopies of the filled form for your reference

- If you still sense that the agent is being dishonest, return the policy in the free-look up period which is generally 15 days from the date when you receive the policy in your hand

- Email the management and customer care and tell them you will be complaining to banking ombudsman and grievance cell about this and also file a police complaint on fraud.

I invite suggestions from our readers on what solutions are possible if someone becomes a victim of such a fraud?

April 23, 2014

April 23, 2014

Mr Manish, Thanks for giving examples. This will really create awareness among people.

Thanks for your comment Shivakumar

Very nice article. Due to the fraudulent agents , I ensure that I always fill the form myself. If thats not possible , I ask the agent to fill the form , review it and ONLY then sign the form. NEVER before that.

Great ! .. this is the way to go !

True, happened with my Dad, who is a senior citizen (70+) – the agent sold ICICI Pru Elite Pension policy, verbally telling that its a one time premium of 5L.

The Policy docs arrived late – just 2 days before the free look up period would end, the policy asked to pay 5L premium for 3 years – to his surprise!

This was in Aug 2009 & today’s fund value is Rs 4.6 L (even with Sensex booming to 24K), the policy is so rigid that it has just 5 funds to switch/allocate the amount online- all 5 with poor NAVs.

Wish I was aware of this investment way back then & this could have been avoided.

Thanks for reading.

Vyom

Thanks for sharing that Vibhor !

Who fill up the form ?

And lookup period starts from the date when you get the policy in your hand, not from the date of buying the policy !

Manish

The agent filled the form – the biggest mistake! (though the form was attached when the policy arrived).

Yes, I’m aware of the lookup period, the policy arrived very late & it had a date which was just 2 days away.

Thanks.

Hmm yea that was the biggest mistake I guess !

It is always better to write one’s name and Policy No on the back of the cheque/DD one gives to the agent. Otherwise, there is a scope for the agent to use that cheque/DD to pay for others persons policy and pocket the cash given by the other person.

Very Valid point !

Another story I would like to mention here which is similar to above:

One of my friend took a policy with an insurance company. Premium amount is 1 Lakh and policy term is 5 years. He took two policies. On first year he filled the forms and paid 2 lakh in cheque. The agent collected the money and the policy is delivered. He told my friend that he will come to his home every year and will collect the premium and will give the receipt for the same. On 2nd year, he collected the premium amount of 2 lakh cheque for renewal and he hasn’t back with receipt. The amount is debited in his bank with the name of an insurance company. So my friend hasn’t worried much. When he called the agent, he said he is very sick and he went to his native and will be back soon and will handover the receipt. days pass by. After a month, my friend called the agent again but this time his mobile is switched off. He went to the insurance company branch and asked for the receipt. That time only he found that the cheque he gave to agent has not been used for the policy renewal. Instead it has been used to buy 2 new policies. The old policies are lapsed already.

Thank u sir for enlighten us..

Buying a policy has a mess now a days…Not worth it, at of the day i unless for saving tax..Normally for all my Medical and Kids plan i go online and do it..Instant receipt and confirmation.

Thanks for sharing that incident Sri !

Dear Frnds,

Needed some enlightenment here..

Had taken a LIC Jeevan Anand Policy from a know LIC agent last year. Old LIC product, so though nothing could go wrong with it.

Its a 20 year policy with 1 lac annual premium. He has divided it into 20 individual policies with different policy numbers. With 1st year policy maturing in 21st year and so on. I did not understand why he did it but he said its for better returns.!!

Normally i understand buying a single policy and paying regular annual premium over the policy term but this one is a bit complicated.

Kind advise what am i missing here?? Agent getting better commission every year.?

Regds

Jay.

Manish Ji..Kindly advise on above??

He did this for one reason that it looks more attractive to customers . You will start getting yearly income that way . A policy will mature in 2030 , you get money .. then in 2031 , you get money .. etc etc ..

So its a structure which gives you yearly income like pension

I am not sure if he will get a better commission here ~

Dear Sir,

Firstly, I would like to say Thanks for your valuable articles.

I would like to add something regarding this article.

All this kind of frauds will be done by corporate agents and agents of private insurance companys (Many of my friends are victims of corporate agents and I have different types of examples like selling one product and explaining a different product initially, etc. ). In your article, you mentioned as Agents. I feel that you cannot use the term “Agents”, instead you have to mention “some agents” or “some corporate agents”. Your article heading damages the image of all Agents. This is because usually you will circulate your articles with titles and links. Most of the people just see the title and try to understand/conclude from the title itself instead of reading the entire article.

In case of corporate agents and agents from private companys, there is no long lasting relationship between the customer and agent. Their relationship is on the fly and there will be no follow up from the agents most of the cases (more than 90% of such agents will not do any follow up). So these kind of agents wants to earn as much as possible.

I took my first policy from one of LIC agent more than 14 years back and he is regularly in touch with me. In these years I took multiple policies and I never have any bad experience. The same case with many clients who took policies from him. I use to hear the same thing about agents from LIC. I never heard any wrong commitments from LIC agents.

You cannot treat all agents as same kind. I can understand that it is not your intention, but I suggest to change the title to convey the correct information.

Hi Rajendra

Thanks for sharing your views . .you are really lucky to have a great agent. However there are many LIC agents whose horror stories you will find in this same blog at various places .

Also when I say “agents” – surely it does not mean “every agent” in the same way “politicians are corrupt” means “some politicians are corrupt” .. But here maximum agents are not honest as per my experience with readers.

Manish

Most of the fraud is being done by LIC agents only since its the largest Insurer in the country and sells more policies than any other private Insurer. Since LIC enjoys the trust and faith of the people of India, its that much easier to carry out these fraud by the agents.

Why should Manish sugarcoat the reality of what’s happening just because you happen to have a good agent? I wouldn’t even say your agent is anything special. Most agents keep in touch and collect premiums yearly so that they can sell more policies to you in future and also ensure the commission flow is not abrupted.

My father also thought his agent was ‘great’ until the day came when he chose to surrender one of his many policies recently. He was initially refused outright and then given the real run around. That’s when you realize how ‘great’ your agent is and this is an agent with whom we share a 30 year long relationship. The same agent also tried his level best to dissuade my father from buying LIC’s term Insurance saying all sorts of nonsense. He kept suggesting LIC’s Money Back Plan instead!!

Fair point !

sir,

what do you mean by multiple policies?

I am real Victim of M/S Birla Sunlife Insurance Company,Jorhat Branch, Assam. Two polices were made with yearly premiums on 2010 and 2011. Agent use to collect cheques yearly 2012. But after that agent stopped collecting premiums. But on enquiry with my passbook and Bank, I have seen electronic deduction of Different premiums( Higher Amount) and on quarterly basis are made without my knowledge and authority. I asked Bank official, they let me understand that they cannot stop the premium deduction, unless Birla sunlife insurance ask them. I have written to their head office. To my surprise they let me know earlier two polices were lapsed and new polices were made with high quarterly premium. They said I have signed for the New policies and electronic deduction from my account. In fact that was total fraud, as I have never received any New policy nor I am aware of such policy.

For last one year I have written to Birla sunlife and even IRDA a large no of complains . They are asking me to renew the earlier two policies with big amount of consolidated premiums and they are silent about how the New policies were made without my knowledge.

I am cheated , can any body help me in this regard ?

You need to move to consumer forum now …

@Jyotsna – I have a Financial Services co based out of Guwahati, Assam. I am myself from Jorhat, Assam though I am based in Bangalore. Write to me, I will try and see how we can help you.

Exellent article and experiences from public.Thanks.

Thanks

Dear Manish,

Very good eye opening article. I never ever heard this type of fraud!

My wife is an LIC agent and what we do is fill-up the application form, send / show to customer for their review for each & every details and once they say it is ok, we submit it to LIC office for further processing. Customers really gets amazed when we do this. Many customer share their earlier experience that they never came across with such approach. It’s agent’s moral responsibility to give each & every details correctly.

Many customers also amazed and shared their experience about non-medical ploicy. What happens, when a policy is non-medical, agents need to mention weight & height, chest & abdomen measurements in the proposal form itself. Many agents don’t measure it actually but write down these details based on customer’s body. One should not allow agent to do so and must insist on taking correct weight & measurement details. At least, we do take correct measurements.

As I know, LIC have now started enclosing a copy of the proposal form along with policy document. Customers should go through it once received. If they don’t, they must insist through written application.

Thanks again for this info.

Regards,

Ashvin

Yes, one has to review it for sure !

another suggestion is that inspite of all the emails, branch visits or phone calls, if the life insurance company doesnt honour your request, you can write to “Pehredaar” programme on cnbc awaaz channel or write to moneylife magazine; these 2 forums are doing the work of providing adequate justice to the sufferers due to misselling

Infact this is an extremely common way of misselling being used by insurance advisors since many years now; few companies have launched the system of welcome calling to the customer before submitting the form in their branch to avoid such misselling and customer service issues in the future. One way to stop getting duped by such practices is to fill the form oneself. Such practices of asking the advisor to fill the form leading to problems also happen in case of home loans, personal loans, credit cards etc and not just restricted to life insurance

Thanks for sharing that point !

In my case, I have followed recommendation suggested in the article. Same thing was told me that pls sign the blank application form and later they would fill it. They exactly told the same thing that if we fill it up, there could be some mistakes and the it might get rejected.

I refused and told them to fill up the form and bring it to my signature. When the filled form was brought to me, I almost took a day to review the details and ensure everything is right and signed the doc. Although the taken ULIP underperformed, I did not have any issue of miscommunication or agent fraud.

Another thing I noticed with HDFCLife Insurance is that your filled & signed application is scanned to be made part of the Policy document. When you recv the policy doc, you can actually view your signed application form which I felt bit transparent .

Thanks for sharing that point . you did 100% right thing ! .. great !

I have also experienced the same with Bajaj Allianz ,my father who was retired want to invest 2 Lac money in a single premium policy , but the agent sell him a regular premium policy, which he came to know after a completion of one year when he get a shocking call from Bajaj Allianz to pay next premium.My father who was retired won’t be able to pay the same amount and the agent is also left the Job Bajaj Allianz also raised hand. Although he has complained the matter to various official but no one is listen his pain for loosing the hardcore income of his entire life. My father is decided to close the policy and he get the final refund amount 1.22 Lac . We have loosed 78000 in a year.

sad to hear that .. Yes – its a cheating from agent, but I am not sure how do you prove that you didnt knew that its a REGULAR premium plan, In the court of law, everything depends on the PROOF . You should have read the policy document once it came to you !

I fully agree to a comment made above that it is “team game plan” and obviously individuals are soft targets for them. But the question is why one should be a soft target ? Simply because we trust them blindly ?.

Following are some suggestions, for like we say “prevention is better than cure” :

> Do not just by policy from an agent who has approached you on his own through somebody like your old friend or distant relatives, saying that pl. buy a policy from me so that I would be able to achieve my yearly target.

> Always remember that, buying a policy is your need and can not be somebody else’s whom you do not know.

> When you receive a policy original document, do not just file it, but give some time and take some pains to go through in detail for what was assured verbally by an agent at proposal stage.

> If you have a slightest doubt that verbal assurances are not fulfilled in policy document in ‘Black on White’, first and foremost important thing to do is, do not discuss your doubts/questions on phone, but send an e-mail and preserve all such communication.

> Seeing your e-mails, if an agent/customer care center tries to call you and explain then listen, but do not accept their verbal explanations immediately. At the end of the call, always tell them silently that they should put all this communication on record by sending you a reply mail referring to your original query mail.

> If the agent or a company is dishonest, you would never receive a reply in writing. Then send them reminder only once.

> General experience is, you will not receive a reply mail, because no cheater would like to put their false & hollow explanations on record by writing you an e-mail.

> In such a case never call for follow-up. Because if you call, they will try to convince you for a solution which would cost you huge amount of money and you may agree to settle the case to get out of it.

> Without calling them, lodge your written complaint to banking ombudsman or authorized customer grievance bench with a copy to an agent / insurance company.

> If you take immediate above step, then and then only the case will be settled in respectable manner OR remember that it is their “team game plan”.

Great points .. everyone should read these points !

yes, every word is true.

I want to ask a question regarding the free look period .Does the free look period start when we get the policy documents in our hands, or does it start when it has been dispatched by the insurance company?

Starts when you get the policy in hand !

Thanks for your reply!

yes, date of receipt of your policy bond by courier or speed post.

kindly note that 15 days only, NOT working days.

in one case the courier itself delayed by 5 working days.

another case the life co. closed on sat, sun and monday on pongal/ dushara etc. holidays.

in such, kindly call the help line immediately.

3. in one case customer returned the policy by courier which excceded the above 15 days.

these are all from my old memory.

i do not know what really happened.

thanks

Better talk to company only through RTI now !

thanks manish … this is new for me ..thanks for sharing this information .

Welcome .. now share it with more people !

I have taken TATA AIA -MAHA LIFE GOLD policy three years back. my age now 48 years. I have taken it online, just 3 days before leaving abroad(for employment). The online agent told me that the policy period is 10 years. I received the document after two months (In India).

I came back India and gone through the policy document . This is after three years and noticed the premium payment term. it is 15 years. As per my age, i have to pay premium even after retirement. I am facing a strange situation, is difficult for me. I understand that it is also one kind of fraud.

Please advice me what to do about this policy ?.Should I cancel or continue.

In case, if I cancel the policy, beneficial for me ??.

There is an alternate option called making the plan “paid-up”. In this case, one would not need to make additional premium payments. However, there would be a reduction in the amount of sum assured. It would be a ratio of the number of premiums paid to the total number of premiums multiplied by the original sum assured.

IMO, cancelling a policy would not be beneficial as the amount that would be paid back would be a fraction of premiums paid excluding the 1st year premium. You can check if the insurer provides such an option.

But Bhargav, one can do that only after 3 yrs of payment , a lot of people cant even make 3 yrs payment because the amount if quite high !

Thank you Mr.Bhargav for your advice.

hi manish,

it was really nice and informative blog. but apart this some shocking news more. it’s done by not only agent, it’s complete team game.

for this i want to talk to you over the phone for sharing my won experience.

rahul agrawal

Hi Rahul

Can you share your experience here ? I am into few things these days which take all my time, if possible can you write your experience here ?

Well nothing surprises me anymore, this is India afterall, the land of frauds and scams. People here will do anything to make a quick buck and agents are the worst of the lot. This is why I have vowed not to buy an LIC policy until the day they allow us to buy policies directly without agents.

The only reason agents have the audacity to carry out such frauds is because there seems to be little consequence and the rewards are high. How many people pursue their case in court and are willing to sue the agents?

But to be honest, I find it hard to believe that there are people who just pay a huge chunk of money in order to buy a single premium policy and never even look at the policy document once. A cursory look at the Sum Assured amount would be enough to raise the red flag as a policy with Rs.2 lac yearly premium would have an abnormally high Sum Assured. The first page of the policy document itself contains all the relevant details.

If anyone is putting that much faith in an agent, they probably deserve to get cheated. At the end of the day, its your hard earned money right? You can’t just give some stranger a bag full of cash and your signature on a blank form and expect him to do what’s best for you rather than himself.

Well said. Everyone can check the policy at least once.

I echo your thoughts . Well said !