What is EPS Scheme Certificate? (this is related to EPF pension)

Do you know that, when your employer contributes to EPF then a larger portion of it goes to EPS (Employee Pension Scheme)? In this article, I will elaborate to you what is EPS, how it works and also the process of getting its certificate to claim your pension.

What is the EPS scheme?

EPS i.e. Employee’s Pension Scheme is actually part of EPF itself, which means it is applicable for all the employees who are contributing towards EPF. This scheme offers a guaranteed and secured pension to the employee after retirement. A nominee can also get the benefit of pension under this scheme after the death of the employee.

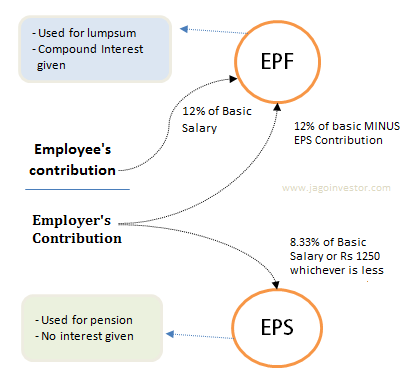

Both employee and the employer contribute equally i.e. 12% of employee’s monthly salary towards employees EPF. However, the 12% which the employer provides, out of that 8.33% goes towards EPS and only remaining 3.67% goes to your EPF.

Features of EPS:

- The minimum pension amount that you get is Rs.1000 per month.

- The employee can avail of the pension benefit after retirement or once he attains 58 years of his age.

- The employee can defer his EPS up to the age of 60. In this case, he will get an increase of 4% on his EPS balance for every deferred year.

- Widow/ widower and children (up to 25 years of age) of the deceased employee will also get the benefit of this pension scheme.

- In case the widow/ widower opts for remarriage then, only the children will receive the pension until they attain the age of 25 years.

- If the child is disabled then, he is eligible to receive the pension for his entire life.

- To claim your pension you need to get the EPS certificate from EPFO.

Who can get EPS certificate?

Every employee who has been registered under EPFO can get EPS certificate for claiming his pension. The EPS balance can be either withdrawn after retirement or it can be claimed as pension by opting EPS certificate depending on the tenure of service and the age of the member. So, to elaborate this, I have given some examples below (The length of the service is rounded off to one year if the number of months served is more than 6)

-

- A person working for 9 yrs. and 6 months (will be considered as 10 yrs.) but less than the age of 58yrs can either apply for the scheme certificate or can withdraw the money from EPS.

- A person who has attained the age of 58 yrs. but has completed only 7 yrs. of service then he can either apply for a scheme certificate or can also withdraw.

- A person who has done more than 10 years of service has to apply for a scheme certificate. He cannot withdraw money from the EPS account.

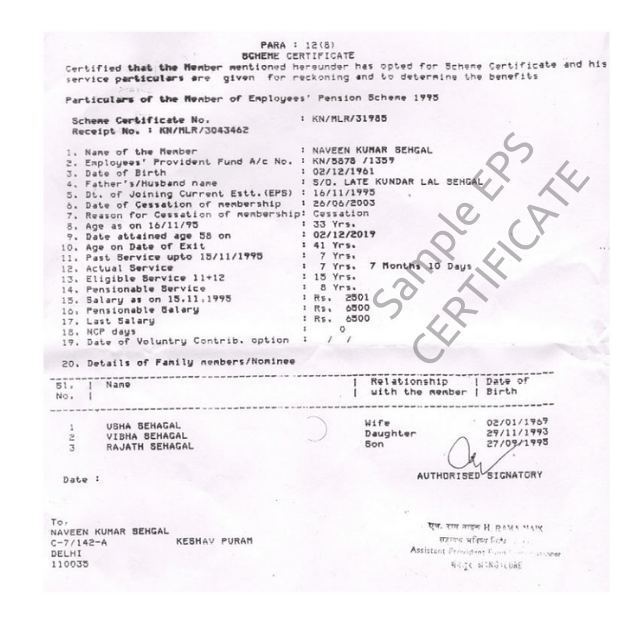

What is EPS Certificate?

EPS Certificate is a certificate issued by the Employees Provident Fund Organization (EPFO), Ministry of Labour, and Government of India, stating the details of service of the Provident Fund member. The EPS Scheme Certificate shows the service details of the employee, i.e. the number of years he has served and the family details of an employee, i.e. the member of the family who is eligible to get a pension in case of death of the member. As the EPS Scheme Certificate has all the details regarding the service of a member of EPFO, it serves as an authentic record of service.

This is how EPS Certificate looks like:

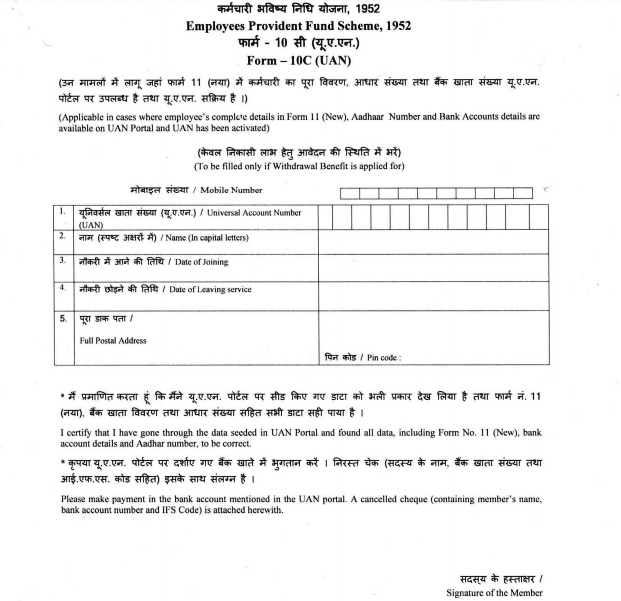

How to apply for EPS Scheme Certificate?

Once you are leaving the job, then you have to fill the Form 10C. In the form 10C, there are options either to withdraw EPS or apply for EPS Scheme Certificate. Once you chose the options to issue EPS Scheme Certificate, then your employer sends the same to EPFO and then EPFO will issue you an EPS Scheme Certificate. If your all inputs are correct, then EPFO will issue you the EPS Scheme Certificate within a month or so.

This is how Form 10C looks like:

I hope this article has helped you in understanding every detail about EPS and its certificate. Let me know if you have any queries or doubts in the comment section.

June 24, 2019

June 24, 2019

I have my Old employer’s Scheme certificate . Now I am working in second firm since last 18 years.

Now how to apply for pension, because that time there was no any UAN Numbers. How to merge both services now on UAN. Previous company is also not in operation now.

Have you retired already ?

I have my Old employer’s Scheme certificate . Now I am working in second firm since last 18 years.

Now how to apply for pension, because that time there was no any UAN Numbers. How to merge both services now on UAN. Previous company is also not in operation now.

I have my Old PF Pension certificate from RPFO Karnal before 1998 Now I am retiring at the age of 58 years. I have also worked in second company from 1997 to till date

Now I how to apply for pension, because that time there was no any UAN Numbers. How to I check my pension scheme sertificate from old RPFC Karanl

I worked in A company from 1991 to 2012 and I joined B company and worked there from 2012 to 2019 and joined C company in 2019 and worked there till Nov 2020. I have scheme certificate of A company , but do not have scheme certificate of B and C company. Moreover I have not rendered scheme certificate of A company anywhere. Now I am in the age of 52 years. I want to avail pension facility now. What should I do?

You shall now apply for the scheme certificate from compnay B&C now

Hi Sir,

I have worked in 2 different firms over the span of almost 6 years. I’m almost 30 now. I wanted to withdraw my EPF amount for studies. Can I do that yet and how long will be the process.

Looking forward to the response.

Yes, you only withdraw it after 7 yrs of service .. Shall take few weeks or a month to do all process if your documentation and setup is there!

Manish

Hi Sir

Thanks for the informative article. I completed 11 years of service with my previous employer and now not contributing any PF. I can get EPS certificate by applying online that is understood. Can you please suggest if I can contribute to pension fund EPS only or else can I connect/transfer the EPS amount to my existing NPS account because the overall EPS amount is very less and I want my pension amount to be increased while I attain age of 58 years.

I dont think its possible. Whatever is there in EPS will have to be taken !

Hi Sir

To begin with this is a wonderful article. Thank you for posting it. I needed some guidance from you regarding the process of applying for my father’s pension online.

My father worked in a firm from 1987 to 2000 (13 years) and the company was shut down in 2000. the PF was withdrawn then. Later in 2001 they resumed their operation again and my father rejoined them in 2001 and worked there till 2019. (18 years). Hence his total service becomes (13+18=31 years). However the service period available in his epfo account is only from 2001 to 2019. So in such a scenario can I apply for 31 years of service in form 10 D for monthly pension or first get the employer to correct the employment period online and then proceed with 10 D application?

PN: The establishment number of the employer has not changed however i think my fathers member ID has changed.

Looks like the change in member id is the issue. You will have to apply for both the EPS pension scheme certificate and give it both to get the full pension, but its surely going to be a very frustrating task to get it done given the govt office functioning!

Use RTI as a tool in your overall journey. Best of luck

Manish

After 11 years of service, I left the company and again going to join the same company after 1 and half year. PF withdrawn. Do I need to apply scheme certificate online and submit to same company?

This is tricky 🙂

In general when you leave a company, you need to do that.. so even in this case I suggest you do it

I have just submitted the form 10(C) for scheme certificate..and after submitting the form I found that I had entered the wrong address. What should I do now?

You shall contact EPFO department itself on this and ask them for correction

Hi,

Great article. Pl advice on my case.

I have total 12.6 yrs of work experience ( 9.3 yrs with a PSU and 3.3 yrs with an IT Limited company) and age 36yrs . I am unemployed from past two months and moving abroad in next two months.

What should I do with my Pension Fund? Since my experience is more than 9.6yrs, I cannot withdraw Pension fund. How scheme certificate will be useful for me as I am going abroad?

Please advice,

Regards

It will be useful in future not right away. Its a record of employment for future pension purpose. Dont skip it .. do it

Hi,

Thanks for the article. could you inform, by which mode EPFO will share the scheme certificate (Hard copy by courier or what mode) & what is the expected timeline to get the certificate from the date of 10C form submission.

Not sure of the mode though

Dear Sir,

I have resigned and obtained my PF certificate during 2009 with 13 years of service.

Later from 2012 onwards I am working till now…. How to attach the PF certificate that I am having with this UAN number?

My existing employer is unable to help!

Sir,

How long does it take for the verification of the SC , as submitted to the current PF Office. Secondly any way to know the status of the same by the employee itself

I guess there is no way to directly find it out!

My original family pension certificate submitted along with Form 10C was lost by EPF office but I am asked to send application with affidavit of loss of the same. Please send me the format of this affidavit.

We dont have it .. please check that with EPF department itself

Hello there, thanks for the wonderful article, mostly we don’t find the EPS information this much clearly anywhere online. I have a quick question, any assistance will be much appreciated and I’m grateful.

I created three UAN for three different companies. I was not aware that time that I can submit and maintain the same UAN account. I transferred company 1 to company 2 & then company 2 to company 3. Now it the consolidated PF amount is reflecting in current company passbook. But EPS amount didn’t get transferred.

Now my question is, Can I get EPS scheme certificate from first two companies, please let me know how can I apply for it.

Note: Service history is not getting updated if we transfer the PF amount & I have sent email to EPFO for merging & deactivate the duplicate UAN but its been more than one month, no reply from them. Please assist. Thanks in advance.

If you have transferred it to new company properly then you can get EPS certificate from the last company itself.

Hi there, I have the exact same problem. My last company was a startup and is closed now.I worked there for 6 months.

I have transferred the PF amount to my new UAN but pension amount is not transferred.

Please suggest how can I get the EPS certificate or withdraw that EPS amount.

Thanks

EPS certificate you can get once you complete 10 yrs of service

Dear Sir,

I worked with a Chennai based company and left the job in 2004 and withdrawn my entire P/F amount. I also did receive a scheme certificate which I could not submit to any organization afterwards. Kindly note, from the company I received my SCHEME CERTIFICATE closed down their operation way back in 2005/ 2006. I did have the scheme certificate with me and this july2021, I shall attain the age of 58 years. That time, there was no provision for UAN which I received from my last employer. Now, I have some enquires :-

1. How can I submit my scheme certificate.

2. As their is no existence of the company, how do I claim it online and for doing so- what is the attestation process ?

3. Is it necessary to get it attested by my local BANK MANAGER in case of online claim & what is the process ?

4. I am also eligible for P/F from my last company(Kolkata) which I can claim online I suppose. What is the process ?

5. Can I add my Scheme certificate with my UAN and claim my pension against the scheme certificate or claim the whole amount along with the present claimable PF ?

6. In a nutshell, I want to claim the overall claimable amount online through my UAN .

I tried to explain everything in details, please go through it and ADVISE me the whole process as I am in deep financial crisis due to unemployment happened due to covid and its APRIL already as I mention above, I shall be 58 this JULY 2021.

Thanking you and soliciting and immediate guidance from you so that I can do what is required from my end ASAP.

Truly speaking its a complex thing. You will get proper answer from EPFO only. I suggest filing a RTI and asking your queries

Dear Sir,

First of all my sincere thanks for such a wonderful article.

I did 3.75 years job in one company and 11.6 years in other company in India. I have already applied for PF withdrawal and for Pension my last employer asked me to apply for Scheme Certificate. But since now I am migrating to other country so in that case can I apply for Pension withdrawal ? Or I have to apply for scheme certificate only ?

Pension Scheme has to be applied as of now. You will be able to get the pension later in life when you will have to provide that pension scheme certificate.

Manish

Hi,

i have worked in 1 organization for 1 year and for 7.5 years in 2 organization. there is 1 year gap between two services. so my total service period is 8.5 year. 1 Year gap will be counted in total service period? Can i withdraw my EPS amount?

No, it wont be counted. It will be 8.5 yrs only!

I am 61 years old working for private company. I contributed for EPS 95 for 16 years now when i apply 10D form portal is asking for scheme certificate number. From where i will get the scheme certificate number.

As you are already 61, you should now be getting the pension .. for that apply to EPF department !

Hi,

I worked for 15+ years and got the entire PF transferred to a new job (organization). Do I have to still get a scheme certificate? Now I am retiring and going to apply for a pension.

You need EPS certificate if you are going not be in employment. IF you are directly applying, then I don’t think its needed

AN EMPLOYEE COMPLETE SUPERANNUATION SERVICE PERIODS IN ONLY ONE ESTABLISHMENT OF TWENTY YEARS SERVICE CONTINEOUSLY. AFTER 58 YEARS HE APPLY MONTHLY PENSION FORM 10D ONLINE APPLY. BUT ONLINE APPLY PORTAL SHOWS THAT SCHEME CERTIFICATE NO NEED. BUT WHY NEED SCHEME CERTIFICATE NO????? EMPLOYEE COMPLETE TWENTY YEARS SERVICE CONTINEOUSLY IN ONLY ONE ESTABLISHMENT.

Its for someone who didnt continue employment till 58 yrs and left in between!

Hello Sir,

Thanks for the amazing article. I switched my job about 14 years ago after 21 years of service with my previous employer. I recently started receiving my pension but it does not include the amount of the initial 21 years. Please tell me what I can do in this case.

Did you transfer your EPF/EPS properly?

Enquire about it using RTI !