How many Mutual Funds you should have ?

Investment in how many mutual funds is enough? Though it depends on individual needs and situation, we can always arrive at a number or a range which should be optimal for a large chunk of mutual funds investors. Many a times Investors invest in a large number of mutual funds which does not add any additional value to their portfolio most. They have to understand that investing in every new mutual fund coming into the market will not help them in any ways because after a point they have their investment in most of the companies in stock market. In this article lets see how many mutual funds a common man should invest in general.

Reason we buy mutual funds

Before moving forward, let’s understand why do we buy Mutual funds at the first place? We sometimes neglect the basic reason to invest in mutual funds, the reason is very simple:

We invest in Mutual Fund because we have money to invest but we dont have the expertise to invest in Stock Market. We do not want to spend time to manage the investments directly in different stocks and we want to make sure that we diversify our investment across a number of different companies.

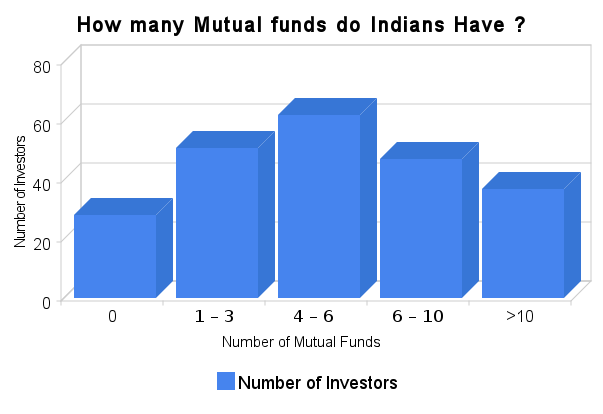

Statistics on Number of Mutual funds in a portfolio

I conducted a Poll on this topic and we have some interesting results .

Facts

Facts

- 63% people invested in less than 6 Mutual funds

- 84% people invested in less than 10 mutual funds

- 50% people invested in 1-6 mutual funds

- The maximum number of investors were in the optimal range of 4-6 .

- Total Vote : 225

- Average number of Mutual funds : 5.57

If you look closely the graph results mimic binomial distribtution (Ignore this if you don’t understand), which shows that law of numbers apply even to this phenomenon and somewhere the average number of mutual fund converges to the most logical number by default .

Why it does not add much value when you invest in more mutual funds?

Each mutual fund on an average invest in at least 50-60 companies. If you buy 3-4 mutual funds then you are anyways going to invest in close to 100 companies overall (considering there will be some overlaps). So If you buy any equity diversified mutual funds, your money is going to be invested in some of the best companies probably 50-100 of them. Now when you buy another Equity diversified mutual fund there are high chances that the money is going to be invested in almost same set of companies in some proportion, so you are going to invest in same set of companies again. Buying 2nd mutual fund of same category will obviously increase your reach to some companies which were not part of the 1st mutual fund. But now as and when you add 3rd, 4th or 5th mutual fund, you will actually be invested indirectly to same set of companies. The price movement of these companies share prices will be same for all the mutual funds (most probably).

[ad#big-banner]

So what you have to understand is that after a certain point, adding more mutual funds of the same category is of no much value for the portfolio. Adding more number of mutual funds leads to another problem which is tracking problem if you are a kind of investor who buys a mutual funds and just looks at the NAV to find out if you are in profit or loss then you are not doing right thing. Mutual funds investing is very much close to Share investing where you track the instrument, see how it’s performing, what’s going inside the fund, how is fund manager doing, how are they churning the portfolio etc etc. So if you have too many mutual funds in your portfolio, it will be too tough to track them and your portfolio will be very cluttered.

You have to understand that investment of 1 lac in 20 mutual fund will roughly behave in the same way as investment in 5 mutual funds because finally the investment has happened in shares of top companies (roughly the same number of shares), so the investment value is result of the underlying share prices movement and not the number of mutual funds in the portfolio.

Thumb rules:

You can ask two basic questions to yourself to find out if your portfolio size is too big for yourself:

- Can you name all the mutual funds in your portfolio and a 2-3 line explanation about what the fund does?

- Can you guess roughly how does the movement in stock market affect your corpus in general? If stock market is going to drop or increase by X%, so you have a rough idea of what will happen to your portfolio at a high level?

Example of a Portfolio of Mutual funds

Let’s create a sample portfolio of mutual funds. We will consider ETF’s as a mutual funds for this example:

- 2-3 Equity diversified Mutual Fund (Tax + Non-Tax saving): See the List

- 1-2 Debt Fund: See the List

- 1-2 ETF’s or Index Funds

Note that 2-3 Equity Diversified Mutual funds will cover almost all the big companies in your portfolio. Some ETF or index fund will give index level exposure and make sure you invest in top companies. Debt funds will add exposure to Debt part and no-correlation with Equity.

Most of the people do not invest in the same old fund they have bought, they feel that buying every other mutual funds in market will some way help them earn extra returns which is far from truth. Consistency in investment and faith in one of the good funds you have chosen is the right way to invest in mutual fund.

How having more than one Mutual fund in portfolio reduces the risk?

You have to understand the concept of standard deviation, it’s nothing but risk and return potential from mutual funds point of view. So a single mutual fund has the highest standard deviation and the risk and return can be very high. Adding more funds will help in reducing the standard deviation of the portfolio. As per Morning Star Research (Many thanks to Hemant Beniwal for sharing this)

After 4 funds, the effect of adding another fund diminished. It’s still noticeable, but not so dramatic. After 7 funds, things have mostly leveled out and after 10 funds, a portfolio’s standard deviation stays nearly the same regardless of how many funds you add. Thus, once you own between 7 and 10 funds, there may be no need for more. In fact, the more funds you own, the more likely you are to own at least a couple that do practically the same thing. That could be a drag on your returns because if you have multiple funds doing the same thing, one is likely to be better than the others. Focus on the superior fund and you’ll get better returns .

How do you Buy Mutual Funds? [POLL]

Comments, Please comment on what do you think is the optimal number of mutual funds?

February 24, 2010

February 24, 2010

Hi,

I have the following MFs in my profile:

1. Birla sun life frontline fund -G

2. SBI blue chip fund-G

Both as 1500/- SIP per month (each).

I have low risk apetite.\

Am I on the right path?

Its surely not for someone how has LOW RISK APPETITE.

The funds are equity funds and their movement will be quite choppy ! . Are you ok with that ?

Dear Manish,

I have query on below protfolio

5K Axis Long Term Equity Fund

1.5K birla sunlife frontline equity largecap

1K HDFC Balanced Fund

1.5K ICICI PruValue Discovery Fund

2K HDFC Mid-Cap Opportunities Fund

Q1 Is portfoilio too large?

Q2 Is portfolio diversified? I am moderate risk taker and in late 20’s

The portfolio is fine …

I would have just chosen 2 funds .. why 5 funds ?

I have choosen 5 to diversify the investment. Is it too large portfolio?

Not too large, but 5 is worst case..

Hi Manish,

I am 27 yr old and have just started earning. I have moderate risk profile.

Would like your inputs on my portfolio

1. DSP BlackRock Micro Cap Fund 1.5k

2. Franklin (I) Smaller Cos (G) 1.5k

3. ICICI PruValue Discovery Fund 1.5k

4. birla sunlife frontline equity 1.5k

5. Birla Sun Life Tax Relief 96 5K

Q1 IS portfolio ok?

Q2 Should i trim down my portfolio?

Looks good to me . A bit on midcap side, but thats ok if you are fine with high volatility

Nice article. I as a minimalist i prefer simple portfolio. So I chose Franklin India Bluechip fund and I am doing SIP and occasional lump sum. Returns are good and I believe risk is small because of Bluechip. What I am doing is correct or should I be adding more funds?

Thank you

Equity is always risky (volatile) but safe in long term.. Keep going .. you are on right path

Thank you

hi Mr. Manish,Personally I am thankful to you for providing your ideas in the world for investors.

I have one query.

My portfolio consists of

1. UTI equity growth direct rs 3000/- per month

2. HDFC balanced fund Growth direct 3000/ month

3. Axis long term equity (tax saver) growth direct 5000/month

4. BSL tax releif 96………. 5000/month

My time span is not less than 10 yr and i am 37 yr old.

also I am a tax payer and my wife is also indpt haing good govt job.

Please comment on my portfolio and also suggest for my wife’s investment

to save tax I want to go for MF such as frak. tempolon tax shield and one other and other two pure equity fund total 20000/month in her name. We dont want to put money in Pf of FD these days due to very pow return. please suggest. We can take risk high/moderately..

Your portfolio looks good anyways .. you should just continue it !

Thanks a lot.

Hi Manish

I have been investing per month in below mutual funds:

Axis Long Term Equity Fund –

Growth Rs.3000

Axis Mid Cap Fund – Growth Rs. 1000

Birla Sun Life MNC Fund – Growth-

Regular Plan Rs. 2000

DSP BlackRock Micro Cap Fund –

Regular Plan – Growth Rs 1000

DSP BlackRock Top 100 Equity Fund

– Regular Plan – Growth Rs 1000 stopped now invested for 5years

Franklin India BLUECHIP FUND –

GROWTH Rs 1000

HDFC Top 200 Fund – Regular Plan

– Growth Rs. 1000

ICICI Prudential Focused Bluechip

Equity Fund – Growth Rs 1000

IDFC Premier Equity Fund-Growth-

(Regular Plan) Rs 2000

RELIANCE SMALL CAP FUND –

GROWTH PLAN GROWTH OPTION Rs 2000

SBI Emerging Businesses Fund –

Regular Plan – Growth Rs 1000

Please suggest if I continue investing in these funds or do in need to make modifications in this.

Thanks for your valuable reply.

Regards,

Rahul

Hi Rahul

These are too many funds .. I suggest building a totally new portfolio

Dear Manish,

Please suggest on the proposed plan.

Planning to redeem existing sip’s and invest them in below funds as lumpsum investment.

NEW FUND INVESTMENT Amount

1 Franklin Temp shield fund 85000

2 axis long term equity fund 85000

3 birla tax relief 96 fund 85000

4 idbi wealth assurance fund 99000

5 tata india fund 85000

6 dsp sheild fund 85000

Also looking for sip investment in these funds for regular monthly investment.

Sip Investment

1 Sbi blue chip fund 3200

2 Tata Balanced Fund 3200

3 Hdfc prudence fund 3200

4 icici valve discovery fund 3200

5 birla sunlife equity fund 3200

Thanks for your valuable reply

Regards,

Rahul

Looks good to me .

However dont you want a more crisp portfolio ? Why 5 funds ?

Hi Manish,

Thanks for prompt reply.

Request your guidance on how many funds I should go ahead.

Also which will be the best from these or any better funds you suggest.

Regards,

Rahul

I think 2-3 is the max you should go with . Do you need our teams support in documentation and overall help ? Just fill this form incase you are willing to invest in mutual funds with Jagoinvestor ?

http://www.jagoinvestor.com/pro#schedule-call

[…] finance blogger, JagoInvestor:How many Mutual Funds you should have ? ( Feb 2010) suggests following […]

I have started an SIP of Rs. 3500 since last month and planning to increase it up to 10,000 within next month. i am looking at long term aspect i.e at least 5 years.

My portfolio is under.

Already invested from last Month

ELSS – Birla Sun Life Tax Relief 96 (G) -1000

Large Cap – ICICI Prudential Focused Bluechip Equity Fund (G) -1500

Hybrid – Reliance Retirement Fund – Wealth Creation Scheme (G) – 1000

Planning to Invest in coming Month

Multicap – Motilal Oswal MOSt Focused Multicap 35 Fund – Direct Plan (G) – 2000

MidCap – BNP Paribas Midcap Fund – Direct Plan – 2000

ELSS – Axis Long term Equity – 2000

I have already opened an account with Motilal Oswal with Rs. 5000 for MOSt Focused Multicap 35 Fund – Direct Plan (G).

I am thinking to switch from Reliance Retirement Fund. would that be a right decision?

How my remaining fund selection looks like? is it well balanced? Any change is required?

Secondly, i am thinking to do do lumsum investment around 10-20 K in Motilal Oswal MOSt Shares NASDAQ – 100 ETF Fund. would that be wise decision? Brief about me I am 34 years old, have one daughter.

Hi Manish,

Thanks for your valuable site !

I am new on this section & trying to understand the concepts. After reading from your site & other too i am planning to invest 5k per month. i decide to invest in 2 plan each 2.5k in long term.

I find these below

1. Tata Ethical (As per Sharia) – confirmed

ELSS (which one is best)

2. Axis Long Term Equity Fund

3. ICICI Prudential Long Term Equity Fund (Tax Saving) – Regular Plan

4. Reliance Tax Saver (ELSS)

5. Above is not good, can you suggest some other choice ?

And what should be the minimum time of investment ?

Thanks

For Tax savers you can go with Axis long term equity fund

Hi Manish,

I am a newbie to mutual funds & stock market. I am looking for long term investment.

I started reading about MFs from past few months and got some understanding. I recently stumbled up on this website which is of great great help to me 🙂

I recently(Jan 15 – till now) invested in the following and these are the only two MFs i own so far-

1. Axis Equity Fund – Direct Plan (G)

2. Kotak 50

Both of them i have put equal amount, these were all one time purchase. I don’t have an SIP so far.

Was my decision correct so far?

Should i also invest in an index fund?

Thanks,

Kapil

Hi Manish

I am Reading on several mutual fund sites that Major Portion of Investment should be in Large cap Funds and then the Mid and Small cap Funds . if investor is risk oriented small percentage in Sectoral funds. I was Comparing the return of Large cap / Equity Diversified With Balanced Funds and i found that in 5 to 10 year period the return from both type of Funds are either same or Balanced fund is lower by 1% to 2%.

So if i am getting lower risk in Balanced fund compared to Large/Equity diversified funds , why Experts are not suggesting the major portion of the investment to balanced funds as Core fund in Portfolio.

Krishna

There is no suggestion which is common for all . The suggestion for you will be as per your risk profiling and what you need.

Manish

These two funds looks good to me ..

Manish

Dear Manish,

Thanks for the informative post.

I’m very new in this Fund management field though I’m 40Yrs.

I do invest in FD ( Yly. 50000Rs), LIC (Yly. 90000Rs) & PPF (Yly. 25000Rs.) & no want to start my investment in long term Mutual Funds through SIP. I have 2 Lakh Rs to invest & monthly I can invest around 10000Rs./Month

Please let me know the following:

1. Best combination in MF (name & diversification of portfolio)

2. Whether I should surrender some of the LIC’s & invest in other Tax saving investment?

Thanks in advance for your guidance.

I think you should go for a proper advisor who can restructure your portfolio … On a very high level basis, you first need to learn a bit on mutual funds and then

1. Invest in 2-3 funds like HDFC top 200 , DSPBR top 100

2. Yes, see if you should make some policies as PAID UP

Hi Manish,

Thanks for sharing such a good information in simple words 🙂

Currently I am investing in 2000 per month HDFC top 200.

I am planning for retiement after 15 years.

I am planning invest in below funds via SIP route.

HDFC top 200 2000 (existing investment)

Franklin Blue Chip 3000

Canara Robocco 4500

IDFC Primer 1500

Reliance Pharma 1000

Recurring depost 4000 with 9.25 % returns

I added Reliance pharma, as I thought exposure to health sector is less in the above port folio. But I am not sure of it .

Please let me kow if the portfolio

1) portfolio can give me returns of 12-13 % in 15 years term.

2) portfolio is well diversified or over diversifed

3) Is the equity / debt ratio correct.

Regards,

Minu

1. Yes

2. Its fine . Properly diversified

3. That you need to check 🙂

Hi ,

i want to invest in mutual funds through SIP . so can u guide me which are the best ones to start with. i have gone through some of the posts here . seen the http://www.valueresearchonline.com/ site also but could not come to a idea how to categorize ie. diversify my investment . i am ready to invest about 5000 per month and looking for a long term .

one more doubt is due to some reasons if i could not invest for a month or two months or may be more ,what will be the process . is there any penalty to be paid . after two month can i once again start .

can u please clarify .

thanks in advance .

Anji

You can start with HDFC Prudence, DSPBR top 100 etc , SIP has to be paid each month .. make sure you commit the amount you are very clear you will be able to invest each month . If you are doing investments manually each month (with out SIP) , then you can invest whenever you want , whatever amount you want !

Manish, in your book there is a passing reference to Index Fund. (Invest in…. Index Fund…. retirement corpus….), It is just an example or Index Fund is more appropriation (than other diversified funds) for retirement planning? Should I prefer HDFC Index to HDFC Equity for my retirement plan (its 25 yrs away)?

Shreyas

Its for reference .. Index fund are suggested to those who really want to be free of any monitoriing and believe in long term equity story .. but for other active mutual funds are suggested .

Manish

I have 3 SIPs covering 3 types of MFs (Large Cap, Mid & Small cap, Balanced), but all are from the same fund-house-HDFC (its convenient for me that way). Pl tell me if it is advisable to have diversification based on Fund Houses as well?

Saket

Yea it would be a good idea to diverdify across atleast 2 funds houses . however this si just a good practice . iF you cant do that, it should be ok

Manish

Hi Manish,

I really appreciate your efforts to enlighten people like me. Also, I want to thank all others who have actively participated on the Blog with valuable insight.

Request you guys to please help me in re-balancing my portfolio:

S.No. Scheme Latest Value %

1 Birla SL MIP II-Savings 5 (G) 31575 10.0

2 Birla Sun Life Cash Manager (G) 27752 8.8

3 Can Robeco Dynamic Bond-RP (G) 14805 4.7

4 Can Robeco Emerg-Equities (G) 29300 9.3

5 Can Robeco Income (G) 10579 3.3

6 Can Robeco Liquid (G) 9780 3.1

7 HDFC Prudence Fund (G) 50339 15.9

8 HDFC Top 200 Fund (G) 58942 18.6

9 Reliance RSF – Equity (G) 49045 15.5

10 Nifty JuniorETF 24330 7.7

11 Gold BeES 9960 3.1

Total 316407

Few pointers:

1. I am investing in SIP pattern but at my will every month

2. I want to keep Equity:Debt to 70:30 for MFs (irrespective of my other investments)

3. I understand that Gold BeES would act as Hedge for me

4. I don’t need any monthly income (should I still have MIP or get into other Debt funds?)

5. I also have a small Direct Equity exposure, I don’t want to get into direct equity hence would keep it very small for the long term (only selected Bluechip funds)

6. I am also investing in PPF, LIC, Term Insurance etc. in order to save Tax.

7. I am not interested in TAX Saving MFs as I am saving Tax through other means

I would really appreciate help in this regard.

Manoj

You can ask your queries at Forum : http://jagoinvestor.dev.diginnovators.site/forum/

Manish

Hi,

Would like your inputs on confusion facing since couple of months. Have identified the following funds and just want to invest them out of the fact that they all are good, still not sure how they will help me touch my goals of good retirement life, kids education and so on:

Already invested::

1. HDFC Top 200

2. HDFC Prudence

3. Sundaram midcap

4. Quantum Long term

5. Reliance RSF Equit

//Stopped SIP in Reliance Growth since its performance didnt seem to have lived upto its hype!

Planning to Invest

1. DSP BR Top 100 (for kid)

2. Birla frontline

3. Birla dividend yield plus

4. Reliance MIP

5. HDFC MIP LT

Absolutely appreciate your inputs on clearing my mind and confusion.

Dear Manish

item no 3 in link specifies the amt of Rs 2 lakh /annum for AIR

http://taxguru.in/income-tax/air-annual-information-report-detail-in-new-itr-forms.html

For compulsory scrutiny issue

http://itronline.blogspot.com/2009/12/scrutiny-related-issues.html

Below is is relavent paragraph

” The cases are being selected for scrutiny on the basis of AIR information from Assessment Year 2005-06 and it has been seen from experience that large number of cases that have been selected for scrutiny on the basis of AIR information are related mostly to the investment in share and Mutual funds and have resulted in a futile exercise. Though there are instructions from the Board that in such cases of scrutiny on the basis of AIR information, the assessment proceeding should be conducted in such a manner that there should be no harassment of assessee. These guidelines and instructions are being blatantly flouted by the authorities and the assessments are being made as normal scrutiny assessments. Though these instructions are binding on Income Tax Authorities but even the Appellate Authorities are not interfering in cases where the assessments are being made in violation of instructions. It has been held in various judicial pronouncements that these instructions by the board are binding on authorities, subordinate to it and this is the duty of the Court to uphold the sanctity of such instructions in the interest of transparency in administration and public policy. “

Chetan

Thanks a lot for this , It makes a good post for future .

Manish

Dear Manish

I have one more reason to keep multiple mutual fundwhen your investment amount is more.

Investment in one mutual fund either in different scheme or SIP, if it is more than 2 lakh /year, it will be reported in annual information report to income tax authority. Reporting in annual information report is criteria for compulsory scrutiny by income tax authority.So total sip of more than 16,000 /month in different scheme of same fund will invite unnecessary scrutiny of your return &consequential harassment.

Chetan

That was a new information for me , can you give more info or some links to read on this matter ?

Manish

Thanks manish