Do you want to make extra income on a consistent basis apart from your regular job ? In this 5th article under “increasing income” series, we are going to look at some of the ways you can make some extra money other than your salary. I will be discussing 13 ideas, out which which most of the things can be instantly tried out by most of you.

Note that, here were are not talking about creating passive income which requires huge investment. We are mostly going to talk about ideas which can be implemented without requirement of huge capital, but only some time and dedication.

Lets look at these ideas one by one..

1. Consulting in your domain

If you are expert in some area, you can always give your consultancy service to smaller businesses who cant hire big companies. When we were brainstorming with a client of ours to generate second line of income, he identified that he has some great knowledge in the area of terrace gardening. He could see that he can help families with large enough terrace to setup their own balcony garden and earn some fees over weekends or extra time.

Look back at what all you know and have learned over these years, and you will realise that you have some really deep knowledge in some field, and surely there are many who are looking for someone like you, who will guide them well for a lesser fees (compared to professional fulltime companies)

2. Referral Business

Connecting two entities is another great way to make extra money by spending less energy. So can always have an agreement with some business entity to give clients on referral basis and earn a commission. I recently hired a designer for some work and I asked him if he knows someone who can PRINT the designs for me. He referred me to his friend who done the printing work. I am sure he must have got some cut for the referral and there is nothing wrong in it. Its a smart way of earning money.

Here is what Ajay shares in our last article.

I used to refer students to a local computer institute where i myself learnt ms office. they used to pay me 10% of the course fees paid by the student. i used to earn average between 1000 to 3000 monthly those days.

You might not know that even builders pay you 20-30k for each client referred (who bought the house). So now, have you got a friend who is into business or some kind of service ? Just talk to him if you can pass on clients to him and earn some money on it.

3. Create products and sell on Ebay

With websites like Ebay and OLX, you can now sell virtually anything on internet to those who are looking for products. So you can do some handicraft or anything else, which can be created at home in extra time and then it can be sold on ebay. Or you can find some local product which others would find awesome, but its not available in other parts of country and then start selling it online for a profit. Even you can look at some products which are selling at huge discount at stores (wholesale market or under clearance sale) and then sell it on amazon at regular price.

Earlier, when you wanted to sell something along side your job, you needed to have a shop and someone was required to be at shop all the day, not anymore !.

Ramit has a great article dedicated on this topic.

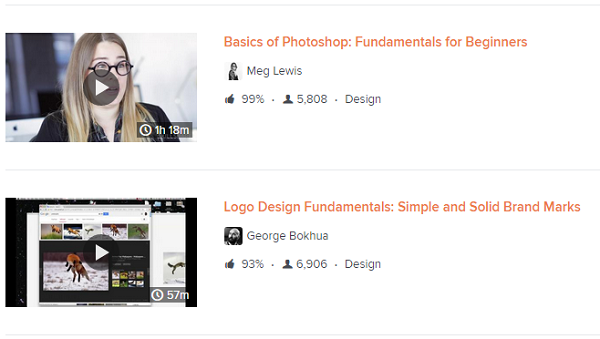

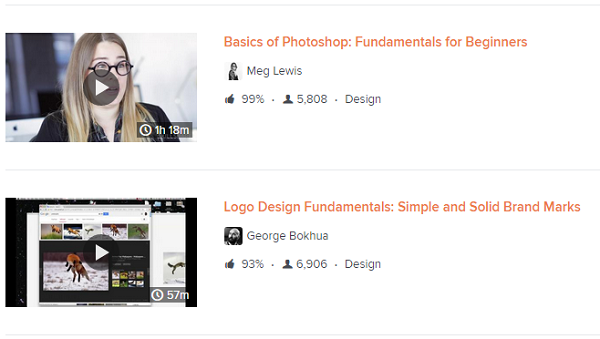

4. Create a Course and Sell on Udemy.com or Skillshare.com

If you are an expert in some area, which you think can be taught to others by creating a course out of it, you can always sell it on udemy.com or skillshare.com and make money on the fees recieved by the students. So if you are an expert on cooking, Yoga, SEO , Designing, MS Excel, Java, Python … whatever.. Create a nice rich course , record your videos and done ! .. You can tie up with these websites and then earn a lot money. Just understand those models and work on it.

5. Freelancing online

If you have extra time with you over weekends or after your job, you can freelance and take small projects. There are many websites like elance.com , odesk.com or freelancer.com where you can earn money by working on projects. There are thousands of people in India who are working full time on these kind of freelancing websites and believe me, they are earning in lakhs. Look at it as a serious way of making money and not just a time pass activity.

6. Become a Tutor online if you love teaching

If you have a knack for teaching and if you are an expert in some subject, you can become a tutor online for students. There are tons of websites like TutorVista or Tutor.com where you can try out this. You would need a great internet connectivity for this. It can work best for someone who is ready to work late in nights as many students from US and Canada would be right fit for you then.

7. Tutions at Home

This is the old favorite way of earning some side income. You must have listened to great stories of how many people have supported their families and their own studies just by taking tuitions. Then why not to extend your income even if you have a job ?

Do you know Music ? Are you an expert in Maths ? Vedic Maths ? Yoga or may be cooking ? Do you live in a residential society which has 100’s of other families? Then tutions is a perfect thing you can start give you are good at what you claim to. You can always dedicate 2 hours (if you really have them) and do some basic advertising in your apartment or nearby places and take students to teach them at home. The best part of this kind of tutors is that you refresh your dying knowledge, earn some money at the comfort of your home and you kill time which goes into unproductive things most of the times. myprivatetutor.com is a good place to register and start with.

7. Rent your empty house/room on Airbnb.co.in

Do you know that next time you head over to Goa for a family holiday, you can just rent out the whole house for 6-8 people at just Rs 5,000 a day . Thats correct!

Airbnb gives you great way to rent your house or even an empty room, if you want to earn some extra money out of it. You can always give your extra room to travellers and people who are looking for 1 day-week stay on Airbnb.co.in. Just put pictures of your house/room, explain your conditions and rules, put the facilities and thats all. Clients will find your listing, make the payment online, and if you accept, you host them!.

The best part is that you keep 97% of the fees paid and you don’t have to search for clients yourself . Serve them as they come. If you have a full house at some great tourist place like Goa/Shimla/Manali or those kind of places, you can put your whole house on rental basis. Many people who have a second home or extra room, hire a maid and offer the full range of services of a regular basis. Imagine if your extra room is rented even 5 times a month and you earn Rs 1,000 from it ? Its Rs 5,000 extra income !

8. Teach someone live on Google Helpouts

If you have a skill, you can teach someone live on google helpouts. There are tons of categories like Arts and Music, Cooking, Home and Garden, Fitness and Nutrition and many more .. which you can choose from.

In this era of globalisation, I am sure there are enough number of people in the world who would like to pay to someone to learn some thing unique.

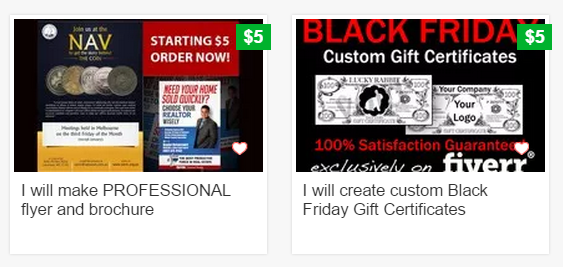

9. Do Odd jobs at Fiverr.com

Imagine you want your logo/brochure to be designed or want your website andriod app to be created ? It can be done at only $5 (Rs 300). There are tons of odds things you can do at fiverr.com . Most of the times its a small manual task, which is super easy for you, but tough for others.

A small assignment can be done at fiverr.com for $5 and you can raise the fees depending on the complexity involved. There are tons of people in world who are looking at delegating some task at a small fee.

I have used it 2 times myself to get some work done and paid $5 two times.

10. Cooked meals Pickup

I recently ordered some amazing Egg Biryani in Pune (the most delicious) I had till date and the lady sold it from her home through registering at tastykhana.in. I had to go to the place to pickup the biryani.

That got me thinking how many people in our country cook some amazing things, but never capitalize on it. So if you have people at home who cook some speciality and you feel that it will loved by people in your city, you can start pickup service at home. Get the order, prepare the food , opt to deliver at home (at extra cost) or ask them to pick up from your place. And if you are thinking about preparing “Andhra meals” in Pune, I am your customer already.

11. Starting a Creche at Home

I am not talking about professional/big size creche here. If your home is big enough and there is a scope of it, a simple creche can be started. There will surely be some market for it. If most of the couples living around you are into full day jobs, you can surely cash on this opportunity and think about it.

Even if it means renting another 1 BHK flat and starting your creche there, its worthwhile. See how you can actually implement this – I just gave a direction

12. Freelance writing for someone websites/newspapers

If you are strong in writing and can put your ideas on paper in creative manner, then you can write for newspapers and magazines. I get tons of emails myself for freelance writing (i don’t do it but). Here is what Abhijit kulkarni has done..

Checkout how you can put your writing skill to earn more..

13. Sell nutritious health drinks around the Park nearby

One of our readers shared this idea with us. If there is nearby park or place, where people come for walk, jogging early morning, then you can always sell health/vegetable drinks and various healthy breakfast too. I am sure it will help you also personally to take care of your health and earn some extra income.

If you don’t have some one at home to do it or you lack time, you can employ a part time person to do this for 2-3 hours and pay them salary or a profit cut.

14. BONUS IDEA – Be a passive partner in someone else business

I know most of the people can’t do fulltime business, because they are into a regular job. But you can always invest your money, your ideas and some basic level of administration to run a side business along with a 3rd party whom your trust.

There are many awesome people, who have the ability and passion to do some business, but they dont have money or experience or some ideas to implement. You can partner with them and offer to invest money in the business and also contribute your time over weekends or after work if its possible for you.

Example 1 – Image a person who has a shop, you can help him/her start a internet cafe – because you are an expert in computers, networking and know the technical side of how to do it. You can build the systems and overall business. You do the backside work and the other person does the front office job. Divide the profits !

Example 2 – Do you know someone who is looking for a job and can drive well, but has limited time? How about you buy a Maruti Van and ask him to use it to start a pick and drop business for children in school . Divide the profits ! ..

Sonme months back, I heard the founder of Tastykhana.in in a TIE talk, where he shared that when they desperately needed some money in the starting years of their business, that time – one of the employee of an IT company put in Rs 1 lac in their business and within a year or two, he got back 20 lacs return through an exit option when they got funding later (it was something like this, if not exact)

Can you see a point I am making? I know its not an as easy as it sounds, but at the same time, its not as tough as you imagine. You need to take some level of risk and try out these things if you want to earn extra income.

How to handle .. “But .. “

I know these ideas must have pumped a lot of excitement in you and a lot of you might have a feeling of “But … and followed by some reason”.

Note that earning an extra income apart from your regular job, takes huge commitment. Its simple, but not an easy task. Its not for weak hearted. You will have to keep aside some of your reasons,come out of your comfort zone and take some pain in order to implement it.

It might means waking up early, it might mean sacrificing something in life (Read the story of Anupam on creating second income) , you might have to redesign your schedule, ask for support from others and taking some tough decisions. There is no shortcut when you want to make money in life.

This is exactly why most of the people never create any additional income, because they never take efforts for it. They are just focus on reducing their expenses, where the possibility is limited. Today I invite you to look at the other side, thats INCREASING YOUR INCOME, which has unlimited potential.

Also do not focus on the quantum of money you earn in the starting. What about Rs 1,000 extra in the first month ? It pays your PHONE BILL ! . Thats big thing .. Its EXTRA money afterall. I hope you loved these ideas and you would surely try out atleast one of these over the next 1 month. Plan for it and take action.

I would like to hear some more ideas from you, no matter how silly or crazy they sound. Even if its something which can earn you Rs 100 extra, please share it. Any contribution is appreciated.