Are you saving for the future? NO or YES?

If you are, then you must be wondering what a stupid question that is, because it’s so obvious that one needs to save money for the future. We all do it anyways!

You are WRONG!

Trust me, in last 10 yrs – we have dealt with so many investors who are not as prudent and forward-looking as you are. Many investors are hand to mouth when it comes to saving money. They are just postponing their savings in future and relying on luck or maybe they are not giving putting enough energy to save money.

So today, I thought of writing about 10 simple reasons why one should save and invest their money for the future. I want these 10 points to act as a reminder to you. Note, when I say “Save” in this article, it means “Save and invest”!

Let’s start

Reason #1 – It will help you in bad times

We all know that life is dynamic and bad things can happen. One may lose a job and become jobless some day. Or one may need lots of money to admit a loved one in the hospital. You never know what the future has in store!

If you have enough savings with you, you will be able to handle the situation in a much better way and won’t have to run around to others for money. There are always phases in life when things are going bad and if you don’t have savings, it can trouble you!. So savings help you in bad times!

Reason #2 – One day you will stop earning

At times, I am surprised to see many people forgetting this simple point, that one day they will stop earning.

That’s called “Retirement”

I see many people in their 30’s and 40’s behaving as if they will keep getting salary in their bank account all their life. They don’t take enough efforts to save money. They keep delaying their plans to invest and one day they realise that they are now in danger zone!

Dont forget that after you start your job, the expenses will never stop after that, but your earning will come only till you are 55-60 yrs!.

Reason #3 – To have peace of mind

One always feels a sense of security and peace of mind, when you have enough wealth to fall back on.I am talking about the day to day feeling you go through when there is bad news coming in.

Imagine situations like

- Talks of layoffs in your company

- Thoughts of getting someone hospitalized in the family.

- News of your children school raising the fees .. AGAIN!!

All these small things in life will subconsciously haunt you and you will not have peace of mind because you know deep down you have no savings or less wealth. If something happens to your job, how will you manage things?

If you are working for many years, you will agree at there are some tough days, when you feel like just running away from everything and just chill out and enjoy life. You feel tired of corporate life and this rat race and all you wonder is – “If only I had enough wealth in my bank account”! ..

This also leads to a lot of stress and you may feel left-out compared to peers. Hence it’s very important to start saving for the future!

Reason #4 – To Get Financially Free

We all want to reach a stage in life when we dont have to depend fully on our salaries. We all want to create a level of wealth so that its enough to generate some income for us to handle our basic expenses at least. I am talking about financial independence.

When you start working, you have no wealth and you have to rely 100% on your salary. But over time, your wealth basket needs to go up in value so that if required – you can take out money if needed.

If someone needs Rs 40,000 a month for his expenses and he has 4.8 lacs savings – they know deep down that they at least have 1 yr worth of money with them.

With 48 lacs – they can last for 8-10 yrs (not considering inflation here)

This way, you reach a point in your life when your wealth itself is enough to create a stream of income which handles your basic expenses at least if not a lavish lifestyle.

Recently I tweeted – “Investing money is nothing but an act of gifting yourself more Retirement days”

#Investing money is nothing but an act of gifting yourself more #retirement days

— jagoinvestor.com (@jagoinvestor_) January 7, 2021

If you have started your wealth creation journey on time – you are moving towards your financial independence slowly and maybe somewhere in your 40’s or 50’s (dont confuse this with your retirement) you will have some level of financial independence

Reason #5 – So that you don’t get into the debt trap

Remember that people who are into debt trap today started small. They got into a small debt first, and then they continued it, didn’t manage it well and now after many years, they find themselves into a deep debt trap. Think why they even started with the small debt like credit card debt or a small personal loan of 2 lacs?

Its because they didn’t have enough money saved!!. The root cause of the debt trap is because people do not save for the future, and then slowly have to rely on debt to fund their needs and desires.

Reason #6 – Feeling of Progress in life

Sense of “progress” is very important in your financial life. You may have ZERO bank balance at the start of a career. But if after working for 8-10 yrs, you have very less to show – then its crushes you from inside.

It’s like running for hours, only to realise that you have not moved much. If you do not save on time, then over a period you may feel like a failure because you dont see any progress in your wealth.

I also said in one of my tweets that “If your Net worth if not going up, you are probably a RICH SLAVE” and nothing more than that. Think about it!

And its not too tough to create wealth over time. A small sum of money can also turn out to be a big sum over a long period of time.

Check out how much wealth can you create just with the monthly SIP of Rs 10,000 in 30 yrs

So if you have been late till now – START NOW!

Reason #7 – To handle major life events

A lot of major life events are going to come in your life.

- Kids School fees (recurring)

- Vacations (recurring)

- Child Education Higher Education

- Buying House

- Upgrading of Car (recurring)

- Home Renovation

- Retirement

and lots and lots of small events which will demand money constantly!

What are you going to do – if you will not save enough for the future? Depend on Loans? Get into a Debt Trap?

Starting your wealth creation journey early in life increases the chances of you meeting these financial goals with less stress and on time without compromising on them!

Reason #8 – So that you can spend without guilt!

I have seen enough families who do not take enough vacations or spend properly on themselves enough. They keep cutting corners and often try to show that they are simple people and they dont believe in wasting money. But deep down the reasons is that they just don’t have wealth!

This means that on each occasion, they often feel guilty for spending money. They feel as if they are doing something wrong. They deprive themselves today so that they don’t have to deprive their future-self!

It doesn’t only impact them but their spouse, kids, parents and everyone around them at some level. A good financial life is not about just saving money, but spending money sensibly!

So start your saving today to that in future, when you have to spend money on things you love, you can do it with free mind without any guilt feeling!

Reason #9 – To explore an alternate career

A lot of people are not happy with their jobs. They feel stuck and they want to do something about it. But once you take a home loan and don’t possess any other skill, it becomes a permanent job for you.

You cant quit and explore other career choices because you have no backup plan. Forget switching career, ask yourself if you can even take a 2-3 yrs break from the job? Do you have enough wealth to support that?

If you save enough today, there will be a time when you will feel more comfortable to take that kind of tough decision. Having wealth on your side – gives you enough power to tell your boss that he sucks and that you are not coming from the next day!

You will be able to take calculated risks in life and try out many things .. so start saving now!

Reason #10 – Do that you can leave a legacy

I have many friends who have got enough legacy from their parents. Their money issues are partially solved. Imagine someone in a big city (Bangalore or Mumbai) whose parents are going to leave them a house or a big portfolio/business.

Only a person is burdened with a big EMI and no future inheritance can understand what I am speaking about.

One of my close friends has a Rs 10 crore net worth today (he is just 35 yrs age) all created by his grandfather. He has his own home, other properties and few income sources. Imagine how it would be for you if you were to acquire a lot of wealth from your ancestors!. What would be your mental state?

I am not saying that this itself will solve all your life issues, but you have one big less thing to worry about in life. You just build upon that!

You don’t get legacy because your parents messed up their retirement and didn’t do enough wealth creation. You can choose to not do that your next generation. I know that its a subjective thing and not everyone is excited or agree with the idea of leaving an inheritance.

Why we don’t save enough money when it’s so obvious?

Below is an excellent video from Shlomo Benartzi on why we don’t save enough and a framework to solve that issue. Listen to it!

A simple financial plan for you to invest your money

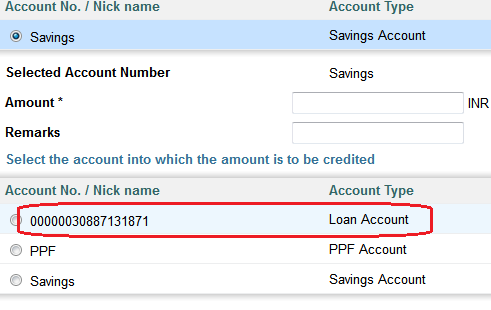

So here is a very generic roadmap on what you can do to invest your money

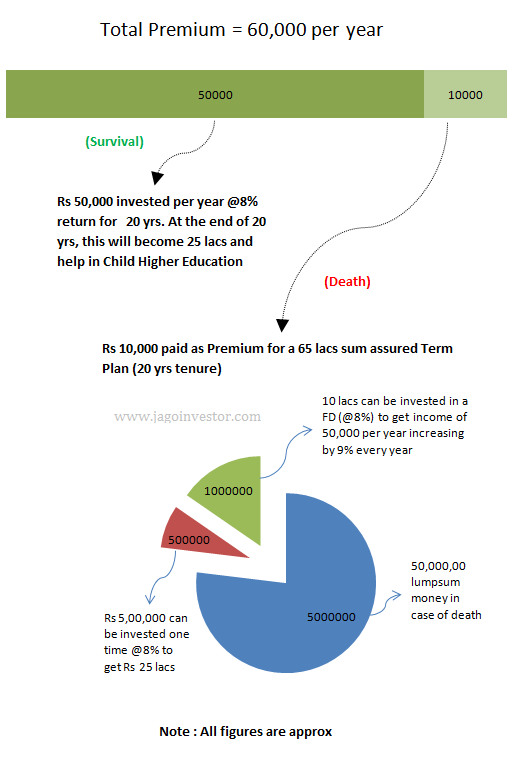

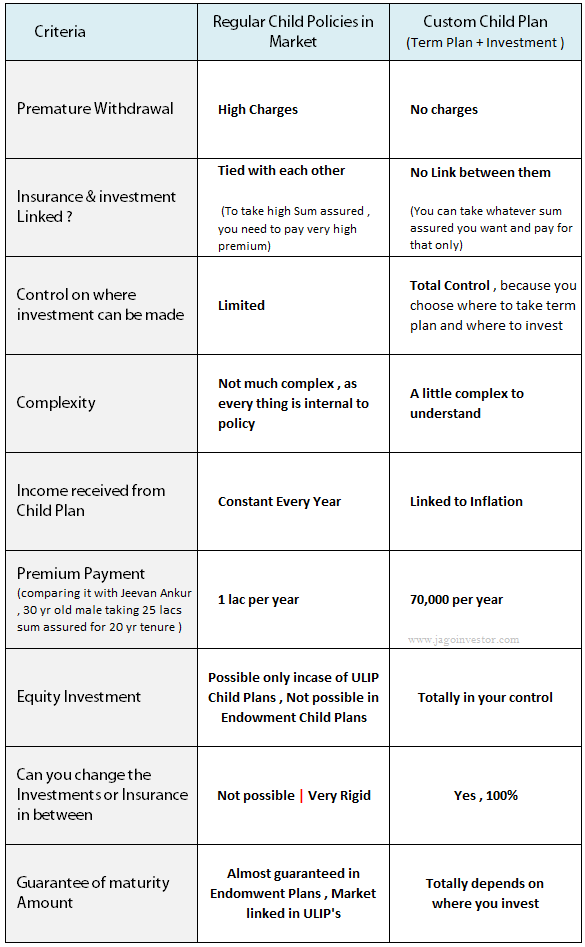

- First, take enough term plan and health insurance early in life

- Make sure you have 12 months’ worth of expenses invested in an ultra-short-term bond fund. This will give you good liquidity and decent returns at the same time!

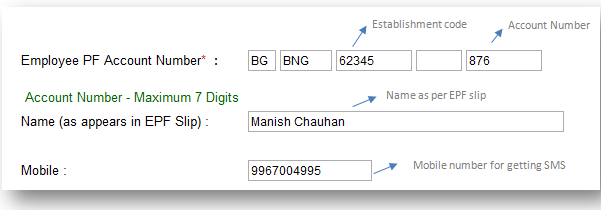

- Invest 20% – 40% of your take-home income into equities (as you already have debt portion covered by EPF). The options can be a mutual fund, Index funds, direct stocks if you understand it

- Over time, as you grow older you may also have investments into debt mutual funds to lower the volatility of your portfolio

- If you wish to, you can also have some fixed deposits – but preferably very less of it

- If you are investing in NPS already, you have some equity exposure!

- Stay away from an endowment and money-back insurance policies

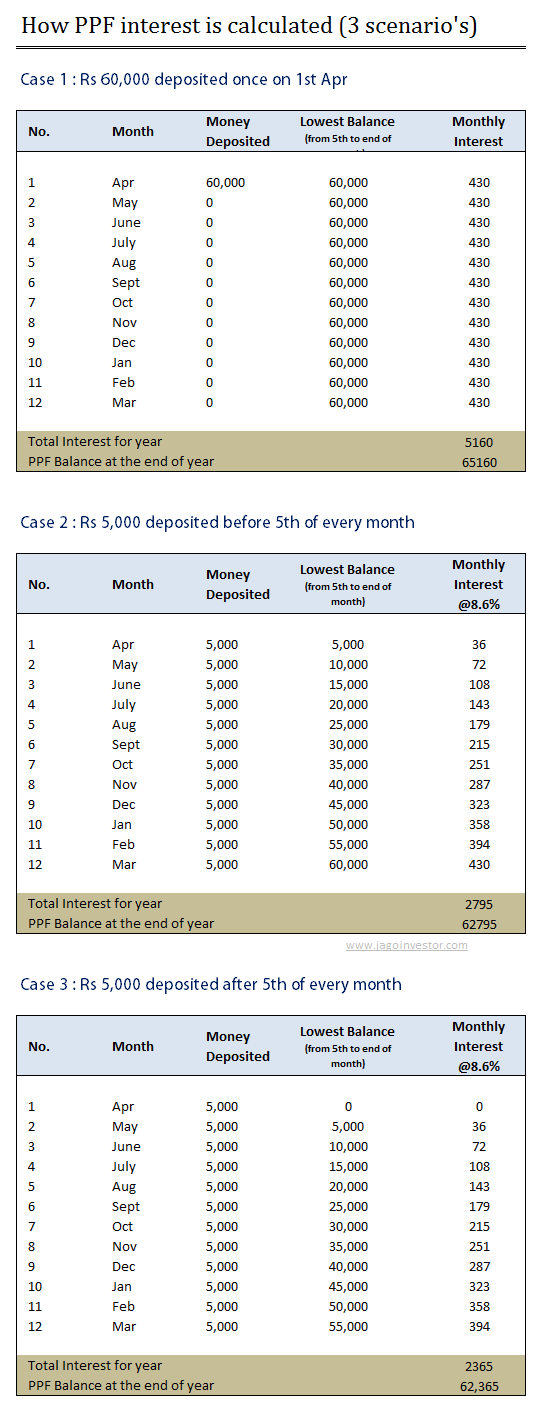

- You can open a PPF account, but don’t over-invest in it at a young age!

The above suggestions are all generic in nature. If you are interested in wealth creation in a more focused and structured manner, you may want to look at our investments services brochure

Let me know if you liked the article and share your comments