Personal Accident Insurance Policies in India – With Comparision

Did you ever know someone who met with an accident and he was the main bread-winner of the family? Mostly yes. A personal Accident Insurance plan is policies that cover a person from accidental death, accidental disability and several other features. There can be very bad consequences of meeting an accident like death or pause in income, ranging from a few weeks, months to even years.

A term plan can only help in death and a health plan can help in case you are hospitalized, some of these policies also offer accidental riders, but these riders are not as comprehensive as standalone Personal Accident Insurance policies have. In these articles, let’s see the benefits and features of Personal Accident Insurance policies.

Ajay was one of the best employees of his company based in Bangalore . He bought a term plan as soon as he realised the important of securing his life. He also bought a health coverage to secure his wealth (not health). He had recently bought a home through loan and he was also investing for his 2 kids future . Ajay was the only one earning in his family which also had his mother as dependent on him.

It was the last working day of the week just before Diwali holidays and he had to rush home early that day. He was as attentive while driving as he was always, but he forgot that accident happens not because you are careless , but because other can be damn careless … While Ajay was taking a u-turn another car slammed into his car which was coming with a lot of speed.

It was a serious accident and what Ajay never imagined happened ! . Both of his hands were non functional after the accident . Being a senior programmer in his company, he knew that his future is lost now . This one incident changed him life. While his income stopped, his expenses at the house, EMI etc had to still continue.

His term plan could not pay him because he was not dead. His health insurance plan covered the expenses for hospitalization, but only covered for a basic amount incase there was a temporary disablement. But Ajay case was not covered in any of his existing insurance policies. At this point in time, if Ajay had a Personal Accident Insurance Policy, it might have helped him a lot.

If you are a reader of this blog. Most probably you must be living in a big city, most probably you are salaried class and obviously you must be travelling from home to office and office to home, you will do it every day, for months and years .. that would be thousands of days. The chances of death or getting hospitalized for some illness is far lower than the chances of meeting an accident these days. So in today’s world more than a Life Insurance and Health Insurance, the first thing which you need is an accidental insurance policy and why not. Its costs so less that one can afford it very easily. You can buy a 10 lacs accidental cover anywhere from Rs 800 to Rs 1,500 per year depending on the company and benefits. But one thing is sure that it’s very cheap.

what a Personal Accident Insurance policy gives you?

Think for a moment, what all can happen if one meets an accident, what can happen, what are different kinds of end results of it? An Personal Accident Insurance policy covers almost all of them. Below is a table that gives you an idea of what kind of situations are covered by accidental policies.

| 1. Death | In case of a death due to accident, the policy would pay 100% Sum Assured to the nominee. Some companies also pay a “Children?s Education Bonus” of 5000 or 10000 for a maximum of 2 children. |

| 2. Permanent Total Disablement | This means that in case there is a permanent total disability, in which a person is disabled for life, the SUM assured is paid to the person. Some companies also pay around 125% or 110 %, depending on the company. Example – Loss of

|

| 3. Permanent Partial Disablement | In this case, a small percentage of SUM assured is paid on a weekly or monthly basis. For example – 1% of the sum insured is paid every week up to 100 weeks. Example below

|

| 4. Temporary Total Disablement | This means that for some weeks or months a person is totally disabled and will not be able to work and earn money. In this case, most of the companies pay a part of the sum assured, some pay 100% and some pay 50 %, there is also a cap in this case, like a maximum 5 lacs or 10 lacs. Example below

|

Other Features

- Some companies cover claims arising out of Terrorism or acts of Terrorism

- No health check-up required for policy issuance

- Worldwide coverage of the policy

- It gives coverage starting from 5 lacs to 50 lacs

- Free lookup period of 15 days

- 5% per claim free year to a maximum of 50%.

- Family discount of 10%

What is not included (Exclusions)

Accidental policies do not cover Deaths or disablement because of

- Intentional self-injury, suicide or attempted suicide.

- Influence of intoxicating liquor or drugs

- By committing any breach of law with criminal intent

- Suffering from any pre-existing condition or pre-existing physical or mental defect or infirmity.

- Aircraft pilots and crew, Armed Forces personnel and Artistes engaged in hazardous performances are totally excluded

Premiums do not dependent on AGE

The premium of accidental policy does not depend on age. So if you are 25 yrs old or 50 yrs old, the premiums would be the same, rather it would depend on your working conditions and the nature of your job. If you are a software engineer working in Bangalore, then your chances of meeting the accident are different from an army personal working in the border or a worker in a factory that has dangerous machinery. So each kind of job profiles are divided into different risk level, sometimes it’s 1,2,3 and sometimes it’s just 1,2. Risk level 1 are those who are less risky and their premiums are lower and risk level 2 are high risky category and their premiums are higher. Let me give you an example

underground mines, explosives, magazines, workers whilst involved in electrical installation with high tension supply, jockeys, circus personnel, engaged in activities like racing on wheels or horseback, big game hunting, mountaineering, winter sports, rock climbing, potholing, bungee jumping.

| Risk Level 1 (Low Risk) | Risk Level 2 (High Risk) |

| 1. Doctors 2. Engineers 3. Bankers 4. Accountants |

1. underground mines workers 2. jockeys, circus personnel 3. Mountaineering, rock climbing & bungee jumping, |

Note that some companies have a list as 3 different risk levels – 1,2,3

Examples of some good accidental policies

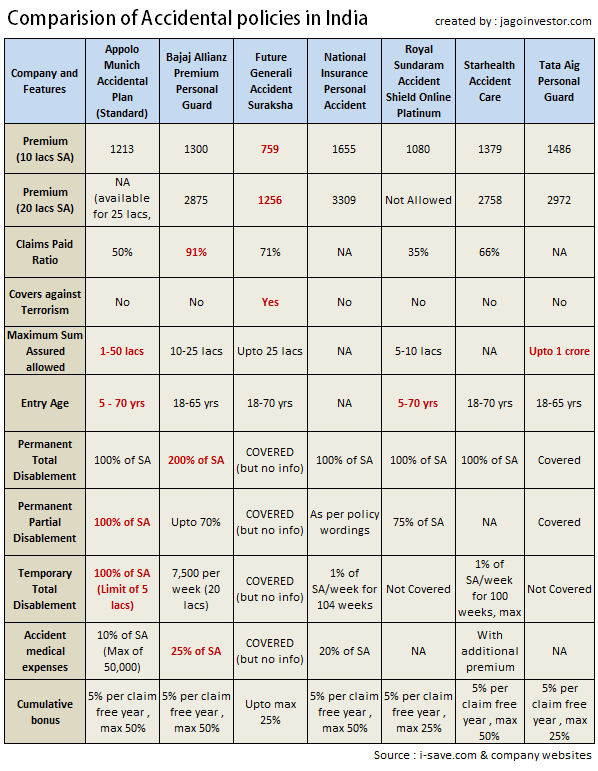

Below I am listing down some of the accidental insurance policies and their different features. If you see all of them, you will realize that all the policies have something good or bad in them. This chart is made by collecting information from different portals and companies’ websites. Note that the premiums below are for Low-risk professions (Level 1)

If you see the above table, you can see that on absolute level Bajaj Allianz seems to be the best option and it’s the recommended one. The best part is that the claim settlement ratio is high and that’s the biggest parameter people look for.

Please comment on what do you feel about Personal Accident Insurance policies and what has been your experience in that?

December 12, 2011

December 12, 2011

Hi Manish,

Could you please suggest a company for buying a personal accident policy for an amount of 50 lakhs?

Thanks,

Varun

Thanks for the nice informative eye opening article.

If I have 2 personal accidental insurance policies, covering 20 lacs each, can we claim both in case of any temporary or permanent disability?

Asking because Bajaj or most of them cover only 25 lacs. If we want to cover more, what will be the options?

Also if the disability happens due to paralysis or via some disease (stroke, cancer etc), will it be covered?

What is covered and what is not, is mentioned in your policy document. Its better that you have a look there.

Thanks Manish, for the answer.

However I’ve not found details about the following queries:

If I have 2 personal accidental insurance policies, covering 20 lacs each, can we claim both in case of any temporary or permanent disability?

I will have to check that !

I plan to buy a personal accident policy for me and my wife. Ideally it should include child education benefits as well. Any clue with which insurance provider should I go ahead? Intended amount – 20L

Also, how’s Religare Secure plan?

Look forward to your reply.

Regards,

Zeeshan

I have no recommendation as such , but you can just leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/buy-health-insurance-policy

and we will connect you with our trusted partner who will help you select the best plan for your requirement

Manish

Hi Manish,

The best personal.accident insurance company in pvt & govt sector.

Pls suggest me.

There is no much difference …

Normally, any single Insurance Company does not provide more than Rs. 30 Lacs for individual person. But if want to go for higher sum insurance , How much maximum PA that i can insure myself with multiple Insurance Company policies ?

You can insure yourself with multiple insurers !

hi! is it true that normally after 4 years of term plan subacription the claims are not rejected?

Yes, not as a rule it ca be done !

Thanks for valuable information

Need your views –

whether to buy Term Insurance with additional Accidental Death Benefit as additional rider or to Buy 2 different policies from 2 different companies

1. Term Insurance policy & 2.PA Policy for Accidental Death.

I suggest buying it from a single company only and you can add riders if you really feel the need of it, else not !

Hi Manish, that is a real good informative and helpful write up about Personal Accidental Insurance (PAI). Thanks!!

I have a few question about PAI; if you can answer or guide me to any article regarding the same, it’ll really help. Below are my queries:

1. Lots of Debit/Credit cards provide PAI service with it. So suppose I have a card that is providing me 10 Lakh cover for PA, shall I still go for a separate PAI?

2. Suppose, I am using two debit cards from same bank, both giving a cover of PAI 10 Lakh each. Does it mean I have a total PA cover of 20 Lakhs?

I would really be thankful if you can guide on this. Thanks!!

B Regars,

Bineet

Bineet, just as you should not depend on your employer for term insurance and have your own term cover, similarly you should not depend on accident cover offered by a debit card provided by some bank.

Also read fine print carefully. Generally this cover will be only for accidental death only and may not cover disability that should be a basic purpose of this cover. Also this cover may be related to swiping some amount on the card in certain timeframe. So consider this as an additional benefit if available, but don’t look towards it as a primary accident insurance cover.

Avinash

Will write in article on this.

I would like to have your feedback on current accidental and Mediclaim policies and the best companies to go for who have good claim settlement ratio.

Thanks for posting your sugestions

Hi manish , can you plz jelp me with claim settlement ratio of oriental and national for accident policy.

I liked the bharti axa smart individual accident plan, its better than natioan & oriental, but their claim settlement ratio is only 69%

If can get the comparison of claim settlement ratio, it’ll be easy to decide between private & public sector insurance company.

Hi Amit

I suggest you dig it out of IRDA report. Else wait for my article on this

Hi Manish,

Thanks for the informative article.

For the sake of clarification & better understanding, i’m reframing the question which was already asked but with a different context. Request you to clarify it.

How do multiple personal accident policy work for same person? For example, I have two personal accident policies with coverage of 10L and 25L. Typical case is one taken by employer and other taken by self. And I lost my legs (PPD), for which amount allowable by their tables may be 1L and 2L individually. So am I eligible for 1+2=3L? Or maximum of 1L and 2L i.e. 2L? Here, there is no expense occured, the claim is for disability.

Will I get benefit from both personal accident policy in case of PTD / PPD?

Also, just to inform you that 80D exemptions are available in case of Bajaj Allianz Premium Personel Guard.If you add on “Accidental Hospitalization Benefit and Hospital confinement allowance”, the amount of premium you pay is exempted under 80D. I got this confirmed by Bajaj Allianz.

You will get benefit from only one of the policies which ever you choose

Manish

I want to know that disability from Paralysis attack or from any medical negligence is also covered or not in accidental policy ?

It would be written in the policy document if its covered or not !

sir i am already cover in ESIC and i already taken Personal accident policy, due to accident can i take benefit from ESIC and PA policy both

Yes you can do that

Hi Manish,

Great forum got lot of information about PA policies.

Just want to know what are your views regarding HDFC Ergo Plan?

Regards,

Suraj

I got quote from lic for me and my wife 50+50 lacs term insurance for 31 years only premium 44000 and from edelweiss tokio I got 22000 (41 years)for same +ATPD RIDER for 50+50 lacs

Why is so much difference in premium of any insurance companies

This article will teach you that http://jagoinvestor.dev.diginnovators.site/2013/05/how-insurance-companies-work-and-the-business-model-behind.html

can someone suggest me in below

i am planning to buy edelweiss tokio (my life +) term insurance 50 lacs with rider ATPD 50 lacs for me and my wife(same) its total premium comes for both 19710/-annually for next 41 years

i am planning to travel around world as many destinations i can cover so i am little bit worried about accidents so i want to insured

You can read their fine prints if they cover you outside India or not ! ..

I was searching for a Personal Accident Policy for myself. Although my employer covers me for the same for a decent amount, i still wanted to be on a safer side in case i change my job and the new employer might not offer an accidental policy and i ddint wanted to risk the gap in coverage.

I was looking at a basic cover of 50 lakhs (Death) combined with Permanent Total Diability (PTD) + Permanent Partial Diability (PPD) + Temporary Total Diability (TTD) which is also known as weekly benefit coverage.

The basic things i researched was for Sum Insured (50 lacs) availability of all the above mentioned covers, inclusion of terrorism coverage, maximum cumulative bonus on claim free renewal, maximum allowance for weekly benefit and presence of family discount in the policy if i want to cover my spouse and children in the future (i am unmarried now). Add on covers didnt bothered me much because if the basic policy is good, it automatically compensates for additional covers.

Sum Insured for All Policies: 50 Lacs (Death+PTD+PPD)

Sum Insured for All Policies: 10 Lacs (TTD) -This is the maximum which most insurers offer as the weekly benefit is maximum Rs 10K or 1% of Sum Insured which ever is lower)*IFFCO Tokio might offer Rs 25K per week (mentioned in their wordings but 6K mentioned on their website)

IFFCO TOKIO – RS 5650 (Median Policy, offers 100% in PTD, 50% Bonus, Terrorism, Family Discount)

BHARTI AXA – RS 4500 (Best in this range, offers 150% in PTD, 50% Bonus, Terrorism, Disability due to Medical Reasons – Total Paralysis. No family discount)

Bajaj Premium Guard – Rs 7300 (Premium too high, offers 200% in PTD, 50% Bonus, Terrorism)

Tata AIG – Rs 5700 (Avg Policy, offers 100% in PTD, 25% Bonus, Terrorism, Disability due to Medical Reasons – Total Paralysis)

Apollo Premium – Rs 5225 (Bad Policy – Not Covers Terrorism)

Future Generali – Rs 4250 (2nd Best Policy, Lowest Premiums, offers 100% in PTD, 25% Bonus, Terrorism, Family Discount)

My Verdict: Go for Bharti Axa as it offers 150% PTD coverage and 2nd lowest premiums

Hey ANKIT

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Check out edelweiss tokio my life+ with ADB and ATPD riders

Ankit,

I checked Bajaj. They are not specifically mentioneing that terrorism IS covered. Infact they have mentioned that war is not covered. The reason u may reject bajaj is that their max SI is 25lac.

I checked Bharti AXA…they too dont mention terrorism. And exclude war

And u can reject it as they offer max 30lac.

Dear Mr. Manish,

We are working as subcontractor for residential projects by big and reputed developers. we do the work there as subcontractor. It is a partnership firm with around 10-20 labour.

Is there any accidental policy which we can take for our labour (individual or group) to secure them in case of any incident.

Regards,

Dimple

I am not very sure on that. You should contact health insurance companies for this .

My monthly gross salary is 18k and I am a PSU employee can I take two pa policy for 10lacs each

I am not sure if the company will allow it just based on the policy number. They will have some limit .