2014 has already started and you must be feeling reinvigorated – just as you were when 2013 started :). How then do you expect 2014 to be different from 2013? Let me explain a bit. When we get on call with some of our clients, we ask them –

“Do you want your next 5 yrs of financial life, like your past 5 yrs ?”.

Naturally, We get an emphatic “NO” and horrified looks (though we cant see them). Now ask yourself the same question and I am confident, for most people the answer would be the same. If your financial life is all messed up, I am sure you must have thought to correct it in this New Year. Let me help you a bit and give you 5 suggestions that you can implement and improve your financial life by leaps and bounds. It will start small, but things will improve steadily.

Here are those 5 ideas, which you should look at. Trust me, these are proven to succeed for most people we work with and even ourselves.

Idea #1 – Help others in their financial life

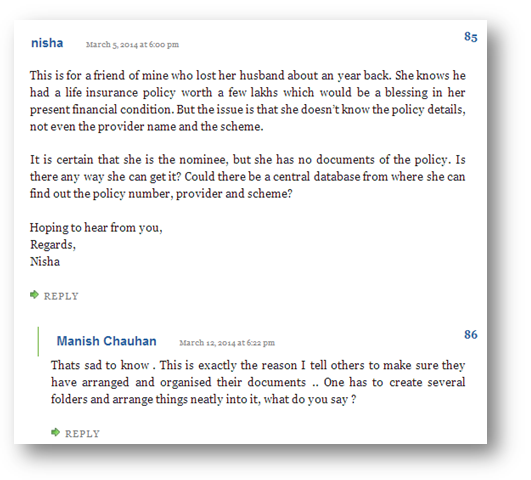

I can proudly say today, that all my knowledge and understanding of personal finance has come from (and only from) solving other people’s queries on this blog and our Q&A forum. Of course, some part of my knowledge has also evolved by writing these articles. I write the articles and they elicit variety of questions in comments section. I then reply back to those who commented and try to solve their problem. It really takes a lot of time and effort from my side to do this, but in the process, I learn a lot. If I do not know the answer, I ensure I find it out by researching it on the Internet, or come up with an answer through disciplined thought and introspection.

This helps me learn new things and also it feels nice to be able to help someone – after all, I love bonding with people and I hunger to be able to “give” back to our community! Conversations in the comments section between me, and the person asking the question, allow both of us to come out with better knowledge of the topic. What’s more, it really feels amazing to realize that one’s help has contributed to someone’s decision-making process.

I occasionally get into face-to-face conversations with people who seek my help regarding personal finance, and I do my best in helping them. Over time, this has created a wealth of information and knowledge inside me. Heck – I wrote two books too on money just by helping others !

So if you want to learn about personal finance, I can tell you with 100% confidence, that there is no better way than helping someone else on personal finance and answering their queries. You might feel – “but I do not know much myself”. The truth is, even if you do not know the full answer, making an attempt to help someone and contributing a bit extra helps you realize that personal finance is more about common sense and less about expertise.

You can anytime go to our Jagoinvestor Q&A forum, where dozens of personal finance questions are asked each day and hundreds of investors just like you are helping out with all the knowledge they possess. So just pick a question and reply with an answer. You must have surely learnt a lot from this blog and other resources and I know you are 100% capable of giving suggestions to others. I know you might be scared at times, thinking how it would look if you do not give the right answers or best answers to someone. But do not try to give the “perfect answer” – just give an answer with a full commitment to help someone. You will find that not only is your effort genuinely appreciated, but you will also feel amazing yourself and will make a friend and learn in the process. Alternatively, you can also reply to the comments that are posted on the articles from time to time.

I strongly recommend reading this book this book called “Go-Giver”, which will truly transform your way of looking at life and help you in your professional life.

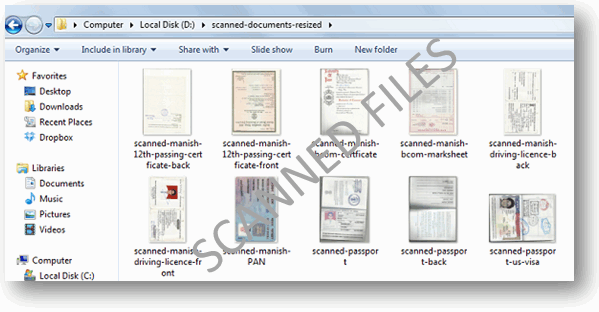

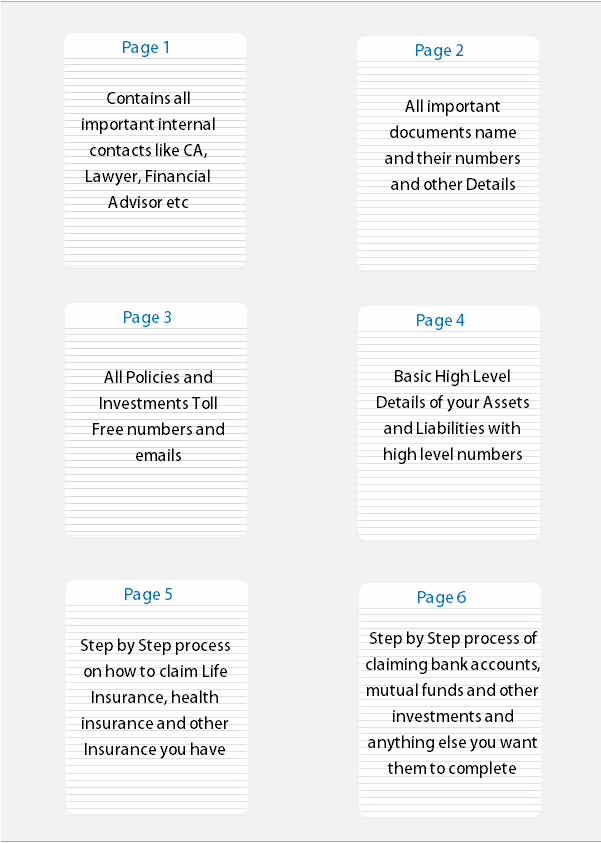

Idea #2 – Write all your financial details at one place

When someone wants to work with us on his/her financial life, One of the first things they have to do is, fill up a detailed datasheet we give to them to capture all their financial details. This is what most of the financial planners will do as initial steps. Now most people react by thinking – “Oh no, I am not filling up a lengthy excel spreadsheet” and some people ask us – “Do I really need to fill this up?”

We tell them very calmly – “Yes, in 2 days, and ONLY then do we move ahead”

4-5 days PASS and we remind them once again about it.

It is only then that we finally get a mail saying that the datasheet is filled and we also get from them something like this –

“Hi Manish & Nandish

Please find attached the datasheet in this mail. My Apologies for sending it late. But let me share with you something about filling up the datasheet. I never knew about my own financial life before I filled this datasheet (here is ZIP version). I mean, I always thought I know everything and all the things are inside my head, I know the details. But in reality, I was so much cut off from my financial life.

I had to find out so many things while filling up this datasheet. For the first time, I seriously looked at my policies, where are my mutual funds, what is their worth exactly. I have discovered how much is my EPF worth and had to discuss a lot with my spouse and few things from other family members. I discussed about my expenses with my spouse and we released so many tiny things we can change and improve. We never realize these things in daily life, because we are just not in touch with whats going on with our expenses. Money just comes in my account and goes off here and there.

We also for the first time, really talked about our long term goals, had to think about the numbers and discussed a bit about which one are more important the others. I felt a bit worried on how will I fill all this , but once I started it, me and wife got involved in it and really liked it. For the first time I feel I know where do I stand in my financial life and have some sense of what all we want from our financial life. This datasheet filling exercise was a short but amazing journey in itself. Thanks a lot Manish and Nandish”

Nandish and I often talk about this and we have now realized that just putting all your financial data in one place is a wonderful way to improve your financial life because you really get in touch with your finances and start thinking about them seriously. For almost 90% of people who do this, it’s their first time taking some time off to focus on their financial life. What was previously a fuzzy area for them suddenly becomes clear and obvious. Just noting down your financial data in one place solves so many queries you had earlier.

So next Sunday (or whenever you can take out some time), allocate 3-4 hours for your financial life and just open a blank excel sheet and put down all your income/expenses, policies details, mutual fund data, Fixed/recurring deposits data, loans details, long and short term goals and everything else you can imagine, and see the magic. You will thank us. Let me make your job easy and share with you this ready made excel datasheet (here is ZIP version) , you can download it and you can fill it up. This is the same datasheet we send to our clients.

Idea #3 – Slow down and make some strategy

Most investors are just moving with the flow of life. They get up, go to work, they earn, they spend and if something is left, they spend it again. If after all this, if still some money remains, it stays in their saving bank account, and is usually consumed for some useless reason – which looks reasonable and important at that point of time, but makes no sense in long term.

Nandish had recorded this wonderful audio on “slowing down” which talks about why you should step back for a moment and not be hasty with your personal finances It explains why you should “Slow down” and lower your pace in financial life and ask yourself where you are headed.

Listen to the “Slow Down” Audio below

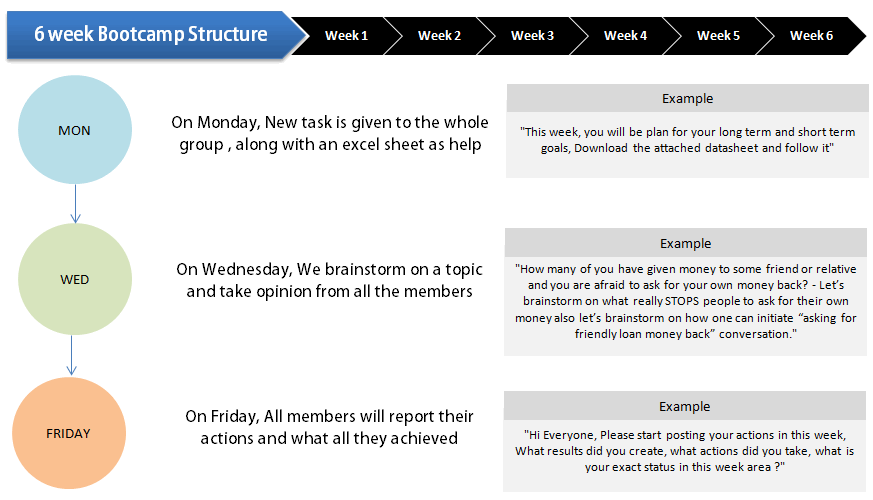

Most people do not even know which direction they are going in their financial life and where they want to be in the next 5 years. In our Investors’ boot camp (next batch starts 20th Jan), we do an awesome exercise for one week, just to make you think what you want in your financial life and to get you in touch with your financial life.

So your current task is to apply some brakes on your momentum and investigate your own financial life. Ponder over few things and find out what is important for you. It is all about getting clarity and coming out from a state of confusion!

Idea #4 – Write down your past 5 yrs history on Paper

Investors keep on doing random things in their financial life for years, sometime with a rational mind and sometimes without much thinking. It would be a good idea to capture for the last 5 years – the major decisions you took in your financial life and the reasoning behind it. For example, you may have bought some policy after meeting an agent, or bought a property, or broken a Fixed deposit, or added major expenses in your life etc. Make a list of all those decisions over the last 5 years, and write down in detail, the reasoning behind those decisions. What made you do take the steps you did?

Do you still feel you did it for the correct reason? Do you feel you were right? Looking back at it, was it the right decision?

When you do this, you will be clearer about your own thinking and how you feel about a lot of things. Maybe you realize that you did something just to look good in front of someone. Maybe you find out that you focus too much on the short term and do not look at things from a long-term perspective. Maybe you will find out that you compromise on your long-term wealth creation just to fund some short-term happiness.

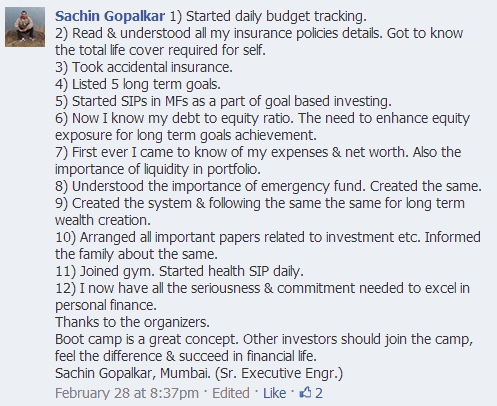

To give you a flavor of how people feel after writing down their history and all they have done in their financial life in past, here is an experience of one of the members of our Investors bootcamp

“I felt many emotions while filling out these questions – pride, great joy, regret & sadness. I saw how I had grown from a child to an adult as an investor and kept coming back to document what I missed. As the picture emerged, it was so interesting to see the patterns emerge and to find blind spots that would probably be immediately evident to someone else. It took me a long time to answer the second question. I was worried, but to document exactly what was worrying me took time. Now that I have it on paper, it feels a lot less worrying! I’m excited to see what the boot camp holds and am looking forward for the next week.”

So start this exercise the moment you complete this article.

Idea #5 – Get accountable to someone in your financial life

In his book – “11 principles to achieve financial freedom” , Nandish talks about Level 1, Level 2 and Level 3 promises.

Level 1 promises are “professional promises”, which you fulfill and complete at any cost and ensure they are never left pending. You bring work home, stay up late, but complete those tasks. You are fully committed to your level 1 promise.

Level 2 promises are ones that are made to our families and we keep them sometimes and do not keep them sometimes. We are somewhat committed to those level 2 promises, but not fully.

Level 3 promises are those promises, which we make to ourselves.

We excel at not completing these Level 3 promises! We surpass others in forgetting those promises and on no occasion do we display the level of commitment we do with Level 1 and Level 2 promises. Waking up early to exercise falls in this level 3 promise. Starting a “SIP” also falls under level 3 promises. And, most importantly, all Personal Finance actions fall into Level 3.

| Level One |

Professional promises |

You keep them always |

| Level Two |

Promises made to family members |

You keep them at times |

| Level Three |

Promises made with self |

You break them all the time |

Ask yourself, how long has it been since you promised yourself to start that recurring deposit, write your budget, start your SIP or write a will? You will realize you are worse than you imagine :). This happens because you are not accountable to anyone. No one will complain, if you don’t do things and leave them incomplete. You can always rationalize your behavior and you will surely not “Punish” yourself – and that’s the weak point.

Your life goes on, and you give a clean-chit to yourself every time you break a promise made to yourself, citing reasons beyond your control. But this errant behavior is costing you your future. This small thing can jeopardize the happiness of your family some day, can make your retired life a nightmare and can mean your kids get a mediocre education because you were not able to accumulate enough wealth to pay their fees in the future.

This is more serious than you think, but you will realize it only later.

Be Accountable to Someone

The only way to improve it is to be accountable to someone about your promises and actions. Hire a professional Mentor who keeps track of your financial life and your promises, and to whom you report your actions.

A lot of people look at a financial planner as someone who will give “advice”, but not as someone who will help them track where they are headed, who will ask them – “Tell me, what did you achieve this month?” and someone who says things like – “Can you tell me, the reason you failed to change your bank account nomination which you promised to complete by this month? Didn’t you get 2 hours out of your schedule?”

The mentor can also be your family member or spouse if you want. Declare your actions and deadlines to your family. Do whatever it takes, but ensure you are answerable to someone, if only to some extent.

Importance of “Accountability” in your financial life

Let me also share with you, the “Accountability” feature of our Online Investors bootcamp. At the bootcamp, each week you declare your weekly action and what you are going to complete in coming 4-5 days and then you go back and do those things. You have to report things back on Friday and share with us your progress. If you do not complete it, you are asked questions and reasons for not doing your tasks.

Now someone will not shoot you or put you behind bars for not doing what you promised, but when you see others declaring proudly how they completed their tasks and see them feeling euphoric about it, you feel bad for not keeping your words and feel ‘left out’. These group dynamics work for participants and they complete things most of the times. We have seen it working in Batch 1 and Batch 2 of our bootcamp. A little work each week improves your financial life, and at the end of 6 weeks, you move to the next level and realize – “Wow! I have finally done so many things which I was only thinking about all this time”

Now it need not be only at the investors bootcamp – you can report to your spouse, your friend, your Facebook friends (if you are okay declaring your actions) or else, you can pay a professional financial planner and take his help. Anything that helps you is a “great” option. There are no rules.

So bring some accountability structure in your financial life and you will surely see the results.

Conclusion

You really need to design your financial life based on these 5 ideas . Do not just read them, but really practice them and see the effect.