Review of iWish Recurring Deposit from ICICI Bank

Around December last year, ICICI Bank launched a flexible Recurring Deposit scheme called “iWish”. Customers with an ICICI savings account and who have access to Internet banking can use the iWish facility. Here’s how

- Login to the iWish section in your ICICI saving bank account

- Define a goal (like buying a laptop, vacation, down-payment on a house, etc.)

- Define the amount and tenure

- Make the starting contribution and the iWish goal starts

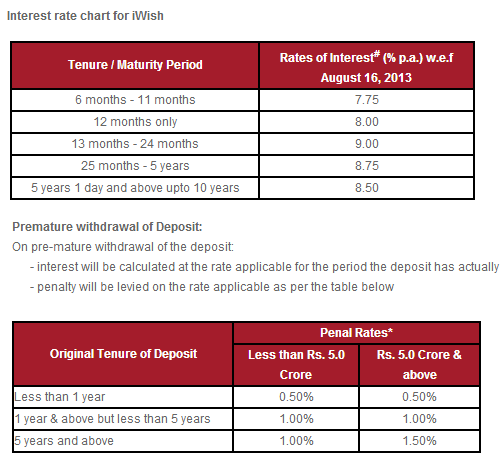

After this point, you are free to deposit additional money in your iWish account anytime you have surplus funds. Also, you can clearly see how much of goal is completed in % terms at any stage of the process. Interest rates on the iWish scheme range between 7.75% and 8.5%. Rates depend on the tenure of your goal – which can be between 6 months and 10 yrs.

To learn more about ICICI iWish Scheme, please watch the video below.

How its different from normal Recurring Deposit ?

Compared to a standard Recurring Deposit, the iWish scheme does not make it compulsory for users to make payments on a fixed date and also gives them the power to categorize savings into goals – which is a more human way to visualize and save your money.

Personally, I see iWish as a mechanism to define goals and save for them through Recurring Deposits. While standard Recurring Deposits just help save money for an unlabeled goal, iWish helps you define and prioritize your goals – helping you decide which goal to save for first. It also helps build a focused saving approach as once someone defines a goal, they are more likely to be serious about achieving it.

The scheme is clearly going to benefit the young generation, who are new to investing. For a generation who rely a lot on visual stimuli, the ability to see defined goals and a visual image of progress towards that goal (e.g. 34% of your ‘new car’ goal has been achieved) is a huge plus.

Fine Prints and things to know

While, on the whole, the iWish Scheme is good, there are few things one should be aware of to avoid a mismatch with expectations.

- One can create maximum of 10 goals (wishes) and the maximum goal amount can be Rs 10 lacs

- The minimum installment amount per month has to be Rs 500

- If you want to withdraw the money on maturity or even before maturity, you need to open a request online for that.

- There is no compulsion of making payments each month, so you can skip the installments if you want

Disadvantage of iWish from ICICI

By now, you must be wondering what the downsides of the iWish scheme are? Simply put, it is the problem of “manual intervention”.

I am convinced that it takes a great degree of resolve and discipline to properly manage one’s personal finance and investments. Unless the saving process is automated, people are tempted to be a little relaxed about saving in every period. While iWish touts its ‘flexibility’ as an innovative feature, in real life it might not help, as people are more likely to stop ‘voluntarily’ paying into their goals after 2-3 contributions.

With a traditional recurring deposit, the process of investing is compulsory and forced on you and in essence, you are compelled to make payments on a fixed date. Furthermore, the knowledge that there is an auto-debit leads you to ensure the monies are there in the account on the designated date. All this means that over 1-2 years, the Recurring Deposit really works and creates the money pool you need. While iWish is a fancy product, I do not see it as an improvement over the traditional Recurring Deposit.

Only in selected conditions and situations, iWish seems to work better than normal Recurring Deposit. An example would be when the investor’s income is not stable (one does not know if the bank account will really have the required balance on a certain date). For all other cases, I would prefer using traditional Recurring Deposits. Choose a goal, fix the amount, divide it by number of months and just start the RD for that amount. That should get the job done without needing my involvement every month.

What’s your verdict about iWish Feature and its utility? Do you think it’s any better than traditional Recurring Deposits?

UPDATE : Just realised later and came to know that you can have funds debited from your account automatically just like traditional RD, but it was kind of hidden and I never realised it . So mainly iWish has both, traditional RD features and innovative flexible way to accumulate your money and hence is better than what I have projected above.

December 26, 2013

December 26, 2013

[…] Review of iWish Recurring Deposit from ICICI Bank […]

how can i see all transactions/statement for my iwsh account? I need to know how much did i put in and how much was my interest paid

You can view in Transactions tab after you navigate to iwish account from your icici savings account.

Yes Rahul you are right. I think ,this is the philosophy of this Iwish RD

Is there any TDS applicable on maturity of goal?

Now RD also has TDS anyways

Hi,

At what interval interest will be credited for Iwish?

What I meant to ask is, Is it monthly or for 3 months or directly at the end?

Thanks,

AM

It will be done in 3 weeks

Thanks for the detailed explanation Manish, I have found an additional caveat in I wish as with below example.

1. If your complete your goal before mentioned duration: i set a target of 100,000 for 13 months @ 7.5%. I have to put around 73064 each month and with the interest applied i will get 100,000 post 13 months. Now if i put all 100,000 today itself, for rest 13 months, i will get the interest rate of only 4% which is generic interest on savings. Seems like cheating to me.

Seems the only benefit of this recurring RD is we are not forced for saving. Flexibility! is actually a disadvantage.

ok thanks for sharing that . Didnt knew that ~

Not true, read their faq again. It clearly says if you reach goal before goal period you will still enjoy higher interest rate on the amount until goal period is over.

The other case where your goal period is over and you haven’t transferred money from iwish rd to your savings account (which user is required to do himself), you will get normal savings interest on the amount.

Hi ,

I set my 1 lakh. and i made my first deposite of 10k and then again i deposite 10k .

from my account 20k is deducted but in iwish account only 10k is displaying i:e the second txn.

and i do receive the message you achieved 10% of your goal.

then what about the 10k which i have deposite earlier.?

Hi Aditi

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

iWish is not counted towards the savings account balance and “Minimum Account Balance” charges have been imposed by ICICI. I think that is a no-brainer and quite conveniently in the service request options, there is nothing that a customer can query ICICI about the charges!!

But any RD is not counted under saving bank balance . IWISH is RD !

I’ve created a goal today and added 5000 as first deposit.

But the iwish says it had zero balance. Whereas my bank account says amount transferred towards i wish.

How long does it take to reflect the money in iwish?

Check with ICICI on this !

Hi ,

have you got the refund..?

i also added 10000 as first deposit. But its not showing in the iwish balance.

Whereas my bank account says amount transferred towards i wish.

It shows up after 48 hours per icici.

I have been investing in a iWish for last 6 months, but somehow I forgot what was the tenure for my iWish. how to know the tenure for a iWish? I couldnot find it.

Customer care !

what is interest overpayment, interest deposit and misc deposit amount credited for each goal on quarterly basis?

I am not sure of that!

Needs a call from ICICI for better clarification of I wish Flexi RD

I have not made any savings till date and need to start now. I am amateur at all these stuff, specially tax related. So please tell me if i get it right:

1. There will be no TDS

2. I have to pay tax at interest only and not the saved amount.

3. after maturity the money will be transferred to my savings account.

4. If i complete early and let the money in till tenure completes, I earn more interest as it will be calculated on the amount present in the account.

Yes, all points are correct !

Thanks 🙂 will explore this.

Can I withdraw amount from I-wish any time? Is any penalty charges if I withdraw the amount??

Yes, you can withdraw any time you want

How is interest amount calculated in Iwish

For 6 months account it is 7.75%

But what is the formula?

Do we have concept of IBB here?

(IBB * Interest rate )/(Duration of account * 100) ???

if ensure deposit 10k/month to my iwish account for 6 months RD what would be matured value and what would be the interest

Not clear about IWISH interest calculation

That is where the catch is as far as Flexible RD is concerned. I am sure there will be a different formula. Trying to google it but so far not succesful. Probably will have to check with ICICI Bank. Not sure if they will reveal it.

Hello Prabhu – I am also trying much to find out more on the formula and how ICICI is calculating the Interest Amount and Maturity value. However, till now I have not got any concrete info.

Did you get any futher info on this topic? If you could please share, that would be of great help.

Hi,

There is one time deposit of 500rs option for every goal we create.Is it like one time deposit for each goal or for all goals only once deposit is enough ?will the deposit gets added to goal or its like non-refunding.If it is non-refunding then it is lose for customers.Anyone please reply me.

I created 3 goals without clarifying this, now am little thoughtful of losing 1500rs.

Regards,

Samatha

Its not a deposit or anythign like that. You get it back

i made a goal earlier this week and deposited 5000 as the initial onetime deposit thing. its been a week and its not reflecting and my progress is still 0. have i lost the 5000?? how do i get it back? iwish does not show anything about 5k. it displays however, in the statement. also, it deducted 1000 rupees today but even that is not visible and the progress bar still shows 0%. plase help. how can i get the money back and close this goal. its not fun to put in savings and then see 0% everywhere 🙁

Hi anandi

I suggest you talk to ICICI Customer care on this .

No you will get it in your iwish account. Best way to use icici app for faster processing.

@ Anandi.. what is your goal amount ? if it is 10,00,000 then to reach 1% u must atleast invest 10k.. as u said it is 6k now, u can see the 1% only after it reaches 10k.

In section “Fine Prints and things to know”, doesn’t your second and fourth point contradicts each other?

Yes prasoon . I think i made a mistake. I wanted to say in second point that incase in any month you want to put money, it has to be minimum 500

is it possible to take a hard copy statement regarding iwish of icici bank …

sahanul

Hi Sahanul

You can visit bank and take it

Okay thanks for the reply..

NK

Hi Manish

I have a doubt which many could not clarify..AS per IWish calculator for goal of Rs 10,000 for 12 months (at 8% interest), the savings reqd is Rs 798 per month for 12 months…I open this IWish and put Rs 798 , 12 times say in the first month itself.. Will the final goal amount accrue to more than Rs.10,000 as all the installments have been there for almost 12 months…Even the ICICI personnel were not sure of this…

Would be thankfull if you can clarify.

NK

Yes, it will be