10 money lessons for millennials (Recent corporate webinar by Jagoinvestor)

We recently had an opportunity to conduct a personal finance session for the millennial.

For those who don’t know this word, millennial means the people who are just reaching their adulthood. They are quite young, and may be just out of college and recently started earning money. I am writing the article so that we can inspire other young professionals to kick start their journey as an investor.

This was my first experience leading a session ONLY for the millennial

It was done for an organization called Squareboat based out in Gurgaon and the experience was awesome. I was amazed to see a high level of energy, participation, and hunger to learn from each participant.

I started with a statement, “I am leading the session to my Younger Self and not to an audience”.

I covered things which if someone would have shared with me at the start of my career, my financial life would have been very different. At the start of my career, I was not at all serious about managing money. I was extremely casual and would only focus on spending.

I was also having some junk financial products in my financial life which later discarded. I was candid with them, it was a casual chat with personal finance as a theme.

10 important lessons and realizations from the session

Here are the 10 things which I realized from the session and I am putting them up here. You can forward this for your young brother or sister or any other person you know can benefit.

1. The first 10 years of our career are CRUCIAL

All the major Mistakes happen in the first 10 years of our working life. We taste the blood called “salary” and start spending money on things we love the most. The first few years set the tone of our entire financial journey and so it is important to manage money well at the start.

In the first few years, people are so busy in establishing their career that they end up buying many financial products without doing the homework. The participants learned an important lesson to avoid common mistakes and to keep their financial life on track.

2. The Unit System

I shared my Unit system theory with them.

After I got serious about my financial life I decided to work on my net worth. Now, I was always scared of the word “Crore” and so I use to call “10 Lakh” as one Unit. I started playing for the units so that I can stay relaxed in the area of money and the word crore does not put pressure on me.

In the session, I invited the participants to play for their first unit. It can be 10 Lakh or 5 Lakh or even 1 Lakh. Many liked my Unit System and they started sharing about their first Unit.

3. Learn to think small

I invited participants to think small.

Everyone wants to directly become Warren Buffet. Well, first you have to learn to become better in any area and then great. The world always teaches us to think BIG and almost all of us have bought the idea of thinking BIG.

There is nothing wrong with thinking big, but to think small can also be equally powerful. I invited the group to go very slow and to set a very simple and easy goal as an investor. I wanted them to have a sense of winning and the idea was to help them to experience winning.

We took examples of the power of starting small, we saw what Rs. 5000/-. Rs. 10000/- and Rs. 20000/- can help them to create in the next 20-30 years of time frame. They loved the idea of starting small and then continue to expand their game of wealth creation.

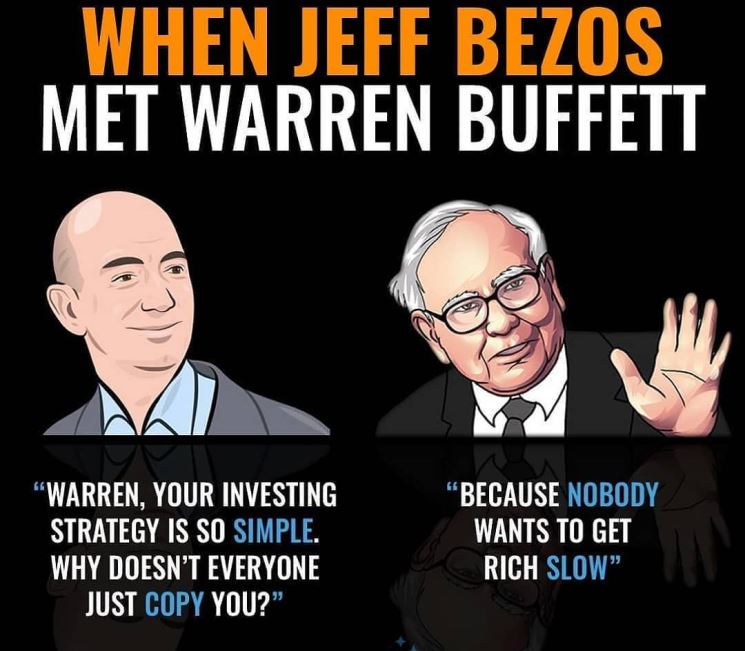

4. Become Rich Slowly

I was sharing with them the conversation between Jeff Bezos and Warren Buffet in which Jeff asked Warren, “You have shared all your secrets around wealth creation with the world through your talks, videos, and books but then why not many people are RICH”, the answer by Warren buffet was, ” Because not many people want to become rich slowly”.

Yes, everyone wants to become RICH quickly and that is where all the problem starts.

I invited the millennial to focus more on the word “CREATION” than the word ” WEALTH”. It takes time and there are no short cuts. No stock or 1-2 actions will make you a millionaire quickly. Wealth creation is always like a plant it grows slowly, row by row, Inch by inch.

Well, that is exactly how wealth grows.

5. Goals are always a by-product

We did an interesting and insightful conversation on giving and serving. The song which is being played in our mind is the “want” song.

- I want a car

- I want a house

- I want an iPhone

Our want list occupies 99% of our Mind’s bandwidth and in that, we forget to serve our financial life, we forget to serve people, we forget to serve our organization.

The participants learned the biggest lesson of their life and decided to give time, commitment, consistency, and discipline to their financial life and if they do so the goals will automatically start entering their world. I wish someone would have given this learning or insight at the start of my career, for many years I was finding wealth on the wrong side of the river.

6. One action at a time

I made a statement at the start, “only action products WEALTH”– It is not the thinking, worrying, planning, imagining, visualizing that helps to create wealth.

The book called, “Think and Grow Rich”, is a great book but the title is totally misleading. The participants learned the most important personal finance lesson that, “Only action Produces WEALTH”- One action at a time, I asked them to find their first personal finance action and encouraged them to complete the action in the next few days.

7. Cost of Delay

I did not want the session to be preachy and so instead of asking them to start investing, I showed them two different scenarios, what if they start now and what if they delay and I left for them to decide. After seeing the example and calculation they decided not to delay their investment journey anymore and they made a commitment to start their monthly Investments.

I was happy to see the session was helping them to give a new direction to their financial life. It was more like a wake-up call for many and was making them a confident investor.

8. Power of HABITS

Our Habits have the power to make or break our financial life/future. Habits are Powerful, they are brutal and they are our invisible enemies to create wealth. It is absolutely normal to have habits but the problem starts when habits start to have us. That is from where the real disconnect happens between you and your financial life.

Almost all participants admitted some habits they need to work on to improve their financial life. I think it is a very important realization and it takes courage to accept your disempowering habits. At the start of the session, I invited every participant to bring in a lot of honesty and they did so, I appreciate them for their honesty.

9: Compounding is the way of Life:

Again a very powerful conversation learned by the participants. Personal finance is not about money, it is about YOU. We all have learned compounding as a concept and we all know the formula of compounding but it is about practicing compounding as a way of life.

I invited them to practice compounding beyond personal finance, maybe in the area of health, learning a new skill, or doing some activity on a regular basis. No Break. We took the example of being overweight, calories compounds, good work you do in your Organization compounds, efforts compound, and money also compounds- In Life everything compounds and we need to build a strong relationship with compounding.

10 The One-page action Plan

I wanted the session to end with a simple and easy action plan. I gifted a one-page simple action plan to all the participants, I am sure the actions listed will help them to kick start their journey as an investor. I promised them at the start, if they complete the training you won’t be the same person in the area of money.

The participants shared their results and actions before ending the program and it filled by heart with a lot of happiness.

Are you an HR or Entrepreneur?

I invite all the HR Professionals, entrepreneurs, and everyone to join hands with us in spreading financial awareness. You can become our partner in spreading financial awareness.

Let’s GIFT financial wellbeing to others, trust me there are many who are waiting for a helping hand and you and I can become their helping hand. The conversations we do helps an investor to reset their mind and personal finance actions and it saves them to create wealth, avoid the debt trap, and have a smooth financial journey.

If you are an HR of any company or someone who can help us conduct the sessions for investors. Do fill up the form below.

We have already done programs for several Companies like HPCL, Wabtec, Tata communications, Airbnb, IAS officers Academy, BSF, symbiosis, and many other institutions and Organizations. I invite you to join hands with us to make a difference in someone’s financial journey.

September 9, 2020

September 9, 2020

Glad to know! it is very interesting and informative. Thanks for sharing this.!

Welcome

Thank you for sharing this wonderful and informative article.

Welcome

You are doing amazing work by spreading financial knowledge. Thanks for another great article!

Thanks

Good read. Very clearly communicated. Also found another interesting video about Financial Planning Basics on YouTube very interesting.

Glad to know that 🙂