10 unconventional financial goals which we came across from investors!

Today I want to share something interesting with you. I recently asked my team to share with me some very unconventional and “hatke” financial goals of our clients.

Generally, when we all talk of financial planning, we feel its just about the boring-sounding goals like Retirement, Children education, Children marriage, Buying House & Home Renovation etc. But its not true. We all have very special and unconventional dreams which we want to achieve. So I just compiled some unconventional goals of some of our clients.

Here are 10 unconventional finance goals of some of our clients which my team was able to recall.

1. Taking a 2 yr break from work

One of the clients has a goal of taking a 2-3 yrs long break from his work. He wants to explore what he is good at or not?

He is great at his current job and love doing it. But somewhere deep down he wants to know if there exist other areas of life he can make his profession and that is not possible unless he takes a very long break.

He was already working from last 11 yrs and within next 4-5 yrs he wanted to take a big break for 2 yrs, so that he can pursue his interests, like travelling, writing, research, volunteering or other activities and also take some quality rest. I know this sounds a bit risky, but its his life and we better not judge others decisions.

2. Send Parents on a World Tour

One of the clients wants to gift her parents a world tour (travelling to different destinations in 5 yr period) and wants to create a big corpus specifically earmarked for this goal. Her childhood was full of struggle and her parents almost never took vacations. But now she is earning well and she wants to pay back to her parents in whatever way she can.

She wants to now create a big corpus in a few years, which can be used for regular international tours. I think its a wonderful thought. Somewhere deep down we all want to do this for our parents (and many do), but she chose to make a financial goal and work towards it

3. Reach financial freedom by 45 yrs

Generally, every investor has “retirement planning” as a financial goal, but few of the investors also want to achieve financial freedom much earlier than retirement.

Some people want to get financially free at age of 50, but folks from IT background always mention the timeline as 45 yrs.

#Retirement = When you stop working#FinancialFreedom : When you stop working for Money!

— jagoinvestor.com (@jagoinvestor_) January 18, 2021

Financial Freedom is a situation where you have not yet retired from work, but you have enough investments which can generate “enough monthly income” to support from financial life for the next 20-30 yrs.

4. Dedicated Corpus for Skill Upgrade

We had this amazing client from Bangalore, who was very sure that if you want to excel and do amazing in your career, you have to deeply invest in the constant upgrade of your skills.

So he wants to create a dedicated corpus which he can dip in every 1-2 yrs and do some courses/workshops for skill upgrade. It can mean taking up online certifications, go for specialized weekend courses in IIM’s (you can pay a fee like 80k to 1 lac and take these courses).

I think this is a sign of high-quality people who think like this for their career enhancement.

5. Medical Expenses Corpus for self/parents

This is not very rare, but not very common too.

Off late we are seeing many investors who want to create a dedicated corpus for the health-related expenses of their ageing parents and even for themselves. In many cases, people do not get health insurance for their parents because of some illness history and these people want to be prepared for large expenses and creating a corpus solely for that.

Even if you have health insurance, many times it may happen that due to emergency you will first have to incur the costs from your own pocket and then you will apply for reimbursement. So this kind of emergency medical corpus can come handy at that time!

6. A road trip from India to London

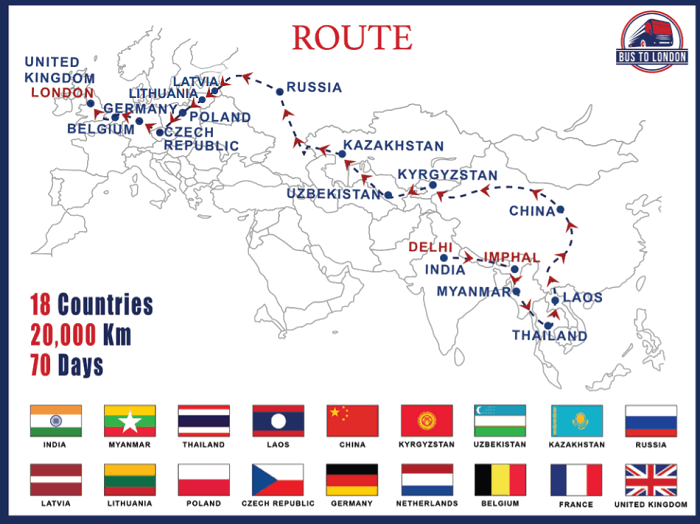

Check out these 2 bikers from Bangalore who went to London on the bike and travelled 23,500 KM .. It was a dream come true for them. I watched their story and I also felt that someday I want to do it too.

But one of our clients actually has started planning for it, but not on bike!!. He will take a tour package and travel by bus.

There is a dedicated travel agency (https://bustolondon.in) which has started India to London Tour and it costs whooping 16 lacs (one side). However, its a 70 days journey and crosses 18 countries and I am sure this will be a trip of the lifetime!

7. Start Farming

Some investors are very sure that they want to get into farming after they reach the age of 50 in their corporate jobs and some have actually bought the land already and want to create a corpus to give their farming dream a serious shape.

They want to do the setup and also give it the of business. Most of these investors are clear that they don’t wont to be in jobs till 60th yrs and would like to move on to farming much before that. I am not sure if this will turn into reality for most of them or not. But there is no harm in trying out!

8. Legacy for future generations

Some clients also mentioned their strong desire to create a legacy which can be passed on to their next generation. They were not talking about the properties which will go by default to their family. Here they wanted to create a sum of money within a specified time which will be passed on to their children or grandchildren apart from the properties

9. Business Setup

A lot of investors who are in jobs also want to shift their careers at some point and want to move to business by the time they are in their mid 40’s or 50’s and they have already started accumulating money for the business setup.

A big chunk of these investors are from IT background and they often tell us that beyond 50 yrs they feel it’s going to get tough in the software industry and hence they want to plan out things for their future. Business is not a cakewalk either, but at least they are thinking of their plan B.

10. Charity / Social Work

Very less number of investors actually think about this, but some investors also show a strong desire to create a corpus which will be used for charity purpose itself. Many of our clients have shown deep interest in charity goals. Here are 2 of them

Example #1 – Create a pool of fund to do ongoing charity

One of our clients told us that since his college days, a close group of 5-6 friends had decided that in future they would like to keep doing various social work like for poor kids, senior citizens etc. Now, this clients wants to set up a 25 lacs corpus which will be used solely for this cause.

Example #2 – Create a Hospital in my village

One of our client comes from a very small village and now doing very well in life. His dream is to make a hospital in his village to serve his community and give back to society.

11. Buy a Harley Davidson (Fat Boy)

One of our client’s dream is to go on a long vacation and cover the whole coastal belt of India. He wants to do a solo trip but on a Harley Davidson bike (Fay Boy Model) which will cost around 18 lacs in today’s terms. He has already started saving for this.

What’s your “Hatke” financial goal?

Can you please share one unconventional financial goal for which you would like to plan out?

Also, I would like to hear how was this article and if you enjoyed it?

January 18, 2021

January 18, 2021

Great information!! Keep it up!

Mine no. 7.. Really wanted to get into serious farming

Why not .. work towards your goal in a serious manner .. Whats stopping you to invest for that goal ?

Hi Sir,

Thanks for sharing the information about… I really like the blog and amazing work

Welcome

Thanks for sharing wonderful article.

Welcome

Thanks for putting them together Manish!

Here’s what I have in mind and assuming everything goes as planned. Keeping my fingers crossed.

38 years at present and have reached coast FI but continue to work in Europe just to travel within the continent for less money

47-50: will volunteer full time in an animal charity in India

51-70: will relocate to country-side and construct a tiny cottage in a 1 acre land and do bee farming

71-80: will sell the above and will buy a retirement home

81+ (if still alive): sell the above and get into a geriatric home

Nice .. that looks like a very well thought plan

Thanks for sharing Sumanth!

Cheers for providing a platform Manish!

Welcome

For me i want to make one Temple catering small 5 bed hospital along with School for everyone upto 5th std within same premises

Great. Have you started your journey for investing for that goal?

Manish

These goals may sound unconventional but actually, they are buried somewhere in everyone’s mind.

And the way you are listing them is cool.

And not only that, after reading your newsletter I always started thinking and planning to execute the goal.

All the best Jagoinvestor.

Great to hear from you Aarekh

I know these are normal goals truly speaking but I am calling them unconventional because we somewhere believe that these are not the true goals and never work towards them!

Manish

The bus to London is an interesting one & may be worth the experience.

I have explored a number of what you have said from time to time…I am in mid 40s and have a WIP goal sheet, which gets updated on a regular basis depending on the circumstances and fund availability.

I think with a hybrid WFH set to become fairly de-facto in the days to come, we will see a lot more experimentation/ completely new set of goals that would have sounded impractical previously eg. setting base to a new location away from the cities, close to the nature and able to operate remotely.

Yea .. I also feel the same.

Also in coming times the spending on travelling and enjoyment is increasing day by day .. so in next 10-15 yrs we will see very interesting concepts!

Manish

Thanks for sharing wonderful article

Welcome!

Interesting Article ????????????. It made me to think what I need to plan like the above said points…

Great to know that Balan!