Is 30x of annual expenses enough for retirement in India?

Today we will discuss an interesting topic – How many times of your annual expenses do you need as your retirement corpus to retire comfortably?

For example, if someone has an annual expenses of Rs 6 lacs per year, then can they retire with Rs. 1.8 crores (30 times)? This is the focus of the article today!

The current state of “Retirement” Advertisements

From last 4-5 yrs, I can see a lot of conversations, articles and YouTube videos which talk about retirement and its importance.

There are many retirement plans and pension plans also launched these days which talk about importance of retiring with enough money and a secured way of generating pension once you stop working.

There is no doubt that retirement is top most financial goal (and the longest one) for any investor. We all will probably have a much longer retirement life than we imagine today. Our parents also have retired just few years back (or going to retire soon).

A 60 yrs old person can expect to live anywhere up to 85 – 105 yrs in future. With changing life style, less dependence of kids, increasing expenses at retirement – planning for retirement has become much more important than any time in history.

The problem is that we don’t know when we will die. You CANT plan for just 20 yrs of retirement, because what if you die at 100 yrs? It’s quite a tough thing to predict when you will die, and almost impossible to plan for it.

Hence the best you can do is take the worst case, and plan for a very long retirement.

Retirement Planning is very tough

First thing you should know is, that there are many variables when it comes to retirement. There are things like

- Inflation

- Returns

- Taxation

- When will you die

- When will you retire

When you do any retirement calculations, you make some assumptions and you get an answer.

One big problem is that in reality there can be a lot of changes in these numbers, and your planning can go for a toss. Hence you need to look at things realistically and plan in such a way that takes care of worst scenarios.

Next 40 yrs cash flow

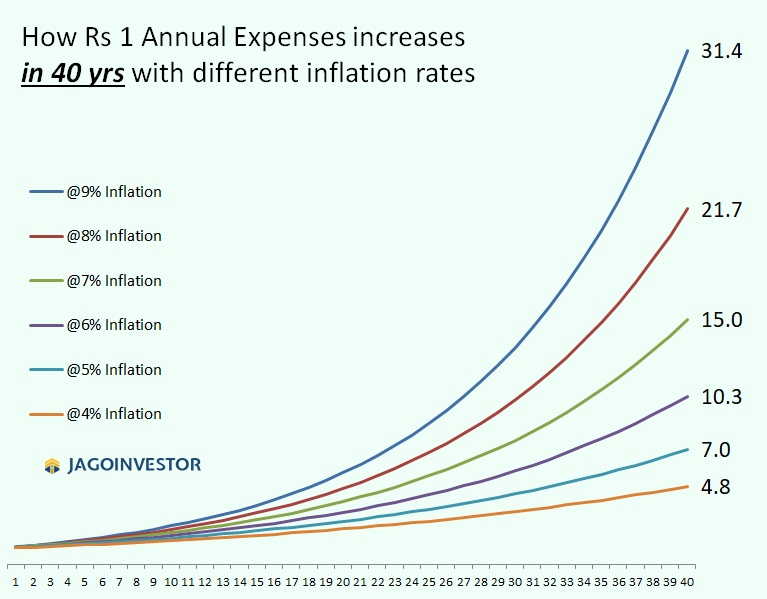

So let me start with asking how your expenses will look into future? If someone wants to retire today, how will their next 30-40 yrs of cashflow may look like.

Assuming that you want to retire at some point of time and your annual expenses at retirement is 1 unit. Then how this will change over time?

Can you see how drastic the expenses can vary in your retirement life due to various inflation rates? Note that in reality, the expenses might come down a bit once you are old enough like 80-90 yrs, but I have still not considered it because there can be other types of expenses like medical costs which will shoot up.

Is 30x corpus enough for retirement?

Now let’s dive deeper into the main question and focus on this article – “Is a corpus of 30 times yearly expenses enough to lead a long retired life?”

The short answer is YES, but before I go deeper into the answer – let me show you a case study

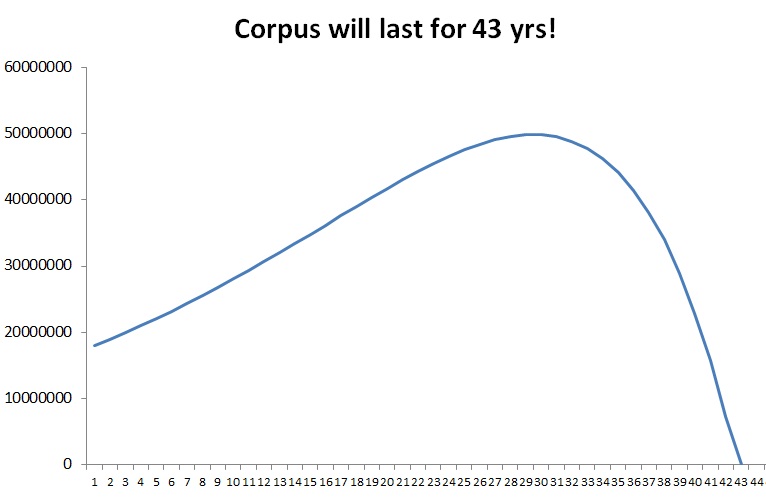

Imagine a person retires with following numbers

- Per month expenses in the start of retirement = Rs 12 lacs (1 lac per month)

- Corpus = 3.6 Cr (30x)

- Inflation Assumed = 7%

- Post Tax Returns = 9%

How long will the retirement corpus last in this case?

The answer is 43 yrs as per excel calculations. For simplicity purpose, for now we have taken a case where inflation, returns are all fixed and the person only needs the monthly expenses as per increasing inflation and no other withdrawals are done till end. In which case, the corpus change will be very smooth.

Here is how it looks like

What if your assumptions are wrong by 10% margin?

Most of the calculators just give you an answer like above graph, but does not ask a question – “What if things go wrong?”

- What is the inflation is more than what you assumed?

- What if you needed more income in future than you planned?

- What if you were not able to generate the returns you assumed?

- What if you had less corpus than you originally planned?

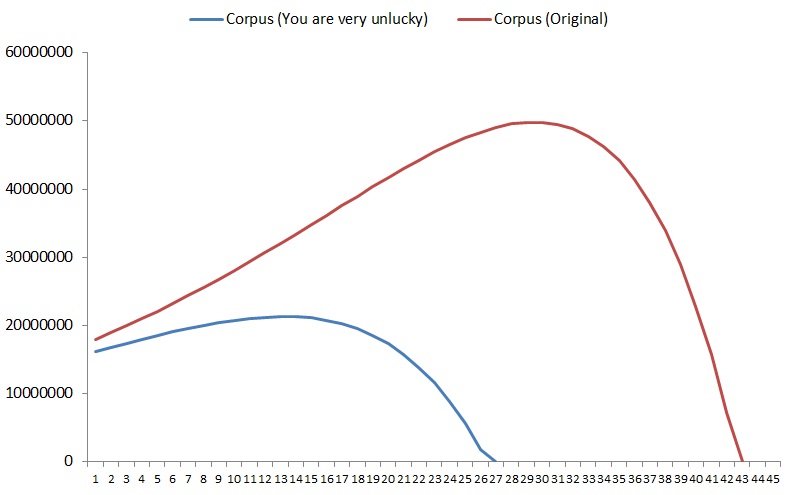

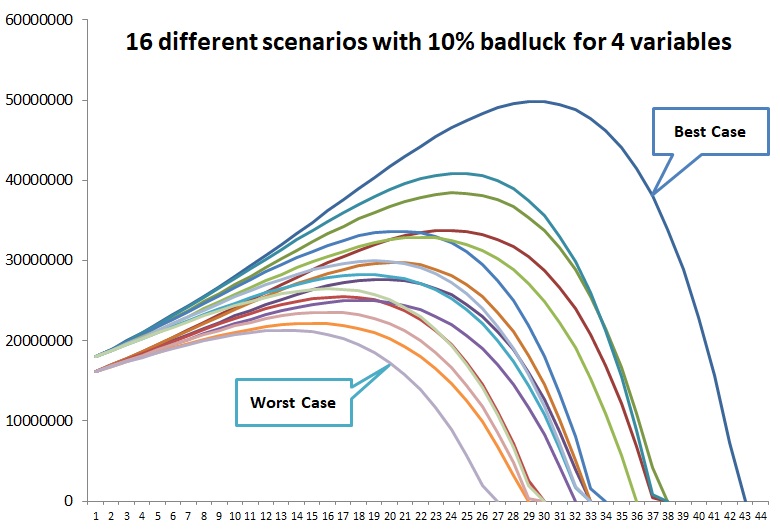

How different will be the result now if you are wrong by 10% margin on all 4 variables?

So, lets see that case too.

- Corpus is 10% less = 3.24 cr (instead of 3.6 cr)

- Monthly Expenses are 10% more = 1.1 lacs per month (instead of 1 lacs)

- Inflation is 10% higher than assumed = 7.7% (instead of 7%)

- Returns are 10% lower than assumed = 8.1% (instead of 9%)

So instead of 43 yrs, how fast the corpus will finish now?

The answer now changes to 27 yrs

Yes, from 43 yrs .. it now changes to 27 yrs, which is 16 yrs earlier.

However in real life, either all 4 things can go wrong by some margin, or just 1 or 2 or 3 things may go wrong.. so there are various scenarios here..

- Nothing goes wrong

- One variable goes wrong

- Two variable goes wrong

- Three variables goes wrong

- All four variables go wrong

This in total makes 16 different combination.. We have seen the best case (when nothing goes wrong) and worst case (when all 4 variables go wrong) ..

But when we see all 16 variables together .. it looks like below

Note that these calculations above are assuming an inflation of 7% and post-tax returns of 9%. If you take lower returns or higher inflation, then the results will be different ..

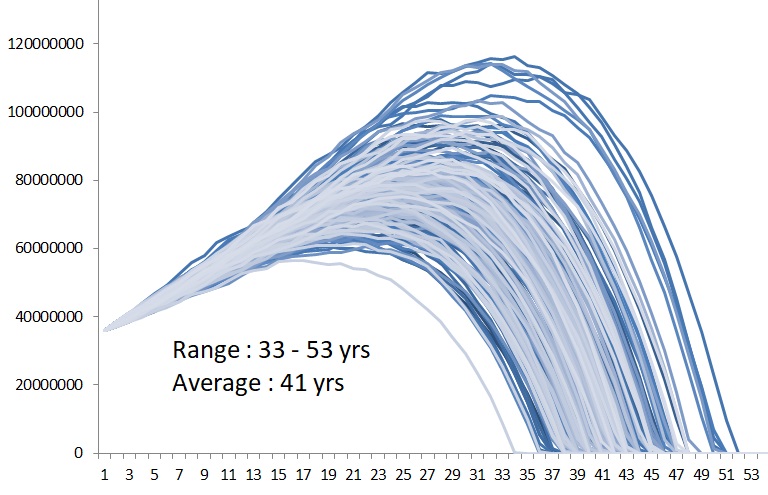

Testing the data for 250 iterations

I assumed that Inflation and Returns will come down slowly over long term as we move towards a more developed economy. We might reach to a 2-4% inflation (starting with 7% today) and 4-6% returns post tax (starting with 9% today). I added a variation in calculations and plotted 250 variations of the same chart and here is the results.

As you can see from above graph, the results can vary a lot depending on inflation and returns combination. On an average the corpus lasts for 41 yrs.

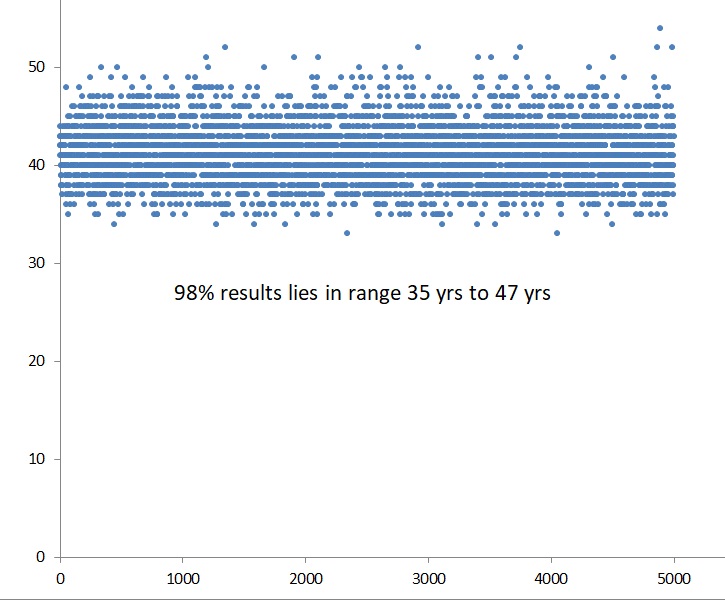

I also took 5000 iterations to see how long the money finishes and here is the plot.

What we observed was that 98% of the times the money lasted in range of 35 yrs to 47 yrs, which is a decent enough planning, but the assumption is that all our assumptions about inflation and returns hold true.

Investing in Fixed Deposits for Income Generation

A lot of investors are extremely conservative and don’t want to invest in anything other than bank fixed deposits. We know that bank fixed deposits are highly secure, but at the same time – they are extremely inefficient in taxation and also provide below inflation returns.

But let’s test that case as well.

Let’s assume that a person is putting all their money in fixed deposits only. In which case the returns can be taken as 4% post tax (30% tax deducted from 5.5% returns)

Below I have shown how long the retirement money will last when a person has 60x, 50x, 40x, 30x, 20x and 10x corpus. I have done 250 scenarios and plotted them to see how the corpus ends.

As you can see, when the returns are lower – you need much more than 30x corpus if you want to last it for a very long term.

With just 30x, it will last for just 22 -24 yrs. The frustration of seeing your money finishing while you are still don’t see your death coming your way might be very horrible experience.

So conclude, Yes 30x corpus is good enough to retire, but the assumption is that you will not be dipping into that corpus to withdraw any big amounts like for buying house, or for your kids’ education or any large medical emergencies.

Better to have those things separate than your 30x corpus.

What if my corpus is less than 30x?

It’s going to be an issue if you are retiring with less corpus like 20x or 10x or 15x. In which case, you will have to make sure that you also have some decent equity exposure to bump up your returns so that your corpus can last longer. We at Jagoinvestor are working on various strategies which can be used to make sure that the corpus last longer using an equity exposure and generating a regular stream of income for our clients.

Do let me know what your thoughts about this article are.

Also, if you are interested in the topic of retirement planning and want to listen to a casual but very detailed talk on this topic, do listen to my talk with P V Subramanyam where we have discussed various aspects about retirement

Disclaimer : Note that these calculations are highly complex at times and there are lots of things which contribute to the calculation. I don’t claim to have done things perfectly from statistical point of view. This article is only a basic calculation with some high level assumptions. Do talk to your financial advisor before creating your retirement strategy.

August 24, 2020

August 24, 2020

I am male, never married, no children – this remains for life.

I have total corpus 3.6 crore (Equite plus debt MF).

I own a 2bhk flat with no loan.

My parents live with me and my father has pension of 45K permonth.

Our househould monthly average expense is 55K per month.

I have health insurance and a separate accidental insurance.

I also pay 55K per year for my parents health insurance.

At the moment my take home salary after tax is 200,000 per month.

If I retire, how long will I be able to sustain this?

You in quite good shape.. your current expenses per year is around (7-8 lacs) that too when parents are with you.. If you consider that much also , then you currently have 45X , which technically is enough to be financial free.

I assume you are below 50 in age and hence you can retire.

Its still advisable that you work few years mostly to keep your self busy (may be in some other job, which is light and of your liking) and that will make your position very strong.

Manish

HI Manish,

Excellent article !

I am 40 and my family comprises of my wife (39), daughter (10) and son (4). I have a corpus of 2.7 cr comprising 1 cr ( Mf and Equities) and 1.4 Cr ( PF, EPF, etc) and a property ( 40 Lacs). I have my own home and no EMI’s right now. Have term insurance of 1.2 cr and health policy family floater ( 10 lakhs) and super top up of 65 lakhs.

I plan to retire by 50 with major goals such as Children Education ( Total 2 Cr), Children Marriage ( Total 1 Cr) and Retirement ( 5 Cr). So total corpus required is 8 Cr.

I invest around 1.8 Lakhs -2.0 lakhs monthly ( 1 Lakh in VPF, EPF PPF and 1 Lakh in MF/ Equities). With an approx conservative return of 9 % overall, the expected portfolio at retirement will be 10.5 Crores. Also I am expecting an inheritance , that will kick in once I am around 60 years. The current value of inheritance is around 2 crores and this will grow to around 5 crores in 20 years. This is largely a backup should I run out of money. Plus a pension of around 20 K will also kick in from 60

I want your inputs on

(1) How do you see my current financial planning and what are the changes that I should make.

(2) Secondly, will it be dangerous to retire at 50 considering the un-certainties of life considering the above numbers or should I be able to sail through. I dont want to work beyond the age of 50, in fact if possible want to retire as early as possible.

(3) What is the best strategy for me to generate a regular cash flow from the corpus I would have accumulate at age 50. I expect my monthly expenses to be in range of 2.5 lakhs to 3.00 Lakhs monthly

Thanks

1. Without much of calculation .. numbers look good, but exact answers cant be given unless we do proper calculations and numbers

2. That will depend on your “Real Return” . At 50 , if you can earn more than 2% than inflation on entire portfolio then yes retiring with 30X corpus would be totally fine, not othr wis

3. That is a big discussion which requires buckting strategy and regular monitoring and tax optimization. You may want to get more details from us on that if you wish to.

Manish

I’m a 41-year old single guy with 2cr on FD/shares/EPF/PPF etc. i’m having my doubts on the retirement corpus. i’ve a monthly expenditure of 30k max. will this be sufficient ?

YEs, its sufficient

Dear Jagoinvestor,

Really good article with very detailed information.

Could you please help by providing your valuable inputs for my plan, which i am about to execute.

Details:

44 yr male, wife 40, mother 65, son 14.

currently employed in provite organization, staying on rent in Mumbai.

planning to move to tier 2 city in gujarat once the pandemic situation normalizes. want to goodbye employment permenantly. (survived a life threating health problem, not covid, & not considering life expectency beyond 65-67, already on medication for stress, sever anxiety and panic attacks)

Current expenses : around 60K per month (living, entertainment, transport, school, vacation, medical, policy premium, EXCLUDING rent and big travel/vacation), expecting a bit lower or same cost of living in future, inflation adjusted

Not owning a house yet (got sold ancestral house due to some dispute, old tenants and received almost nothing)

Planning to buy 2BHK for 15-17 lacs, 1-2 lacs for movement, new schools etc, So total initial cost would be around 20 lacs

Future major expenses would be health for self/mother/wife, Son’s school/college/marriage and settling him, may be go on a tour once in few years.

VERY LOW RISK TAKING PERSON

my current investments:

1) around 1.70 crore in various bank FDs in self/wife’s name (current avg FD rate is around 7%)

2) 85 lacs in EPF/PPF (maximized in VPF sometime ago)

3) 5 lacs in market linked policy, some in savings acct

4) may get around 25-30 lacs if another disputed property gets sold in next 5-10 years

Would be receving around 3 lacs per annum LIC return after 54, every year. (premium already included in above)

Too much stress at job and unable to find suitable replacement even after 4 years of trying and difficult to get anything new and different at this point in life. (not many opportunities due to specialized field).

Have already made up my mind to leave.I have planned to start some home tution or small business with wife since we both are graduate and wife already has experience in teaching

Would really appreciate if you could provide your valuable inputs or suggestions. Please let know if further information is required. Really looking for feedback from you / others also if they can

Thank you very much.

Avinash

Hi Avinash

Thanks for sharing your case in public forum.

I can see that there is too much of stress level at your end right now at this age of 44 itself. It looks to me that even if you have earned money, its not helping much to lead a happy life.

Coming to portfolio, I think you are on a conservative end, but not sure why is the core reason for it. Is it because you dont understand other asset classes or you are over -sensitive about volatility in portfolio which can happen due to less time left in employment and not getting decent clarity of future income so you are over protective about your current networth.

Your portfolio right now is very tax-unfriendly and you are in a way loosing out of lot of wealth due to taxation.

I think you shall move to debt mutual funds for some part to reduce the tax liability and soon add some equity component too for portfolio growth.

Manish

I am 47years old and left the Job due to stress. Now I have savings around 2.1 cr. : Me and my wife no kids. Have own flat.

65 Lacs in equity MF

30 Lacs in PPF?EPF

Balance in FD.

My annual exp is 5.00 pa . Whether this money is sufficient to survive for next 45 years if I am not able to find the Job

Yes, it looks like this much money shall be enough for a lot of coming years.

You can check our calculator for this : http://jagoinvestor.dev.diginnovators.site/calculators/how-long-money-will-last-calculator

Manish

Thanks for sharing the helpful information. Your writing is very good, I really use full this post. thank you very much for this post.

Thanks for your comment Dinesh Shah .. Please keep sharing your views like this..

Vandana

Manish, very good article and the question answers are equally interesting. Thanks for this gem.

Welcome Mukul 🙂

Glad to get your feedback!

Manish

Nice detailed article. Especially considering all the variations to understand the range of all possibilities.

I’m wondering how the current age of the person plays out in this equation. I suppose the scenarios will change whether you are 40yrs now or 60yrs. Please comment. Thanx!

No. It has nothing to do with age.

Its valid for any person who has 30X corpus. It will last for X number of years..

Nice Article, here is my version and individuals can calculate based on their needs. For e.g.

1. Retirement Age 42, with 2 kids aged 7 and 4

2. Rental Income from 2 houses after tax and maintenance exp 2 lakhs per annum , and stays in own house with no debts

3. Low risk taker

4. Kept some costs for some major medical exp every 10 yrs (10 lacs at age 50, 25 lakhs at age 60, 50 lacs at age 80, )

5. Yearly School exp for 2 kids is 4 lacs and it grows at 10% each year

6. Major Milestones are higher education assuming both kids study Medical and Marriage expenses. (5cr for Medical, and 2cr for Marriage)

7. Inflation assumed is 6% for first 10 yrs post retirement and after that 7%

8. Income return post tax is 5%.

Corpus at age 42 needed will be 9.5 crores to survive till age 107, and post this will have to sell the house’s. Cannot upload the calculator here, else if option provided can upload.

Thanks for sharing your data and inputs .. You can mail us the calculator at help@jagoinvestor.com for me to have a look.

Manish

Would you be able to share ur calculator please?

Check moneyliteracy.in

They give financial opinion

A very nice, informative,well-written and helpful article on retirement requirements. Thank you.

Thanks VIdya!

Superb eye opening article. Thanks for sharing.

Welcome !

I am 54 yrs old. My 50yr old wife and 23yr old son live with me . I retired on 31st Dec 2019. I worked in a pvt company and they asked me to leave so i was forced to retire. Since then I am trying but not getting any other job at the moment.

I live in my own house, no homeLoan . I have 50Lacs invested in HDFC balanced advantage fund dividend option (myself 27L, my wife 23L) ……….actually invested amount of 50L is today only 37L because of low NAV in current stock market situation. The combinedMonthly dividend is 40K

And another 50Lacs is in postOffice savings (20myself+30wife) . I have 10.5L in bank Fixed deposits. . I get HDFC Life pension Rs 8500 per month.

Annual expenses is 3.5L , this includes society maintanence, electricity bill, grocery, maidservant, annual LIC premia, property tax, vehicle insurance and servicing, and medical premia(family floater 4L insurance coverage STAR HEALTH, 3L family floater LIC Jeevan suraksha, total premia Rs 30000 annual) Son is working and lives with us. He contributes around 3K per month for household expenses (he landed a job very recently in Dec 2019 , he is working from home) So HDFC dividend and postOffice+bank interest and this HDFC pension all put together yields Rs 65K per month to the household. So I am able to save 35K per month approx.. I have another 20L in my PPF account and wife has 7L in her PPF account. This earns roughly 1.8L per annum in interest but we are not touching that neither the principal amount nor the interest. We are keeping that two PPFs and its accumulated interest as a separate fund for our future post 70 yrs age………….i have extended the account by another five years just last year and will keep extending it as long as they allow. Maybe we will just withdraw the annual interest only when the need arises to cover any extra expenses on account of inflation or for any capital expenditure. I have a SIP in HDFC AMC and ICICI prudential mutual fund total of Rs 25K per month which i will continue for as long as its possible so that during any next peak in the stock markets when the NAV peaks, i will sell majority of the units and put part of it in bank FDs or postOffice FDs OR reinvest in Mutual funds. My mother is 78 yrs old and stays alone in her own house , its a old flat purchased by my father 25yrs ago. i give her just Rs 7000 per month approx which is adequate for society maintenance, medicines and some expenses. This flat was fully paid for by my father when my age was 25yrs but he bought the flat in my name . She is separately covered in a medical policy (she is part of family floater policy in my sisters medical policy) Additionaly , I have taken for her a medical policy Rs 15K per annum from STAR senior citizen policy coverage is Rs 1.5L. i was not in govt job so no govt pension for me. So, including my mothers expenses, my annual expenses are max 4.25L

My future plan : after five years when I turn 60 , I will selloff the entire HDFC balanced advantage fund and invest in a SWP in some good fund house. OR whenever the stock market is at its next peak I will take back 50L by selling all units and immediately start the SWP . With this I should be able to get say 15K per month without the principal amount getting diminished much, rather it should grow . I will take reverse mortgage on my flat (any one flat out of the two flats). This will give me additional maybe Rs 10K per month (because the flat would be old its market value may be lesser and bank may not consider more than 50% value while calculating the monthly payout so I am considering only 10K). I will start getting Rs 3800/month in a LIC pension scheme from 2023 onwards. I have to pay the last two annual premiums Rs 6000 each in 2021 and 2022 ….after that pension starts . At the age of 60, I will do away with my car so that annual servicing and insurance will get reduced from my annual expenses. I may retain my twoWheeler just for small trips in the neighbourhood.

Whatever I save in the next five years will be kept separately as a fund for emergency only (medical expenses, hospitilisation expenses). So by the time I reach age 60 I should have a emergency fund of say 15L over and above the existing corpus. This 15L I plan to accumulate invested via the two SIPs

I had purchased another (third) flat for my son and he will move in there next year (planning to marry next year). There is no loan on this flat. Though he has promised he will give me rent once he moves in there, I am not considering that as any confirmed income. I have deliberately not rented it out as of today to preserve its newness. All these three flats are in same city (Bangalore). Once I turn 60, my mother will move in with us, so we will get rent from her flat providing us additional monthly income(roughly 15K per month).

So, after I turn 60, my projected total monthly income should be : 67K, breakup: 15bankPOinterest + 10reverse mortgage + 15SWP + 15houserent + 12pensions).

Now,age 60 onwards I will keep saving as much amount as possible every month as long as I am alive and all the saved amounts will be for further investment to make the corpus grow, though a part of it will always be for emergency expenditures. As we cannot predict our lifeSpans, its better to save as much as possible for medical emergencies.

Please advise whether my financial planning is ok.

Hi Praful

I think your overall resources are good enough for your requirements which are quite limited and not very extravagant . Also you are quite well versed with mutual funds which is good.

One red flag which I can see in your sharing is that you want to get out of mutual funds equity from age 60. I think thats not right move. Considering your overall resources are not extremelly high, I suggest keeping atleast 30% in equity even when you turn 60 which will boost your retirement corpus once you turn 70-75.

Other than that, I think you need to also sit with a financial planner may be 1 yr before your retirement at 60 to consolidate everything and make it more simpler

Manish

The below two variables can also be defined (foreseen) as worst case scenario :

When will you die – 100 years ( which is most unlikely)

When will you retire – 55 years.

May be 60 X corpus – may give little more flexibility and peace of mind.

Good point..

Note that we are not thinking of age here. The article is about will 30X be enough and how long will it last. So if someone wants it to last for 40-50 yrs, then surely 30X will not be able to achieve it as we have seen above. In which case 40x-45x is required.

However very valid point raised by you!

Manish

Great article. Couldn’t be write much better!

Thanks Kalamsaar!

Very nice article. Yes, how much corpus will be sufficient for post retirement life, is a tough question to be answered. But with some realistic assumptions, you have indicated an answer.

Thanks once again.

Thanks

Very informative and detailed article as always !!

Thanks

SUGGEST SUITABLE FINANCIAL PLANNING

Exactly what you want? Please explain “suitable financial planning” meaning!

Nice article. However, the multiplier of annual income can vary based on age of investor also. A fresher will have a higher multiplier while some one who is 40+ will be having a smaller multiplier.

True .. I have considered a person who is near age 60 and looking to retire as per “conventional definition”

For a young person a 45x-60x is desired

Manish

30X – retirement plan article was excellent, interesting and thought provoking.

Sir, I retired in August 2019, received a corpus amount of Rs 2.75 Crores, consisting of PF, VPF, Gratuity Leave encashment, Superannuation fund.

The entire corpus amount is invested in Fixed deposits in banks, Post office, nbfc’s, LIC. Exposure to equities is nil. The average return on these, is about approx. 8% pre-tax, and 5.5% post taxation. Nearly 50% Corpus amount invested will mature in <5years, rest 50% will mature in the 10th year (2029).

My monthly expenses is ~Rs50K.

I have a own house, two dependents, a daughter to be married. Have no any loan liabilities. Have floater medical insurance of Rs4 lakhs sum insured covering myself and spouse.

Considered average inflation of 7%, and in the above scenario of investments made, how long can my corpus last? With interest rate risk looming large, further reducing post tax returns in the coming years.

Sir – I think you should consider investing part of the corpus in equity market thru MF

We just created a retirement plan for a retired clients who had a very similar profile like yours (2.5 cr corpus with 60k expenses) and his money shall last for just 24 yrs considering FD and similar investments because they are highly inefficient from taxation point. If you can be ready to put some exposure into debt funds, equities with proper strategy then it can last for 40-50 yrs ..

Manish

Any reason why my comment was removed?

No comments are removed.

Comments are approved later, which I did today!

Very nice analysis, for any goal we always by default calculate + or – 10%, so taking 10% less to be a ‘worst case’ scenario is not correct in my opinion, for me a worst case scenario would be when my net-worth depletes by 1/3rd , that can be practically considered a worst case, so pls put up a post with 33% reduction as the worst case…that more practical than 10%

In the article, we have not taken a very aggressive return and its not assumed to be into equity funds fully. Only a small portfolio might be there in equities in my example above.

well the analysis shows corpus lasting for 27-43 years, over that long period of time what % of equity are you assuming so that the overall portfolio return will give 9% post tax? a depletion of 1/3rd of the corpus is a likely scenario over such a long period is it not?

We have not done that kind of analysis in this post. We have not taken a real life return fluctuating scenarios (which was ideally to be done) . Thats what I mentioned in the article also that there is room for more deeper analysis.

The calculations are mainly taking the fixed returns.

Manish

Best blog to think about your retirement plans

Thanks

Need a comparision between liquid funds/short term funds and bank savings account after taxation with examples

Will do a post on this in future. But its quite easy to calculate in Excel ..

Great article. You may want to recheck why corpus graphs shows starting amount as around 1.8cr instead of 3.6cr assumed.

Ah .. Actually I changed the monthly amount .. But the graph still is correct, because its showing how 30X will last , not matter how are monthly expenses numbers.

Manish