RBI has announced that its going to issue Inflation Indexed National Savings Securities – Cumulative (IINSS-C) for retail investors where one can invest and get returns equal to Inflation + 1.5%.

These bonds are now coming up in markets, as it was announced in the last budget that govt will bring inflation linked products very soon (RBI link here).

The minimum Investment amount for these inflation linked bonds is Rs.5,000 and the maximum can be Rs.5 lacs per applicant per annum. The inflation linked bonds are going to be available only for 9 days, starting from 23rd Dec to 31st Mar 2014 only (update – This date was earlier 31st Dec, later it was extended to 31st mar).

The best part about these bonds is the hedge against inflation, so you don’t have to worry if your investments will be able to beat inflation or not.

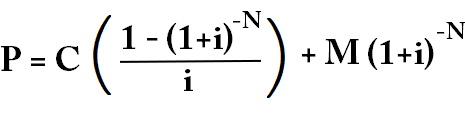

Returns from Inflation Indexed Bonds

As per the RBI guidelines, the return you would get is “Base rate of 1.5% + Inflation Rate based on Consumer Price Index (CPI) , compounded half yearly”. So assume that, CPI inflation number is 10%, so your final return would be 11.5% (10% + 1.5%) .

Actually because its compounded half yearly , the returns would be a little more than 11.5% . One important point to note is that in case of negative inflation (which we are all sure will not happen), you get 1.5% guaranteed.

The best part about these bonds is that the benchmark for returns is CPI inflation and not WPI !. Because CPI is one the best measures of inflation parameters available in India. CPI is more close to reality, tracking the change in prices of end-user numbers unlike is sister WPI (Wholesale Price Index), which tracks the price changes in wholesale market. Read more about WPI vs CPI here .

Below is the last 3 yrs history of CPI inflation for you to get an idea about what was CPI in last some years ! .

Taxation Angle ?

This can be disappointing for many, but there is no tax benefit when you invest in these RBI bonds. You do not get any income tax exemption at the time of investing under Section 80C or anything else, nor they are tax friendly at the time of maturity.

You will have to pay income tax on your returns as per your slab rates at the time of maturity. Now that’s the price you need to pay to get the guarantee that your investments will be hedged against inflation.

Can you get Loan by Pledging the Bonds ?

Yes, you will be able to pledge these bonds and get the loan against it. Given that the bonds comes from RBI and govt guarantee’s the returns part, the lenders would not mind lending you against the inflation linked bonds. However you wont be able to sell the bonds in secondary markets, like you can do some of the other bonds which came few years back.

Can NRI’s Invest in These bonds ?

NO. NRI’s are not allowed to invest in these inflation linked bonds from RBI. As per the guidelines from RBI declaration about bonds, only Individuals , HUF’s and Charitable Institutions and Universities are allowed to invest.

Premature Withdrawal

The bonds tenure is 10 yrs, however its possible to withdraw prematurely after 3 yrs of investments (with penalty charges) , however a senior citizen (65+ yrs) would be able to do premature withdrawal after just 1 yr. Note that premature withdrawal rates are high enough to discourage you to do so ! .

How to Invest ?

One can invest in these bonds at branches of SBI bank , all other nationalized banks (Vijaya Bank, Bank of Baroda, Maharashtra Bank, Bank of India etc etc … all of them) and 3 private banks which are ICICI bank, HDFC bank and Axis Bank.

Subscription to the Bonds will be in the form of Cash/Drafts/Cheque/online through internet banking. Cheque or drafts should be drawn in favor of the bank (those mentioned above), specified in paragraph 10 and payable at the place where the applications are tendered. I think its better to visit the bank for exact procedure incase you are interested.

Full Brochure about these bonds from RBI is below:

Who should Invest ?

At first glance the bonds look very good option to make long term investments who are too scared with inflation and it worries them to core.

Those investors who are approaching retirement and want some kind of security against inflation can surely look at these bonds, but then be ready to pay income tax on the returns part. Truly speaking your final return depends on various things like CPI inflation in future and the Taxation laws at the time of maturity.

I contacted some of the other bloggers and experts to know their opinion about these bonds and their comments and here they are !!

Karan Batra, A Chartered Accountant who writes on Income tax on his blog was not very excited about these bonds and says

These Bonds are only Inflation protected and not Tax protected but sadly the Tax Rates in India are much higher than the Inflation Rates in India. Therefore, it is always advisable that the investor should prefer to invest in tax-free instruments like PPF as they yield a better return.

Moreover, the computation of interest and principal readjustment is complex which leads to an even highly complex tax structure. These Bonds may give slightly higher returns but the complexities are so much that it I’m advising my clients to stay away from this issue and rather invest in PPF/Fixed Deposits

However when I contacted Deepak Shenoy to comment on these bonds from long term perspective, He was positive about these bonds and says

The product makes sense for anyone in income brackets that are less than 30%, but you have to buy the idea that inflation will remain fairly high over the next few years. If the CPI inflation falls, your return comes down appropriately. (In which case the fixed coupon tax-free bonds or PPF is a way better idea).

You can read the detailed posts from Deepak on these inflation linked bonds here and here.

Are you worried about inflation in future? Are your investments hedged against inflation? Please share your thoughts about it in comments section below !

Also be ready for the “Oh My God” Offer coming on 7th Jan, which will be a great one in a year offer from Jagoinvestor you can’t afford to miss. More information about it soon !