SBI bonds @9.95% , Who should buy ?

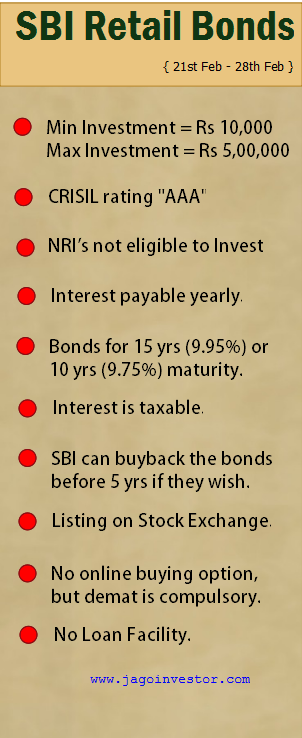

SBI retail bonds or SBI bonds are the latest offers from the State Bank of India. These savings bonds issue will open from 21st Feb 2011 and closes on 28th Feb 2011.

These bonds are offering attractive interest rates to investors which are better than even fixed deposits, however, it does not suit every kind of investor. Only if you are looking at income generation, these bonds will be good for you, but if your aim is capital appreciation, you will benefit by investing in PPF instead of these bonds.

Lets look at the details of these retail bonds . .

Tenure and Interest Rates on SBI bonds

These SBI bonds will come in two variations. The first one is with 15 yrs maturity period offering 9.95% interest and the other option is with 10 yrs maturity period offering a 9.75% interest rate. Note that these interest rates are applicable only if you are investing less than Rs 5 lacs (retail category).

If you invest more than Rs 5 lacs then you will come into the category of non-retail investors for whom the interest rates are 9.30 percent for a 10-year bond and 9.45 percent for 15 years bond. The interest offered by these bonds is a payable yearly, which makes them a great alternative to Bank Fixed Deposits.

Following is an illustration which will clear a bit about how it works.

Ajay invests Rs 1,00,000 in 10 yrs SBI Retail bonds. He is entitled for 9.75% interest each year. So he will get Rs 9,750 per year for next 10 yrs . Note that each year this interest amount of Rs 9,750 will be added to his income and he will pay the tax on it accordingly as per his tax slab.

He can sell off these bonds on stock exchange incase he is getting a good deal . One more thing which can happen is that SBI can force him to sell off the bonds back to them if SBI exercises their “call options” , which we have talked about below ! .

Call option

There is something called “Call Option” in these SBI Bonds. For people who are familiar with “Futures and Options” , they know that a Call option is nothing but “Right to Buy” . So as per this call option, SBI has the right to buy back these bonds from you and terminate the contract with you much earlier than the actual maturity.

If they choose to “exercise” the call option, SBI will pay the principal back to you. For 15 yrs bonds, the call option can be exercised in 10th yr and for 10 yrs bonds, the call option can be exercised in 5th yr. Note once again that it’s the right of SBI, not yours.

For example: If you buy 15 yrs bond in 2011, then if SBI wants to buy back the bonds after 10 yrs which is the year 2021, they can do it. In which case, they will pay back the principle amount to you and close the contract. But in case they dont want to do it, they will continue the bond and you can’t do anything :).

How to Apply for SBI Retail Bonds

There is no way to apply for these bonds online. You will have to physically go to SBI Bank and get the form from there and fill it up (See the list of all the designated branches of SBI in PDF and EXCEL format, thanks to Babu for providing the list).

However, these bonds will be issued in Demat form only and therefore you will need to have Demat account for buying these Savings Bonds from State bank of India. So be clear on two points

- You need to have Demat account to apply for these SBI Bonds

- For applying you need to go to SBI Bank Branch and fill-up the form , there is no way to apply online

Listing on Stock Exchange

One great thing about bonds is that they are listed on a stock exchange so that you can buy and sell them in the secondary market in case you want to exit from it before maturity. SBI retail bonds will also list on the stock exchange after 1 month of the issue, after which you can buy or sell them on the stock exchange.

Last time when SBI came with a similar issue, the buyers benefited a lot because the bonds listed at 5% premium on the first day itself, so there was an instant 5% gains for those who bought these bonds. However, there is no guarantee that it will happen again.

Taxation

The interest which you get from these bonds will be taxable. The interest will be added to your salary and taxed accordingly. Also, these bonds do not give you any tax benefits on investment amount and are not covered under sec 80C. So effective return for these bonds will be much lesser for investors in 20% and 30% bracket post-tax. Watch this video on 7 tips of saving tax

Should you Invest in these bonds?

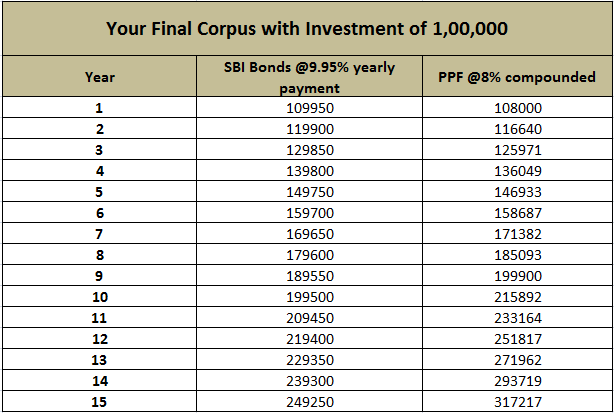

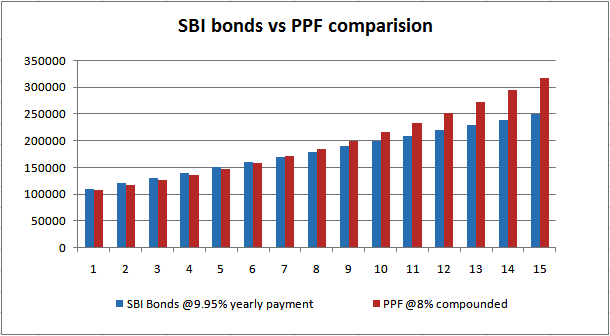

So the main question anyone will ask is “Should I invest in these bonds?“. It would depend on your goal as an investor. Just by looking at 9.95% you cant say that its the best investment. Note that the interest payout if yearly. It’s not compounded like your PPF or FD’s. This means that the returns do not earn anything on it later, but its paid out to you.

So in case, your goal is to generate yearly income at decent rates, It would be a nice investment. However if your goal is capital appreciation and you are looking at the growth of your investments, these bonds would not be the best option. Note that even PPF would give more money to you at the end.

Below is a chart that shows the yearly amount you have got by the end of each year.

You can see that in the case of PPF you are having more money with you even though the interest you get on it is just 8% because of the compounding of money which is happening there .. However, in the case of SBI bonds, it’s not the case.

Here the reinvestment of those yearly payouts is not taken into consideration. So the point here is that if you want yearly income, only then these bonds make sense.

What about interest rates in the future?

But the only suspense is what will be the interest rates in the coming years? What you don’t know is how interest rates will move in the long-term and if interest rates offered by these bonds will look attractive in the future?

SBI might not be too dumb to offer these returns for such a long-term. Here is an except Deepak Shenoy …

“why is SBI doing this? They don’t need to. They’re really smart people. Let me reiterate that. SBI has extremely smart people. If they could have offered a lower rate, they would have. That means this is actually a low rate compared to what they expect rates to go to.

Meaning, there will be more rate hikes, and the 9.95% that looks good now, won’t look so great if you can get, say, 12% outside. (Don’t tell me 12% is out of reach, please. Even 10% was out of reach a couple of years ago) So that’s the risk – the feeling of regret if rates go up to 12% – in fact, you will think of it as a “loss” because the market value of the bonds will be below par, in that case.

But if you have a different view on interest rates or can swallow such regret, go ahead.” – Excerpts from Deepak Shenoy on his blog post.

Some Great Advice from Experienced Investor

In case you are going to buy these bonds, you need some real-life tips. One of the readers Mr. Sundar shares some good and worthy points based on his experience of applying in these SBI bonds in 2o10. Read it below …

1. Apply in retail quota and do it on the first day. It is first to come first depending upon the day. I applied for HNI Quota and failed. Retail gets preference over HNI. Read the offer document carefully.

2. Those who apply for 15-year bonds get first preference over the 10-year bond applicant. Read the offer document carefully. So don’t apply for 10 years if you want to improve your chances of allotment.

3. SBI Bonds are listed on the NSE as N1 and N2. Go to NSE Website and search for SBI equity. You will get SBI, N1, and N2. Trading per day is not that good. 15-year bonds are trading with a premium of 4% (N2)and 10 years (N1)at 2.5% as of yesterday.

4. On the whole this offering is good. But if you are looking for holding it up to maturity you will be shocked to know that the gains will be treated as interest and not as capital gains. So it will be better to sell this bond in the market in which case it will be treated as capital gains on Debt Funds.

Unfortunately, the trading is small and only small lots can be sold on a per-day basis. See the trading pattern on NSE.

Other Features

- There is no Loan facility on these bonds. You will not be able to pledge these bonds for taking the loan.

- The minimum investment is Rs 10,000 and the maximum is Rs 5,00,000 for the retail investors.

- NRI and PIO can’t apply for these bonds

- CRISIL has assigned a rating of “AAA” to these bonds which comes into the “safe” category.

Comments? Have I missed anything in the article which you want to point out? Are you investing in these bonds?

February 17, 2011

February 17, 2011

Hi

IFCI Ltd. (BSE:500106 NSE:IFCI) has now come out with its Tier II Bonds Issue fetching 10.75% interest. The issue is quite similar to the SBI Bonds Issue. IFCI Bonds are going to trade on BSE upon listing.

Key Points of the Issue are:

> Interest Rate of 10.75% p.a. (15 Years) & 10.5% p.a. (10 Years), which makes the issue quite attractive

> Easy liquidity as the bonds are going to list on BSE

> No TDS

> Issue Size: Rs. 150 Crores with a “green-shoe option” to retain over-subscription

> Bonds will be issued in the Demat mode only

The bonds are most suited to those investors who want to earn better interest on their investments as compared to Bank Fixed Deposits. Issue opens on June 1st & Closes on July 15th but its expected that the issue will get closed much before July 15th as & when IFCI achieves its target.

To invest in IFCI Tier II Bonds (10.75% or 10.5%) or for any other info you can Call/SMS us at 9811797407 (For Delhi, Gurgaon & Noida).

can i put 500K in ppf in name of myself and mywife? NO…. Now does your PPF vs SBI bond comparison makes any sense to me? NO.

Its an illustration with a debt instrument . You can replace PPF with Tax saving FD

Hi, Manish,

really good informative and good comparative between SBI v/s PPF,

excellent

Thanks

Shivakumar

Shiva

Thakns 🙂 . keep reading

Manish,

These bonds will be listed on Stock Market then how interest on it will becorme taxable as FD? Also you may have rightly pointed out that compound interest in PPF/PF may give more returns on 15 yr window but you are missing one point. One can easily invest interest earned every yr in other savings intruments available to earn more income. Your capital is alway secured.

Let me know your thoughts.

Thanks

-Mandar

Mandar

What has listing on stock exchange to do with taxation ? Is there a rule that anything which is listed on stock exchange are not taxed ?

Also , I didnt miss the point that the amount got yearly can not be invested , the first point is that if you get it each year , its taxed first and only then you can invest it in something .

Very nice & informative write-up. If we invest in Bank FDs with Re-Investment option (interest not taken, i.e. Cumulative Option) & where interest is quarterly compounded, what happens to the maturity vale i.e. Total Interest earned? Is the interest earned annually taxed on accrual basis or the whole interest is taxed in the year of maturity, or is there capital gain tax involved? Kindly give details.

Can anybody Explain me why one should go for a debt instrument for a long term ? Why shouldnt go for an STP in mutual fund?

Bhavin

You should not invest in debt funds for long term , unless you are extremelly risk averse .

Manish

[…] for saving a tax. Hi Sandy, Found something related to this SBI bonds 9.95% , Who should buy ? SBI issues Retail Saving Bonds [with summary] Thank […]

PPF limit is 70K per year so we should compare 70K in PPF and rest 30K in other instruments if we are comparing one lakh in SBI bonds vs. PPF.

Sandeep

thats a good point , but the point remains the same , Take any guaranteed thing which gives 8% return , what if I had done comparision with just 50k ?

Manish

Is it a good move to put money in a debt instrument for a long term? Rather one should do an STP? Whts ur view , Manish?

Bhavin

How is this related to SBI Bonds ?

Manish

Fantastic Comparision Great work done, the explanation given hera i can tell everybody even not known by the some reputed Brokers also, i have faced it……intelligent work.

Alisagar

Thats great to hear 🙂 . Keep reading

Manish

I understood the concept.But since it doesnt support 8th wonder of this world and since its a long term product(i wont go for it).

But somewhere in posts and in article i read that it got listed at premium.I read 5% on Et site.And someone mentions thats above the rate of return we get.So does this means i buy the born and say again this bond lists at 5% premium .Would i be able to sell the bond within a year?Or its just that to buy from market i have to pay the premium .

Sohil

The listing point was for the last issue ,it might not get listed right now , It all depends on the interest rates

Manish

Sorry did not got the point why it depends on interest rates?

Just read on mint in grey market its offering 320 bucks premium on 10000.16k on 5 lakh.

That is 3.2% annual return within a month or two when listed.

People suggesting to go for it and invest the interest some where else as it doesnt suggest compounding.

But one thing i fail to understand is its obvious when economy comes on track interest rates will start falling from 10,11 12% back to 7,8%.Than how come rate of bonds will increase.Does this means the premium will widen?

Sohil

Understanding interest rates is not that simple as you have mentioned . You cant tell that for next 10 yrs the interest rates will come down only . So its not sure which way it will move .

If its said that in grey market there is some premium , it might happen that the bonds will list with premum , its your personal call if you want to take the risk or not . Remember that when Reliance power IPO came , even it was on premium in grey market. But you know what happened .

Manish

Agreed.But i have data of last 5 years of my banks where i have seen interest rates on fd at 10.5% and same fd i kept for 7.5% some times back and now the same is being offered at 9.25% .One cant bet it will be always above 9.3% annually that was my point.Also if rates go say at 12% in bank fds still this bond will give same returns 9.3% .

As i said i wont be betting on this bonds.I can easily get those returns in shares i feel.But ill suggest people who know how to invest and where to invest than only put your money in stocks.

But still the question i failed to understand is how come rate of bond increases if fd rates go down.ALso this rate going up is on trading market?

Sohil

Its not FD interest , but general interest rates declared by the RBI . If the interest rates go down , say for example 7% , then these bonds will become attractive for investors , and people will buy them from secondary markets , but SBI will exercise their option of “call-option” and withdraw it .

If interest rates go up , then these bonds will become unattractive for investors but for SBI it would be a good idea to continue these .

I would suggest initiating a discussion on the forum to know more on this now

Manish

Finally found a good piece of information on dna newspaper mumbai explaining how bond rates and interest rates associated with one another.

http://img684.imageshack.us/img684/3895/121rvy.jpg

Sohil

the link has some issue . Kindly download it and send it to me on email

Manish,

Very good article.

I won’t be investing in these bonds due to the longer tenure. I would rather invest in FD where i am getting 9.5% for a year. There is more likely chance of interest rates going up in the future, so i would not want to block my money.

Rakesh

Hmmm ok

Its a risk you are taking , if interest rates go down , in that case you will loose . Also note that these bonds are listed , so liqidity will be there

Manish

Interest rates wont be up for eternity in 1-3 years after it will start coming down.Also i see no reason fd interest rate touching above 12% in any case.That will happen in extreme liquidity and also if it does the tenure of such fd wont be more than a year or 2.

I am not sure why SBI chosen to raise the funds through high cost bonds. I hope SBI did due diligence. There are significant additional costs associated with bonds issue (bond manager fee, application processing, allotment, cheques refunds, annual interest process, SEBI reporting, bond listing). Hence the net cost of funding could be anywhere between 12-15% for the SBI for 15 year tenure. Even at 15% lending rate it would just break even. The predominant loans i.e. home & auto loans are lower than this rate. Only personal loans seems to be the option and SBI is not aggressive in this segment. Overall bond issue from SBI is not a good news for shareholders and could affect the bottom line in future results.

Krish

I am not sure. WIll the costs be really that high ? SBI cants take suchg decision without thinking much

Manish

Hi Manish,

Very informative article indeed!Thanks a lot. I have the same view as Murli’s,and I am not in the 20% or 30% tax bracket,so do u think it will be a good investment option for me? and one more thing it’s one of the alternatives to company f.d.,bank f.d. and p.p.f ,not that people should not put money in them but this is another lucrative and safe option they have apart from those instuments.

Geetanjali

Yea .. if you are in 10% bracket of below taxable limits , then it would be a very good option 🙂 .

manish

Hi Manish,

I did not understand why persons belonging to 10 % or below tax brackets should take these bonds.I did not get the reason why it is preferable for them?Can you please explain me in detail?

RaviShankarKota

What actually matters to an indiviudual is post tax returns , so even if returns on SBI bonds is 9.95% (say 10%) , if you are in 30% bracket , your in hand return comes at 7% , and 8% for 20% one .. If you are in 10% bracked , it would turn to be 9% , a good one

Manish

Manish,

Thanks for great post. What are other debt fund options which can give better capital appreciation, say 8% or 9% (better than FD post 30% tax bracket)? If invested for more than 2-3 Yrs.

Thanks in advance for your reply.

Ritu

Ritu

Monthly Income plans are good options : http://jagoinvestor.dev.diginnovators.site/2011/01/monthly-income-plans.html

Manish

Wonderful.I got the point.Thanks a lot Manish.

Hi Manish,

It’s a good article but I do not agree with your view on conclusion that returns on the bond being lower than PPF. Since this is based on your assumption that the yearly interest on bond is not invested elsewher which is incorrect. If the interest on bonds received every year is reinvested in Recurring Deposit (which I assum will provide at least 8% return) then the total amount at the end of 15 year would be far greater than PPF. Please find my comparative chart.

SBI with RD PPF

109950 108000

120696 116640

132302 125971

144836 136049

158373 146933

172992 158687

188782 171382

205834 185093

224251 199900

244141 215892

265623 233164

288822 251817

313878 271962

340938 293719

370164 317217

Murli

Yes , the assumptions here are that its not invested . However did you look at taxation also , the interest which you get each year is 9950 , but it will be added to your salary and taxed , so for someone in 30% bracket , he will be left with just 70% of 9950 . now if you consider investing the money in RD , does it outperform PPF ?

Manish

Hi Manish,

I guess the interest rate for the SBI bonds are priced attractively to encourage more retail participants in the bond market. As we all know the debt market is shallow and under penetrated in india. I see this move to create vibrant debt market by pricing attractively. SBI indeed planned to raise capital via bonds every quarter. I dont think nothing much to read about the future interest rate movement from this. Even if the interest rate rises 100/150 basis point in short term, it wont stay there for long term. Hence i would say this bond issue as a good debt component for long term investor or for people looking for annual income.

Thanks

Jagadees

Jagadees

Yes .. but again I would say that if you want to gernerate yearly income , then these bonds are good , but if you want capital appreciation , then not the best one as there is no compounding effect 🙂

Manish

Dear Manish,

QIB / HNIs are eligible to invest , agreed, but they will be issued the bonds at 9.3 & 9.45% coupan. My question was ‘Can QIBs / HNI buy the bonds which are issued to retail (at 9.75% & 9.95% coupan) after listing ?’ In other words, would QIBs / HNI be restricted from buying bonds bearing 9.75% & 9.95% coupan (which are issued only to retail), from the stock exchanges after listing ? The price of 9.75% and 9.95% bonds on listing will depend on this. Retail can expect higher listing price of their bonds, if QIBs are allowed to purchase the bonds issued to retail (i.e. 9.75% & 9.95%).

ok , in that case NO . Non-retail clients will not get the retail interest rates .

Manish

Dear Manish,

Can you please tell me whether HNI / QIB investor would be allowed to buy 9.95% Bond after listing ?

Thanks

TCB

TCB

Yes , QIB are eligible to invest , look at the table at the end here : http://www.docstoc.com/docs/71713181/STATE-BANK-OF-INDIA-%28SBI%29-Retail-Bonds-Public-Issue-February-2011

Good write-up Manish.

Thanks Srinivas 🙂

Manish

Thanks for the good information Manish.

Even at the height of liquidity crisis the FD interest rates didnt cross 11%. May be it is safe to assume they wont cross it again and there is every chance that they will go down. I had made FDs with axis abnk at 11% for 500 days (that was the tenure avaialble with 11%) and when they got matured I had to put them in 7.5% FDs. Whereas with these bonds, same interest rate is assured for 10 or 15 years.

One thing to be noted is FDs give interest quarterly and can be compounded. With these bonds, it is not clear if we can compound the interest. If not how do they give interest – is it into bankaccount linked to demat or …..Manish may clarify on this.

Giridhar

hmm.. i cant comment on interest rates .. SBI has given these rates after a lot of study , i hope the rates will not fall down a lot . Incase they do , SBI will exit with a call option they have 🙂

How did you get 11% with axis bank ? Its really great deal . any catch ?

Manish

It was in dec 2008. There was no catch. It was at the height of banking crisis when many feared to put money in banks.

hmm ok . got it