Today we will talk about how a newcomer or a fresh investor start his investment journey. We will see 4 steps which a newcomer can follow to start his invstments. I see a lot of new people on the blog asking things like

Hey Manish

I am totally new to this world of investing, I just joined job 3 months back and it seems like I have no idea how to start. I can see my friends who have been in job already, but they have messed up so much in their financial life. I do not want to be that way and want to do best. Can you tell me where should I invest?

In today’s world of over communication and an environment where things look complex it’s no wonder, a new person is confused. While there cant be a one strategy that fits everyone, we can still propose a generic 4 step rule, which can help most of the fresh candidates and these 4 steps becomes more important these days because most of the people mess up hugely in the first 5 yrs of their financial life and they have no idea how important starting years are in financial life. So today, here’s a look at the 4 steps, I feel will be applicable for most of the people.

Step 1. Enjoy for the first year – Spend !

Almost everyone who starts a new job has this feeling for a long time – “Once I start earning, I will buy things for my parents! I will buy a bike! I will roam places! . I will buy that awesomely cool mobile which I could not afford when I was a student! . I will do this! . I will do that! I will go here! I will go there!” . Everyone goes through that feeling and when I started my first job, even I had those same kind of excitement.

You know what? This is totally acceptable and a 100% correct!

The moment we enter the world, we become the part of the rat race (remember 3 Idiots?) We get good grades, we get into best school, study hard to get into college, and then finally land at job, assuming its the end of the race. At this point, if someone tells you – “Start Investments Early!”, what would be your reaction ? I would say that as a statement, its a great thought, but to a young guy (or girl), who is yet to get comfortable with the environment, it’s a foolish statement, distant from reality and kinda crushing the emotional side for their ‘desire to spend’ .

The only thing which makes sense at this point is to let all those wishes come true! Let the guy spend!. Let him or her spend on those things which he or she ever wanted. Let them splurge! . Buy things which they dreamt about for years . Let them travel! . Buy gadgets! . Shop for clothes and phones and whatever they wish to! .

I’d say, go for it!. Let it happen for the full 1 year in the start. After a year, the person should have done most of what he or she wanted, in that time, he or she should be more settled in the first job. He/she would have got a taste of “earning money” . Now! This is the good time to talk to him about finances.

Step 2. Start a Recurring Deposit and Start learning

The next step is to get started, to get into the process… The biggest issue which I feel with newcomers is that they do not have this habit of “regular investing” . Lots of people, when they start their financial life, want amazing returns immediately! . They hear about SIP from media, they hear about stock markets and real estate markets and suddenly the only thing that plays in their mind is “high returns”.

First, they need to work on their “habit of investing.” They should first understand, what it means to save regularly, they should first get a feel of how money grows over time. A person is mostly raw in the beginning and needs some serious understanding of basic concepts and how everything works! The need of the hour is “habit” and “education”. For anyone new to investing and who has just started his career, should read my first book “Jagoinvestor” where I talk about few fundamental principles of personal finance. From most of the people who have read it, they told me that it was an eyeopenor for them. If you want to get a understanding of what it looks like download this sample 1st chapter of my book and read it . It also has tons of reviews from other people who have read it already.

So coming to the point, what can this new investor do at this step once he is ready to take the plunge ?

I can think about 3 things here.

a) First, open a Recurring Deposit in your bank for a big amount which you can save. It can be 10,000 , 20,000 or even 50,000 depends on how much are you saving! . This will make sure that a part of your salary is now getting invested in a Recurring Deposit on a regular basis for next few months atleast. You can see some money regularly invested and get a feel of how money grows over some months. The money will also be safe.

b) This is also a serious time to start exploring and learning about the other kind of investment options. You can learn from all kind of websites, blogs and books written on personal finance and more. Ask questions if you have any doubts on our Q&A platform (we already have 4,000 questions and 20,000 answers on it). This phase will act like the preparation for rest of your life. The clearer the concepts and fundamentals to you, better it is. At this point, you should concentrate on learning things. Your money is getting accumulated anyway in the recurring deposit and is safe. So nothing to worry about there.

c) Apart from the above points, you can also start the background documentation & processes which will be required in the future. You can apply for your PAN Card incase you dont have, start a demat account, get your KYC done for mutual funds investing. If some document is missing, apply for it, & open more bank accounts if you think you would need them. It’s like, you’re getting all your weapons ready for the future.

For those newcomers who like to learn through Video’s – we have a 37 min course called Basic Concepts of Personal Finance on our Jagoinvestor Welath Club.

Step 3. Complete Most Important and Primary Tasks First

Now, you are ready & educated, have a good understanding of everything, gotten a taste of investing money and are ready for the next step. Now in any financial journey, there are few steps which you should take right at the beginning. These are like the “first things first” tasks. I see people on this blog, who have not completed these important early tasks even after 5-10 years of their first job. There are few things like

- Buy Adequate Life Insurance via a Term Plan

- Buy Health Insurance

- Put your Emergency Fund in place

- Activate your Internet and Mobile Banking

- Open your PPF account.

These are mostly one time tasks. Once you complete them, They are complete ! . You might have to pay a regular premium for few products, but the main task of taking actions in those areas are complete, which most of the people struggle with. Understand that, if you delay these most important tasks, they will just get pushed for “future” and it will take ages to complete those when you actually need them.

Remember, these one time activities complete a major part of your financial life. After this, you mainly have to just review these each year from time to time, and mostly concentrate on your “investments part”. After you have completed these tasks, your primary objective is wealth creation. A lot of people I see are still lost in these primary, first level tasks even after years and years , just because they didnt do it in start and now when its time for concentrating on their wealth creation, they are still stuck in these primary level tasks.

By this time, you will be more comfortable investing in new avenues like Equity mutual funds, Real estate, ETFs, Stocks, and other investments. To start with and to get a taste of mutual fund investing, start SIPs in a a balanced fund like HDFC Prudence or HDFC Balanced or if you are too risk averse, you can also start SIP in Montly income plans (MIP’s) or some debt mutual fund.

4. Design your financial life and explore more

In the end, after you’ve completed the 3 steps mentioned above, you can see, how easy it would be to extend your actions. I’d say the above 3 steps will take anywhere around 2-3 years depending on what kind of person you are and your circumstances. In those 2-3 years, you must have accomplished these things

- You must have done a good amount of spending and fulfilled most of your wishes

- You must be educated well about financial matters and have good clarity about your future.

- You must have completed the primary level of basic tasks which any financial life needs

- You must have saved a respectable amount through recurring deposits and other investments.

At this moment, you can plan the next 5-10 years of your financial life. Clearly define and prioritize your financial goals in life, and start investing aggressively for your wealth creation. Even if you feel like applying for a loan to buy home or car, you should be able to handle it in a much better way after the first 3 steps. Because you know about his future premiums outgo, & your aspirations more clearly. At this step, if you feel you need some kind of external help to get a better clarity, you can also hire a financial planner for yourself and work with him to get more clarity. A small investment for your financial life can prove to be worth.

You can see that with these 4 steps, the actions one will take will be more defined and realistic, rather than the random events, that push you & which gives an unwanted shape to your financial life.

Conclusion

You can see that these 4 steps are just about giving more meaning and a better shape to any financial life. It focuses on slowing down and then slowly moving forward in your financial life. Any new person is very excited about his life ahead and there are great chances to mess up. These 4 steps will help a person to move forward in his financial life. Good luck!

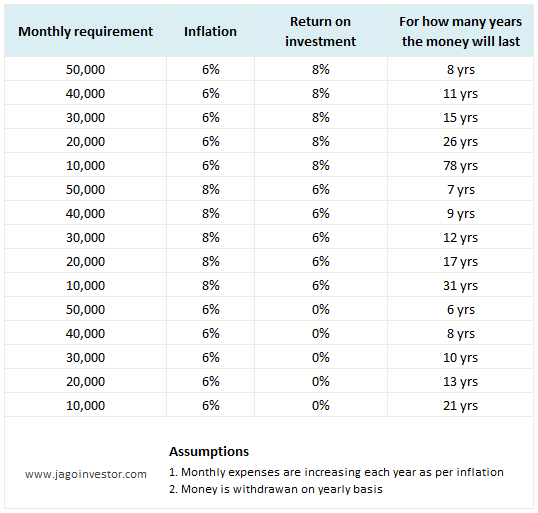

You can calculate this in many ways , but one of the ways you can do is by calculating it in excel sheet. We have this calculator on our upcoming

You can calculate this in many ways , but one of the ways you can do is by calculating it in excel sheet. We have this calculator on our upcoming