Today we will talk about interest rates and inflation, the two hot topics of conversation in the investment world. I will try to simplify these two topics in a simple way and link it with your financial life.

The vast majority of views that we read in newspapers and blogs offer some form of asset allocation advice based on these 2 parameters. A simple retail investor like you and me will definitely get confused.

“To complicate is simple, to simplify is complicated. Everybody is able to complicate. Only a few can simplify.” ~ Bruno Munari

Before we discuss interest rates and inflation, a story comes to mind.

My wife and I really like to go for long drives. It just relaxes both of us. In fact, it’s the only common interest between the both of us.

For these long drives, we do some basic checks with the car and environment – whether it is raining or not, food, water and comfortable clothing. Since music is now streamed via the Internet, we don’t need to worry about CDs or cassettes, etc. Sorted.

Now when we start the car, Google Maps tells us that we will reach a particular destination in the next 7 hours with an average speed of 80 kmph based on the traffic. So we simply add a couple of hours of rest, washroom breaks and some lunch or dinner along the way. Effectively our journey becomes 8.5 to 9 hours.

Those of us who constantly drive on highways know the unpredictability of accidents. It’s like you are strolling and suddenly there’s a whole lot of traffic that you have to sit through. The crazy part is that there’s just no washroom or food mall available. So you are stuck in traffic listening to music and praying to God that the traffic clears very quickly.

Some uncles who are strolling around in such situations often become the messengers of bad news. It’s their duty to update every car whether there’s an accident, a fire, arrival of the ambulance, or police and then leave us with the hope that the traffic gets cleared quickly.

These unpredictable events lead us to a delay in reaching our destination and if we are not careful, these events also cause a bit of mental instability that leads to irritation.

But when the traffic clears, we drive as if our school’s last bell has rung and it’s time to go home. That feeling of relief. Some of us even want to cover the time wasted by driving at ridiculous speeds. It’s just different strokes for different folks. But if you just drive, you will reach your destination. It’s not rocket science.

Rocket science is what you do with your peace during these unpredictable events. That defines the happiness of your journey, not the destination.

Similarly, when you have planned your financial journey of life, there’s a destination set in your mind. Our financial independence is when we are no longer worried about looking after the expenses of our home and fulfilling the expectations of our loved ones.

There will always be some unpredictable events that will cause you to rethink your entire investment strategy. My humble request here is to understand the gravity of the situation before jumping into a complete restructuring of our financial plans. Because sometimes, the situation is made to sound a lot more horrible than it actually is.

Please keep an open mind and allow me to simplify these concepts to the best of my ability.

Inflation

This term has become the most used and highly abused in the world of investment today.

Some people talk about it as an end-of-the-world apocalypse in the making. It’s then linked to consumer spending and how things that are getting expensive won’t be consumed, so let’s stay away from the fast-moving consumer goods (FMCG) sector, and so on and so forth. It’s hilarious and disturbing at the same time.

So let’s understand what inflation really is and what it means to common people like you and me.

Simply, inflation is understood as a simple rise in the price of a particular commodity or service. Suppose, the price of milk goes up from Rs. 75 per litre to Rs. 80 per litre, the extra Rs. 5 is attributable to inflation. If you add human intervention to it, such as putting the milk in a bottle and charging extra won’t be considered as inflation.

To track inflation, the Reserve Bank of India (RBI) uses the metric of the Consumer Price Index (CPI). The idea is to capture the rise in price experienced by roughly 140 crore Indians. It’s a tough job, to be honest. That’s precisely the reason why such macroeconomic numbers should always be seen with a pinch of salt.

In the chart below, we capture the last 10 year’s journey of India’s CPI inflation. RBI has set a mandate to keep the CPI in the range of 4% to 6%.

Currently, CPI is inching towards 8% which is out of RBI’s comfort zone of 4% to 6%. There are multiple explanations for this and in my opinion, every explanation is valid. Because in macroeconomics, data is always supported by a story that we create.

However, if you come to think about it, our yearly expenses don’t rise by a mere 4%. They tend to be well above 18-20%. We call this luxury inflation.

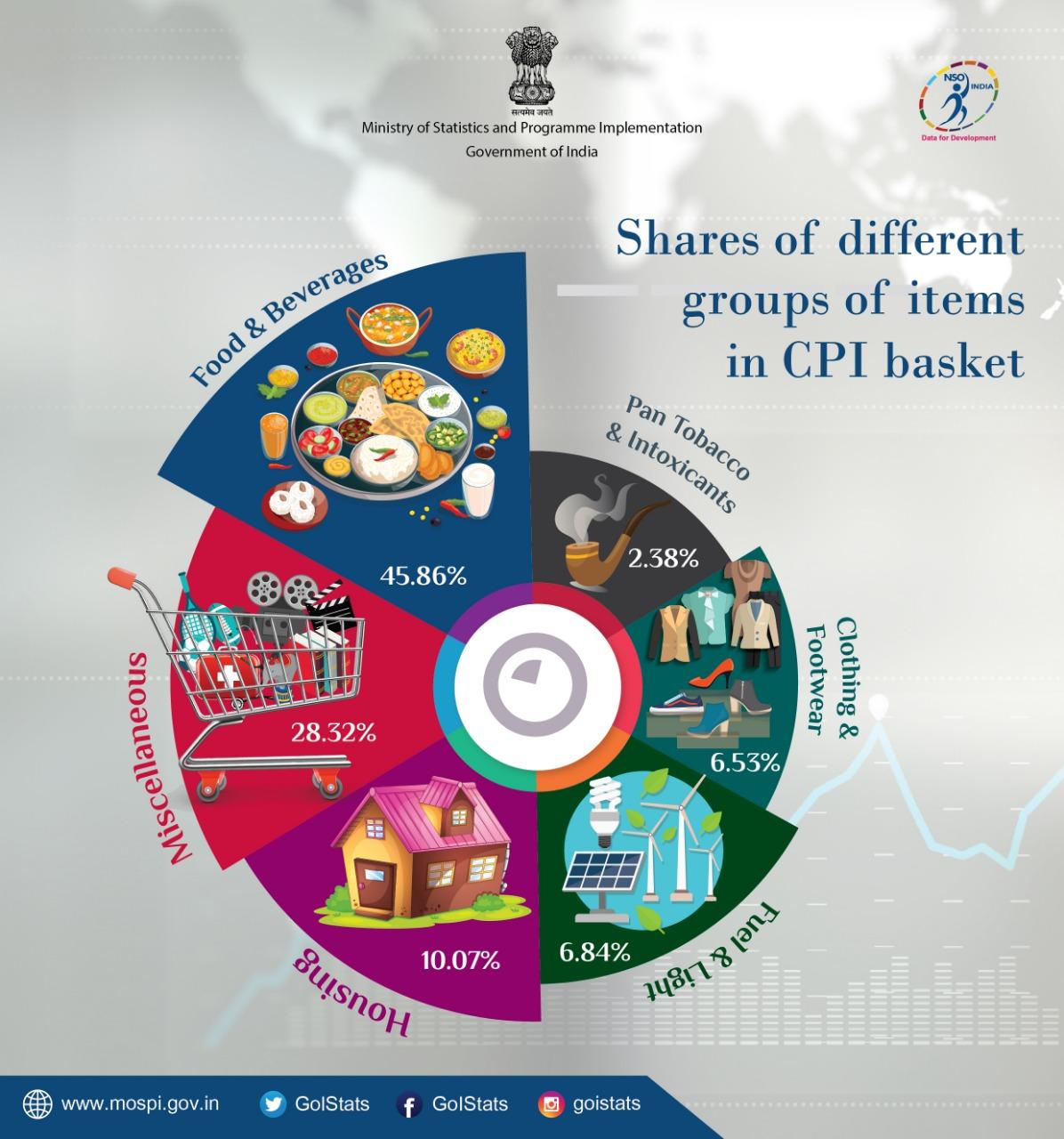

RBI constructs its CPI with the following constituents.

Don’t be surprised! This is how the RBI budgets itself. Our household budgets are different.

The major pie of the CPI basket falls into Food and beverages. It constitutes a good 45.86%. So any unusual price hikes in onions, tomatoes, etc. have a direct impact on the inflation rate. Housing is 10.07% which is largely stable in price.

We don’t see massive fluctuations in a matter of a few months. Fuel & Light does have a lot of impact on our wallets but for RBI’s CPI it’s barely 6.84%. So a whopping rise in petrol prices might not directly affect the inflation rate so much.

So it’s safe to say that RBI’s expectation of the inflation rate and the inflation rate that we experience are two separate things. Yet, we give a lot of importance to inflation and base our investment decisions on it too.

We should really reconsider it.

Next in line is Interest Rates!

Interest Rates

When an investment professional speaks about interest rates, he generally refers to the Repo rate published by the RBI in its Monetary Policy Meeting.

In layman’s terms, the Repo rate influences our fixed deposit interest rate that we receive from the banks and the loan interest rate that we take for a house, business, car or bike.

Inflation and interest rates are interdependent. When the inflation rate goes high, RBI generally prefers to hike the interest rate. When the inflation rate is low, RBI prefers to bring the interest rate down.

Why does this happen?

Think about RBI as a head of the family, someone like a grandfather who looks after the entire family’s budget. He is constantly strategizing about which child of his should go out on his own and which child will stay together. Plus, business decisions even when they are independently run by his children, he is there to keep guiding constantly.

Suppose our monthly budget is Rs. 3 lakhs for a family of 10 people, and suddenly the entire family wishes to go for a small vacation.

How will he do it?

There are 2 options, to either tighten the household budget for a few months so that he doesn’t need to withdraw from investments or ongoing business. Or he will borrow from the bank to fund the small vacation and recover it later from the investments or business.

In the first case, the entire family will have to go through a tough phase because their expenses will become less for a while. In the second case, there will be too much pressure on the grandfather and his children to recover the money.

Similar is the case with RBI. When inflation goes out of its comfort zone, like a grandfather, it has the option to limit the supply of money in the economy so that people spend less. Or it has the option to print more money that will have to be repaid at a later date to avoid currency depreciation.

In a nutshell, whenever we see interest rates going high, we have to assume that inflation is higher too and vice versa.

Let’s look at a brief history of RBI’s Repo rates (interest rates).

Right from 2014, interest rates have been slowly coming down as inflation eased. However, in the last few months, we have seen them going back up. Home loans have become a bit expensive and so have our day-to-day expenses. But they are not so significant as to affect our budgets. If the price of tomatoes goes up, we will consume a bit less. It’s not a life-and-death situation for us.

Even if the interest on a home loan or car loan gets expensive by a couple of percentage points, most of us simply yawn. It’s not a material impact.

We are not macroeconomic forecasters who will tell you what is going to happen in the future. The intention of this article is different.

Yet, we take these 2 numbers seriously when considering our investments. Isn’t it so?

When interest rates are high, banks offer a very high fixed deposit rate. So we tend to move our money from equity to fixed deposits.

Contrary, when the interest rates are low, we move our money from fixed deposits to the equity market.

We forget the most important principle here.

The equity market is a completely different beast to conquer. Fixed deposit is a completely different financial instrument. They are not supposed to be interchanged due to some temporary economic factors.

What is an equity market then?

In simple terms, the equity market is a place where you get ownership of a business. So suppose, you want to own the growth of Reliance Industries. You will go to the equity market and buy some shares of the company. And if you want to sell because you don’t see any further growth in the same, then you can go and do that.

Companies like Zerodha, Upstox, etc. merely offer a platform to enable such a transaction. They are not the equity market themselves. They are merely enablers.

The factors that make you buy or sell a particular company’s stock is a completely different discussion that we will keep for a later date.

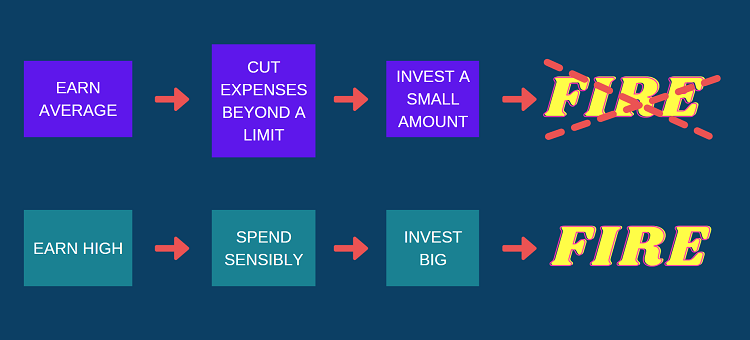

The biggest mistake that we see investors making today is simply moving their money out of fixed deposits and pumping it into equity markets. If you ask them why? That’s because equity markets will make better returns than the interest rates on fixed deposits.

Yes, we agree that equity markets will always make better investment returns than fixed deposits. Here’s a question I want to leave you with.

Will these interest rates and inflation make you a better investor?

Think about it.

Hint – We will cover this answer in the next article. Stay hooked.

The article is written by Jinay Savla, Jagoinvestor.