Model Tenant Act, 2021 is very soon going to be a reality in India and it’s mainly to set up the rules and protect the rights of tenants and property owners from each other.

The rental market of properties is a very vibrant and deep market in India and every year millions of people rent out properties (residential and non-residential) in India.

At one end, tenants think that property owners are bloodsuckers, who just want to withhold the security money at any cost and try to dominate them. On the other hand, property owners feel tenants are also horrible who do not care for properties and do a lot of damage which forces them to keep enough security deposit with them.

10 Important Rules under Model Tenancy Act 2021

Many times, though an agreement is made legally, on the ground level things don’t work out and there is a lack of professional relationships. This Model tenancy Act 2021 is trying to exactly solve this and wants to lay down enough guidelines, rules which will help both parties.

Here are some of the most important rules you should be aware of the model tenancy act, 2021

1. Heavy Penalty if the tenant does not vacate premises on time

Once the agreement is over, there is a maximum of 6 months of extension on the same conditions and rules which are mentioned in the agreement. But if even after this 6-month extension, (or if the tenancy is terminated by notice or order) the tenant does not leave the premises, then there are heavy penalties levied on them. They will have to pay double the rent for the first 2 months, and then 4 times rent for another 2 months and then 6 times the rent for another 2 months.

2. The security deposit can’t exceed more than 2 months’ rent

As per the law, the security deposit which homeowners take from tenants can’t be more than 2 months of rent. In cities like Bengaluru, one has to deposit the security deposit as high as 10-12 months of rent, which many tenants complain about. However, at the same time, a lot of homeowners feel, it’s too little money to cover the risk of having the premises damaged by the notorious tenants. Note that this limit of 2 months’ rent is only for residential properties. In the case of non-commercial premises, the security deposit can be a maximum of 6 months’ rent.

On Twitter, Krish gave his real-life example which shows us how 2 months of the deposit is not enough in real life for property owners

3. Separate Rent authorities, courts & tribunals set up in each district

A separate 3 tier system will be created in each district for handling the cases related to the rental market. A civil court will not have jurisdiction over these cases which come under Model Tenancy Act. At the first level, there will be rent authority, then a rent court and finally a rent tribunal will be set under each district. This will make sure that a separate resolution system will be set up for these things.

4. Written Agreement is mandatory

Now a written agreement is mandatory when any premise is given on rent. I guess anyways most of the people were making a proper agreement, but now it’s a law in itself. This agreement is also to be submitted to the concerned rent authority within 2 months of the agreement date. There will be some digital platform that will be set up for this as per the current wordings.

5. The landlord cannot stop the essential supplies of the premises

It mentioned that the property owner cannot stop the supply of any essential supply like water, electricity etc. just because there is some dispute with the tenant. In real life, it’s seen that if there is any dispute or argument, the homeowners take these steps to “teach a lesson” to the tenants. It is mainly to protect the rights of tenants as far as they have occupied the premises. If the homeowner still does this, the tenants can complain to the rent authority and order can be passed by them to restore the services and also put a penalty on the homeowner

6. No structural changes or sub-letting of property

The tenant cannot make any structural changes in the property, nor they can sub-let a portion of the property to someone else without the consent of the property owner. If sub-letting is to be allowed, a supplementary agreement has to be made and even that has to be submitted to the rent authority

7. Eviction of the tenant on certain grounds

If the tenant has to be evicted, then the property owner can’t just appear one day and order the eviction. It has to be done only by seeking eviction through the rent authority and it can be done on certain grounds like

- refusal to pay the agreed rent ;

- failure to pay rent for more than two months;

- parting of possession of part or whole of premises without the written consent of landlord;

- misuse of premises even after receiving written notices to desist from such misuse; and

- structural change by the tenant without written consent.

8. Rent Revision can happen only as an agreement

The rents can’t be increased arbitrarily now, it has to happen only as per the agreement which was written and agreed on. This will help the unorganized rental market where many times, homeowners increase the rent many times just to make sure people leave the house on their own.

9. Respect of Privacy and Rights of Tenants

The law also tries to establish the fact that once the tenant has occupied the house, the property owner can’t treat them in the wrong way and can enter the premises anytime without notice just because of the fact that they are the owners. They have to inform that tenant about their visit 24 hrs. before the entry (through an electronic medium). No doubt that this is not applicable if your relationship with the other party is cordial and friendly. This point is mainly there to protect their rights and privacy.

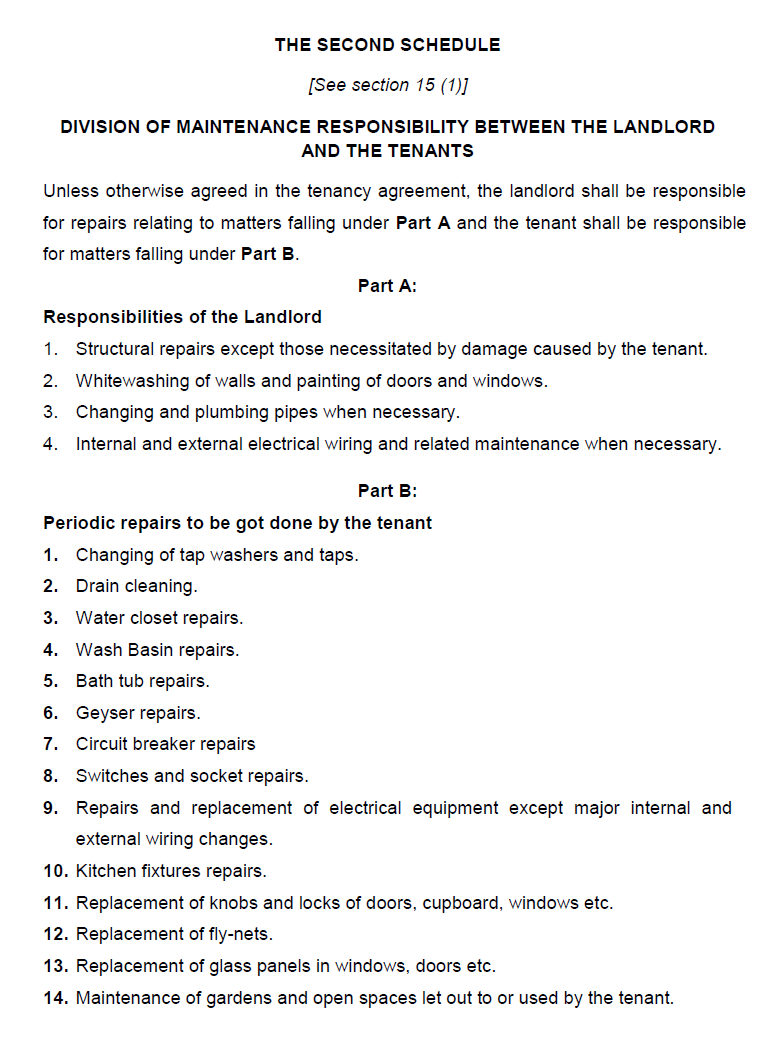

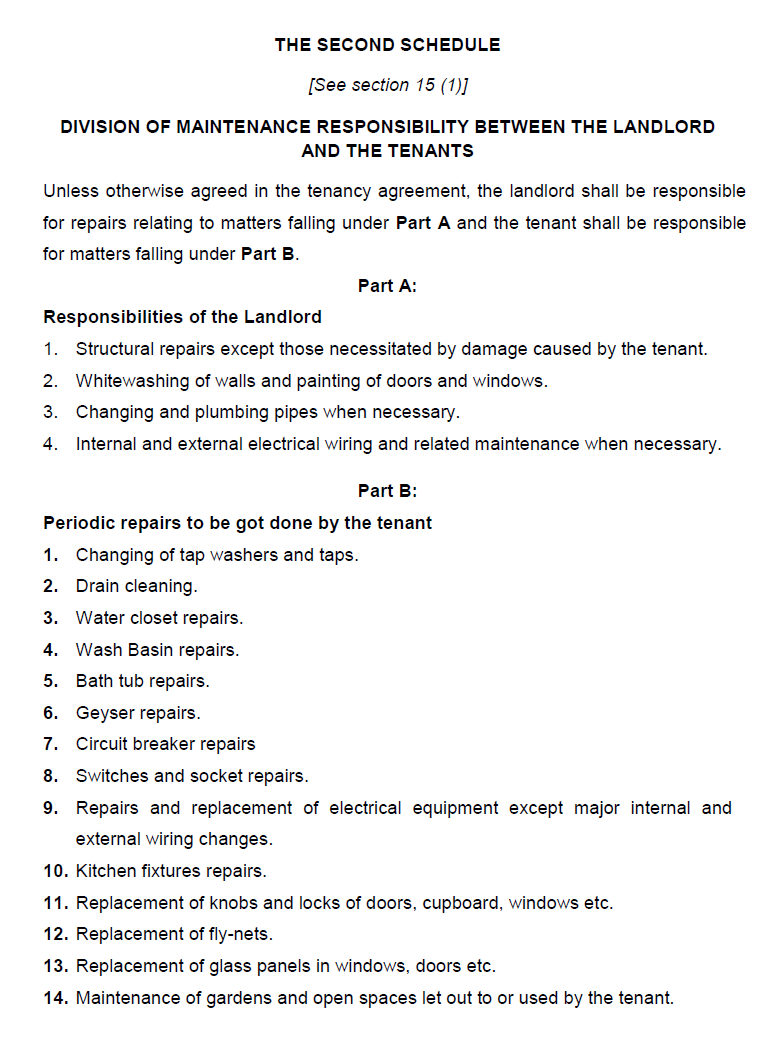

10. Roles and Responsibilities of both parties

The law also defines the roles and responsibilities of landlords and tenants and tells what has to be fixed by whom. For example, It is the tenant responsibility to do most of the repairs and replacement of small components like Wash Basic Repair, Taps, switches and sockets. On the other hand, the landlord is responsible for the whitewashing of walls (hello Bengaluru). In the 2nd schedule of the act, all the details are given which I am putting below

Important Points

- These rules will not be on a retrospective basis and will not impact the old agreements. It’s only for new one’s

- These rules do not apply for premises like hotels, lodges, or any central or state govt owned properties, or even premises owned by corporates, universities or religious entities etc

Download the draft in English

Download the draft in Hindi

Will Model Tenancy Act 2021 really work on the ground level?

Many people raised the point of this act will really work at ground level or not. One person said to me on Twitter that the Indian rental market is a seller’s market and all these laws won’t work, as property owners will also find some other way to get away.

I feel that over time, the law will get implemented, if not in short term. The country is huge and any law like this takes a lot of time to get into the system. But the good part is that at least govt is thinking about this issue and trying to fix things. The law may not be 100% perfect, but things get amended over time and that will happen with this one too.

One feeling which I was getting is that the law is trying to micro-manage many things and in real life, I think it should have not done that.

What do you think about this new law? Please share your opinion in the comments section below