I’ve heard the phrase “financial freedom” several times in the previous 3-4 years from the investors community.

Every time I speak with a customer or an investor on various forums, it appears that “financial independence” has become the new catchphrase. So I decided to talk about it more today.

What is Financial Freedom?

Simply said, Financial Freedom is the accumulation of sufficient wealth to cover your living expenditures for the rest of your life. You’ve saved enough money to cover all of your bills for the rest of your life. After that, you won’t have to worry about money.

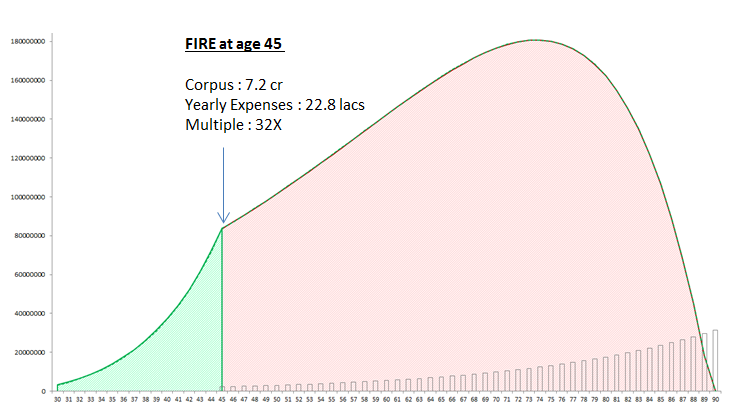

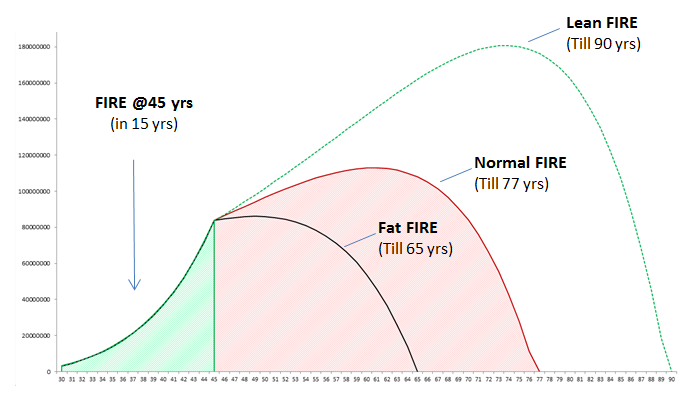

How much money makes a person financially free is a deep question and there can be debate on this topic alone, but in the most simplest form, once a person acquires 35-40 times their yearly expenses requirement, they are said to be financially free. You can read more on this 30X rule for retirement here

Let me get to the point of this article and discuss the top 5 reasons why I believe most individuals should strive for financial independence early in life (strong>hint/strong>: by the time they are 45 or 50 years old).

5 benefits of pursuing Financially Freedom

Benefit #1 : To buy Freedom in Life

We all labour all hours of the day and night to make money. Money covers all of our costs. Rent, food, school fees for your children, and healthcare costs. Everything..

If money is not everything in life, it is certainly a very important factor!!

Many people do not feel FREE in their lives. They become money slaves because making money becomes their major aim in life.

- They cant say NO to their work

- They cant say NO to the schedules

- They can say NO to their bosses

All the times, money dictates their life and decisions.

Sufficient money in life can give you a lot of freedom.

- Freedom of when to work

- Freedom of with whom to work with

- Freedom of when to wake up

- Freedom to take long vacations ..

You name it and you can feel freedom in that area

If you want to experience a lot of freedom in life in various areas, you shall work towards financial freedom.

#Benefit 2 : To bring more power in your career

A lot of people have this myth that one shall achieve financial freedom, so that they can quit their job and retire from work.

Not TRUE!

One has to reach financial freedom so that they can bring more energy and power in their career or anything new which they want to truly do in life.

Most of the people have to do things in life with the primary motive of earning money and not because they wish to do it.

- You feel that the new project in your company is quite exciting, but does not pay enough? What do you do? Forget it!!

- You feel you really enjoy taking risks and do something challenging in your workplace, but wait.. what if it fails and you are fired or do not get promoted next year? You forget it and you focus back on things which are “SAFE” for your career.

We are continuously looking for ways to boost our compensation package, even if it means avoiding activities that we would like doing if money were not an issue!

When the money component is gone and you have to do things just for the love of working and reaching greatness, your job takes on a completely new vitality. You achieve more quickly, and your job happiness grows. This is the actual method of working, but it does not happen for most people since MONEY stands in the way of what you truly want to achieve in life.

#Benefit 3 : More flexibility to pursue other passions

Financial Freedom also gives you freedom to pursue any long due passion which you were not able to fulfil while in the regular job.

“What will you do once you are financially free?” I ask our workshop participants. I receive some unusual responses, such as

- I will become music teacher

- I would like to run a restaurant

- and even I would like to become a scuba diving instructor

Compulsion of “earning money” has crushed a lot of dreams and financial freedom is that point where one can explore those new careers or opportunities.

#Benefit 4 : Reduced stress and worry about money

This is a no brainer.

Ask the question to yourself right now. If you loose your job and are never getting another one again, how many years worth of expenses do you currently have?

- 3 yrs?

- 10 yrs?

- or 2 months?

And wait!.. What about repaying all your outstanding home loan, and funding the expensive education of your children on top of that?

Its quite scary right!

We are all concerned about the future since we do not have enough money.

Here is a quick 25 questions financial health checkup, if you wish to take

The day you have enough money to support everything and live comfortably is the day you feel really safe and at peace. Money does not solve all issues in life, but it does solve MONEY problems:)

#Benefit 5 : Pass a strong Legacy and build generational wealth

- Your grand-parents worked for money

- Your parents worked for money

- You now work for money

Where is your generational wealth? Do you have family legacy which takes care of atleast the basics of your family?

You will see various family where they work towards generational wealth. They have enough money which produces income for family, be it some business, equity wealth, real estate wealth or whatnot!

But lot of families are not able to create it because they dont have attitude like that. They earn and finish the money and at family level they always are in that never ending cycle.

If you achieve financial freedom early in life, there is a good chance that you may put seeds of generational wealth, but you also have to ensure that you teach right attitude towards money to your next generation.

Conclusion

I have kept a very simple version of financial freedom for this article. This topic is quite deep in reality.

Do let me know if you liked this article and if you can add any more benefits of financial freedom?