The Biggest reason Why you will not be able to save enough for your retirement ?

2014 has started, and I wish you all a Happy New Year!. We are into the 4th week of our Investors Bootcamp and I recently brought up a very important point there, which was, “What is the that one thing which stops you from saving for retirement?”.

When I dove into this topic and heard the responses from some of our Plan F participants (senior participants), I came across a simple reason, which can really destroy someone’s hopes for a comfortable retired life.

I was late to realise that I was very late

When I ask someone, “Have you starting saving some money for your retirement ?”, I hear a “NO” and the justification for it is – “I still have a lot of time, so why hurry? I am just 26 right now”.

I say – “Fair Enough, makes sense”

And then I put this question to the same person 5 years later, and the answer is – “I still have lots of time, so why hurry? I am just 31 years old”.

I still say – “Makes sense, at least for now”.

But you know what? There comes a time, where you suddenly realize that “Oh my god, its a bit late now”, because all the time you were thinking – “I will do it later” and never realize that its getting late. Remember, “Someday” is code for “Never”. When you have 30-35 years in hand for a goal like retirement, that goal is so distant that you feel it is idiotic to plan for it right away.

You feel, “let the right time come”, but you do not know what the right time is going to be. Is it when only 20 years are left? Or is it when 10 years are left? Or when only 5 years are left?

This is exactly the same situation as when you have to provide tax investment proofs to your employer. When you have 20 days in hand, you feel there is a lot of time. Then 10 days pass and you feel “It’s just few hours of work, I will do it very soon”.

This procrastination continues, and you keep convincing yourself that whatever time is left is more than ENOUGH. Then suddenly, when there is “just enough time left”, something else comes up unexpectedly – some important work surfaces, or you have to go somewhere, or you catch fever and you eventually miss the deadline. Now you are thinking, “I should have started early; I lost time, thinking there is enough time ahead”.

You wait for the “Right Time”

Unsurprisingly, you repeat this behavior when planning for your long-term goals, especially ones like retirement. We put off thinking about it because the retirement event is so distant in the future that it sounds comical to even plan for it now. So, we wait for the “right time”, but never declare that “right time” to ourselves – it’s just a concept in our head that never gets real.

Ask any 25, 30, 35 or 40 year old about their retirement, and they will say – “I still have enough time ahead”, let me think about other important things right now”. Then they turn 45 years old, things get serious and they “start” considering doing something about saving enough money. This is the first time, they realize – “I think its high time now, I should make a start towards my retirement planning”. Again 2-4 years pass, they are now touching 50 years, and then the PANIC mode kicks in, because they can see very clearly that they will run out of money in their retirement.

It suddenly becomes clear to them that time has flown and that the “right moment” to start saving money for their retirement was years ago. They have taken care of most goals in their life, but they have forgotten to protect their own retired living. All the time when they could have really taken risks and could have grown their wealth has passed. Now they just want their money to be safe and this is obviously a situation where you can only get sub-optimal returns.

At this point they have no choice but to live out a life of regret. Even if they do not wish to depend on their kids, they still have to.

30-30 rule to retirement

In my 2nd book – “How to be your own financial planner in 10 steps”, there is a full chapter on retirement. While writing that chapter, I was stuck at one place where I had to show the reader, the flaws in their default thinking about retirement planning and explain to them that they should start planning while they were young. After a lot of thinking, I came up with a rule called “30-30 rule of Retirement Planning”.

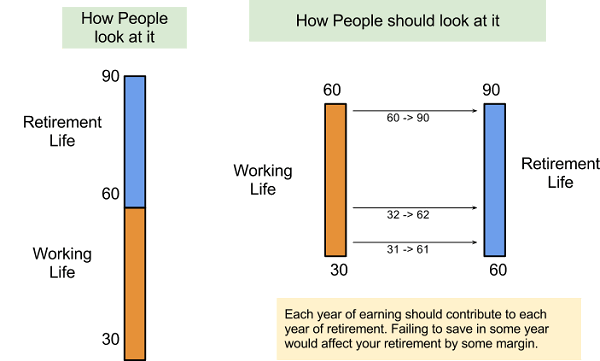

The rule states that an average person works for 30 years and then, after retirement, lives for another 30 years (just a benchmark number). Imagine you are 30 years old. You will work for next 30 years (till you are 60) and then you will live for another 30 years (till the age of 90). For the first 30 years, you will earn and consume the money. For the next 30 years you will not earn, but will still consume money.

Right now, I imagine you are earning, but it is still tough to run your life – there is no surplus money left, you are still not able to achieve so many things. If this is the situation right now when you are “making money”, what about those 30 years, when you will not earn a penny?

You earn for next 60 yrs, not just 30 yrs

I know all this sounds terrifying, but you have to realize that, at any cost, you have to earn for the next 60 years of your life (30 years of working life + 30 years of retirement).

So now lets look at your 60 years in two segments of 30 years each – the first 30 years is PHASE A (earning and consuming) and next 30 years is PHASE B (not earning, but still consuming).

Now Map each year of this Phase A with Phase B and what you earn in this year X (2014), some part of this money has to be saved for the respective X + 30 year (2014 + 30 = 2044). What you earn in year 2015 has to feed you in 2015 and 2045 (+30 years). Only if you save each year, will you be able to fund the companion future year, which will be exactly after 30 years.

Look at things like these.

So it’s very clear that if you lose the next 10 years, then the pressure of retirement saving will build up on the next 20 years of your life. If you lose 20 years of your working life and do not save anything for retirement, then the last 10 years have to shoulder that burden and you will have a punishing time ahead.

Benjamin Franklin once said – “You may delay, but time will not”. You are probably heading for disaster if you are living in this myth that you will save a lot later when the time comes. It never happens.

So sow some seeds right now for your retirement. Buy a piece of land, start planning for a second home which you will use to get rental income, start transferring at least 10% of your income each month solely for the goal of retirement, build an additional skill so that you can earn more in the future, marry a working spouse and don’t blow your money each weekend on that movie which you knew was not worth it! Start taking small steps

You have to ensure that by the time you turn 40, you should have at least a small retirement corpus – this should be your first milestone.

Are you all set to save enough for your retirement corpus? Are you sure you will not get trapped in this “right time” thing ?

January 20, 2014

January 20, 2014

your articles are superb and thought provoking. Thank you for all these articles.

I have an extended though from this article. If we think of my earnings in 30 will help in 60, 31 in 61 and so on…we are leaving 30 yrs for money to grow. Instead we should look at it in reverse order. i.e earnings in 30 to fund me in my 90, earnings in 31 will fund me in 89 and so on. Then my earnings in 60 will be immediately available in 61st year. And more over the earliest savings (i.e in 30) will compound for nearly 60 years and that will take care of the inflation etc.

What do you say

Ohh thats fantastic 🙂 . Really a very good way of looking at it 🙂 . Good suggestion !

Hi Manish,

Can anyone hlep me how and hwo much to save for my retirement. I am already 47.

This will help you to calculate – http://jagoinvestor.dev.diginnovators.site/calculators/html/Retirement-Calculator.html

Thanks a lot Sir.

Sir, If you have any format please send me so that I will be oblige.

Here is one example – http://jagoinvestor.dev.diginnovators.site/2012/12/rti-application-for-psu-banks.html

My father retired on 31.08.2001 and he expired on 23.05.2007. Till Dec. 2011 my mother got full pension and from Jan. 2012 excess payment started deducting from her husband’s pension and it is still deducting.

I want to know how much excess pension paid during this period till dec 2011 and how much is yet to be deducted from pension.

I want your help. or any complaint will be lodge through RTI. Please send the format of RTI which will be submitted to SBI. Already I have submitted a letter to SBI local office. but they neither reply nor issued a letter where intimation that the excess deduction or how many deduction will be there.

Thanks, Subhasish Das

Which pension are you talking about ? Is it from state/centre govt ? You need to file RTI to respective department, you can get the sample of RTI here – http://jagoinvestor.dev.diginnovators.site/2012/03/rti-for-epf-withdrawal-or-transfer.html

My father worked in the Eastern Railway, under Sealdah Divn. It is Central Govt.

For which I have submitted a letter to SBI & Eastern Railway respectively. But Sealdah division replied it is a matter of SBI. Sealdah Divn receipted the letter and SBI also receipted this letter. I want the result so that I need RTI help.

Yes, now you should file the RTI only. Its the only way you can get proper reply !

hey guys

I would like to add few points hope you will defiantely agree

firstly change the defination of savings from your mind . We think that savings means money left after meeting all the expenses i.e. income less expenses= savings

but my new thinking is

expenses=income-savings

first earn then save as much or most you can and then from residual you spend for your expenses

this will give u discipline and target for savings

Thats the best thing one can do to change the mindset !

Hi Manish,

What do you think a businessman should do for retirement planning ? On some years i make as low as Rs. 100 and some year I make as high as Rs. 1000 ? (Figures are just representatives)

Yes, in that case you cant start a SIP like Rs 500 . So commit for the minimum amount and then when you make more money, that time make separate investments !

Go for bonds when you’re a stock, and go for stocks when you’re a bond: a wise man told me once! 🙂

Nice !

I wanted to write this comment every time i visit this website. “It is inspiring for every visit, and each visit”. You guys are awesome. Wish me to be awesome like you (really) 🙂 🙂

Thanks Shravan !

Nice one Manish…very much required for a lot of people

Thanks !

Hi Manish,

Thanks for the Informative article. As of now I am investing in NPS monthly as of now and along with PF, I have my PPF account since last 10 years. I am 31 years old now. Since when I started accumulating amount in NPS, I contribute less in PPF.

What I am thinking is NPS has tax benefit above 80C deduction so in a way I am saving that 20% of tax which otherwise goes to I-T dept.

I know that I am not sure of how would be get my Returns from NPS but still I thought this option is suitable for me at this stage. Need your advice on this.

I am not sure what is the question here ?

Thank You Manish for yet another article. ALL your articles are “SIP” for improving our knowledge and action towards our own personal finance.

Thanks for that comment Krantivir !

Hi Manish

Thanks for the informative post.

However i’d like to know how are we to utilise our terminal benefits,and pension which we get from a govt job on retirement.

I would like your advice on this.

Thanks

Mona

What do you mean by “how to use” ?

Hi Manish

I have been an avid reader of your blog since 1st year of B.tech, 4 years back exactly.

Now I am 23 and have recently started 2 SIP’s of 1000 each and 500 in RD for buliding retirement nest and will keep incrementing it yearly :)!

I am investing in ICICI PRU Dynamic Regular plan(E) and ICICI Focused Bluechip Equity Plan.

Can you please give me a review Am I investing in right funds ??

Thank you so much

Dhiraj

Dhiraj,

congratulations for starting so early! i will also suggest to invest some part of your saving in debt/ppf.

Thanks,

Rahul

@ DHIRAJ: Congrats and well done!! Also if you have NOT got Insured till date, then plz get a TERM PLAN at the earliest. Continue your SIPS, and go for a SIP in PPF too.

Once again well done….and all the best dhiraj!!

I think as a start its good one .. HOwever focus on your long term planning and strategy , rather than just 1-2 SIP ? Whats your 5 yr plan , are you clear on that ?

I would like to add couple of points:-

A] Many of the people who bought home loan, think that its a burden and they want to get rid of it as early as possible. In a quest of prepaying the home loan they ignore the important aspect of saving for retirement.

People should stop thinking home loan as a burden. Prepayment of home loan should not be done at the cost of retirement planning. It is OK if one delays the prepayment for 2-3 years,saving for retirement should be first priority.

B] Also one should not keep more than 25% in equity linked funds (if they are saving it for retirement). People will say that equity will get 10-12%(or more than that) and you can beat inflation.

Reason is as below,

Case 1: Investing in equity for retirement

suppose you invest Rs 100 (assume one time amount, for simplicity). say in 3 years you get +12%,15% and 10% return . So, your Rs 100 will become Rs 141.8. what if it gives negative return for next 2 years? say -12% and -8%. So effectively your Rs 100 will become Rs 114.7.

Case 2: Putting money in debt fund/ppf (tax exempted returns)

Assume 8% return, your Rs 100 will become Rs 146 (after 5 years).

Which is better? While saving for retirement, one should take minimum risk and put the money in those instruments for which they will get guaranteed returns.

Thanks,

Rahul

1) IMO, pre paying the loan might be beneficial since you will be paying less interest to the bank. Hence, the cost of the house will be less. If you are investing in instruments which give lesser returns than the interest which you are paying to the bank, then it makes sense to close the loan. If on the other hand, you are able to generate more returns than your interest outgo, then it would be better to keep the loan and invest the money. Also, once the house loan is paid, there is a huge let off in the mental pressure, which is priceless 🙂

2) The trend suggests that investing long term in equity generates returns which beat inflation comfortably. The returns which are given by the debt fund are still below the inflation rates. In the last 5-6 years the returns from equity is not worth mentioning. This is due to the global issues coupled with issues in the Indian economy as well. Hopefully, this period *might not* continue for long. So people who have invested in equity in this period might see good returns *when* the market turns positive.

Regards,

Bhargav

Bhargav,

You are not getting my point.

Rahul

Thanks for sharing your views . I am sure one should not focus 100% energy on prepayment, but balance it !

Hi Manish, I was not aware of the product FMP and invested in FD, should I withdraw my FD and invest that money in FMP. Please advice.

No , dont do that now . Let it be there.. FMP is not bad , just that you need to know what you are getting into .

Ok. Thanx

Hi Manish,

If FMPs are not bad then why not transfer funds from FDs to FMPs which are much more tax efficient specially for people in high tax bracket. I will request you to please explain the tax benefit through indexation in case of FMPs and debt funds.

Thanks

One can do that, just that now if one has already invested in FD , then lets be it that way. The differential is not that significant. I would not take the pain myself, If someone wants to do it, they can do it , nothing wrong in it !

Informative.

Actually i planned for this by opting for Voluntary PF but unfortunality my Employer said it is available here.

So i should choose right option for saving.

Any suggestions Manish??

Hi Chandu

I believe you mean “Not available here” , you missed that in your comment. Even if its not there, now the best option in Debt category is PPF. But for that long period of 10-15-20 yrs, You should bring some equity element also in your portfolio , so better choose 30-40% equity funds.

Manish

Thank you Manish.

Very informative Post !!

My PPF A/C is 6 yrs old…Now I am 32. Also investing in few equity sip for long term.

Request you to please write a article on NPS Product.

Manish had posted an article on NPS in 2009. You may go through below link

http://jagoinvestor.dev.diginnovators.site/2009/05/nps-new-pension-scheme-detailed.html

Yes, will do , you will have to wait for some time but !

Very good article Manish, infact an eye opener for many of us… Well, I would go for

1 permanent house where full family can stay along with another smaller house from where I can get continuous rental income (totally agree with you).

Also I would increase PF so that with 8.5% return (& cumulative power) it can very well fight with the inflation rate.

Hmm. thanks for sharing your views on this and your plan for your retirement. I think you have good plans, but I would suggest that also have 2-3 avenues, Just planning for rental income can go wrong , what if you do not get rental income on consistent income, also what if those who are occupying house keep changing ? So make sure you have combination of rental income, Interest income from FD and Dividend from Stocks etc !

I Agree Manish.. In fact yesterday itself I had a fruitful discussion with my friend circle on this article and proper retirement plan options. There also we discussed this point which you said that if rental house is vacant/challenging tenant.

Thanks for your views on other options.. can you pour in more information for the benefit of your followers where they can invest wisely with minimum risks for the retirement as couple of options you suggested here..

Well, people are really appreciating your article on the social networking sites

Thankyou, -Prashant

Hi Prashant

I think PPF is a good one option on safer side. But one has to move to it with higher allocation later in life, as a person who is below 40 yrs, one should put more money in equity /real estate ! . Not sure if that answered your question !

Excellent article, and a super perspective on looking at retirement planning. This is the awesome value you provide to your community and clients!

I had a quick question regarding the investment proof submission to the employer example you brought up. If the PF deducted from salary covers the 1L investment by default, is there any real need to make any declaration and submit those proofs? I know many folks who continue with 1L of tax saving investments and it doesn’t look like they are getting any benefit.

I would rather make investments to collect a retirement corpus instead of tax saving – that has a huge impact on the selection of what investment to make. (Bouquet of absurd LIC policies v/s Value MFs type decision)

Any views on this? I think this also impacts the retirement planning you refer to.

Yes, If EPF part is huge enough, and covers almost 1 lac a year, then why should one invest in tax saving products and lock in their money. One should not. You said correct that many people invest 2-3 lacs in tax saving products without realising it.

The EPF/VPF contribution gives 8.75% for this year. Though, the return is below the inflation numbers, one needs to have some portion of his investment in the debt part which gives fixed returns. I do not see any other instrument which gives the safety and such tax-free returns. This contribution could be used as a balance between equity and the debt part of the investment. IMO contribution to VPF is good, though it is above the 1 lakh 80C limit.

Also, if the employee has completed total 5 years of employment, then EPF/VPF amount could be withdrawn (or loaned) for almost all crucial needs. Thus giving the liquidity, though it would be better not to withdraw so as to enjoy the benefits of compounding.

Similar benefit holds true for PPF as well, though it is not as liquid.

Moreover, LIC policies (or insurance of any other provider for that matter) should not be intended for tax saving but for protection of the survivors in case the primary bread earner is no more.

Thanks for yet another eye opening article, Manish. Have been sincerely looking for a retirement plan but haven’t been able to nail down on anything… as NPS has indefinite return % (as of now). Can u suggest some good retirement plans worth considering?

Thanks,

Ruchika

What is NPS?

Hi Ruchika

I can understand your delimma , I must say that do not feel left out just because you are not able to find a “retirement plan” . Go for basic products to build a corpus like Mutual Funds, FD , PPF etc .. You should read this article to get more understanding on this

http://jagoinvestor.dev.diginnovators.site/2013/03/simple-vs-complex-financial-products.html

is EPF,Gratuity,Superannuation a good start to a retirement fund for a 37 year old. Planning for VPF & PPF in next financial year .

Its a good start , but just be clear about your long term strategy !

hey ruchika

i will definately suggest you good retirement plans , I am a Pvt. insurance agent