Is it right to submit fake rent receipts at my office to claim HRA?

If you are living in a rented house and using any fake documents for HRA claim then be careful.

Because from now on there will be a big trouble for those who are using fake rent receipts to claim HRA, as Income tax department have started asking for more document.

Many times it is seen that people claim for HRA by submitting fake rent receipts. This also helps to get them tax benefit. But now as there is increase in the number of fraud HRA claims, IT department has started to ask for some other legal proofs.

Documents which IT department can ask in case of verification

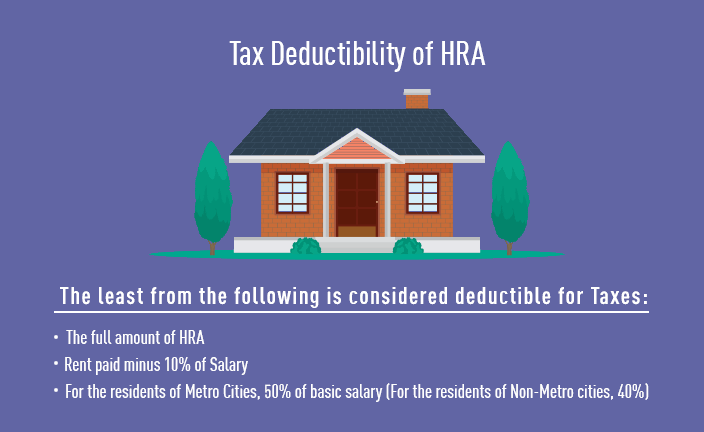

Before you know about the documents needed for verification purpose, lets understand what is HRA (for those who are new to this)

HRA i.e. House Rent Allowance is an amount or we can say a part of salary of an employee which an employer pays if the employee lives in a rented house. It is beneficial for the employee as it lowers the tax which he/she pays on accommodation per year.

If you claim for HRA exemption then you need to submit some legal documents like a receipt or an agreement and ID proof of landlord. You can also claim for HRA exemption on your income tax by filling 12BB Form

If the IT department suspects that a person is providing fake receipts for HRA then they can ask for some other related documents. The list of documents which IT department can ask is as follows –

5 documents which IT department can ask in case of verification

- Copy of leave and license agreement

- Electricity bills

- Water supply bill

- Agreement or a letter from housing society

- PAN card of landlord if the amount is above Rs.,1,00,000.

Is there any risk in submitting fake rent receipts to claim HRA?

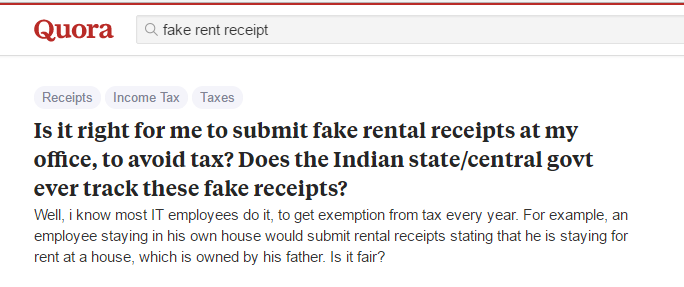

People are asking various question related to fake rent receipt. You can see the snapshot given below…

The verification process is going to be more strict day by day so there is a risk in claiming for HRA exemption by providing any kind of fake documents. If a person wants to apply for HRA with fake receipt by knowing all the risks he has to prepare all the fake documents and as we know submitting each and every document fake is not that much easy.

In many cases employees asks their parents or relatives to sign the documents for HRA claim or sometimes employees shows the higher amount on their rent receipt than they actually pay so that they can get the exemption. In case IT department suspects your case as fraud, in that case you will have to go through verification

Some example where enquiry can happen

- If a person has a house loan and also applying for HRA.

- If a person living with parents without paying any rent but still apply for HRA and says that he pay rent.

- Adding higher amount in receipt than he actually pays.

To know about this in detail you can watch this video..

IT department has stared cross checking the address on ITR ( Income Tax Return) form and the receipt submitted. They are also checking the records so that they can know who is the legal owner of the house to verify the Leave license agreement.

What are your thoughts on this issue? Do you know anyone who is submitting fake rent receipts?

June 15, 2017

June 15, 2017

Just to be clear – my two cents on this issue.

1. Unless scrutiny happens, tax payers dont have worry about it much. The possibility of scrutiny for low income tax payers is very minimal. That does not mean that you submit the fake receipts. Be genuine, be honest.

2. You can legally give rent to your parents/sons (not to your spouse). It is just that you have to prove it in case of scrutiny that you really made those payments. So, make sure you pay the rent every month to your parents (transfer money to their account).

3. Until scrutiny happens, IT department doesnt see your rent receipts or agreements. The rent receipts you submit to employer stays with your employer, they never go to IT dept. – unless they ask the company in case of scrutiny.

3. There is no requirement in IT law to have a rental agreement (or it to be registered). Please correct me if I am wrong by pointing out the relevant section. You just have to prove that you really paid the rent in case of scrutiny. So, if you paid by check, or bank transfer – that is sufficient.

With the changes in law from last 2-3 years, to claim any good HRA amount (> certain threshold), you need PAN of the landlord – which in my experience most of the landlords dont give it to tenants to save taxes. Now, what can employees do who genuinely pay rent. You can register the cases against such landlord, blah blah blah – come on, its not practical in India.

Dont create fake receipts, it is just not worth it.

Very good….hope the transparency is for all and we get a better economy.

Thanks for your comment Kshitij

Hi, can one pay rent to his/her spouse to claim HRA benefits?

No

Eye opening article.. seems right advice

Thanks for your comment Jayant Kadge

Not only rent receipts. Fake medical bills , Fake travel bills., etc., are normally submitted without any hesitation. Since the sum of people is huge & no action being taken, this is getting continued…

Thanks for your comment ashok

I’m not in rented house, I’m giving ₹8,300 per month, not proof to submit. Is this ok to do this?

Its not ok to give fake receipts !

‘Is it right to make a mistake’ This is how is sounded first time to me? 🙂

Hi,

Its really very useful information. But my question is how many landlords are giving their PAN numbers to tenant’s?

I know its very tough to get PAN from landlords !