3 months EMI Moratorium benefit – Why you should NOT opt?

Today, there was a news about 3 months moratorium (which means a temporary relief) benefit on all kind of loans and how investors won’t have to pay their EMI for 3 months. However it was celebrated by investors without understanding it fully.

So I thought of clarifying some doubts regarding it and to share with you that it’s actually not a very big benefit and why most of the investors should not OPT for it.

Let me clarify on what is the EMI moratorium meaning and how does it apply to you?

Meaning of EMI Moratorium

A lot of people in our country might get impacted due to coronavirus and this 21 day lockdown and their incomes and salaries might get impacted. A lot of people may find it very tough to service their EMI on time and there was a need of the hour for some relief. Hence govt has given permission to banks, NBFC’s and housing finance companies to consider an EMI moratorium and pass on the benefit to the customers

Which simply means that it’s not a forced rule, but only a permission given to banks if they want to do it. RBI will not count those missed EMI payments as “defaults” and not count it as NPA (non-performing assets) and also directed banks to not report it to CIBIL and other beaureu

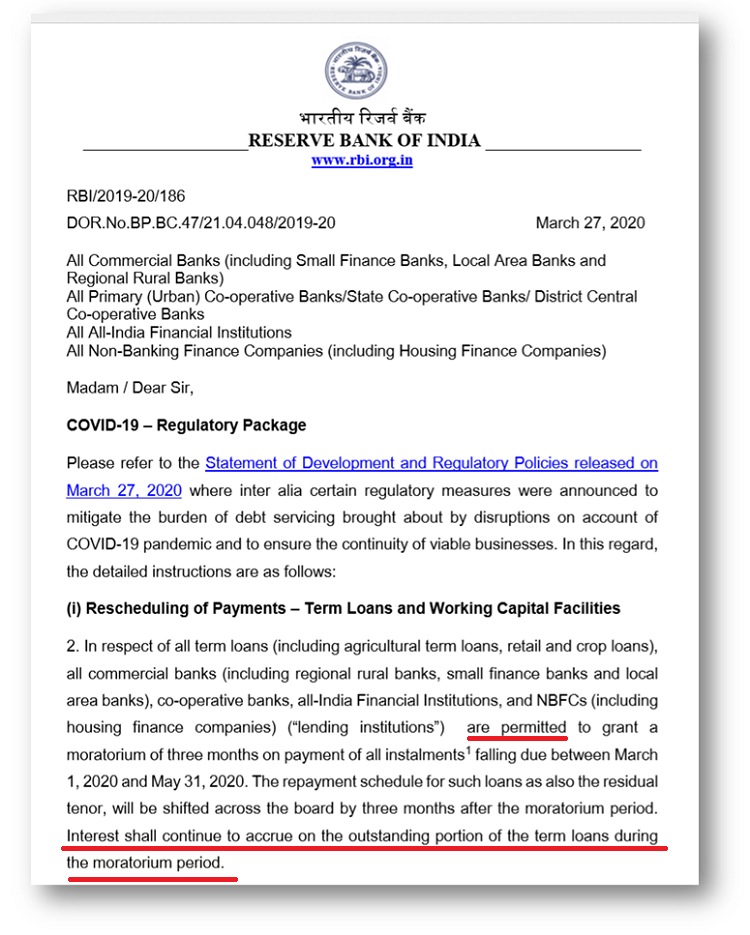

Now it’s up to bank on how they would like to implement it. Banks might pass on the benefit to ALL or some customers. Here are the exact RBI notification wordings you might want to read.

Will your EMI deducted stop ?

No, looks like you will have to apply for this benefit in case you wish to and only when you apply for it, the EMI will then not get deducted. If you just don’t take any action, then the EMI may get auto deducted as always.

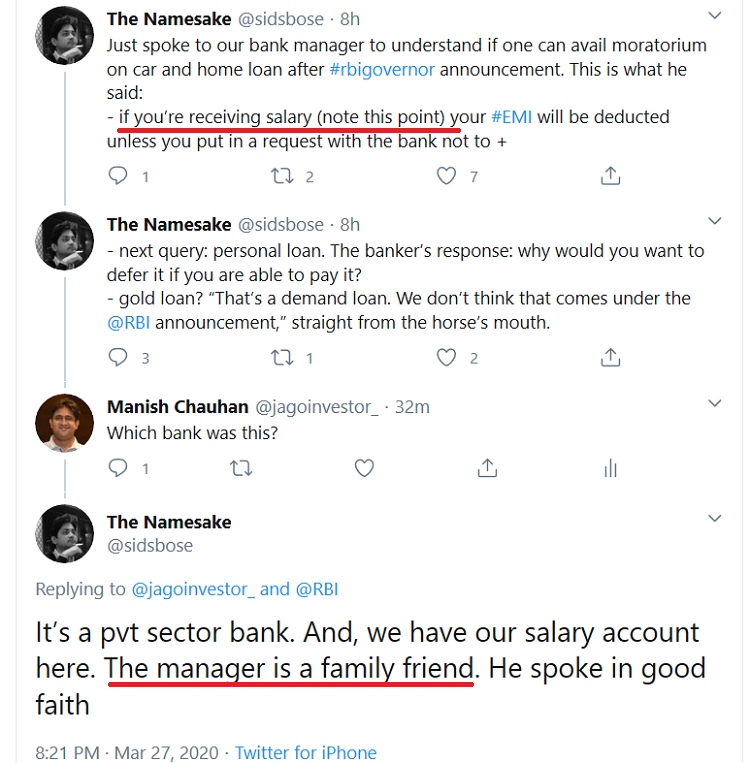

A guy names Siddharth told me on twitter that his bank might deduct the EMI (will not pass the benefit) if salary is credited in the account. Here is the conversation snapshot

As I said, this will only happen if you get this benefit from your bank and bank agrees for it. Checkout the tweet below where an investor asked his bank about it and bank person told that it might not be applicable to him if he gets the salary.

Will I pay any interest for those 3 months of moratorium ?

A lot of investors are showing their happiness about this RBI notification and feeling like they are getting some very big benefit. However in reality it’s opposite and it’s suggested for you to NOT take this benefit.

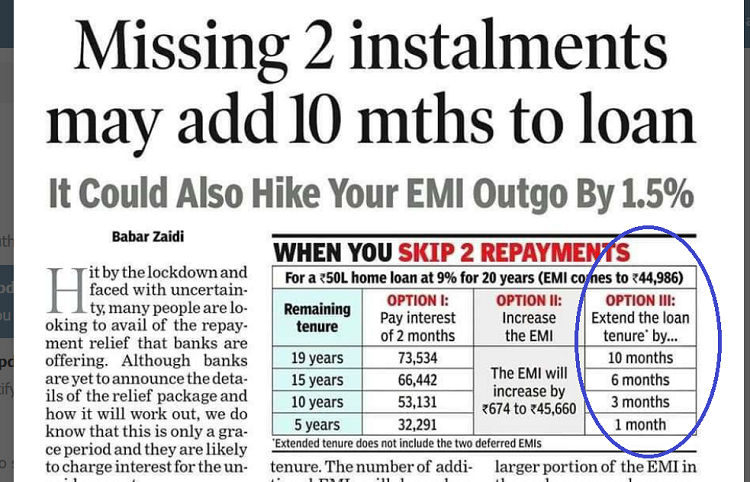

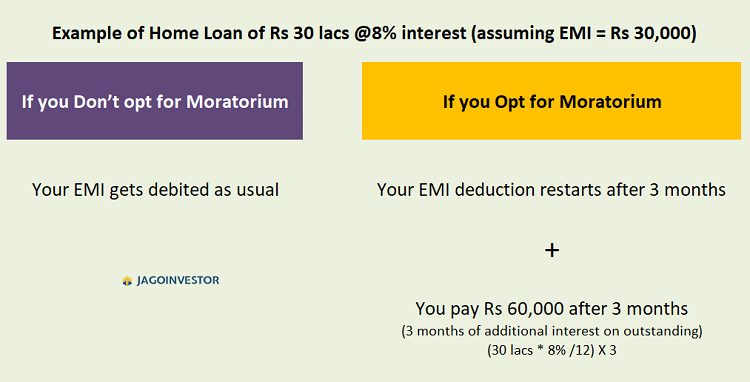

If someone takes this moratorium benefit, they interest will be accruing on the outstanding balance and you will have to pay the interest at the end of 3 months. Their EMI will start getting deducted after 3 months.

What it means is that assume someone has a 30 lacs of home loan, and an EMI of 30,000 (just a random assumption) and interest rate is 8% , then one month interest will be Rs 20,000 (30 lacs * 8% = 2.4 lacs yearly .. Divide that by 12 to get monthly interest = 20,000)

And for 3 months, it will be Rs 60,000 additional simple interest. This additional interest will be added to your outstanding balance and your tenure will go up.

Same is true for outstanding balance on credit cards.

The only benefit you will get here is that you will not be paying any kind of penalty and it won’t be reported to CIBIL.

Update from various banks

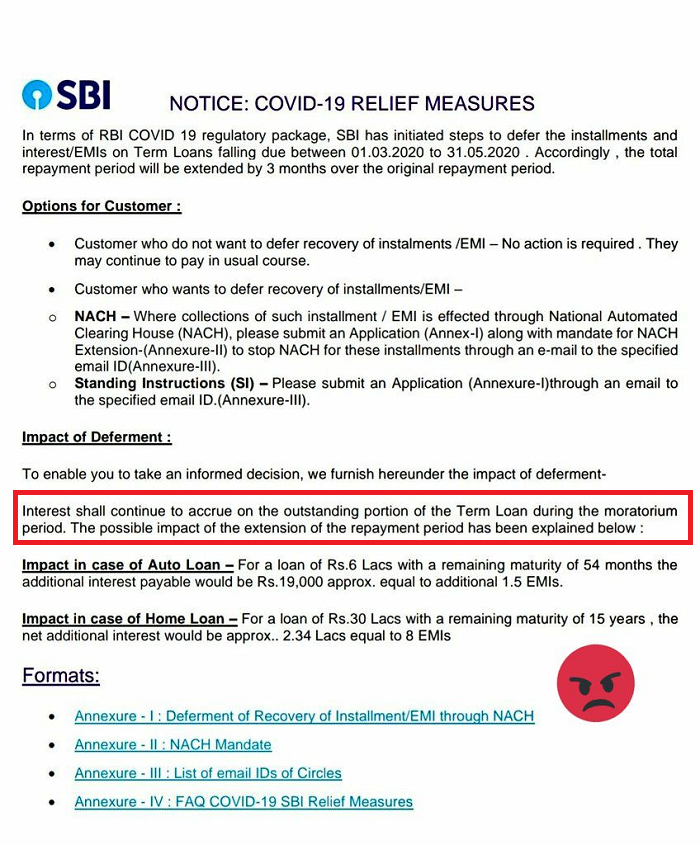

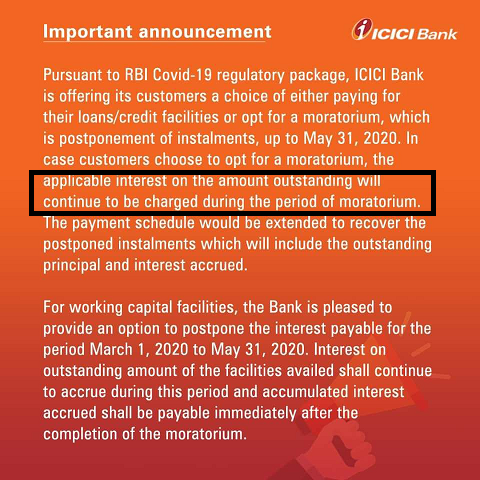

Here is a notification from SBI bank and ICICI bank to its customers that interest will still be charged on the outstanding balance if one wants to avail this benefit.

Most of the banks have also clarified that to take this benefit, one has to contact the bank and ask for this benefit. If you don’t take any action, then the EMI will get deducted as usual.

Should you opt for EMI Moratorium benefit?

By now, you must have understood that this benefit is not for someone who is not facing severe financial crunch or whose income/salary is going to go down due to coronavirus impact. So if you can easily pay off your EMI’s, then please do so and don’t opt for this moratorium benefit.

It’s only for someone who is going to see salary loss, job loss and is facing very hard time financially due to this lock down. They are getting TIME from bank side and nothing else.

Do let us know what you feel about it in comments section.

March 27, 2020

March 27, 2020

explained in simple terms with example. Thank you very much

Welcome !

Thanks for your information. Like others, I am also celebrating this without understanding the actual fact

Welcome !

Hi, there seems like a misinterpretation here… The notification says interest shall be accrued on outstanding loan instead of reduced outstanding as you are not paying EMI for 3 months. No one asks for 60k interest jus because 90k emi is delayed. Pls rectify it.

I didn’t understand it.. The calculations are correct in article.

PLease explain what you are saying !

So, can we say RBI has offered Lolipop instead of real benefits to middle class. I am not a salarised person but self employed. You have shown example of interest rate on Home loan but on personal loan, it is always on higher side.

I think, RBI offer is not at all real benefit to middle class, because majority will think that they can pay 3 EMI after loan period and that’s it. Reading between the line is more important. And again, banks never pass what RBI or Govt offers them in majority cases.

You can say that ..

Sir in this situation i got one new order for labour outsourcing contract for one psu,they want to execute agreement before 12th april2020 with PBG amt 51 lakhs. Banks can make issue in this period against as collateral of my property?is it possible pls advice me

I am not the right person to talk on this.

EMI will be on reducing balance. You cannot assume simple interest of 20,000.

But if one is not paying EMI for 3 months .. the outstanding balance is not reducing right?

Manish

Hi I just want to know how will the bank get to know if my salary is credited or not if my salary account bank is different from the loan account bank.

Bank will not try to find out .. it depends on you now if you want this benefit or not .. and you can tell the bank

Nice article, clearly explains the pros N Cons,

Thanks

Welcome

This is only good for salaried people if they gets salry they can pay ,rbi has played smart and made people fooled ..govt should step in and help self employed person who r not getting any type of slary instead ending up paying office monthly rent ,worker slary and other overheads without being earning anything during this lick down ..I request rbi ,govt of india to complete stop of emi and continue as normal after June 2020 …what’s the point of paying interst after 3 month ..from where the self employed guys bring in the money ..s if after three month instead of water it’s going to be a money rainy season…so I just request to pls review the decision …

RBI has given relief to banks if they want to extend this to public. Just because something is not in our interest does not mean its not right thing .

Thank you so much for making it clear, i was really looking for a clear answer in simple language. Appreciate it.

Thanks

Yes I for this, those who are getting their salaries, or whose salary is hand some, they must not opt for this method, they better pay EMI regularly.

Yes

It means 60k additional on 90k payable as EMI. This is close to 65%+ more. works out to close to 22% per month.

Better to take a loan if possible, from the known source and serve the EMI.

Yea, I feel the same