Corona Kavach Policy – Get insured and save high medical bills

The ongoing COVID-19 pandemic has caused a lot of fear and anxiety in our lives because there are no vaccines or any cure available for this illness. If anyone gets COVID +ve there are chances that there may be huge medical bills running into lakhs of Rupees.

In case you don’t have big health insurance, you can go for a special policy called “Corona Kavach Policy” which got introduced recently in the market.

IRDAI has come up with a standard COVID focused basic health insurance policy known as “Corona Kavach Policy”, which I will be reviewing in this article.

Features of Corona Kavach Policy

- This policy is available on an individual as well as a family floater basis.

- The minimum and maximum sum assured offered by the policy are Rs. 50,000 to Rs. 5,00,000.

- A person aged between 18 yr to 65 yrs can purchase this policy.

- This policy can be purchased for self, spouse, parents, parents-in-law, and dependent children up to 25 yrs of age.

- 2 types of cover -Base Cover on Indemnity Basis which covers COVID Hospitalization cover and Optional Cover on Benefit Basis which covers Hospital Daily Cash.

- This policy has a waiting period of 15 days from the purchase of the policy.

- The tenure of the policy is 3 ½ months, 6 ½ months, 9 ½ months including waiting period.

- Premium Payment Mode is Single.

- Tax Exemption on the premium paid u/s 80D.

What all is covered under this policy?

a) Hospitalization Cover –

If a person has tested COVID +ve in a government authorized diagnostic center then the medical expenses and expenses incurred on treatment of any comorbidity along with the treatment for COVID up to the Sum Insured will be covered under this policy provided the insured is hospitalized for more than 24 hrs in the hospital.

Let us see what all comes under hospitalization cover –

- Room Rent, Nursing Expenses, ICU, and ICCU charges will be covered.

- Surgeon, Anesthetist, Medical Practitioner, Consultants, Specialist Fees whether paid directly to the treating doctor/surgeon or to the hospital will be covered under the policy

- Expenses on anesthesia, blood, oxygen, operation theatre charges, surgical appliances, ventilator charges, medicines and drugs, costs towards diagnostics, diagnostic imaging modalities, PPE Kit, gloves, mask, etc.. will be covered under this policy.

- Ambulance charges up to Rs 2000 will be covered under this policy per insurer only if the ambulance has been availed in relation to COVID Hospitalization. This also includes the cost of the transportation of the Insured Person from one hospital to another hospital as prescribed by a medical practitioner.

b) Home Care Treatment Expenses –

If a person is tested COVID +ve in a government authorized diagnostic center and is getting treatment at home which normal course would require care and treatment at a hospital but is actually taken at home maximum up to 14 days per incident, then home care treatment expenses will be covered provided under the following circumstances –

- If the medical practitioner has advised the insured person to undergo treatment at home with a continuous active line of treatment with is being monitored by a medical practitioner for each day through the duration of the home care treatment.

- The insured or the family member should maintain a daily monitoring chart which includes records of treatment administered and duly signed by the treating doctor.

- Cashless or reimbursement facility shall be offered under homecare expenses subject to claim settlement policy disclosed.

The expenses made related to the treatment of COVID will be covered under this policy. They are as follows –

- Diagnostic tests underwent at home or at the diagnostics centers.

- Medicines prescribed in writing

- Consultation charges of medical practitioners

- Nursing charges related to medical staff

- Medical procedures limited to parenteral administration of medicines

- Cost of a Pulse oximeter, Oxygen cylinder, and Nebulizer

c) Pre and Post Hospitalization Medical Expenses –

Pre-Hospitalization medical expenses of 15 days prior to admission into the hospital and Post-Hospitalization expenses of 30 days after getting discharged from the hospital will be covered under this policy.

d) Hospital Daily Cash –

Hospital Daily Cash benefit comes under an additional cover if the insured has opted for Optional Cover on Benefit Basis. Under this benefit, the insured will get 0.5% of the sum insured per day up to a maximum of 15 days.

From where can I purchase this policy?

This health insurance policy can be purchased from 30 General and Health Insurance Companies. The list of these companies is as follows –

[su_table responsive=”yes”]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[/su_table]

Premium for Corona Kavach Policy

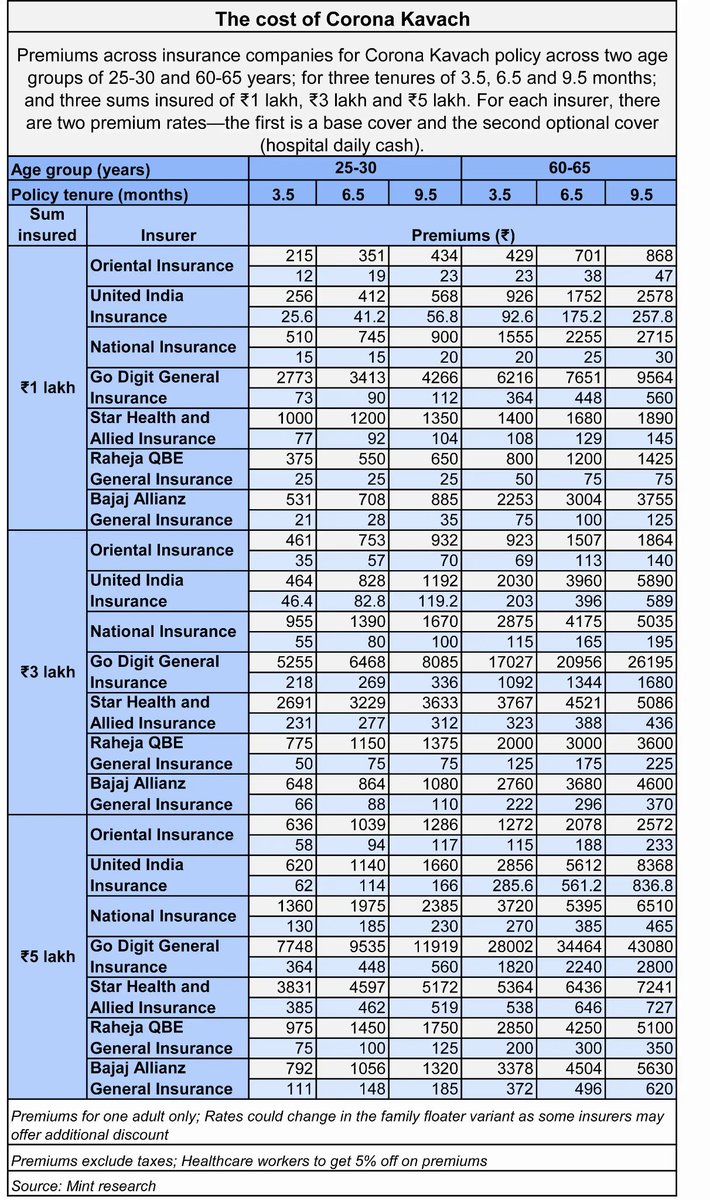

Livemint Research has done a detailed study of Premium for various companies. Check out the premium table below.

Exclusion under this policy –

- If there are any diagnostic expenses made which are not related to COVID, then that expenses will not be covered in this policy.

- If a person is tested COVID +ve before the start of the policy, then this person cannot file a claim to the company.

- Expenses incurred in daycare treatment and OPD treatment will be excluded from this policy.

- If a COVID +ve person is getting treatment outside India, then the expenses incurred in the treatment will not be covered under this policy.

- If any expenses incurred on un-proven treatment, procedures, or supplies related to COVID which lacks medical documentation to support its effectiveness will not be covered in this policy.

- If a person is getting testing done related to COVID in diagnostic centers that are not authorized by the government then the expenses incurred will not be covered under this policy.

- Expenses made on dietary supplements and substances which are purchased without prescription will not be covered under this policy.

A short video review of Corona Kavach Policy –

All features mentioned in this policy are referred from IRDAI notification.

Conclusion –

So this was all that I wanted to share in this article if you have any queries you can put it in the comments section.

July 16, 2020

July 16, 2020

It seems an eye wash, nobody offering full online mode to purchase !

What about Maxbupa?

Dear Manish,

Firstly, I still do not understand, that what kind of “RISK” is seen by different companies through different perspectives. Because, basically policies are only to cover expenses of medical treatment and do not cover a “RISK” of any kind. Do they cover life risk above medical expenses, who charge 17 times higher premium? And of what amount?

Secondly, the terms and conditions are clearly given in the table above, that their is limit of coverage only of medical expenses of maximum up to Rs. 500000.00, which is clearly mentioned as an outcome of detail study by Livemint Research. So what more detail study could be expected by common people above the research by Livemint Research?

That only the insurance company can share how they price it .. Its acturial process!

When the most vulnerable section is seniors, it is no good having upper age limit of 65. That is like any other insurance policy. They should have covered older persons, with premium increasing with age. As it is, it is for people who are either unlikely to get Covid-19, or will come out of it lightly. They don’t need a Covid-specific insurance policy in that case!

The premiums will be very very high in that case, that people will just not buy it at all! .. At the end, its a business

when terms & conditions are set by IRDA & common for all, Why premium rates vary to such an extent for various insurance company? please advise.

Example for 9.5 months for 60-65 age Oriental premium is 2572/- while united is 8368/- & Go digit general is 43080/-. This very large difference.

Hello Kishor,

Every insurance company has their own perspective of viewing the insurance policies. Based on the pros and cons of the policy, they decide the premium. If you feel that Go Digit General Insurance Premium is very high as compared to other insurance company then don’t take policy from Go Digit. Premium charges will vary from company to company.

Thank You

Anuradha

I am not Insurance expert, but, The Insurance Regulatory and Development Authority of India (IRDA), have issued some regulations and guidelines. Treatment on Carona is not a cosmetic treatment. Rather til today, there is no vaccine or medicine which could positively cure Carona. And people from all economic layers are getting affected. More importantly, the company charging premium of Rs. 2572 or Rs. 8368 or 43080, are for the same coverage of maximum Rs. 500000. So, the point raised by Kishor is very valid , and there is a choice available for everybody okay, but, the reply given by Anuradha does not explain that why such a big difference, or what is the basis of the higher premium rate being charged by companies for the same amount of coverage.

The answer was already given in lines with the reality. The companies see the risk in different way and price is differently. Hence the premium difference.

See if terms and conditions of the policy and you will be liable to get benefit upto that extent. One has to take the call on their own level from where. Its like car insurance or life insurance..

Manish

May please advise if there are specific advantage/benefits of high premiums by app 17 times by go digit to oriental?

Different companies , different way to pricing it .. You need to now look at your way of looking at it

Is it only payable on advice from govt in govt hospital n not in pvt hospital

Yes

If we already have a Mediclaim policy for 5 Lakhs, should we opt for this policy too?

This policy is specific to Corona and covers few things which a normal policy does not.. so check if you want to buy it to not!

The important factor is non-medical expenses like PPE kit, gloves, sanitizers etc which are not covered in normal medical policies. Moreover, there has been reduction in premium rates. Check out for the latest or updated rates. Me and my family have already taken on individual basis of 9.5 months for Rs 5 lacs. It is interesting to note that if anyone scrutinizes the hospital bill of a Covid 19 patient, one would find atleast 50% of the total bill represents non-medical stuff

Can you give more details on “non-medical stuff” part?