Corona Rakshak Policy – Get paid when you catch Covid-19

Health Insurance companies have recently launched one more corona specific health insurance policy called as Corona Rakshak Policy” as per the IRDAI guidelines.

This is a benefit based health insurance plan which pays you a lump sum amount when you are diagnosed of covid-19 and are hospitalized for continuous 72 hrs.

Features of Corona Rakshak Policy

- This policy can be purchased only on an individual basis.

- Sum Insured options in this policy range between Rs 50,000 to Rs 2,50,000.

- There is no pre-medical screening necessary for this policy.

- This policy has a waiting period of 15 days.

- Adults aged between 18 yrs. to 65 yrs. can take this policy.

- Tax benefit on premium paid u/s 80D of Income Tax Act,1960.

- The policy cannot be renewed nor it has a free look period.

- Its a single premium policy and the tenure have 3 options of 3.5 months (105 days), 6.5 months ( 195 days), and 9.5 months (285 days).

Benefits under this Policy

If the insured person is diagnosed with COVID +ve and is hospitalized of minimum 72 hours then the corona rakshak policy will pay the full 100% sum assured to the policyholder. Note that it’s not going to settle your bills, but make a single payment no matter what are your expenses.

To get the claim, you have to give the diagnosis report of Covid-19 from an authorized govt center and the proof of hospitalization for at least 72 hrs.

Where can I purchase this Policy from?

While IRDAI has directed all companies to launch this plan, in reality its quite complicated to find out where to buy this plan. It was reported on social media from many investors that they are not able to get the online links to buy. But few also shared that they were able to buy it from the offline agents.

#IRDAI, please instruct insurance companies to sell Corona Kavach and Corona rakshak policies online! At a time when social distancing is the key to fighting COVID19, there is no clear way to buy these policies online!

— RAHUL (@trueIndiafan) July 16, 2020

So right now it’s a bit complicated to buy this plan.

Ideally following insurance companies should come up with their online links for this policy, as soon as possible.

[su_table responsive=”yes”]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[/su_table]

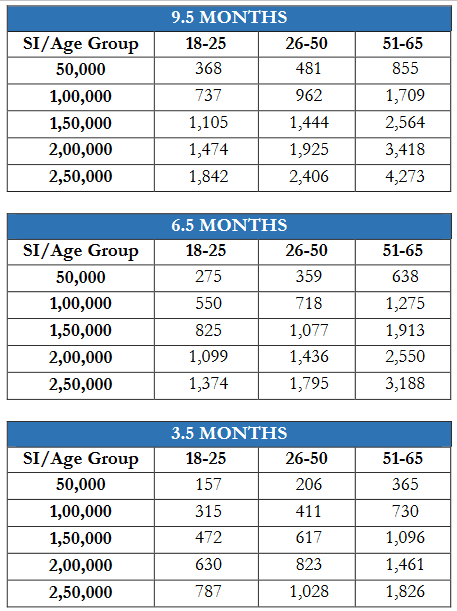

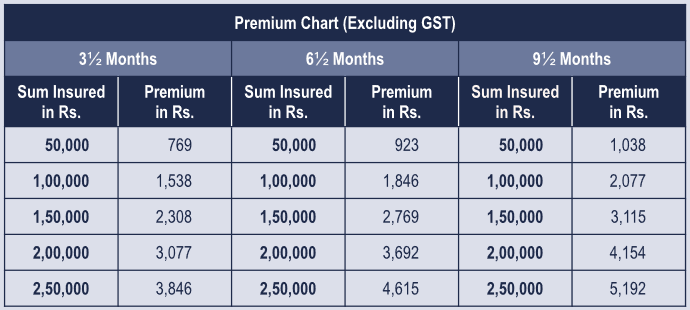

Premium For Corona Rakshak Policy

Here is the indicative premium chart we managed to find online.. but note that these are still indicate premiums and you will get the real numbers while you purchase the policy.

a) IFFCO TOKIO General Insurance Co. Ltd –

b) Star Health & Allied Insurance Co.Ltd. –

The below image shows the premium details of the “Corona Rakshak Policy” with all 3 tenures of the policy.

Exclusion under this policy

- If there are any diagnostic expenses made which are not related to COVID, then those expenses will not be covered in this policy.

- If a person is tested COVID +ve before the start of the policy, then this person cannot file a claim to the company.

- If a person is getting testing done related to COVID in diagnostic centers that are not authorized by the government then the expenses incurred will not be covered under this policy.

- If the insured person travels to any country placed under travel restriction by the government of India the insured person will not get the benefit under this policy if the insured person tests +ve for COVID-19.

Should you take up this policy?

If you are too scared about the expenses which might occur if you get covid+, then you can surely go ahead and take up this policy as the premiums are not very big amount and anyone can manage it.

However do note that this policy will only pay if the hospitalization is there for 72+ hrs. You know that most of the people who are getting corona do not require hospitalization, which means that the chances you getting corona along with hospitalization is quite low.

Also this is going to only give you Rs 2.5 lacs, however the expenses can be quite high if you get hospitalized for a 15-20 days in a good hospital. So treat this policy as just a small support system and not the replacement of the health insurance policy in itself.

Conclusion

This was all that I wanted to share in this article. Let me if you have any queries in the comments section.

July 20, 2020

July 20, 2020

1. Can I get two or three corona Rakshak policies to increase the sum assurance. ?

2. I’m I eligible to claim if I get admitted in Govt hospital.?

1. No I dont think so ..

2. Yes, even in private !… But only if you meet all the criteria .. like you need to be hospitalized for minimum 3 days !

Is there any exception, suppose if someone found positive and advised to be in home quarantine or isolation because of unavailability of beds in hospital. Or still unless you hospitalized for 72 hrs you will not get benefitted though you are diagnosed of corona

If doctor gives in writing that medication is required and the line of treatment is there for each day , then its admissible

But simply being at home on some medicines will not be eligible for claim

Manish

Such a great article.

Really appreciable. i read your article and i found this so informative and useful. I think this article is helpful not only for me infact for all those who have doubt that how to purchase a best corona plan. i really like the way you explain features and benefits of Corona plan.

Thanks for such a informative article. keep updating this type of articles.

Welcome

how to be an agent to help reach to the general public those who are not aware of these type of citizens support benefial scheme?

Empanel with the companies to be their agent ..

Will other health policy give benefit… like I have family floater from star health for 5 lakh along with top up of 20 lakh

Yes, a regular health insurance plan will also cover many expenses, but some things like PPE kits and few more things are not covered !

Corona KAVACH policy is better then the Corona Rakshak policy. Kavach policy requires only 24 hrs of hospitalization. You can even get reimbursement for Home treatment. Future generali has an online option. Regards

Different policies for different requirement.