Dear “1 crore” aspirant,

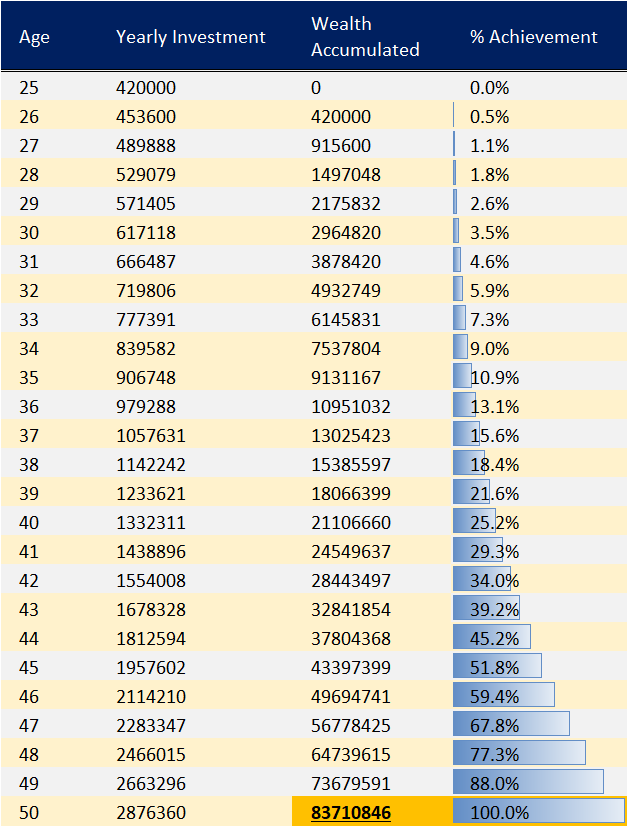

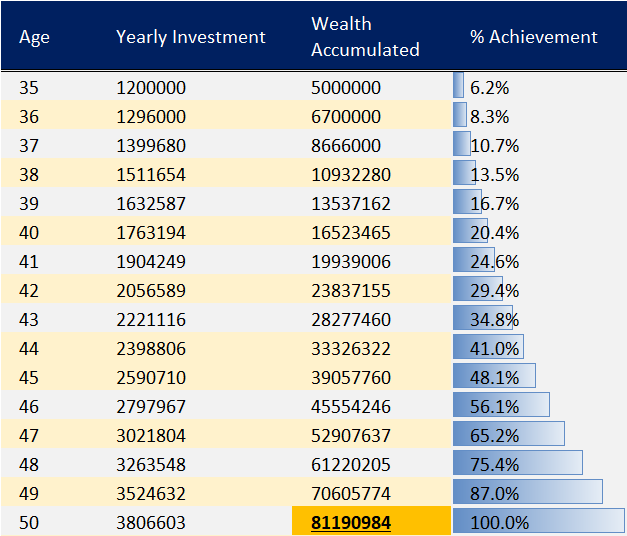

This is Nandish Desai from Jagoinvestor.com. If you’ve chosen to read this article, I assume you are serious about creating your first one crore. If you have already crossed the one-crore mark, this article can still provide insights for achieving your next financial milestone.

This article is written in a coaching format, drawing on my years of experience working closely with investors from all walks of life.

Our team has worked one-on-one with several thousand investors, and we’ve identified key aspects that explain why many people struggle to reach their first one crore.

The cheese (Rs. 1 crore) has moved for many 🙁

Getting cheese ( 1 crore) is EASY and hard at the same time.

We live in a world where it’s easy to be fit – gyms in every building, access to top dieticians and coaches, a wealth of information on health and fitness online, diet food delivery services, running clubs, and smartwatches to track your steps.

Yet, it’s just as easy to become unfit with binge-watching, food delivery apps, partying, smoking, and excessive drinking. Similarly, it’s easy to read a book, and equally easy not to. Forming good habits is just as accessible as forming unsupportive ones.

In the same way, creating your first one crore can be easy, but for many, it’s a challenging reality (referring to liquid money in equities, not real estate).

Many people struggle because their approach to accumulating wealth has become outdated, and they’re unaware that their “cheese” (ways to create one crore) has moved. Their habits around money might not be supporting their goal, or their overall approach to life may be hindering their ability to create their first one crore.

How did I create my first 1 crore?

There was a time in my life when nothing was working out. My income was unstable, I wasn’t investing regularly, and I had no focus on building my net worth. One crore seemed like an impossible goal. I felt like I was at ground zero, negative about life, and upset about many things.

One of my mentors came to my rescue and said, “If you are lying on the ground, you must use the ground to raise yourself. If you are negative, use those negativities to succeed in life.” His words struck hard, and I decided to restart my life’s journey. I realized I had nothing to lose and needed to dedicate myself to changing my financial situation.

It took a lot of time, effort, and failures to reach my first one crore. The question I kept asking myself was, “Nandish, is life predestined or a result of my self-effort?” This is a powerful question to ponder. If you believe life is predestined, you might feel helpless about achieving your first one crore. But if you believe your first one crore is a result of your self-effort, you can continue reading further.

10 pointers why it gets hard for people to create their first 1 crore

Below I want to share 10 reasons why most people are not able to create their first Rs 1 Cr and it gets hard for them to continue on their path of wealth creation.

#1 : Because what you believe may not be ALWAYS true

What you believe may or may not always be true. We all have our internal strategies for earning, saving, and investing, and as human beings, we tend to be very righteous about them.

Many people believe that only through real estate can they become rich, or only by doing business, or only by investing in gold. There are no right or wrong ways, but there are certainly newer and more effective ways.

You need to keep an open mind for new ideas and approaches. Being rigid in your beliefs about how to reach your first one crore can limit your potential. Understand that there can be a thousand more ways than what you currently believe to help you achieve your goal.

If you choose to be fixed in your thinking, you’ll miss out on new possibilities. People who grow faster in life are open to new possibilities, they are coachable, and they are not overly attached to their personal strategies for reaching their goals.

#2 : Low SAY-DO Ratio

Many investors begin their journey with the intention of never redeeming their investments until they reach their financial goals or target wealth. However, data from AMFI reveals that more than 50% of investors stop their SIPs within the first two years.

This discrepancy between what is said (X) and what is done (Y) with their money highlights a low say-do ratio.

To build your first one crore, you need to maintain a high say-do ratio. Trust me, no platform or YouTube video will stress the importance of this principle as much as it deserves. Ensure that you make strong financial commitments and learn to keep them, no matter what.

A high say-do ratio is crucial for achieving your financial goals.

#3 : Your Blood Cells Are Not Yet Enrolled in Creating 1 Crore

When you examine the life stories of champions, you’ll see that their entire being is committed to their goals. Most people wish or hope to create 1 crore, but their commitment isn’t fully internalized. Remember, your self-effort shapes your financial future.

It’s crucial that you fully embrace the goal of creating 1 crore, committing every part of yourself to this future. This commitment is not just about external actions but an inner game, an inner calling, and an inner commitment to yourself.

#4 : Poor Relationship with Your Own Rhythm

Everyone has a unique financial journey because we each have a different rhythm. It’s important to respect your personal pace on the path to creating your first 1 crore. You’ll understand rhythm when you listen to music or go for a run.

I realized the importance of rhythm while learning guitar from my music coach, Nishant, and also while running. You need to identify, acknowledge, and respect your pace in achieving your financial goals.

I recently heard from a friend in Mumbai about how she helped someone from a slum create his first crore through small savings and significant efforts.

Despite starting from different backgrounds and job profiles, everyone has their own rhythm. Don’t worry if your pace is slow; what matters is that you are actively working towards your first 1 crore, taking shots on goal.

#5 : Most People Forget to Bounce Back

Many people begin their SIP or monthly investment journey due to a breakdown in their career, health, or other uncontrollable situations. It’s perfectly fine to pause investments temporarily, but most people forget to bounce back.

Just like it’s hard to maintain consistency in the gym during the first year, the same applies to investing. Excuses (even valid ones) can derail your efforts. In the journey of compounding, breakdowns are inevitable, but it’s crucial to bounce back.

Many of our clients restart their SIP journey or reinvest after redeeming their money, demonstrating resilience and commitment.

#6 : You Need to Have a Thick Face

Having a “thick face” means building a shield against those who doubt your wealth creation goals. People around you may always doubt your ability to create massive wealth. Your thick face is your shield that prevents these doubts from affecting you.

Be clear about what you want to achieve, your goals, and your next milestones. Keep taking massive actions in your financial life. Remember, your only access to your first 1 crore is through consistent action and nothing else.

#7 : Fear Is Your Best Friend

The 13th-century Hindu philosopher, Shankaracharya, mentioned that even the greatest warrior, when standing in the midst of battle, sweats with fear.

You will face a lot of fear before and even after creating your first crore. Fear is a constant companion, and there’s no escaping it. Markets will have corrections, scams will happen, companies will fail, financial crises will hit, and wars will continue.

Despite all this noise and news, you must stay consistent on your path to creating your first crore. These events are tests of your commitment to wealth creation. Are you truly interested in wealth creation, or is it just a casual dream?

#8 : Lack of Self-Inquiry

Lao Tzu, in Tao Te Ching, says,

“Conquering others requires force; conquering oneself requires strength.”

Without self-inquiry, progress is impossible. It’s not just about accumulating one crore; it’s about conquering something within yourself that you may not currently see. You are not the first to aim for one crore, ten crore, or even one hundred crore.

Many have done it before, and the key lies in self-inquiry. It may seem spiritual, but it’s essential to elevate your wealth creation game.

Spend time alone, perhaps on a beach, with a blank sheet of paper, and capture the thoughts that come to mind. This process is about discovering your own strengths and new ways to succeed in wealth creation and life.

I often take such breaks for self-reflection, and this article is a result of my self-inquiry. Share this article with others who might benefit from it, and become a partner in helping individuals create their first crore.

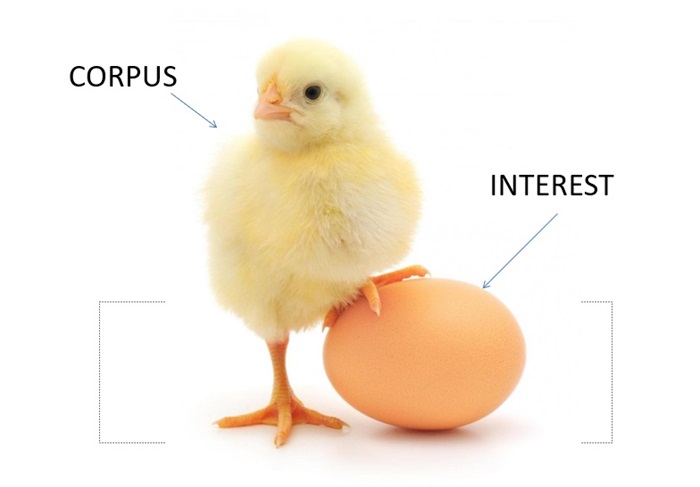

#9 : Kill the Chicken

We all remember the story of the chicken that laid golden eggs. Out of greed, the owner killed the chicken, ending his supply of golden eggs. While it was presented as a story of greed, it’s actually a lesson in financial freedom.

The chicken represents your corpus, and the eggs represent the interest you earn for the rest of your life.

Many people start investing and build up a few lakhs (the chicken in the making). Then, an enticing expense arises, and they kill the chicken by redeeming all their accumulated money. This is a major reason why most people don’t reach their first crore.

They have the ability, knowledge, and money to create the corpus, but they redeem their investments for various reasons, leaving the goal unfulfilled. Check the redemption data of all mutual funds, and you’ll find that most redemptions are not genuine and often harm the investor’s wealth creation journey.

#10 : Not Maintaining a Journal: Experiences Worth One Crore Hit Us Every Day

I learned about journaling from the legendary motivational speaker Jim Rohn, whose words had a lasting impact on me.

My brother and I discovered journaling through one of his YouTube videos. Journaling is powerful and can surely help you achieve your first crore or any significant goal. Every day, your actions lead to experiences, and capturing them allows you to learn from them.

Every day, new ideas that can help you reach your goals will come to you, but if you don’t capture them, you miss out. Journaling might seem outdated or old-fashioned, but it can be a crucial tool in your wealth-creation journey.

How it feels when you reach Rs 1 Cr mark?

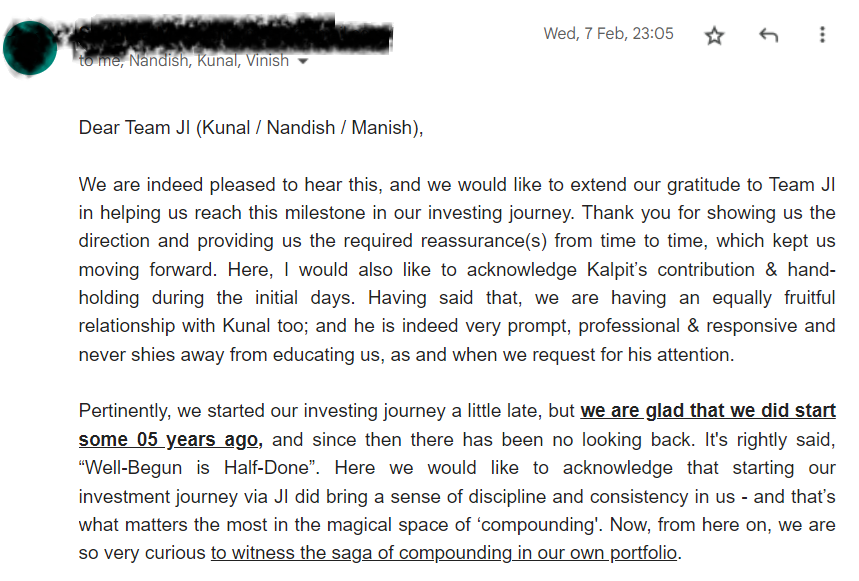

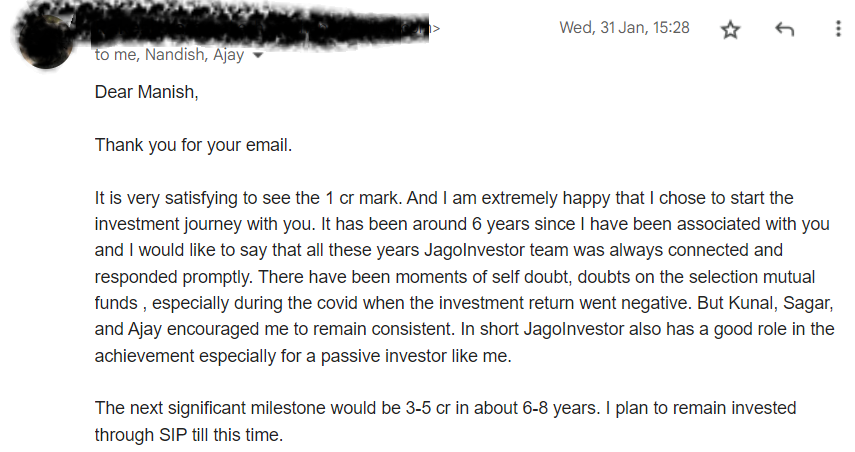

We always congratulate our clients when they reach their Rs 1 Cr mark after years of hard work and dedicated investments and its always very satisfying to read what they think about this milestone. I would love to share a snippet of what they said after achieving this milestone!

Testimonial #1

Testimonial #2

Conclusion

Your first crore is your game, and we are here to help and encourage you to play it.

If you want our team to help you design your first crore game, we would be delighted to have you on our client list. We will share how you can fine-tune your wealth creation game. Many of our clients are playing for portfolios of 50 or 100 crore.

Asking for external help is a sign of strength, and we are ready to pour our experience and expertise into your financial life.

Contact Jagoinvestor Team for Wealth Creation Services

Don’t forget to share your experience of reading this article, and share something from your life that could help someone else create their first crore.